Advanced Micro Devices Earnings: Growth is Forecast - But Will it Come?

Advanced Micro Devices Earnings: Growth is Forecast - But Will it Come?

Date Published: 10-23-2018

UPDATE: 10-24-2018

Shares of AMD fell more than 20% at one point in the after hours sessions. Here's why:

The results for AMD:

* Revenue: $1.65B vs $1.7B (miss)

* EPS: $0.13 vs $0.12 (small beat)

Guidance was quite poor:

Revenue: $1.45B vs estimates of $1.60B (big miss)

CEO Lisa Su had some comments for the press release. We (CMLviz.com) will be speaking with her personally, tomorrow, 10-25-2018, in the morning.

* "Client and server processor sales increased significantly although graphics channel sales were lower in the quarter."

* "We delivered our fifth straight quarter of year-over-year revenue and net income growth driven largely by the accelerated adoption of our Ryzen, EPYC and datacenter graphics products."

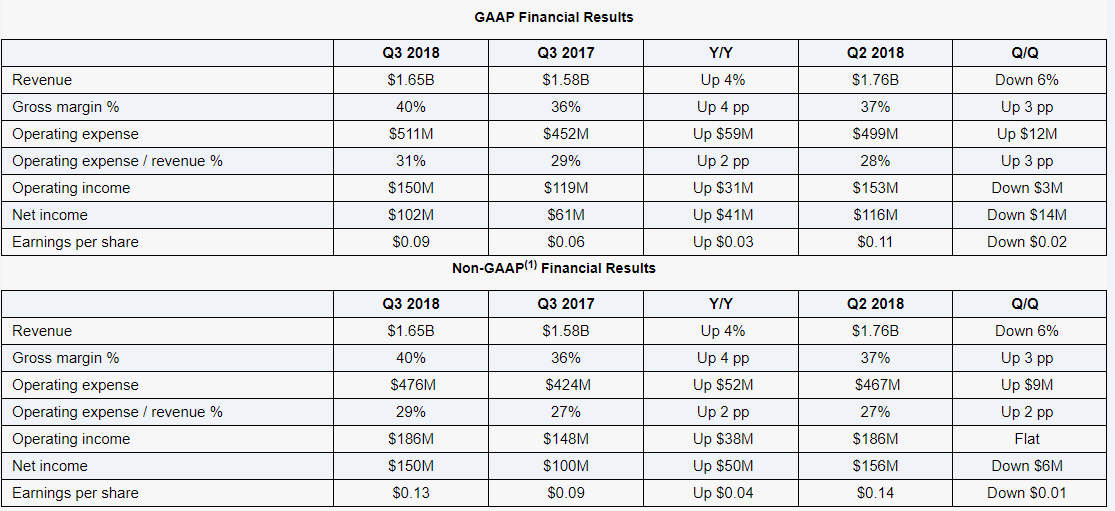

Here is the entire table of results from the company:

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.LEDE

Advanced Micro Devices (AMD) has seen its stock rip from about $2 to now into the mid-twenties. The company has gone from forever irrelevant to now pulling ahead of tech giant Intel in the race to the 7nm CPU.In fact, AMD has beaten Intel already, and the question now is, how much time does it have in the lead, will it retain that lead for the next generation, and if so, will large companies really start using AMD CPUs as the defacto chip?

If the answer to that final question is "yes," then AMD has enormous room for growth, not just in the shrinking PC market, where it has a small piece of the market, but in the booming data center market (aka "the cloud").

As for the analysts, they are mixed. But one thing we will point out -- no one knows how this will all play out, it's a new world in the CPU market, but one thing we do see is that analysts see fiscal year 2020 EPS for AMD climbing to $0.68, up from $0.47 in fiscal year 2019 -- that's 45% EPS growth. Keep that in mind when we get to the valuation, because while it's pricey, with a 45% EPS forecast, pricey might be appropriate.

Advanced Micro Devices - By the Numbers

There is an expectation set by Wall Street -- and there are numbers at the top tier of that expectation as well. Guidance, at times, moves the market more than the actual quarter being reported -- so watch those numbers as well.Current Quarter Analyst Estimates

| Revenue | $1.70 Billion |

| Adjusted EPS | $0.12 |

What Constitutes a "Large Beat" for the Quarter

* If AMD reports a revenue number above $1.74 Billion , that would be ahead of even the highest estimates.* If AMD reports an EPS number above $0.15 , that would be ahead of even the highest estimates.

Next Quarter Analyst Estimates

| Revenue | $ 1.60 Billion |

| EPS | $ 0.11 |

What Constitutes a "Large Beat" in Guidance

* If AMD guides revenue above $ 1.77 Billion, that would be ahead of even the highest estimates.* If AMD guides EPS above $0.16 , that would be ahead of even the highest estimates.

Watch full year guidance as well. A raise would be a surprise in this environment.

Implied Forward PE

| Current Fiscal Year | 53.28 |

| Next Fiscal Year | 36.82 |

* If AMD hits the mean estimates for EPS this year, the company trades at a forward PE (for the current fiscal year) of 53.28.

* If AMD hits the mean estimates for EPS for next year, the company trades at a forward PE (for the next fiscal year) of 36.82.

Again, for fiscal 2020 from fiscal 2019, EPS is supposed to grow by 45%, so a pricey PE could be justified.

What Happened

All of this data we just covered is available for any company, at any time, on the CMLviz.com Analyst Tab, for free: Right HereBookmark the site www.CMLviz.com -- this is -- Free. Forever. Period.

Risk Disclosure

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.