Momentum Leads to Momentum One-Week Pre-earnings in Adobe Systems Incorporated

Adobe Systems Incorporated (NASDAQ:ADBE) : The One-Week Pre-earnings Momentum Trade With Options

Date Published: 2018-05-27Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

PREFACE

There is a bullish momentum pattern in Adobe Systems Incorporated (NASDAQ:ADBE) stock 7 calendar days before earnings, and we can capture that phenomenon explicitly by looking at returns in the option market. Further, we can specify the back-tests that have followed the same pattern but showed a higher win rate and higher average returns, historically, with some thoughtful research.

According to our data provider, Wall Street Horizon, Adobe next has earnings due out approximately on 2018-06-14 -- this date has not been verified -- it's an estimate for now. Seven days before then would be 6-7-2018, but again, we need to wait for confirmation of the earnings date, which will appear in Trade Machine.

LOGIC

The logic behind the option trading backtest is easy to understand -- in a bull market there can be a stock rise ahead of earnings on optimism, or upward momentum, that sets in the one-week before an earnings date. Now we can see it in Adobe Systems Incorporated.

Even further, looking at the prior earnings move has proven to be a statistically significant predictor of the next quarter's pre-earnings stock movement, and whether that momentum is more or less likely to occur.

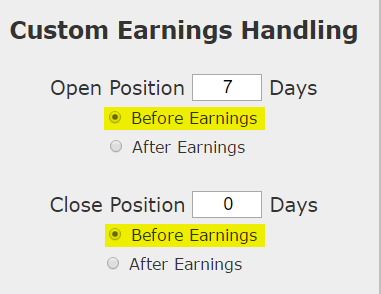

We will start the analysis by examining the outcome of getting long a slightly out-of-the-money (40 delta) call option in Adobe Systems Incorporated 7-days before earnings (using calendar days) and selling the call before the earnings announcement. We use the options that are closest to 21 days from expiration.

Here's the set-up in great clarity; again, note that the trade closes before earnings since ADBE reports after the close, so this trade does not make a bet on the earnings result.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

RESULTS

Here are the results over the last three-years in Adobe Systems Incorporated:

| ADBE: Long 40 Delta Call | |||

| % Wins: | 91.7% | ||

| Wins: 11 | Losses: 1 | ||

| % Return: | 676% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

Track this trade idea. Get alerted for ticker `ADBE` 7 days before earnings

We see a 91.7% win rate and we see that it had an average percent return per trade of 37%.

Amplifying the Signal

We can take a step further with this back-test, and rather than simply look at every pre-earnings period, we can specify to only test the pre-earnings week if and only if the prior earnings move showed a 1% or greater stock gain. Here is that set-up:

Now we can run a back-test that only initiates a pre-earnings trade if the prior earnings move was a 1% or greater rise the stock price the day following earnings.

Here are those results over the last 3-years:

| ADBE: Long 40 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 7 | Losses: 0 | ||

| % Return: | 397% | ||

Tap Here to See the Back-test

Now we see five fewer triggers (7 trades versus 12 trades), but the average return has risen to 43% (from 37%), and the win-rate has increased as well. This is relevant because the last earnings move for ADBE was in fact more than a 1% rise in the stock.

Here's a stock chart of ADBE that surrounds the last two earnings results and the last pre-earnings momentum.

We see a 1% move in the earnings period two-quarters ago, and then the pre-earnings momentum for the next quarter. We also see the greater than 1% move in the last earnings cycle which leads into the next pre-earnings period.

Is This Just Because Of a Bull Market?

It's a fair question to ask if these returns are simply a reflection of a bull market rather than a successful strategy. It turns out that this phenomenon of pre-earnings optimism also worked very well during 2007-2008, when the S&P 500 collapsed into the "Great Recession."

The average return for this strategy, by stock, using the Nasdaq 100 and Dow 30 as the study group, saw a 45.3% return over those 2-years. And, of course, these are just 8 trades per stock, each lasting 7 days.

* Yes. We are empirical.

* Yes, you are better than the rest now that you know this.

* Yes, you are powerful for it.

WHAT HAPPENED

There's a lot less luck to successful option trading than most people realize and this is it.

To learn more about empirical option trading we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.