The Exact Trigger that Indicates Volatility in Procter & Gamble Co

Procter & Gamble Co (NASDAQ:PG) : The Exact Trigger that Indicates Volatility

Date Published: 2020-04-21

Disclaimer

The results here are provided for general informational purposes from the CMLviz Trade Machine Stock Option Backtester as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.Lede

Today, 4-21-2020, Procter & Gamble Co (NYSE:PG) has met the technical requirements for the Capital Market Laboratories (CMLviz) volatility burst model.The stock must stay below the 200-day simple moving average by the close of trading to trigger.

Here is the wild one-year stock chart, and the wilder last few months are the focus:

Don't let the algos run you over. Become the algo. Tap here to become a Trade Machine.

Preface

There is a trigger in Procter & Gamble Co (NYSE:PG) that has preceded a large stock move and that move has created a powerful option trading opportunity in the past. The strategy won't work forever, but for now it is a volatility back-test that has not only returned 489.3%, but has also shown a win-rate of 79% while taking no stock direction risk.Simply owning puts and calls together, like a straddle or a strangle, can be a huge winner, as it was at the end of 2018. But, equally, it has been a huge losing strategy outside of that time frame. So, the need has arisen -- an empirical and structured trigger that indicates when a large stock move is coming so owning a strangle has a higher probability of succeeding.

There is such a technical condition, and we will review it, right now.

Here is a quick 3 minute video that demonstrates the back-test:

The Short-term Option Volatility Trade in Procter & Gamble Co

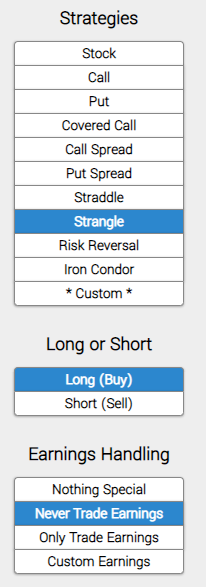

It's time to take advantage of volatility. Fear, uncertainty, doubt, unclear news headlines -- these are all trade-able events. Today we look at exactly what has worked in PG, and the special technical trigger that starts it off.We will examine the outcome of going long a short-term out-of-the-money (40 delta) strangle (buying an out of the money call and buying an out of the money put), in options that are the closest to 14-days from expiration. But we follow three rules:

* Never Trade Earnings

Let's not worry about stock direction or earnings, let's try to find a back-test that benefits from volatility. Here it is, first, we enter the long strangle.

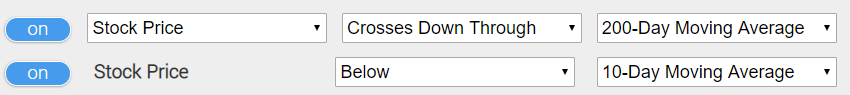

* Use a technical trigger to start the trade, specifically:

Wait until the day that the stock price crosses below the 200-day moving average and the stock price is below the 10-day moving average. Here is a nice simple image of the technical requirement:

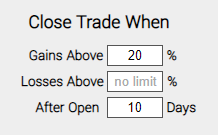

* Finally, we set a very specific type of limit:

* Use a 20% limit

* Close the trade after 10 days, if the limit has not been hit.

At the end of each day, the back-tester checks to see if the long strangle is up 20%. If it is, it closes the position. If after 10-days the limit has not been hit, the strangle is closed so not to suffer total time decay.

RESULTS

Here are the results over the last three-years in Procter & Gamble Co:| PG: Long 40 Delta Strangle | |||

| % Wins: | 83.3% | ||

| Wins: 5 | Losses: 1 | ||

| % Return: | 209% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® stock option backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

We can also see that this strategy hasn't been a winner all the time, rather it has won 22 times and lost 6 times, for a 79% win-rate and again, that 489.3% return in less than six-full months of trading. The trade will lose sometimes, but over the most recent trading history, this momentum and optimism options trade has won ahead of earnings.

Setting Expectations

While this strategy had an overall return of 209%, the trade details keep us in bounds with expectations:➡ The average percent return per trade was 29.2%.

Back-testing More Time Periods in Procter & Gamble Co

Now we can look at just the last year as well:| PG: Long 40 Delta Strangle | |||

| % Wins: | 100.00% | ||

| Wins: 2 | Losses: 0 | ||

| % Return: | 132.9% | ||

Tap Here to See the Back-test

We're now looking at 132.9% returns, on 2 winning trades and 0 losing trades.

➡ The average percent return over the last year per trade was 58.14%.

WHAT HAPPENED

This is how people profit from the option market, its empirical testing, not luck. Don't let the institutional algorithms run you over. Become the algorithm. Tap here to become a Trade Machine.Risk Disclosure

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

You should read the Characteristics and Risks of Standardized Options.