Apple Inc, AAPL, earnings, options, volatility, secret, wonderful

Apple (NASDAQ:AAPL) ">

Discovering Volatility in Apple Inc

Preface

There is a wonderful secret to trading options right before earnings announcements in Apple (NASDAQ:AAPL) , and really many stocks, that benefits from the rising implied volatility but avoids the risk into the actual earnings release and also avoids any kind of stock direction risk.

STORY

Everyone knows that the day of an earnings announcement is a risky event for a stock. This can be explicitly seen in the option market, where the implied volatility (the expected stock move) rises into the earnings event.

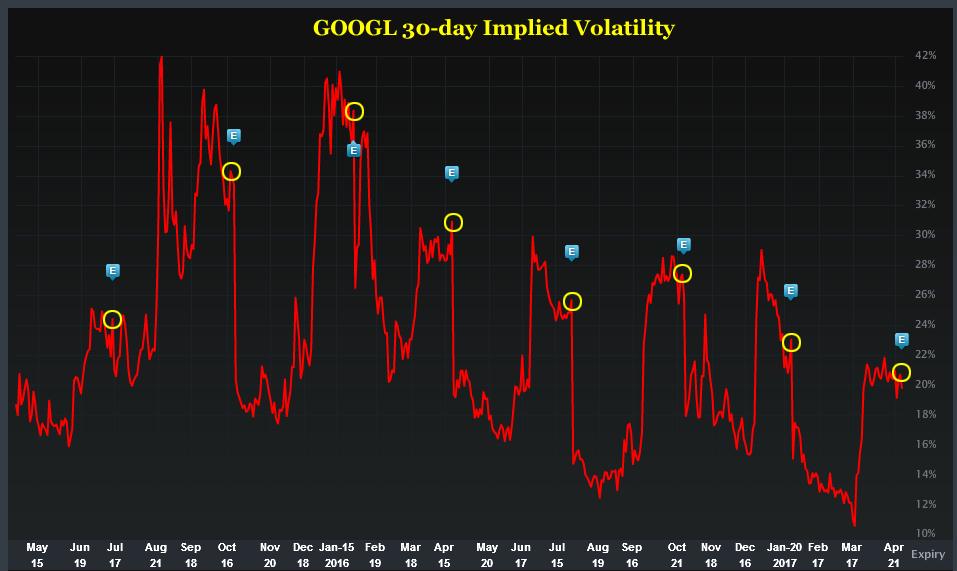

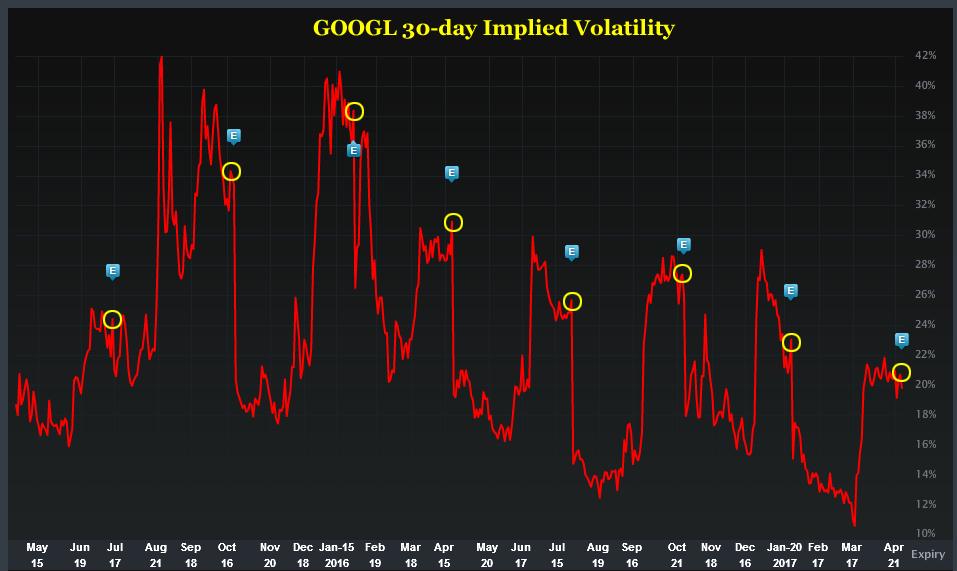

Here is a great illustration of that reality using Google, just as as simple example, and a chart of its 30-day implied volatility over the last two-years, before we turn to Apple Inc . While the implied volatility ebbs and flows, it generally rises into earnings, which are denoted in the chart below with the "E" icon. We circled the rise in yellow for convenience.

The question every option trader, whether professional or amateur, has long asked is if there is a way to profit from this known volatility rise. It turns out, that over the long-run, for stocks with certain tendencies, the answer is actually, yes.

THE WONDERFUL SECRET

What a trader wants to do is to see the results of buying an at the money straddle a few days before earnings, and then sell that straddle just before earnings. The goal, is two-fold: (i) to be to benefit from that known implied volatility rise, and (ii) to own the straddle for a very short period of time when the stock might move 'a lot.'

If either of those two phenomena occur, there's a very good chance this wins, if neither occur, the amount risked is normally quite small.

This trade is not a panacea, which is to say, we have to test it, stock by stock, to see when and why it worked. We start with Apple Inc.

Here is the setup:

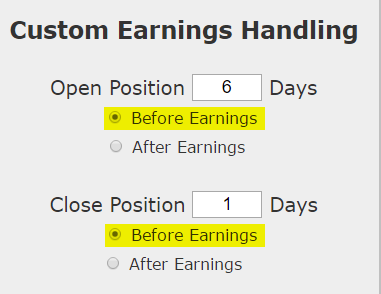

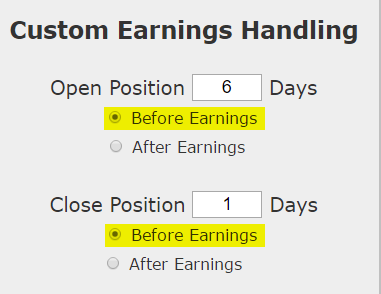

We are testing opening the position 6 days before earnings and then closing the position 1 day before earnings. This is not making any earnings bet. This is not making any stock direction bet.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

RETURNS

If we did this long at-the-money (also called '50-delta') straddle in Apple (NASDAQ:AAPL) over the last three-years but only held it before earnings we get these results:

We see a 48.3% return, testing this over the last 11 earnings dates in Apple Inc. That's a total of just 55 days (5 days for each earnings date, over 11 earnings dates). That's a annualized rate of 321%.

We can also see that this strategy hasn't been a winner all the time, rather it has won 6 times and lost 5 times, for a 55% win-rate and again, that 48.3% return in less than two-full months of trading.

MORE TO IT THAN MEETS THE EYE

While this strategy is benefiting from the implied volatility rise into earnings, what it's really doing is far more intelligent.

The option prices for the at-the-money straddle will show very little time decay over this 5-day period, so what this strategy really does is buy "five days" of potential stock movement with what is actually fairly small downside risk, as long as there are no surprise pre-announcements.

That means the ideal stocks for this strategy have a couple of common characteristics:

(i) The companies rarely pre-announce earnings -- this is an investment that does not look to make an earnings bet, so an earnings pre-announcement is the opposite of what we're hoping for.

(ii) The underlying stock price of these companies tend to move a lot (or some) as earnings approach and various institutions and traders shuffle the stock price around in anticipation of the earnings result. The more one sided the outside world starts betting on direction -- up or down, the better it is to own the straddle.

WHAT HAPPENED

Traders that have a plan guess less. This is how people profit from the option market -- it's preparation, not luck. Take a reasonable idea or hypothesis, test it, and apply lessons learned.

We hope, if nothing else, you have learned about Apple (NASDAQ:AAPL) and the wonderful secret of option trading and volatility ahead of earnings. This works for Google and Twitter as well.

To see how to do this for any stock and for any strategy with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author is long shares of Apple (NASDAQ:AAPL) stock as of this writing.

Back-test Link (custom earnings handling must be applied afterward).

Apple (NASDAQ:AAPL) ">

The Secret to Options Earnings Trading in Apple (AAPL)

Discovering Volatility in Apple Inc

The Secret to Options Earnings Trading in Apple (AAPL)

Date Published: 2017-05-2Preface

There is a wonderful secret to trading options right before earnings announcements in Apple (NASDAQ:AAPL) , and really many stocks, that benefits from the rising implied volatility but avoids the risk into the actual earnings release and also avoids any kind of stock direction risk.

STORY

Everyone knows that the day of an earnings announcement is a risky event for a stock. This can be explicitly seen in the option market, where the implied volatility (the expected stock move) rises into the earnings event.

Here is a great illustration of that reality using Google, just as as simple example, and a chart of its 30-day implied volatility over the last two-years, before we turn to Apple Inc . While the implied volatility ebbs and flows, it generally rises into earnings, which are denoted in the chart below with the "E" icon. We circled the rise in yellow for convenience.

The question every option trader, whether professional or amateur, has long asked is if there is a way to profit from this known volatility rise. It turns out, that over the long-run, for stocks with certain tendencies, the answer is actually, yes.

Yes, there is a systematic way to trade this repeating phenomenon, without making a bet on earnings or stock direction.

THE WONDERFUL SECRET

What a trader wants to do is to see the results of buying an at the money straddle a few days before earnings, and then sell that straddle just before earnings. The goal, is two-fold: (i) to be to benefit from that known implied volatility rise, and (ii) to own the straddle for a very short period of time when the stock might move 'a lot.'

If either of those two phenomena occur, there's a very good chance this wins, if neither occur, the amount risked is normally quite small.

This trade is not a panacea, which is to say, we have to test it, stock by stock, to see when and why it worked. We start with Apple Inc.

Here is the setup:

We are testing opening the position 6 days before earnings and then closing the position 1 day before earnings. This is not making any earnings bet. This is not making any stock direction bet.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

RETURNS

If we did this long at-the-money (also called '50-delta') straddle in Apple (NASDAQ:AAPL) over the last three-years but only held it before earnings we get these results:

| Long At-the-Money Straddle | |||

| * Monthly Options | |||

| * Back-test length: three-years | |||

| * Open 6-days Before Earnings | |||

| * Close 1-day Before Earnings | |||

| * Holding Period: 5-Days per Earnings | |||

| Winning Trades: | 6 | ||

| Losing Trades: | 5 | ||

| Pre-Earnings Straddle Return: | 48.3% | ||

| Annualized Return: | 321% | ||

We see a 48.3% return, testing this over the last 11 earnings dates in Apple Inc. That's a total of just 55 days (5 days for each earnings date, over 11 earnings dates). That's a annualized rate of 321%.

We can also see that this strategy hasn't been a winner all the time, rather it has won 6 times and lost 5 times, for a 55% win-rate and again, that 48.3% return in less than two-full months of trading.

MORE TO IT THAN MEETS THE EYE

While this strategy is benefiting from the implied volatility rise into earnings, what it's really doing is far more intelligent.

The option prices for the at-the-money straddle will show very little time decay over this 5-day period, so what this strategy really does is buy "five days" of potential stock movement with what is actually fairly small downside risk, as long as there are no surprise pre-announcements.

That means the ideal stocks for this strategy have a couple of common characteristics:

(i) The companies rarely pre-announce earnings -- this is an investment that does not look to make an earnings bet, so an earnings pre-announcement is the opposite of what we're hoping for.

(ii) The underlying stock price of these companies tend to move a lot (or some) as earnings approach and various institutions and traders shuffle the stock price around in anticipation of the earnings result. The more one sided the outside world starts betting on direction -- up or down, the better it is to own the straddle.

WHAT HAPPENED

Traders that have a plan guess less. This is how people profit from the option market -- it's preparation, not luck. Take a reasonable idea or hypothesis, test it, and apply lessons learned.

We hope, if nothing else, you have learned about Apple (NASDAQ:AAPL) and the wonderful secret of option trading and volatility ahead of earnings. This works for Google and Twitter as well.

To see how to do this for any stock and for any strategy with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author is long shares of Apple (NASDAQ:AAPL) stock as of this writing.

Back-test Link (custom earnings handling must be applied afterward).