How Amazon is Taking over Technology

Fundamentals

PREFACE

Amazon sits in some incredibly large growing themes and it has one secret weapon that is so big, and so wide ranging, that a discussion of the firm becoming the largest company in the world is in fact on the table.

SNAPSHOT

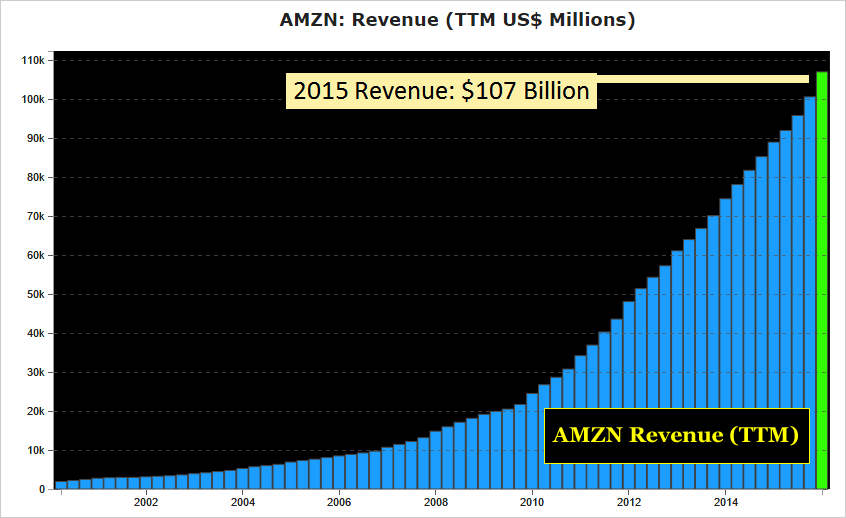

Let's quickly look at Amazon's revenue chart for the last sixteen years:

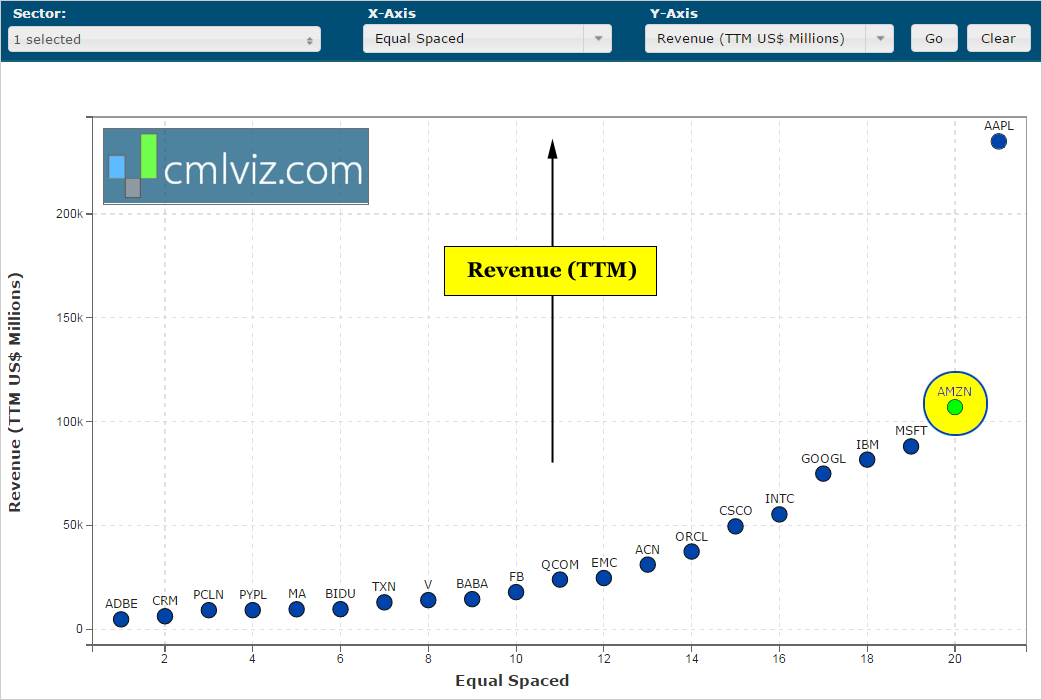

Just to give you an idea of how large that $107 billion in revenue is, here is a chart of all technology companies above $50 billion in market cap, ranked by their total revenue in the last year:

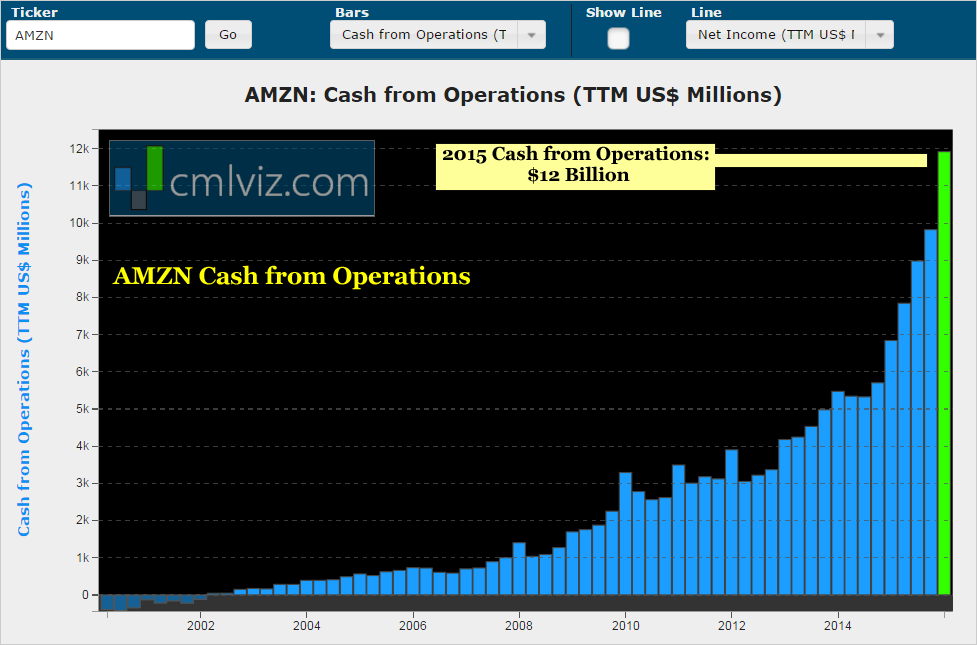

It's stunning to see Amazon's revenue is larger than every other technology company not named Apple (AAPL). Then we can turn to cash from operations(TTM):

Cash from operations is up 74% year-over-year and 117% over the last two-years to $11.9 billion.

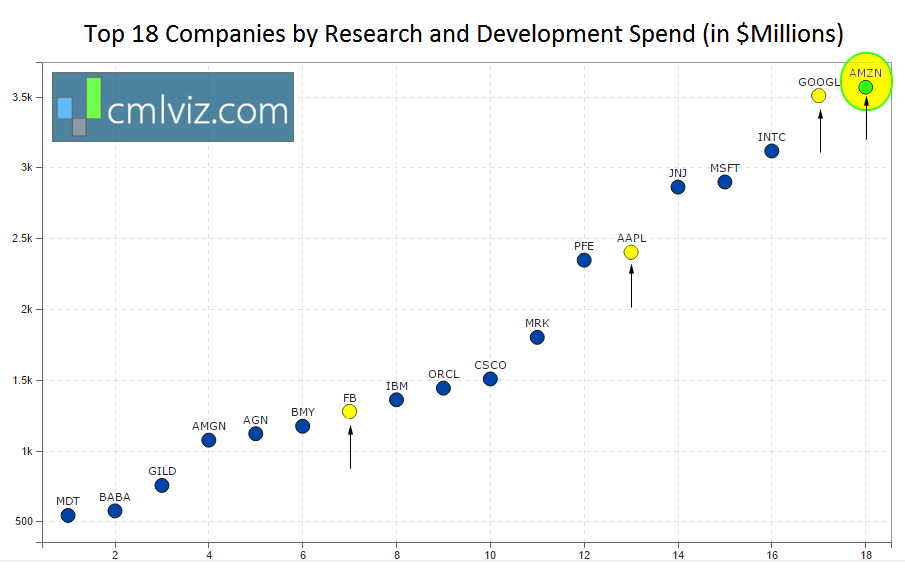

Finally, the real secret: Amazon's research and development expenditures:

There is no company on North American exchanges in any sector that spent more on R&D than Amazon did last quarter. R&D spending is up 35% year-over-year and 91% over the last two-years.

Now we know the "what." It's time to understand the "why," and that means a deep dive into each thematic force that is leading the charge.

THEMES: RETAIL E-COMMMERCE

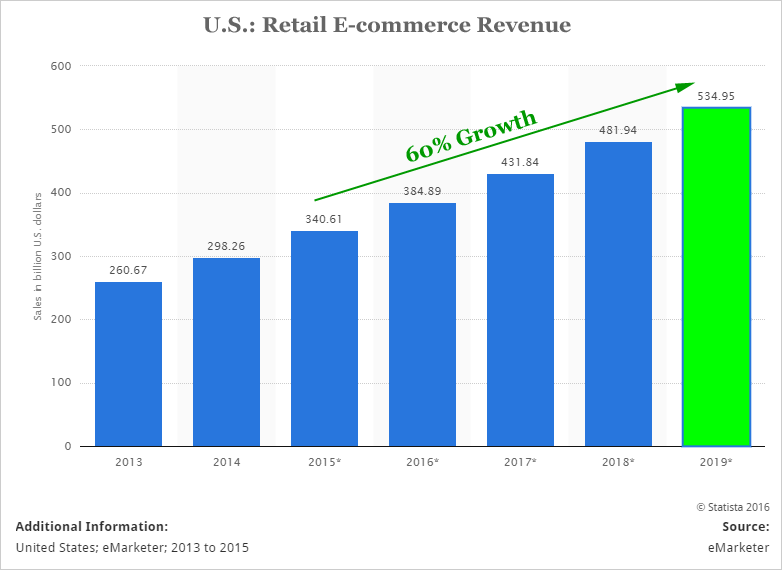

With $70 billion of its $107 billion in revenue coming from online sales, e-commerce is still the revenue driver. Here's the e-commerce theme trend over time:

Retail e-commerce in the United States will rise to $534 billion in 2019. That's 60% growth from last year.

While Amazon finds itself in a booming segment, the company is also gaining market share at the same time, making for that impossibly large revenue chart we saw at the top. Here are some staggering statistics.

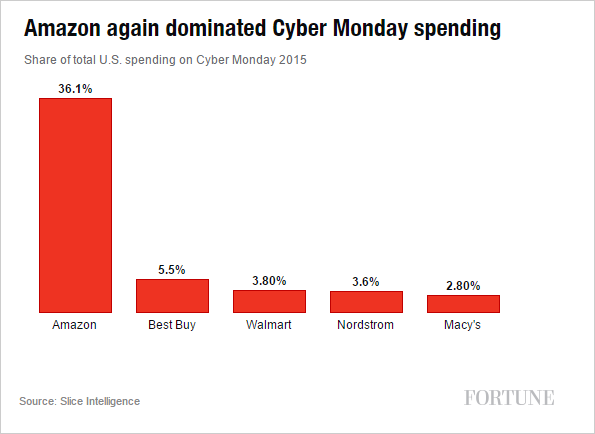

Amazon generated nearly 36% of all online sales on Cyber Monday, November 30, while other players such as Best Buy and Walmart had only 5.5% and 3.8% share, respectively, in total online sales. Here's the chart, which is bordering on absurd:

Now, read this tidbit from Macquarie Research

"Of every additional $1 Americans spent for items online this year, Amazon captured 51 cents."

Source: NY Times

Source: NY Times

There's an even more staggering result. In the entire United States, for all of retail sales both online and off-line, there was a total of $94 billion in growth. Of that $94 billion, Amazon accounted for $22 billion. Yes, Amazon accounted for 25% of US retail growth from every store, resource and platform available to mankind.

Now, let's understand how this is happening.

PRIME

Amazon Prime is a service that allows customers free two-day shipping on purchases and a number of other perks, like access to streaming video on demand (SVOD). Let's focus on retail sales for now, SVOD is an entirely other theme we are going to cover.

Amazon Prime costs $99 a year, and the latest figures from the company put it at a staggering 54 million subscribers, growing at 50% year-over-year.

The Consumer Intelligence Research Partners (CIRP) now estimates that 47% of the people who shop at Amazon are Prime members. The Trefis team now estimates that Amazon's market share in the U.S. EGM (electronics and general merchandise) market will grow from 14% in 2015 to 20% by 2022. That's a 42% rise.

It's easy to breeze buy that number, but try it again, more slowly. Amazon's market share will increase by 42% in a market that is already growing by 60%.

PRIME IS SPECIAL

While the numbers are fun, none of those figures have explained the unbelievable growth in sales that Amazon is seeing. But these three revelations do:

Amazon Prime members and their average household income is $69,300 nearly 25% higher than Walmart shopper's average income.

(Forbes)

The average Prime member spent $1,500 annually at Amazon, versus $625 for non- members.

(CNN Money)

(Forbes)

The average Prime member spent $1,500 annually at Amazon, versus $625 for non- members.

(CNN Money)

That last data point means that a Prime membership is not just $99 a year to Amazon, but also the $1,500 - $625 = $875 a year more in actual shopping. That means Prime is driving $47 billion in revenue from increased shopping and $5.4 billion from the membership fee, or a total of $52 billion.

The third revelation is yet more disruptive and makes the other two nothing more than casual conversation. We discuss it in detail in the full CML Pro research dossier.

THEMES: CLOUD COMPUTING

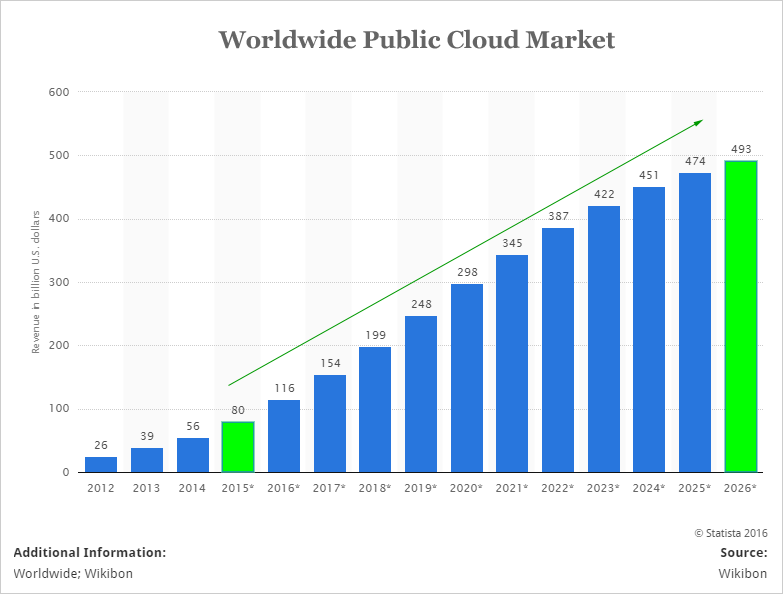

Amazon is also participating in the cloud computing revolution. Here is the expected revenue from public cloud vendors through 2026 via Statista.

Friends, we're looking at the trend in this theme that is going to grow from $80 billion in 2015 to nearly half a trillion dollars in 2026. It will nearly triple from last year to 2020.

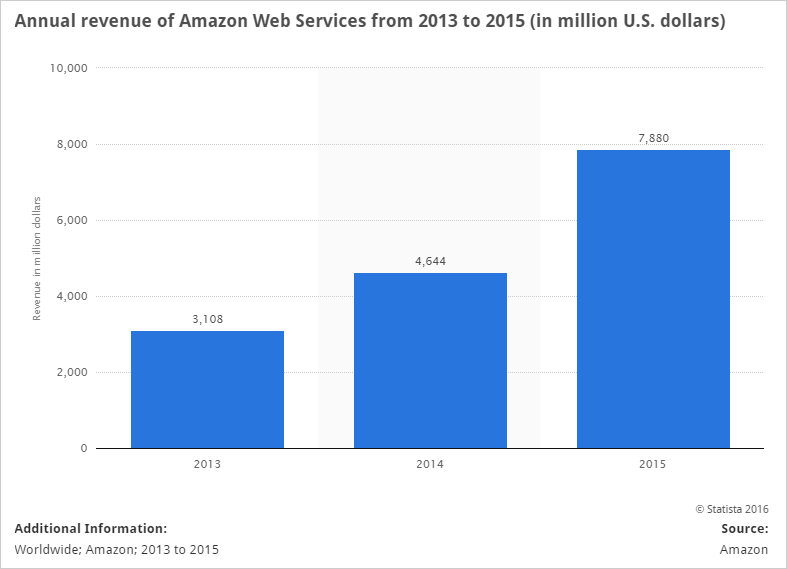

Here comes Amazon. Here is the chart of revenue growth for Amazon Web Services (AWS):

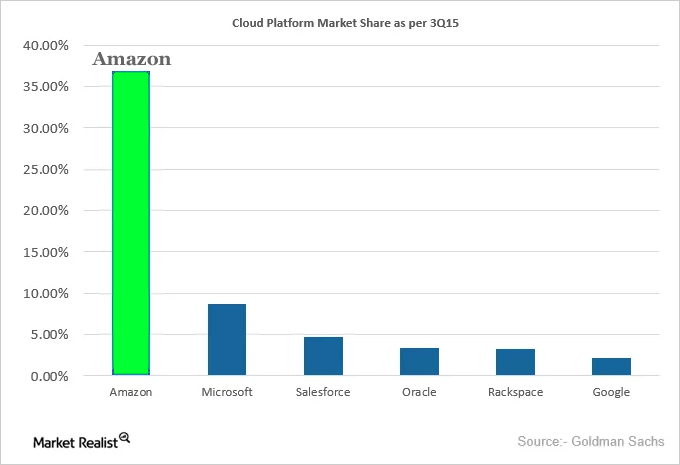

But, if we slice that down to what Goldman Sachs calls cloud "platform" market share, we get this:

While AWS nears 40%, the second largest player, Microsoft (MSFT) sits at 8%. No other firm is above 5%.

THEMES: SVOD

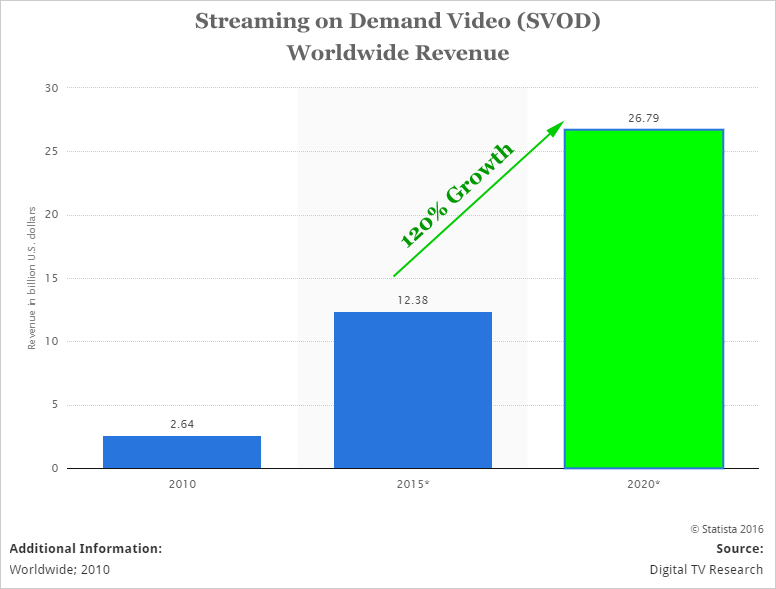

Amazon isn't done yet. The company's Prime membership includes a streaming video on demand segment (SVOD). Here's how that theme plays out over the next several years:

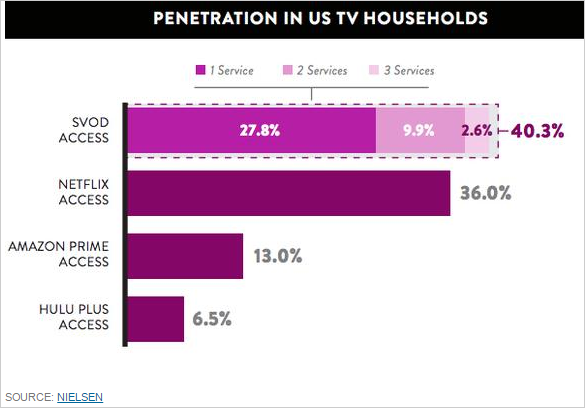

Streaming on Demand Video (SVOD) worldwide revenue will grow from $12.4 billion in 2015 to nearly $27 billion within five-years. As of right now, only about 40% of U.S. households actually have access to SVOD. Here's how the market share breaks down:

Netflix has neared total penetration of the U.S homes which have access to subscription-based video on demand services. In fact, this is part of the reason Netflix (NFLX) is a 'Top Pick' for CML Pro with a specific price target. Of the 40.3% of households with SVOD access, Netflix has 36% using its service (The Motley Fool).

But Amazon is second largest and data suggests it's gaining.

MARGINS

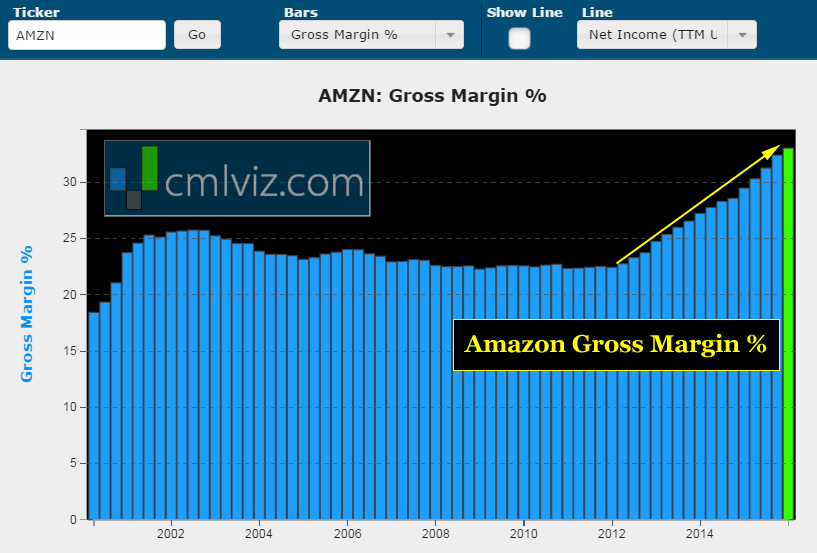

The impact of moving away from strictly retail sales and into the AWS and Prime business has exploded Amazon's gross margin percent higher. Check out this trend and how abruptly it turned once the new business lines were turned on:

Right about here is where everyone stops their research on Amazon. And this is good stuff -- we learned a lot. But the next step in the journey is so big, and so trans-formative, that it has to be prefaced with a sort of "caution flag."

CAUTION

We're about to go into uncharted territory -- and this is going to feel a little bit like Alice falling down the rabbit hole in "Alice and Wonderland." A total and utter transformation of reality.

Here we go:

We break news everyday. Discover the Undiscovered.

Get Our (Free) News Alerts Once a Day.

OWNING THE WORLD: STEP ONE

The BusinessInsider reported that Amazon may be 'secretly' working on a team that will help it replace FedEx and UPS. The goal here is simple, lower reliance on third party shippers. But this is where we start to get absurd again. Read this:

"The online retailer and fulfillment provider's objective is to guarantee delivery within a 90-minute to two-hour window."

How enticing does that Prime membership feel now? But it gets better.

Amazon is already testing "Prime Now" which is a service that would offer delivery in under 60 minutes. If that sounds ridiculous, try this: The company has already launched it in 17 cities, including San Francisco. Yeah, it's actually happening. Amazon now has 173 logistics facilities worldwide.

But this isn't Wonderland, yet.

OWNING THE WORLD: STEP TWO

Amazon has submitted a patent application for its drones. The FAA has already granted experimental testing permits. As CNN so aptly put it,

Delivering packages wherever you want it, through the air, via drone in just 30 minutes -- that's Amazon's vision and the company just made another step forward.

There�s a video demonstration from Amazon in the CML Pro research dossier that is downright frightening to any other technology company and beyond.

But this isn't Wonderland, yet.

WONDERLAND

OK. Here it is.

The culmination of everything comes down to a technology and convenience that is simply unparalleled in the world. We have saved that section for the CML Pro research dossier.

WHY THIS IS WONDERLAND

Shopping is over. Shipping is over. Going on-line to shop is over. Amazon will own everything. And the cost to the consumer: $99 a year with free "instant" shipping.

The expansion of Amazon's footprint in the retail anything space through its ecosystem will break everything. Even the hallowed Apple (AAPL) ecosystem is at risk. This could be so large, that oil consumption could drop because fewer people will be driving, getting deliveries via drone in a matter of minutes.

And believe it or not -- there's one more thing:

WONDERLAND AND ROBOTS

Amazon fulfillment centers are colossal. One warehouse in Baltimore covers one million square feet, or roughly 23 acres. That's a lot of land to cover on foot. One employee, who worked in Amazon warehouses for 14 years, told us he walked 13 miles a day when picking (Mental Floss).

That takes a lot of people -- and people are one of the highest expenses for a retail operation.

The rest of this section is available to CML Pro members and it sows a video demonstration that is absolutely, jaw open, mouth on the floor, unbelievable.

WHY THIS MATTERS

We have a full CML Pro research dossier "Amazon is Taking over Technology and The World" that goes much deeper than even this deep research -- its findings are breathtaking and include two demonstration videos from Amazon and Google that few have ever seen before.

But, while Amazon is a marvel and one of CML Pro's precious 'Top Picks,' to find the 'next Amazon,' or 'next Apple' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top 1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.