Six Stunning Charts That Make Amazon Bears Look Foolish

Fundamentals

PREFACE

Since forever, Amazon has been dismissed by Wall Street and, by default, the main stream media, as an overvalued loss creating machine. Even today, as the firm stands as one of the ten largest companies in the world by market cap, many from Wall Street bellow in full throat about the catastrophe that will soon be Amazon stock.

On the other side there is logic, reason and fact. Those three have led the stock price higher and will soon see it rise yet further. Here are seven charts that even the oldest legacy bearish argument simply has no more response for.

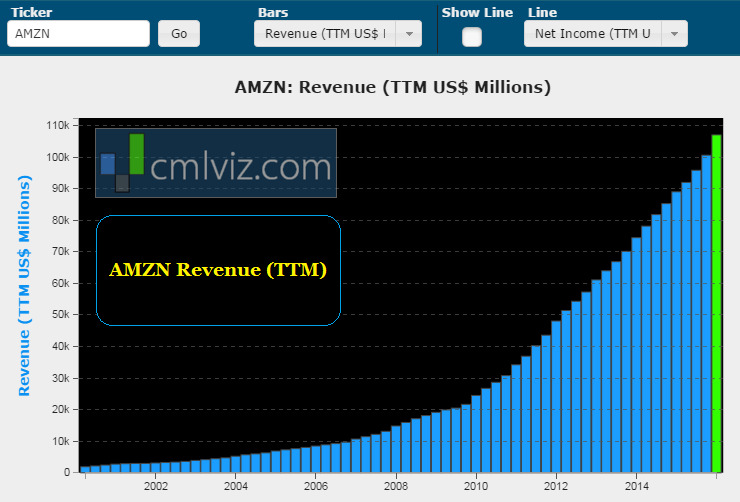

CHART 1: REVENUE

Amazon is part of an elite group creating a new era in business where the leaders are both large and nimble, where pioneering businesses optimize revenue streams while simultaneously taking huge risks with time horizons measured in decades. Here is the company's revenue (TTM) chart over the last sixteen years:

Amazon's revenue is up 20% year-over-year and now stands at over $107 billion. For context, the only other technology firm in the world with more revenue is Apple (NASDAQ:AAPL). That's right, Amazon has larger revenue than Microsoft (NASDAQ:MSFT), Google (NASDAQ:GOOG), Intel (NASDAQ:INTC) and Facebook (NASDAQ:FB).

Further yet, Thomson First Call estimates, of which CML Pro is a member, call for revenue to hit over $150 billion in two-years. That's 40% growth yet again.

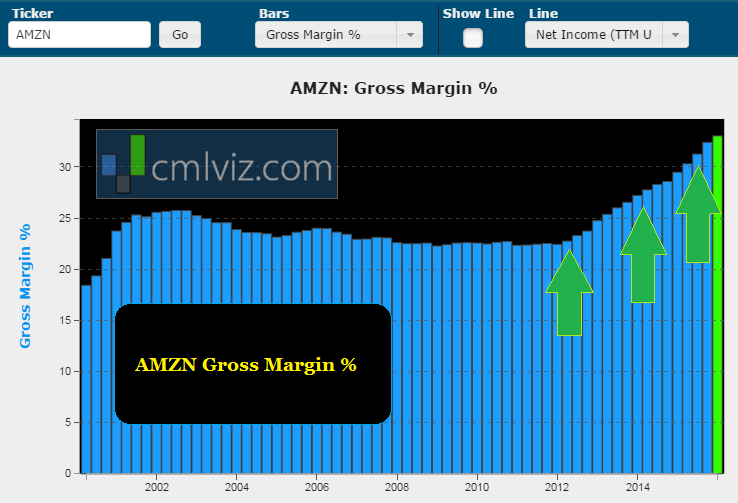

CHART 2: GROSS MARGIN

The bears call to the first chart is simple: Anyone can sell a product for $10 that costs $11 to make. That may be true, but it has nothing to do with Amazon. Here is the company's gross margin chart for the last sixteen-years:

Yes, as revenue has risen, margins have risen further. The margin increase can easily be attributed to Amazon Prime and Amazon's cloud business (AWS), which are both absolute monsters. Prime may account for as much as $70 billion of Amazon's $107 billion in revenue if you include Prime members shopping numbers on the site. AWS accounted for over 50% of operating income.

The "sell a $10 item that costs $11 to make" criticism is not only wrong, it's foolish. It's interesting how facts can end an argument.

CHART 3: CASH FROM OPERATIONS

If revenue is climbing and margins are increasing, then why isn't cash from operations rising? if that's the question in your head, you're not alone. And you're not alone because most of the investing public thinks that's the case. here's the problem, it's totally false. here is Amazon's cash from operations (TTM) over the last sixteen-years.

Amazon's cash from operations is not only at an all-time high of $11.9 billion, but it's up more than 74% year-over-year.

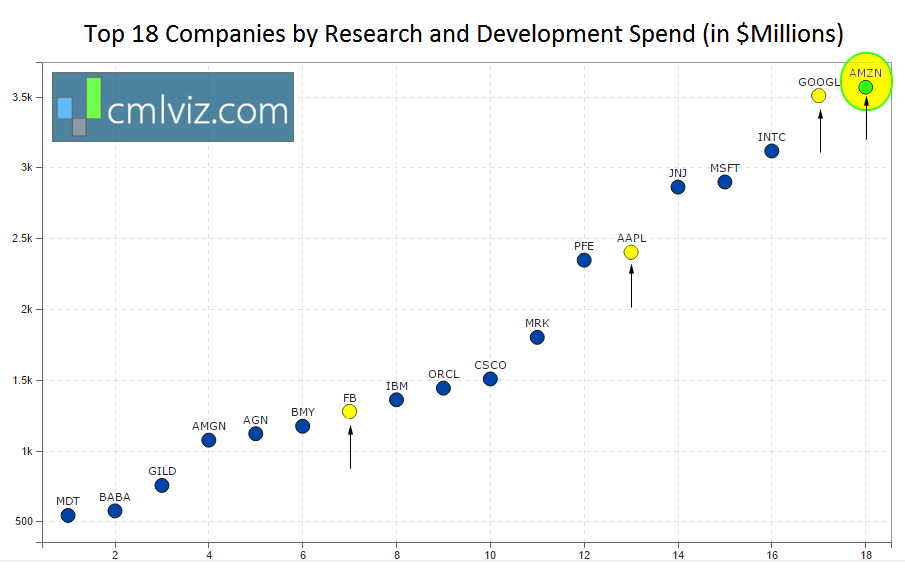

CHART 4: R&D

Amazon has been pouring a huge amount of its cash from operations back in to research and development (R&D). So much so that it spent more on R&D than any company in any sector in all of North America. Yep, every company in every sector. Here's the chart:

It's the secret hidden in plain sight. We have highlighted Alphabet / Google (NASDAQ:GOOG, NASDAQ:GOOGL), Apple (NASDAQ:AAPL) and Facebook (NASDAQ:FB) as well.

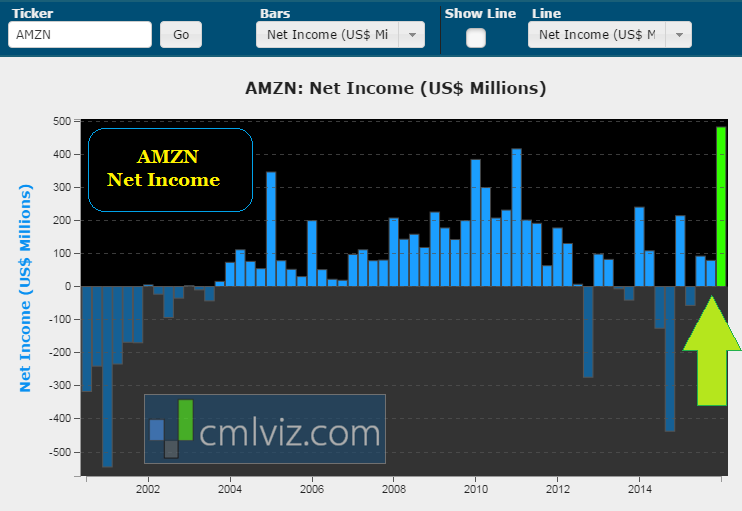

CHART 5: NET INCOME

Of course, the real argument is that Amazon can't turn a profit. Well, that isn't really true either. In fact, last quarter the company reported its largest quarterly earnings ever. Here is the quarterly chart of net income over the last sixteen-years:

Now, it certainly is the case that Amazon's total earnings are small compared to its market cap, but the idea that the firm is not turning a profit is false and many times intentionally misrepresented.

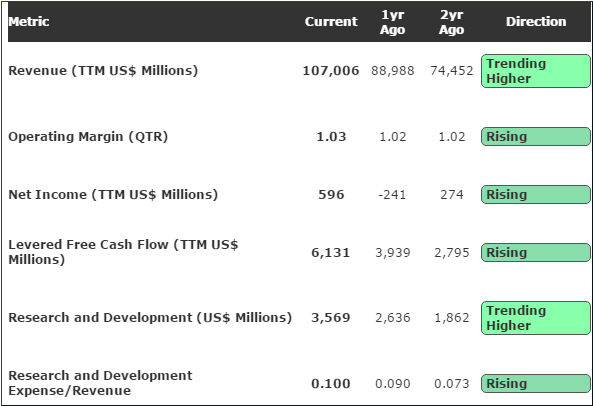

CHART 6: EVERYTHING

Instead of looking at another single metric chart, let's just look at the six critical measures for a technology company all at once:

Just so we're clear Amazon is seeing revenue, operating margins, net income, levered free cash flow, research and development and research and development per dollar of revenue all rising.

And after all of that, this is only the starting line:

ONLY THE BEGINNING

Amazingly, this is only the beginning. Through our research we've uncovered a whole new business line Amazon looks to be entering that has huge implications for the company's future.

Of all the technology companies attempting to replicate Apple's successes, perhaps only Amazon can truly compete with Apple (NASDAQ:AAPL) directly for a simple reason: Amazon is the only other technology company that has created an entire ecosystem from device, to application store, to streaming media, to delivery of products to your home.

And the real problem for Google and Facebook just popped up: We learned from Bloomberg that Amazon is now getting into web advertising, yet again, surrounding Prime Now.

Google and Facebook can make any argument they like about the relevancy of their ad platforms, but an advertisement that sits next to the "buy button" is incomparable.

And just for yet more avenues of growth, we learned from Reuters that Amazon is investing in self driving cars. Let's add Tesla (NASDAQ:TSLA) to the list of soon to be competitors.

WHY THIS MATTERS

There's so much going on with Amazon it's impossible to cover in one report. It spans almost all of technology's transformative themes. But, to find the 'next Amazon,' 'next Apple,' or 'next FANG stock,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.