Apple, iPhone, evidence

Written by Ophir Gottlieb

LEDE

Spotlight Top Pick Apple (NASDAQ:AAPL) was downgraded today by Nomura Instinet to neutral, citing valuation concerns versus prior iPhone cycles. On the other hand, new data is out from Hon Hai (aka Foxconn), Apple's largest manufacturing partner, and it shows record growth month over month.

BACKDROP

We added Apple to Top Picks on January 2nd, 2016 for $104.15. As of this writing the stock is trading at $174.62, up 67.7%. On December 4th, we published the dossier iPhone Demand and Manufacturing Hit Highs.

In that story, we noted that high profile Apple analyst Ming-Chi Kuo, of KGI Securities, had changed his view of the iPhone X cycle. The first report of a supply shortage had Kuo dropping estimates for initial fourth quarter shipments from 30-35 million to 25-30 million units.

But, the tide has turned, and so have projections. The analyst says that Hon Hai's (Foxconn) shipments of iPhone X units have climbed to 440,000 to 550,000 units per day. That's up dramatically from the 50,000 to 100,000 being shipped per day just 1-2 months ago.

He's now saying that Q4 2017 shipments could be "10-20 percent higher than previously estimated."

And now to the story...

STORY

Nomura Instinet lowered its rating for Apple to neutral from buy, and here was the rationale:

This downgrade came one-day after had just set a new all-time in stock price. Nomura wasn't so much bearish as it was noting that the valuation for this iPhone cycle had reached the peak of prior cycles:

But there is other data -- some empirical, some heuristic -- that may point to higher growth than expected. Let's turn to that data.

EMPIRICAL DATA

Foxconn reports revenue numbers every month. It's one of the great windows into Apple's trajectory and oddly, still, somewhat under reported. If you follow news for the ticker AAPL, it's a good idea to follow news for the ticker HNHPF, which is the ticker for Han Hai on the US exchanges.

Bloomberg just noted that "Hon Hai sales jumped 18.5 percent for November, a record high and the fastest growth in two years."

That's the empirical evidence that iPhone sales are in fact booming. But there's more -- this time less scientific, but nonetheless noteworthy.

SURVEY DATA

RBC Capital's Amit Daryanani did a survey and it was reported by the great Tiernan Ray of Barron's.

Daryanani noted that demand for the iPhone X and the most expensive version of the iPhone 8 Plus were significantly better in China than even the United States.

Here are his takeaways, with our emphasis added:

Much like Ming-Chi Kuo, Daryanani believes the reduced wait times for iPhone X are not a function of demand, but rather a function of increasing supply. Recall above that Kuo saw production from Foxconn increasing 5-10 fold from his initial channel checks.

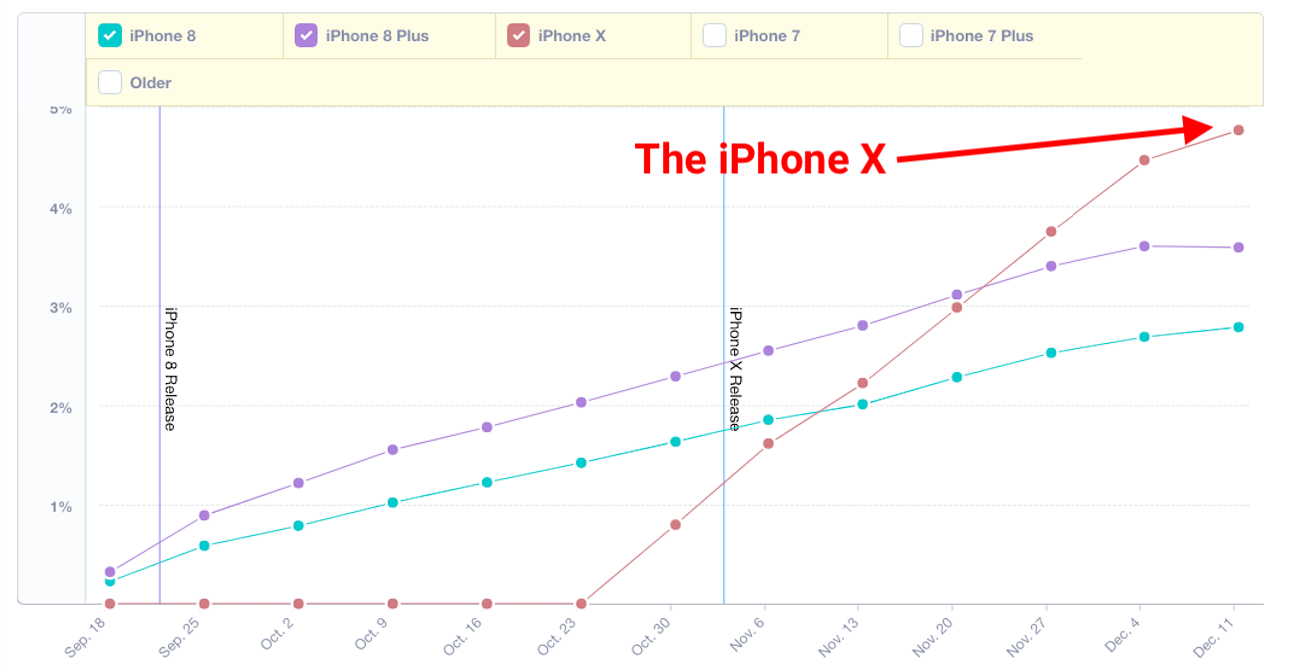

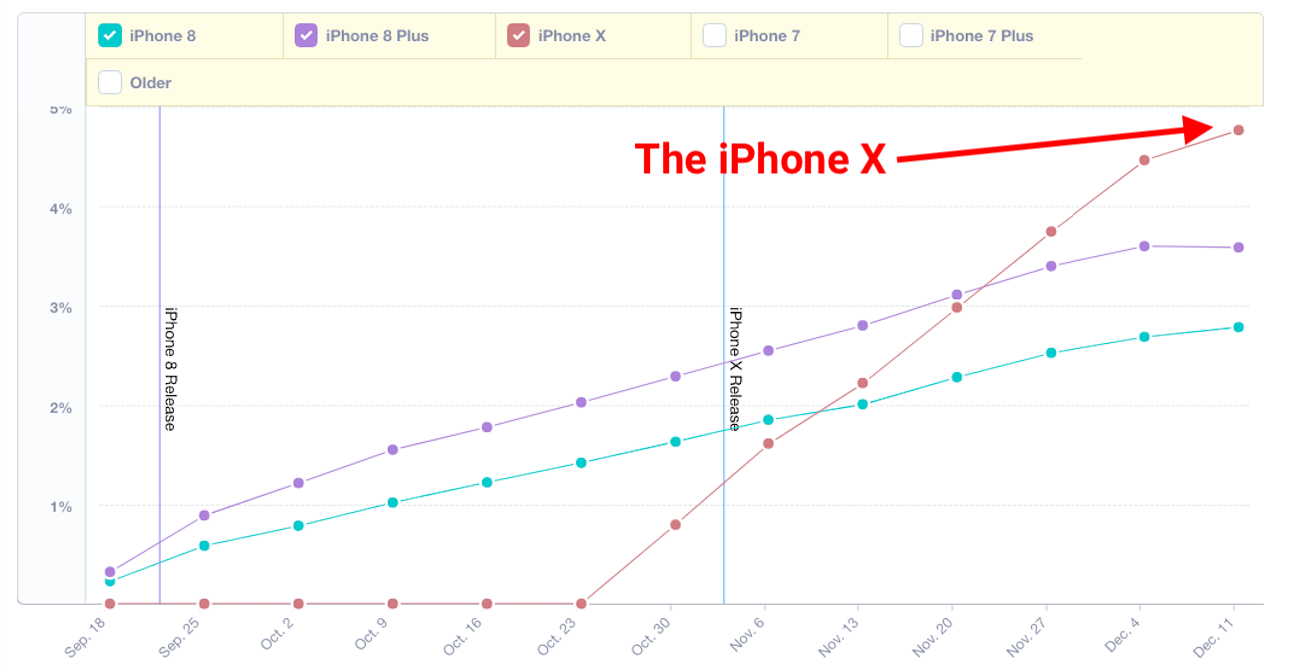

Further, Business Insider shared a chart that shows iPhone X adoption outpacing the iPhone 8 and the iPhone 8 Plus.

Source: Business Insider

Source: Business Insider

The data for that chart comes from analytics firm Mixpanel.

ANOTHER STORY - MORE DEMAND

Another story that we have been tracking is the demand for and supply of Apple's Air Pods.

A quick visit to the Apple Store shows that AirPod orders placed on Monday won't be delivered until January. In August CEO Tim Cook said "we have increased production capacity for AirPods and are working very hard to get them to customers as quickly as we can, but we are still not able to meet the strong level of demand."

The Air Pods story is nice, but a little 'nichey,' unless you take a bit of a leap forward, which we have. We believe that the Air Pods combined with the new cellular enabled Apple Watch 3, together make an entire ecosystem for wearables.

While Apple Watch series 3 order on apple.com appear to ship same day, there is an argument to be made that the demand for Air Pods is in part a reflection of demand for the new cellular enabled Watch.

On November 14th we penned, Apple Watch is Winning, and we noted that according to Canalys research:

Canalys Analyst Jason Low goes onto write that "strong demand for the LTE-enabled Apple Watch Series 3 has dispelled service providers' doubts about the cellular smartwatch not appealing to customers."

And then the analysis gets yet more bullish for the product (our emphasis is added):

Now, when we take the sales numbers from Foxconn, which are empirical, then the survey data from RBC and analytics from Mixpanel, we see that the iPhone 8/X cycle may be nowhere near at its peak. Going further with the empirical evidence that Air Pods are sold out and delivery is weeks away with data surrounding the Apple Watch, we have further evidence that this quarter for Apple could be a massive win.

SEEING THE FUTURE

It's understanding technology that gets us an edge on finding the gems that can turn into the 'next Apple,' or 'next Amazon,' where we must get ahead of the curve. This is what CML Pro does.

Each company in our 'Top Picks' has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty. We are Capital Market Laboratories. Our research sits next to Goldman Sachs, JP Morgan, Barclays, Morgan Stanley and every other multi billion dollar institution as a member of the famed Thomson Reuters First Call. But while those people pay upwards of $2,000 a month on their live terminals, we are the anti-institution and are breaking the information asymmetry.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

As always, control risk, size appropriately and use your own judgment, aside from anyone else's subjective views, including my own.

Thanks for reading, friends.

The author is long shares Apple at the time of this writing.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Apple Downgrade Appears Erroneous, Empirical Evidence for Bulls Grows

Written by Ophir Gottlieb

LEDE

Spotlight Top Pick Apple (NASDAQ:AAPL) was downgraded today by Nomura Instinet to neutral, citing valuation concerns versus prior iPhone cycles. On the other hand, new data is out from Hon Hai (aka Foxconn), Apple's largest manufacturing partner, and it shows record growth month over month.

BACKDROP

We added Apple to Top Picks on January 2nd, 2016 for $104.15. As of this writing the stock is trading at $174.62, up 67.7%. On December 4th, we published the dossier iPhone Demand and Manufacturing Hit Highs.

In that story, we noted that high profile Apple analyst Ming-Chi Kuo, of KGI Securities, had changed his view of the iPhone X cycle. The first report of a supply shortage had Kuo dropping estimates for initial fourth quarter shipments from 30-35 million to 25-30 million units.

But, the tide has turned, and so have projections. The analyst says that Hon Hai's (Foxconn) shipments of iPhone X units have climbed to 440,000 to 550,000 units per day. That's up dramatically from the 50,000 to 100,000 being shipped per day just 1-2 months ago.

He's now saying that Q4 2017 shipments could be "10-20 percent higher than previously estimated."

And now to the story...

STORY

Nomura Instinet lowered its rating for Apple to neutral from buy, and here was the rationale:

We argue that the stock's gains for the iPhone X supercycle are in the late innings. We believe unit growth, if not quite ASP growth, is well anticipated by consensus and a historically full multiple.

This downgrade came one-day after had just set a new all-time in stock price. Nomura wasn't so much bearish as it was noting that the valuation for this iPhone cycle had reached the peak of prior cycles:

Apple is trading at a valuation of 15 times estimated 2018 earnings. He said during the iPhone 6 cycle, the company's earnings multiple peaked at 15 times earnings and then declined to 9 times earnings. The analyst also noted that the smartphone maker's stock went from 13 times earnings to 8 times earnings during the iPhone 5 cycle.

But there is other data -- some empirical, some heuristic -- that may point to higher growth than expected. Let's turn to that data.

EMPIRICAL DATA

Foxconn reports revenue numbers every month. It's one of the great windows into Apple's trajectory and oddly, still, somewhat under reported. If you follow news for the ticker AAPL, it's a good idea to follow news for the ticker HNHPF, which is the ticker for Han Hai on the US exchanges.

Bloomberg just noted that "Hon Hai sales jumped 18.5 percent for November, a record high and the fastest growth in two years."

That's the empirical evidence that iPhone sales are in fact booming. But there's more -- this time less scientific, but nonetheless noteworthy.

SURVEY DATA

RBC Capital's Amit Daryanani did a survey and it was reported by the great Tiernan Ray of Barron's.

Daryanani noted that demand for the iPhone X and the most expensive version of the iPhone 8 Plus were significantly better in China than even the United States.

Here are his takeaways, with our emphasis added:

62% of respondents interested in buying an iPhone preferred iPhone X, which compares to 28% of respondents in our US iPhone survey.

This likely means tailwinds strong mix and higher ASPs should be particularly strong in the Chinese market.

66% of prospective iPhone X buyers opted for the higher storage (256GB) model, while 64% of prospective iPhone 8/ iPhone 8 plus buyers expressed interest in buying the 256 GB model.

This is slightly higher vs. our US survey in which 57% of iPhone X prospective buyers preferred to buy the 256GB model.

Both replacement demand and switching trends appear healthy. ~28% of prospective iPhone purchasers indicated that they were switching to iOS from another OS.

This likely means tailwinds strong mix and higher ASPs should be particularly strong in the Chinese market.

66% of prospective iPhone X buyers opted for the higher storage (256GB) model, while 64% of prospective iPhone 8/ iPhone 8 plus buyers expressed interest in buying the 256 GB model.

This is slightly higher vs. our US survey in which 57% of iPhone X prospective buyers preferred to buy the 256GB model.

Both replacement demand and switching trends appear healthy. ~28% of prospective iPhone purchasers indicated that they were switching to iOS from another OS.

Much like Ming-Chi Kuo, Daryanani believes the reduced wait times for iPhone X are not a function of demand, but rather a function of increasing supply. Recall above that Kuo saw production from Foxconn increasing 5-10 fold from his initial channel checks.

Further, Business Insider shared a chart that shows iPhone X adoption outpacing the iPhone 8 and the iPhone 8 Plus.

Source: Business Insider

Source: Business Insider

The data for that chart comes from analytics firm Mixpanel.

ANOTHER STORY - MORE DEMAND

Another story that we have been tracking is the demand for and supply of Apple's Air Pods.

A quick visit to the Apple Store shows that AirPod orders placed on Monday won't be delivered until January. In August CEO Tim Cook said "we have increased production capacity for AirPods and are working very hard to get them to customers as quickly as we can, but we are still not able to meet the strong level of demand."

The Air Pods story is nice, but a little 'nichey,' unless you take a bit of a leap forward, which we have. We believe that the Air Pods combined with the new cellular enabled Apple Watch 3, together make an entire ecosystem for wearables.

While Apple Watch series 3 order on apple.com appear to ship same day, there is an argument to be made that the demand for Air Pods is in part a reflection of demand for the new cellular enabled Watch.

On November 14th we penned, Apple Watch is Winning, and we noted that according to Canalys research:

Apple retook the lead in the wearable band market in Q3 2017, with shipments of 3.9 million.

It posted its strongest quarter so far in 2017, thanks to the release of the Apple Watch Series 3.

It posted its strongest quarter so far in 2017, thanks to the release of the Apple Watch Series 3.

Canalys Analyst Jason Low goes onto write that "strong demand for the LTE-enabled Apple Watch Series 3 has dispelled service providers' doubts about the cellular smartwatch not appealing to customers."

And then the analysis gets yet more bullish for the product (our emphasis is added):

Apple Watch Series 3 did not reach its full potential in Q3.

It suffered limited availability as demand outstripped supply in major markets.

Service providers had underestimated demand for the new Apple Watch.

It suffered limited availability as demand outstripped supply in major markets.

Service providers had underestimated demand for the new Apple Watch.

Now, when we take the sales numbers from Foxconn, which are empirical, then the survey data from RBC and analytics from Mixpanel, we see that the iPhone 8/X cycle may be nowhere near at its peak. Going further with the empirical evidence that Air Pods are sold out and delivery is weeks away with data surrounding the Apple Watch, we have further evidence that this quarter for Apple could be a massive win.

SEEING THE FUTURE

It's understanding technology that gets us an edge on finding the gems that can turn into the 'next Apple,' or 'next Amazon,' where we must get ahead of the curve. This is what CML Pro does.

Each company in our 'Top Picks' has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty. We are Capital Market Laboratories. Our research sits next to Goldman Sachs, JP Morgan, Barclays, Morgan Stanley and every other multi billion dollar institution as a member of the famed Thomson Reuters First Call. But while those people pay upwards of $2,000 a month on their live terminals, we are the anti-institution and are breaking the information asymmetry.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

As always, control risk, size appropriately and use your own judgment, aside from anyone else's subjective views, including my own.

Thanks for reading, friends.

The author is long shares Apple at the time of this writing.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.