Two Massive Risks For Amazon, Google and Facebook

Fundamentals

PREFACE

There are two risks that exist, one which threatens Amazon's valuation, and one that threatens Facebook and Google. They're different risks -- but both are real and may be the only real solid bearish theses for these three tech marvels.

Here we go:

AMAZON

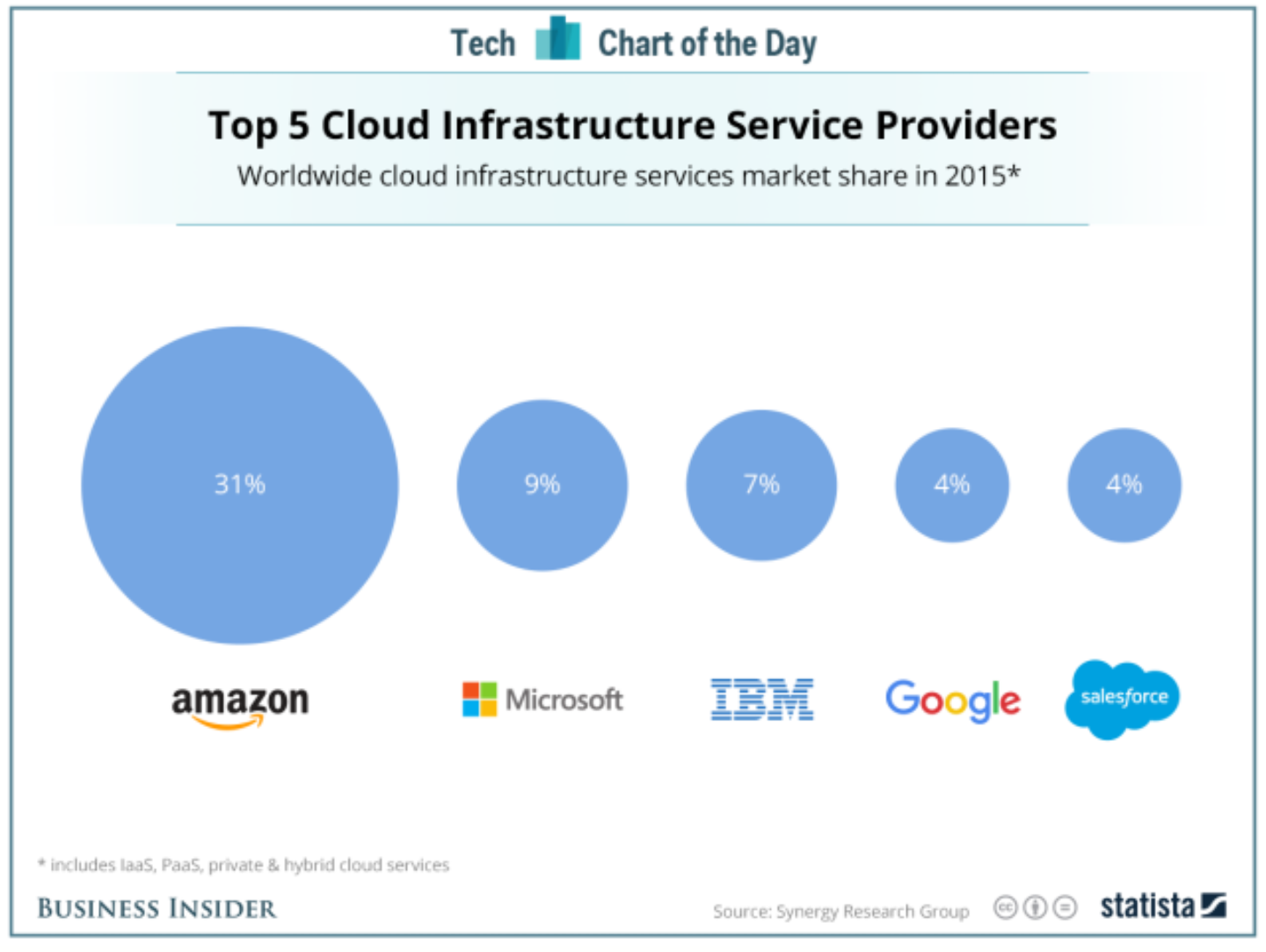

Let's start with Amazon. While the company crushed revenue and EPS estimates in its latest earnings release, we do note that the cloud computing arm (AWS) drove 56% of operating income. First, here is the market share visual:

CLOUD INFRASTRUCTURE MARKET

Amazon is crushing it -- even Microsoft (NSDAQ:MSFT) has yet to crack 10% penetration.

While Wall Street applauded the huge growth in that relatively small business, everybody appears to have missed one staggering reality.

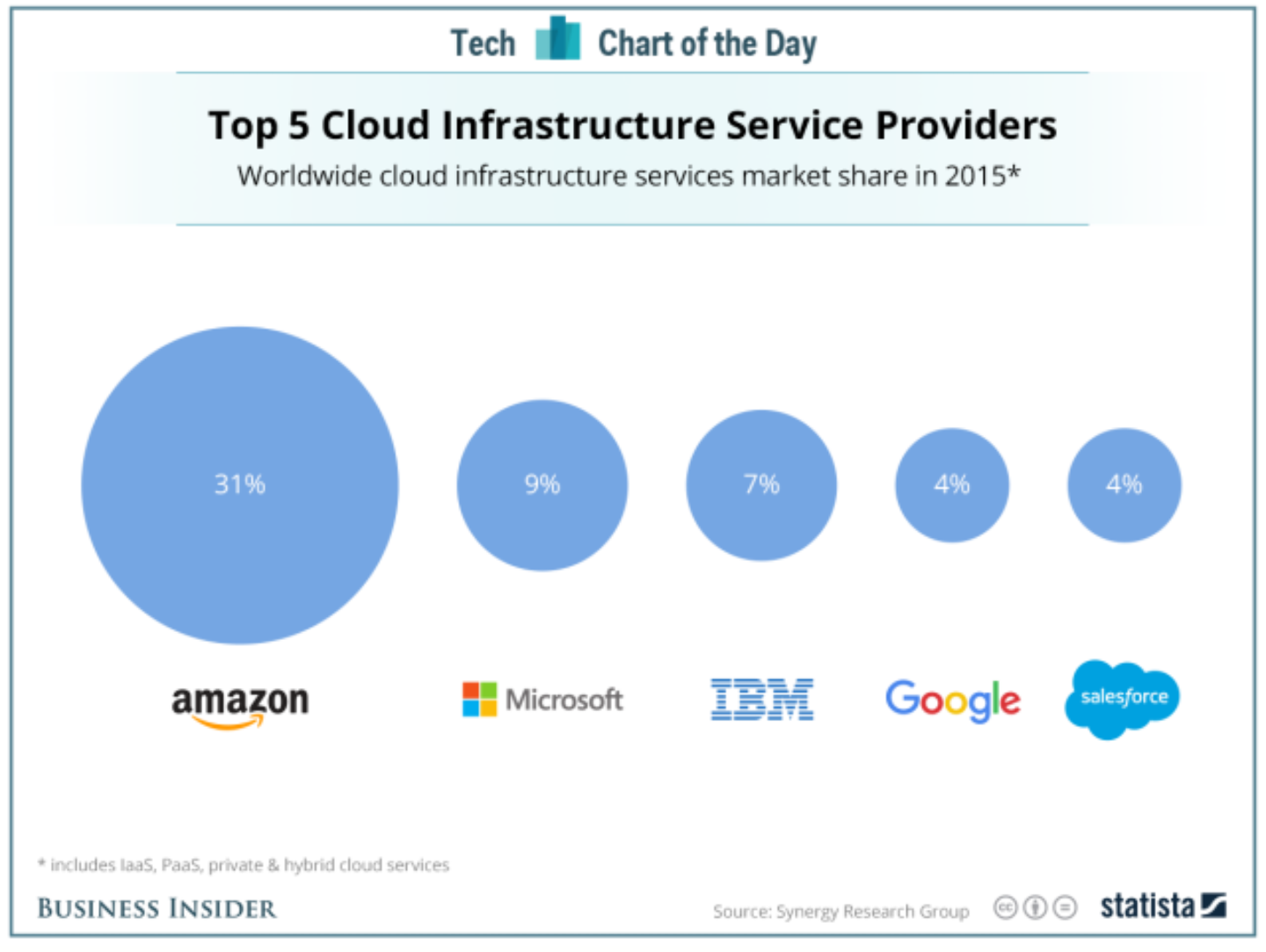

Since AWS accounted for just 9% of Amazon's revenue but the lion's share of its profits it does require us to hyper focus on that business line. That focus reveals a frightening reality and here it is:

In this chart we simply put each quarter of revenue growth from AWS side-by-side with its corresponding quarter from the prior year.

Q3 growth year-over-year dipped from 16% to 14%.

Q4 growth year-over-year dipped from 21% to 15%.

Q1 growth year-over-year dipped from 10% to 7%.

No matter how you slice it, seasonality or not, AWS growth is slowing to a near standstill. Now, usually with mega cap technology we can make a reasonable argument that as numbers become so large, growth must slow, but quite frankly, the $10 billion AWS revenue in the last year is actually not that big for a mega cap. In fact, Amazon nears $130 billion in total revenue.

If AWS is the growth engine for Amazon that has turned it into a $325 billion company, then it's time to focus on the elephant in the room -- and that's rapidly declining growth.

Is Amazon a marvel? Yes. Has the excitement over its cloud business blinded some to a slowing business? Yes.

GOOGLE AND FACEBOOK

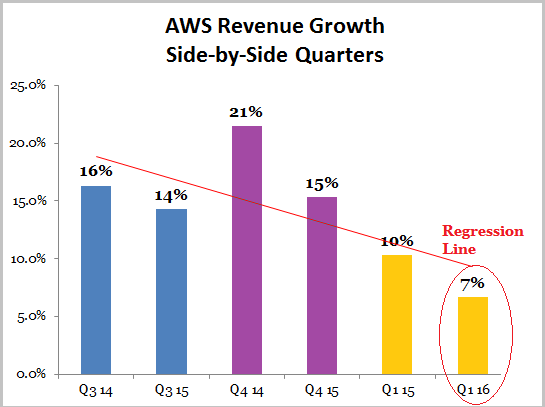

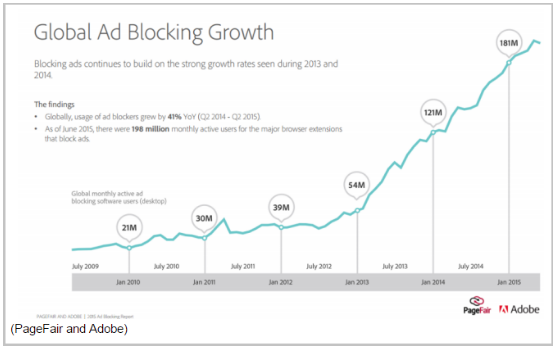

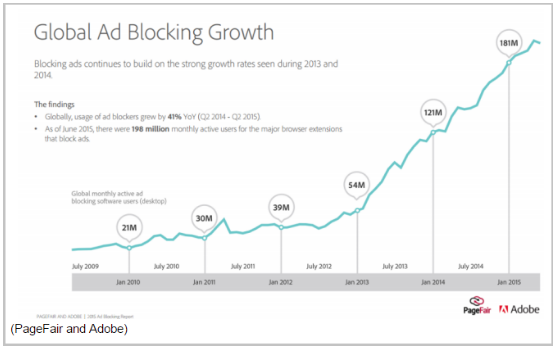

Over 95% of Facebook's revenue and about 80% of Google's revenue comes from advertising. Both companies are growing quickly. But with such a focused profit model, a new material risk has appeared and it's starting to proliferate. Look at this chart that plots the expansive growth of ad blocking software:

AD BLOCKING SOFTWARE PROLIFERATION

According to a report published by PageFair and Adobe, ad blocking software worldwide has increased 41% year-on-year to 198 million monthly active users and is expected to cost publishers more than $21.8 billion in 2015 in lost revenue (BusinessInsider).

The risk for Google may appear larger than that for Facebook since Facebook's ads appear inside the app -- a sort of closed and wholly owned ecosystem for the social media company. But take a step back -- is it really unimaginable for app developers to produce advertising blocking software to be activated inside apps? I'll answer -- no. It's not unimaginable, it might even be likely.

If we go down that rabbit hole, we see that Twitter is also at risk. The risk to Google is so large that the company has started what appears to be, maybe, just a little bit, of a hail marry solution.

GOOGLE TRIES TO FIX IT: SORT OF

Google is exploring the creation of an "acceptable ads policy." This would be an attempt to create an industry-standard for online ad formats and that format would be "illegal to block."

Several executives with knowledge of these discussions confirmed to Business Insider that Google has been looking at spearheading such a policy. Google's SVP of advertising, Sridhar Ramaswamy, said late last year:

“

There needs to be more of a sustainable ad standard that we voluntarily define, and things in that standard should not get blocked.

I think this is essential to us all for survival.

There needs to be more of a sustainable ad standard that we voluntarily define, and things in that standard should not get blocked.

I think this is essential to us all for survival.

”

Source: Yahoo! Finance

Yes, the top advertising executive at Google used the word "survival."

CALMER VIEWS

We've just covered the worst of the worst for Facebook, Google and Amazon. Let's not get too carried away. But, as the market gets toppy and selling takes center stage, these risks will start to get the headlines. It's time to be prepared, even if it's for a storm of negativity that ends up being nothing more than click bait, it could cause short-term panic selling.

It's better to know before hand.

WHY THIS MATTERS

There's so much going on with these three tech giants that it's impossible to cover in one report. But, to take it a step further and to find the 'next Amazon' or 'next Apple' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information monopoly that the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

That chart plots the growth in 4G usage worldwide and how it will grow from 330 million people today to nearly 2 billion in five years. This is the lifeblood fueling every IoT and mobile device on the planet and CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.