Adobe Systems Incorporated, ADBE, earnings, options, volatility, iron condor, Santa Clause

LEDE

This is a slightly advanced option trade that starts one day after Adobe Systems Incorporated (NASDAQ:ADBE) earnings and lasts for the 14 calendar days to follow, that has been a winner for the last 3 years in a row.

Adobe has earnings due out around 12-14-2017 (that date is not yet confirmed). The last trading day in 2017 is Friday, Dec 29th, which is 15 days after earnings. We're examining a back-test that would create a strategy that sells volatility into the end of the year.

Adobe Systems Incorporated (NASDAQ:ADBE) Earnings

For Adobe Systems Incorporated, irrespective of whether the earnings move was up or down, if we waited one-day after the stock move, and then sold a 2-week at out of the money iron condor, the results were quite strong. This trade opens one calendar after earnings were announced to try to let the stock find equilibrium after the earnings announcement.

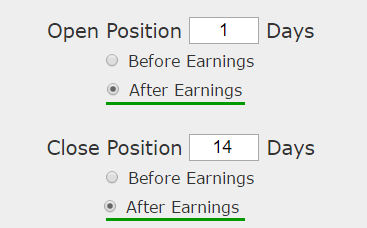

We can test this approach without bias with a custom option back-test. Here is our earnings set-up:

Rules

* Open the short iron condor one calendar day after earnings .

* Close the iron condor 14 calendar days after earnings .

* Use the options closest to 20 days from expiration (but at least 14-days).

And a note before we see the results: This is a straight down the middle volatility bet -- this trade wins if the stock is not volatile the three weeks following earnings and it will stand to lose if the stock is volatile.

RISK MANAGEMENT

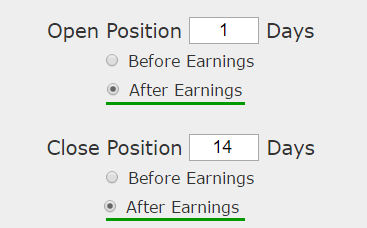

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the entire iron condor is either up or down 40% relative to the open price. If it was, the trade was closed.

RESULTS

If we sold this 40/15 delta iron condor in Adobe Systems Incorporated (NASDAQ:ADBE) over the last three-years but only held it after earnings we get these results:

Tap Here to See the Back-test

We see a 144% return, testing this over the last 12 earnings dates in Adobe Systems Incorporated.

Setting Expectations

While this strategy had an overall return of 144%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 17.5% over 14-days.

SHORTER TIME PERIOD

We can also look at the results over the last year:

Tap Here to See the Back-test

We now see a 65.4% return, with the average trade yielding 14.3% for each 14-day period.

RISK TO NOTE

Adobe has been one of those momentum technology names that has found new love from Wall Street because of its cloud based software offerings. The end of the year has two schools of thought.

One school believes that volatility dips as traders leave early for vacation and if that is the case, then a strategy like the one constructed -- that is, selling volatility, would do well.

On the other hand, some traders believe strongly that there is a "Santa Clause" rally -- which means stocks tend to rise in the last couple of weeks before the end of the year. If that is the case, then selling an iron condor would not be the best trade.

Having said that, the back-test was so compelling, we felt it deserved special attention and a full write-up, especially as we turn to some diversity in our back-tests that aren't directionally focused.

WHAT HAPPENED

This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

The Volatility Option Trade After Earnings in Adobe Systems Incorporated

Adobe Systems Incorporated (NASDAQ:ADBE) : The Volatility Option Trade After Earnings

Date Published: 2017-11-22Author: Ophir Gottlieb

LEDE

This is a slightly advanced option trade that starts one day after Adobe Systems Incorporated (NASDAQ:ADBE) earnings and lasts for the 14 calendar days to follow, that has been a winner for the last 3 years in a row.

Adobe has earnings due out around 12-14-2017 (that date is not yet confirmed). The last trading day in 2017 is Friday, Dec 29th, which is 15 days after earnings. We're examining a back-test that would create a strategy that sells volatility into the end of the year.

Adobe Systems Incorporated (NASDAQ:ADBE) Earnings

For Adobe Systems Incorporated, irrespective of whether the earnings move was up or down, if we waited one-day after the stock move, and then sold a 2-week at out of the money iron condor, the results were quite strong. This trade opens one calendar after earnings were announced to try to let the stock find equilibrium after the earnings announcement.

We can test this approach without bias with a custom option back-test. Here is our earnings set-up:

Rules

* Open the short iron condor one calendar day after earnings .

* Close the iron condor 14 calendar days after earnings .

* Use the options closest to 20 days from expiration (but at least 14-days).

And a note before we see the results: This is a straight down the middle volatility bet -- this trade wins if the stock is not volatile the three weeks following earnings and it will stand to lose if the stock is volatile.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the entire iron condor is either up or down 40% relative to the open price. If it was, the trade was closed.

RESULTS

If we sold this 40/15 delta iron condor in Adobe Systems Incorporated (NASDAQ:ADBE) over the last three-years but only held it after earnings we get these results:

| ADBE: Short 40 Delta / 15 Delta Iron Condor |

|||

| % Wins: | 100% | ||

| Wins: 12 | Losses: 0 | ||

| % Return: | 144% | ||

Tap Here to See the Back-test

We see a 144% return, testing this over the last 12 earnings dates in Adobe Systems Incorporated.

Setting Expectations

While this strategy had an overall return of 144%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 17.5% over 14-days.

SHORTER TIME PERIOD

We can also look at the results over the last year:

| ADBE: Short 40 Delta / 15 Delta Iron Condor |

|||

| % Wins: | 100% | ||

| Wins: 4 | Losses: 0 | ||

| % Return: | 65.4% | ||

Tap Here to See the Back-test

We now see a 65.4% return, with the average trade yielding 14.3% for each 14-day period.

RISK TO NOTE

Adobe has been one of those momentum technology names that has found new love from Wall Street because of its cloud based software offerings. The end of the year has two schools of thought.

One school believes that volatility dips as traders leave early for vacation and if that is the case, then a strategy like the one constructed -- that is, selling volatility, would do well.

On the other hand, some traders believe strongly that there is a "Santa Clause" rally -- which means stocks tend to rise in the last couple of weeks before the end of the year. If that is the case, then selling an iron condor would not be the best trade.

Having said that, the back-test was so compelling, we felt it deserved special attention and a full write-up, especially as we turn to some diversity in our back-tests that aren't directionally focused.

WHAT HAPPENED

This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.