How to Profit from Ulta Inc Options Right After Earnings

Date Published: 2017-05-25

Written by Ophir Gottlieb

This article can be seen as a video or in the written word. The video is presented first and the article below it.

LEDE

Ulta Beauty Inc (NASDAQ:ULTA) has been a top performer in the S&P 500, proving quite definitively that a retailer can find success, even in the world of Amazon.com. But, while all of the focus surrounds the earnings releases, one options trade in Ulta Inc trade after earnings has been a consistent winner, has a much shorter holding period, takes no earnings risk, little stock direction risk all while returning over 90% annualized returns.

The Trade After Earnings

While most of the focus is on the actual earnings move for a stock, that's the distraction when it comes to the option market. For Ulta Inc, irrespective of whether the earnings move was up or down, if we waited two-days after the stock move from earnings, and then sold an out of the money put spread, the results were very strong.

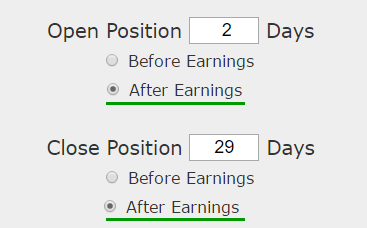

We can examine this, objectively, with a custom option back-test. Here is our earnings set-up:

Rules

* Open short put spread 2 day after earnings

* Close short put spread 29 days later

* Use the option that is closest to but greater than 30-days away from expiration

While there is one additional step we need to make to contain risk, here are the first results:

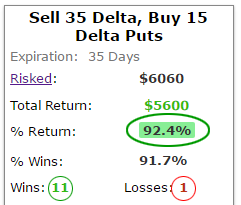

Focusing in just the month after earnings, we see a 38.6% return over a total of 12 earnings releases. We also see that this idea won 11 times and lost 1 time. But, there is a further step we can take.

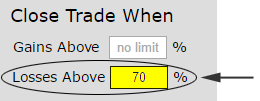

Our idea here is that after earnings are reported, and after the stock does all of its gymnastics, up or down, that two following the earnings move and for the next month, the stock is then in a quiet period. If that's the case, one approach to protect the downside, is to put in a stop loss. We do that, like this:

And here are the results now:

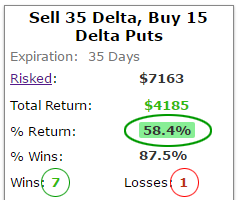

By only trading the month after earnings and putting in a stop loss, we now see 92.4% return while maintaining the 11 wins and 1 loss.

The Logic

The logic behind this trade follows a narrative that even after a bad earnings release, if we wait two days after, we find the stock at a point of equilibrium.

If it gapped down -- that gap is over. If it beat earnings, the downside move is already likely muted. Here's how this strategy has done over the last two-years:

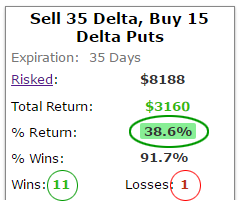

The "single-month" approach returned 58.4% over the last eight earnings cycles -- that's just eight months of trading.

Finally, here are the results over the last 6-months:

WHAT HAPPENED

To see how to do this for any stock and for any strategy with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in Ulta Inc as of this writing.

Back-test Link