Amazon: A Horrifying Fact Wall Street Missed

Fundamentals

PREFACE

Amazon is part of an elite group creating a new era in business. It's a marvel. The facts surrounding the company are so absurd, that this firm in and of itself may account for a large part of the entire United States GDP growth last quarter. This isn't a bearish note, this is a reality check.

EARNINGS

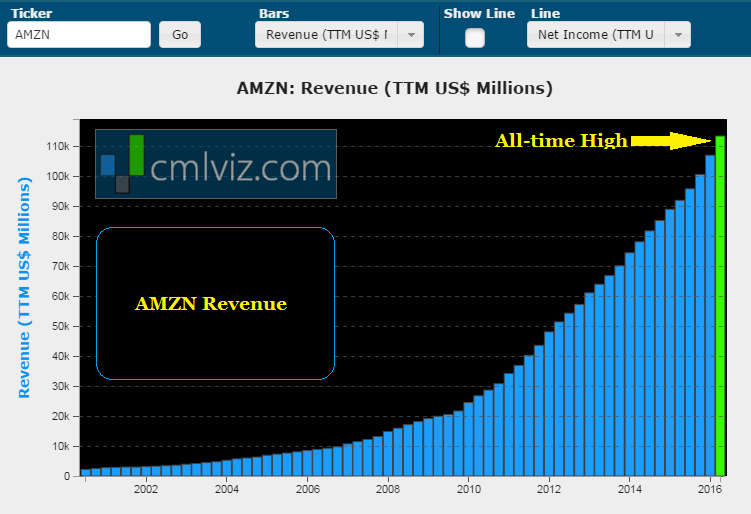

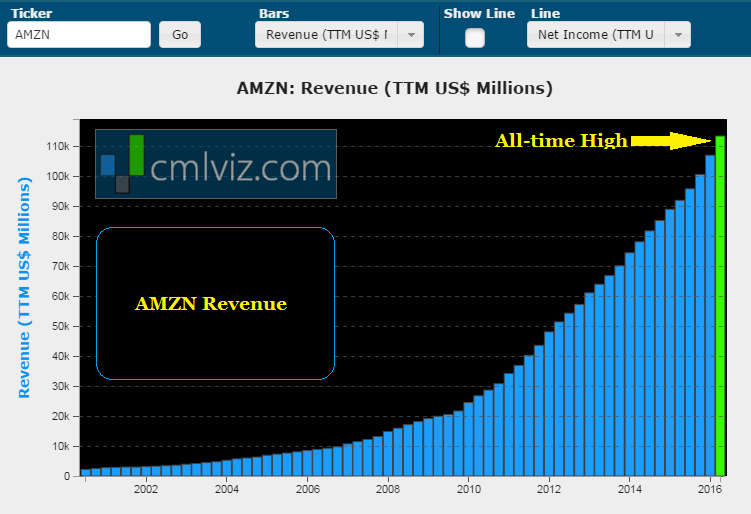

Amazon crushed revenue and EPS estimates in its latest earnings release. Here's what the revenue chart looks like now -- it's just breathtaking:

AMAZON REVENUE

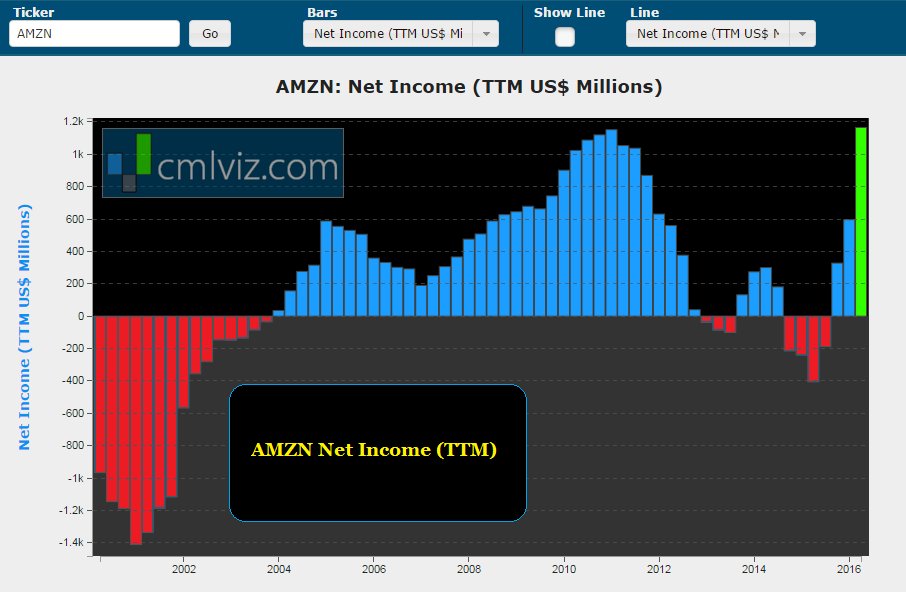

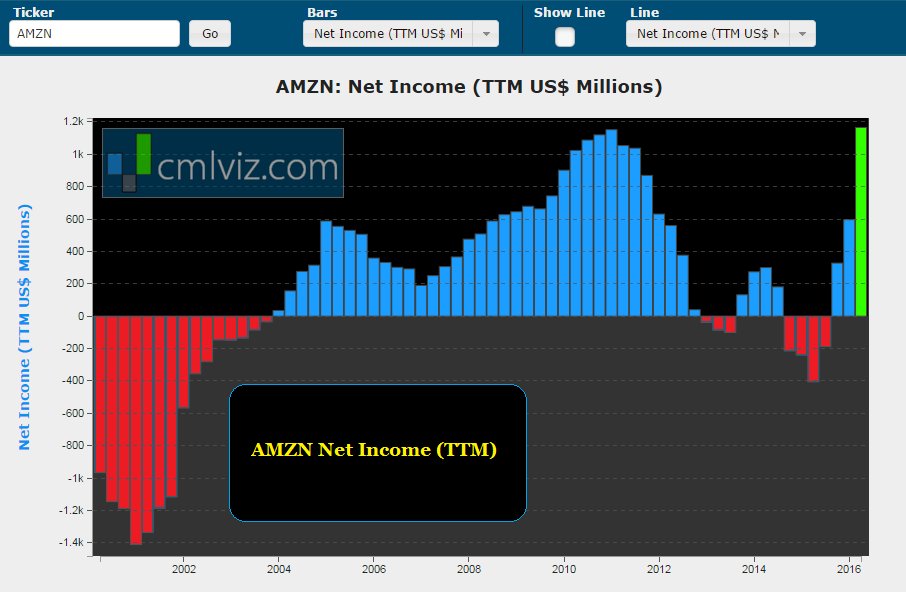

For good measure, while bears have been screaming bloody murder because the firm never generates a profit, well that narrative is dead too. Here is Amazon's net income chart:

NET INCOME

Earnings are here, and they are likely here to stay. Now, we have covered the basics, but it's not the basics that matter.

THE ELEPHANT IN THE ROOM

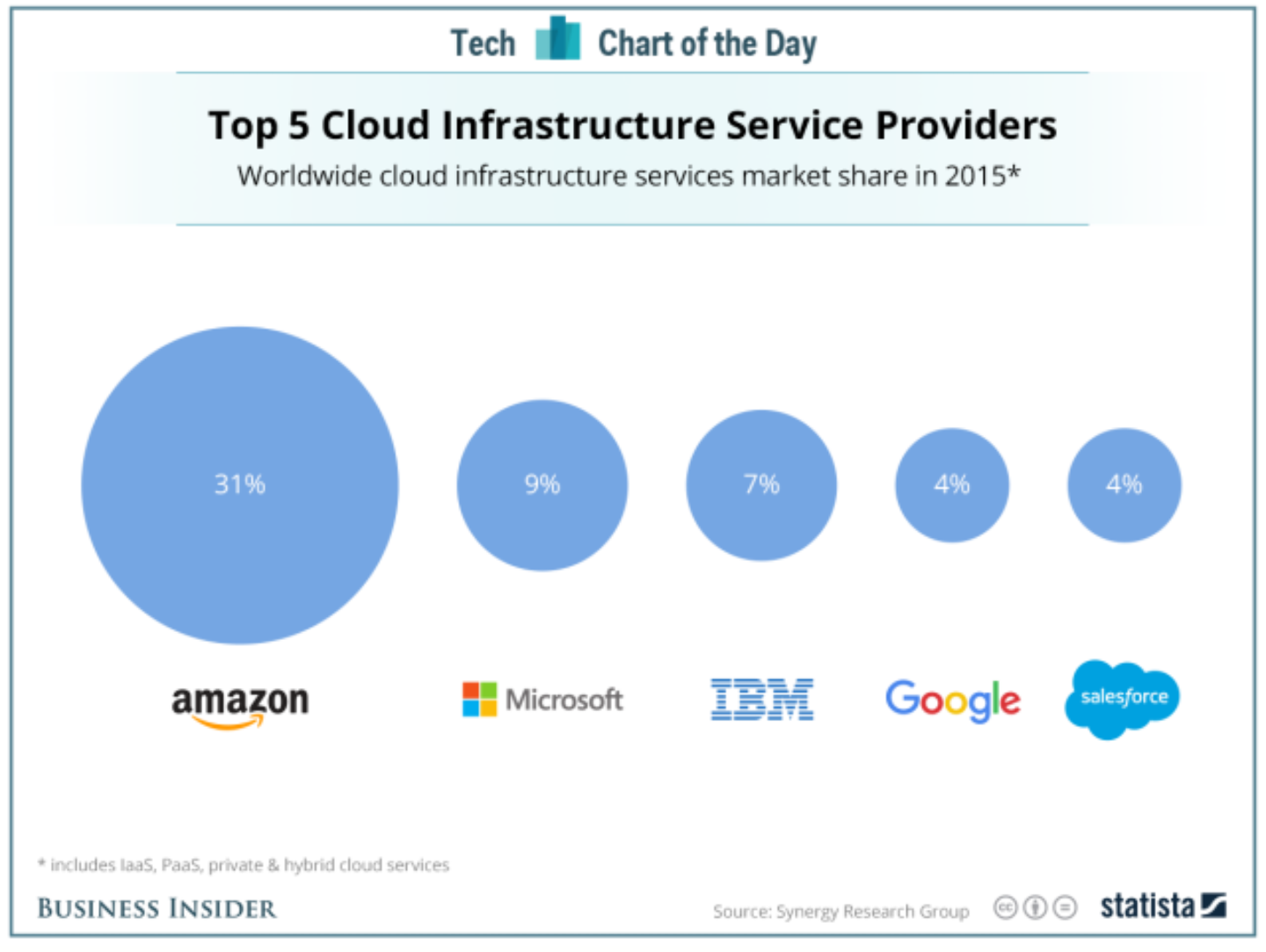

Amazon's cloud computing segment (AWS) has turned into a profit machine. First, here is the market share visual:

CLOUD INFRASTRUCTURE MARKET

Amazon is crushing it -- even Microsoft (NSDAQ:MSFT) hs yet to crack 10% penetration. And if we want to know how important the cloud business is to the Amazon, we can read the facts from the latest earnings report:

The profits from A.W.S. represented 56 percent of Amazon's total operating income even though the revenue amounted to less than 9 percent of total revenue.

Source: NY Times

Source: NY Times

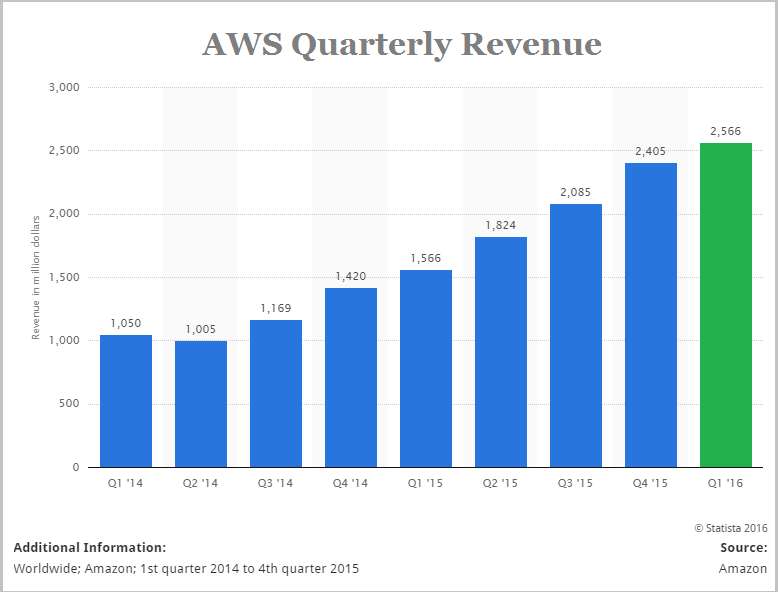

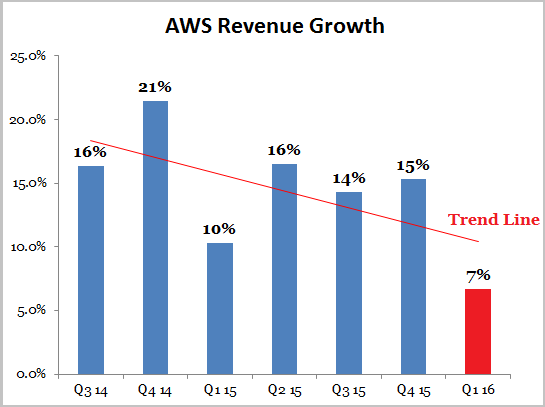

Now, here's the elephant in the room. This is AWS revenue by quarter:

AWS REVENUE

It looks beautiful, right? If this is the engine bringing in 60% of earnings, then no issues here. Or are there?

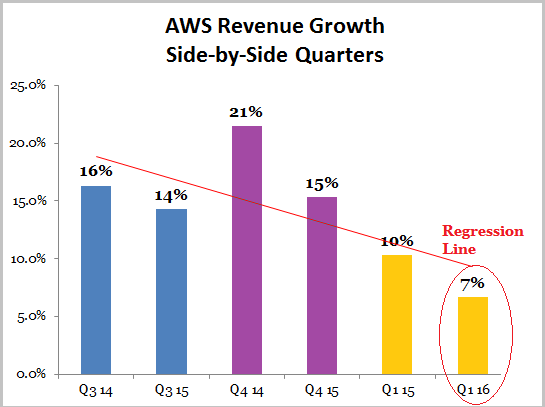

Let's look at these exact same numbers presented in a slightly different way:

If we plot the quarter-over-quarter revenue growth, we can see a rather small 7% growth in the last quarter. Now, there is seasonality in these numbers -- in Q1 2015, AWS saw only 10% growth, but there's actually an easier way to see this data, removing the bias of seasonality:

In this chart we simply put each quarter side-by-side with its corresponding quarter from the prior year.

Q3 growth year-over-year dipped from 16% to 14%.

Q4 growth year-over-year dipped from 21% to 15%.

Q1 growth year-over-year dipped from 10% to 7%.

No matter how you slice it, seasonality or not, AWS growth is slowing. Now, usually with mega cap technology we can make a reasonable argument that as numbers become so large, growth must slow, but quite frankly, the $10 billion AWS revenue in the last year is actually not that big for a mega cap.

Facebook's (NASDAQ:FB) revenue rose 46% year-over-year on a base of nearly $20 billion.

Alphabet's (NASDAQ:GOOGL) revenue rose 15% year-over-year on a base of nearly $78 billion.

Even Amazon's revenue grew 23% year-over-year on an absurd base of $113 billion.

REALITY CHECK

AWS drove 60% of operating income and that business is clearly slowing. Now don't get me wrong, we love Amazon and one of our favorite things to look for are innovative companies that everyone else feels are "overvalued." But friends, no matter the marvel of Amazon, Wall Street blew it on this earnings result and so did the main stream media.

The business driving 60% of profitability is slowing at an alarming rate. That's just a fact.

WANT THE REAL NEWS

If you're long Amazon, don't worry, just as Wall Street totally missed the news on AWS, it consistently misses other news. Here is the bullish part of the argument that you would swear was hidden under lock and key in a government classified document:

Two tech giants have never been more relevant. The first is Apple (NASDAQ:AAPL), which has seen its market share of teenager smartphone power users rise to an almost absurd 70%.

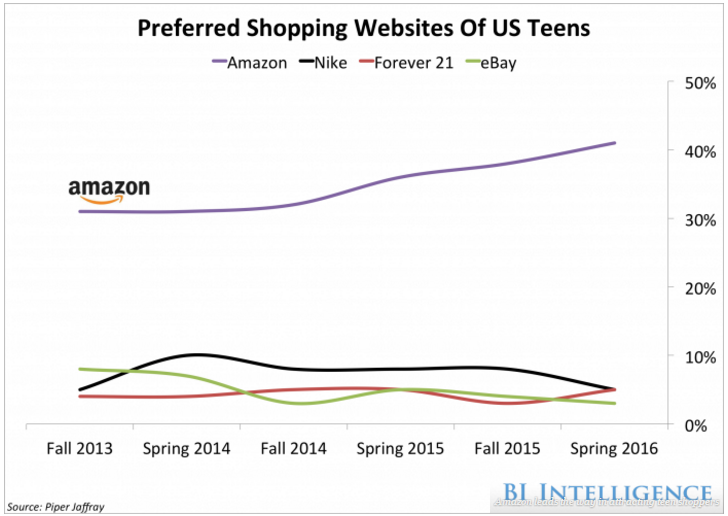

But, here's another incredible fact, this one relevant to Amazon: Teenagers overwhelmingly prefer to shop on Amazon. Check out this chart from the Business Insider:

TEENAGERS PREFERRED SHOPPING

According to Piper Jaffray and Business Insider that 41% market share has grown from 31% in Spring 2014 and 35% in Spring 2015 "and crushes the two sites tied for second place, Nike and Forever 21 at 5% apiece."

This is just piece of the future growth for Amazon and it does outweigh the troublesome slowing in AWS.

WHY THIS MATTERS

There's so much going on with Amazon it's impossible to cover in one report but to truly understand it we must span almost all of technology's transformative themes and we must eliminate the noise from poor data and lacking research. This is the same thing we must do to take it a step further, to find the 'next Amazon' or 'next Apple.' We have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.