Ambarella Inc, AMBA, earnings, options, intelligence

CORRECTION: A prior version of this article used one-day after earnings for the start date -- that is incorrect, it is two-days after earnings that we are after.

You can see the exact back-test here: Back-test Link

LEDE

This is a simple option trade that starts two-days after Ambarella Inc (NASDAQ:AMBA) earnings and lasts for the one month to follow, that has been a winner for 3 straight years.

Ambarella Inc (NASDAQ:AMBA) Earnings

While the mainstream media likes to focus on the actual earnings move for a stock, that's the distraction when it comes to the option market.

For Ambarella Inc, irrespective of whether the earnings move was up or down, if we waited two-days after the stock move, and then sold an one-month out of the money put spread, the results were simply staggering. We wait two days to allow the stock to react fully to the earnings news.

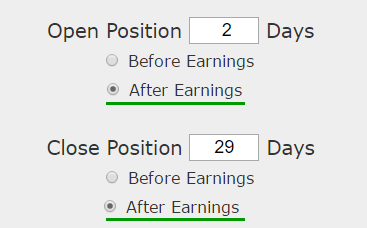

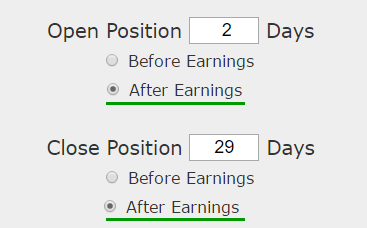

We can examine this, objectively, with a custom option back-test. Here is our earnings set-up:

Rules

* Open short put spread two days after earnings

* Close short put spread 29 days later

* Use the 30-day options

RETURNS

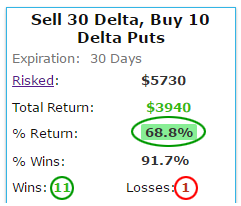

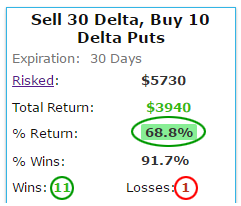

If we sold this out-of-the-money put spread in Ambarella Inc (NASDAQ:AMBA) over the last three-years but only held it after earnings we get these results:

We see a 69.4% return, testing this over the last 12 earnings dates in Ambarella Inc. That's a total of less than 360 days (28 days for each earnings date, over 12 earnings dates).

We can also see that this strategy hasn't been a winner all the time, rather it has won 11 times and lost 1 times, for a 92% win-rate.

Here are the results over the last year:

So we can see it has worked for all of the most recent four earnings releases. This is not a panacea -- there is no guarantee this will work. What we see is that over time, this has worked quite consistently and we have a strong rationale to explain it. Here is that rationale.

MORE TO IT THAN MEETS THE EYE

While a short put spread is a strategy that gains profits if the underlying stock "doesn't go down a lot," there is more to this with Ambarella Inc.

This strategy, and that's what it is, a strategy, not some weird promise of a silver bullet, does not take on the risk of earnings, and while it's slightly bullish, it really isn't a stock direction investment either. In many ways, earnings results are just a coin flip -- and we are not interested in flipping coins with option strategies.

What we're after with this approach is identifying companies that make their large stock move the days after earnings -- whether that's up or down -- and after that, find a sense of equilibrium in the stock price for the next month. This is what we find in Ambarella Inc (NASDAQ:AMBA) .

We can see that this idea has been a winner more times than it has been a loser -- a 92% win-rate. It's that positive win-rate that has created that large 70% annualized return.

WHAT HAPPENED

Traders that have a plan guess less. This is how people profit from the option market. Take a reasonable idea or hypothesis, test it, and apply lessons learned.

We hope, if nothing else, you have learned about Ambarella Inc (NASDAQ:AMBA) and the intelligence and methodology of option trading and this idea of equilibrium right after earnings.

To see how to do this for any stock and for any strategy with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

The author is long shares of Ambarella Inc (NASDAQ:AMBA) at the time of this writing.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Back-test Link

Options Intelligence: Earnings Trading in Ambarella Inc (NASDAQ:AMBA)

Ambarella Inc (NASDAQ:AMBA) : Options Intelligence: Earnings Trading

Date Published: 2017-05-5Author: Jason Hitchings

CORRECTION: A prior version of this article used one-day after earnings for the start date -- that is incorrect, it is two-days after earnings that we are after.

You can see the exact back-test here: Back-test Link

LEDE

This is a simple option trade that starts two-days after Ambarella Inc (NASDAQ:AMBA) earnings and lasts for the one month to follow, that has been a winner for 3 straight years.

Ambarella Inc (NASDAQ:AMBA) Earnings

While the mainstream media likes to focus on the actual earnings move for a stock, that's the distraction when it comes to the option market.

For Ambarella Inc, irrespective of whether the earnings move was up or down, if we waited two-days after the stock move, and then sold an one-month out of the money put spread, the results were simply staggering. We wait two days to allow the stock to react fully to the earnings news.

We can examine this, objectively, with a custom option back-test. Here is our earnings set-up:

Rules

* Open short put spread two days after earnings

* Close short put spread 29 days later

* Use the 30-day options

RETURNS

If we sold this out-of-the-money put spread in Ambarella Inc (NASDAQ:AMBA) over the last three-years but only held it after earnings we get these results:

We see a 69.4% return, testing this over the last 12 earnings dates in Ambarella Inc. That's a total of less than 360 days (28 days for each earnings date, over 12 earnings dates).

We can also see that this strategy hasn't been a winner all the time, rather it has won 11 times and lost 1 times, for a 92% win-rate.

Here are the results over the last year:

So we can see it has worked for all of the most recent four earnings releases. This is not a panacea -- there is no guarantee this will work. What we see is that over time, this has worked quite consistently and we have a strong rationale to explain it. Here is that rationale.

MORE TO IT THAN MEETS THE EYE

While a short put spread is a strategy that gains profits if the underlying stock "doesn't go down a lot," there is more to this with Ambarella Inc.

This strategy, and that's what it is, a strategy, not some weird promise of a silver bullet, does not take on the risk of earnings, and while it's slightly bullish, it really isn't a stock direction investment either. In many ways, earnings results are just a coin flip -- and we are not interested in flipping coins with option strategies.

What we're after with this approach is identifying companies that make their large stock move the days after earnings -- whether that's up or down -- and after that, find a sense of equilibrium in the stock price for the next month. This is what we find in Ambarella Inc (NASDAQ:AMBA) .

We can see that this idea has been a winner more times than it has been a loser -- a 92% win-rate. It's that positive win-rate that has created that large 70% annualized return.

WHAT HAPPENED

Traders that have a plan guess less. This is how people profit from the option market. Take a reasonable idea or hypothesis, test it, and apply lessons learned.

We hope, if nothing else, you have learned about Ambarella Inc (NASDAQ:AMBA) and the intelligence and methodology of option trading and this idea of equilibrium right after earnings.

To see how to do this for any stock and for any strategy with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

The author is long shares of Ambarella Inc (NASDAQ:AMBA) at the time of this writing.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Back-test Link