ASML Holding N.V., ASML, chip, earnings, option, swing, short-term

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

Preface

While 2017 was the year of technology, it was really the year of the chip and chip equipment maker. From Nvidia and Micron, to Lam Research and Applied Materials, the space was on fire due to the promise of renewed and continuous demand that has broken the industry out of a long-time cyclical nature and into a period of sustained growth. Or so say the bulls.

One of the seldom covered companies in this space is ASML Holding, a manufacturer of chip-making equipment sporting a giant $76 billion market cap. Here is the two-year stock return chart:

The stock is up over 100% over the last two-years and nearly 60% last year alone. With that stock rise has come the familiar pattern we are so keenly aware of -- pre-earnings optimism.

According to our earnings date data provider, ASML has earnings due out 1-17-2018, before the market opens. Since that is a Wednesday, 3 trading days ahead of that would be Friday 1-12-2018.

IDEA

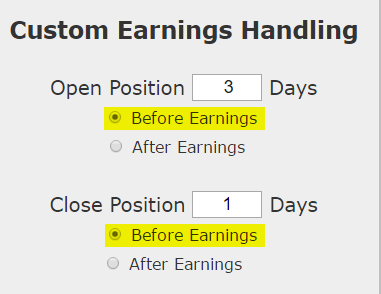

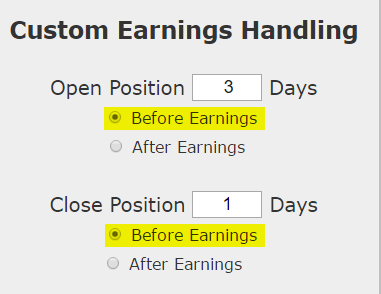

We will examine the outcome of going long a monthly out of the money (40 delta) call option in ASML Holding N.V. just three trading days before earnings and selling the call one day before the actual news.

This is construct of the trade, noting that the short-term trade closes before earnings and therefore does not take a position on the earnings result.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

DISCOVERY

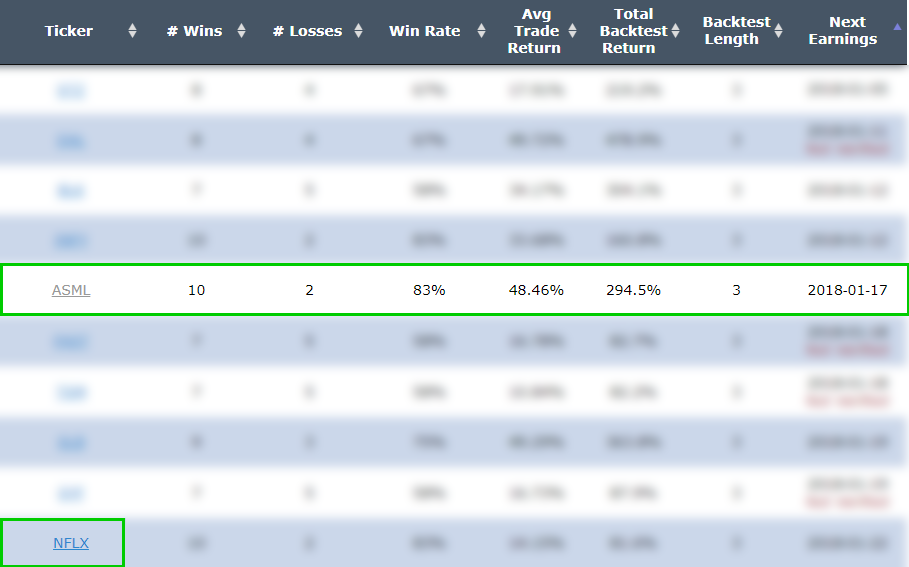

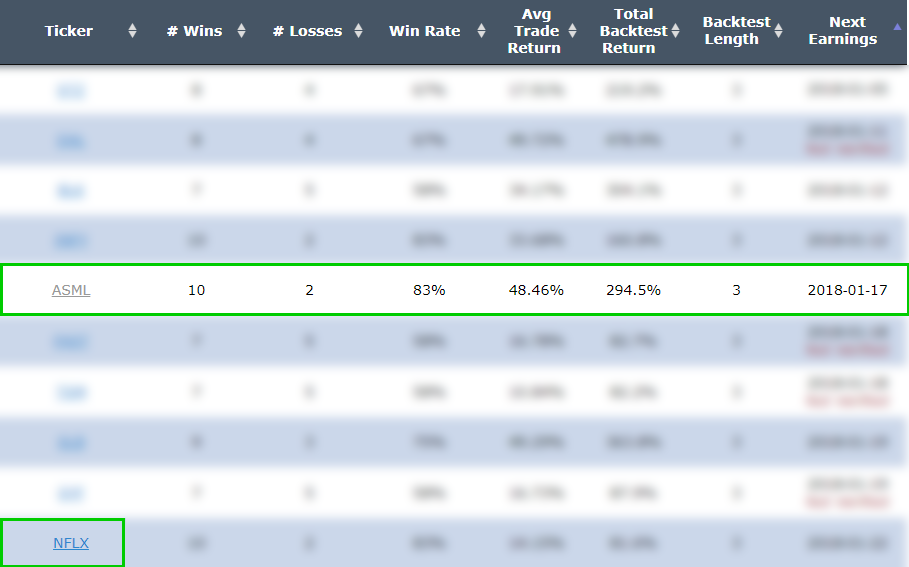

As always, we use empirical results to drive out analysis and we found this pattern in ASML by using the Trade Machine Pro scanner, looking across the S&P 500 and examining the 3-day pre-earnings momentum call. We sorted by the nearest earnings date, and ASML was the fifth result:

RESULTS

Below we present the back-test stats over the last three-years in ASML Holding N.V.:

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

-- Not a member of our community: Stop guessing, discover empirical results and the power of scientific option trading: Watch the video.

We see a 294.5% return, testing this over the last 12 earnings dates in ASML Holding N.V.. That's a total of just 36 days (3-day holding period for each earnings date, over 12 earnings dates).

This short-term trade has not won every time, and it won't, but it has been a winner 10 times and lost 2 times, for a 83% win-rate and again, that 294.5% return in less than one-full month of actual holding period.

Setting Expectations

While this strategy has an overall return of 294.5%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 48.5%.

➡ The average percent return per winning trade was 65.4%.

➡ The average percent return per losing trade was -36.1%.

Looking at More Recent History

We did a multi-year back-test above, now we can look at just the last year:

Tap Here to See the Back-test

We're now looking at 580.1% returns, on 3 winning trades and 1 losing trade.

➡ The average percent return over the last year per trade was 96.44%.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. To see how to find the best performing historical momentum, technical analysis or non-directional trades for any stock using empirical results rather than guesses, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

Short-term Option Swing Trading Ahead of Earnings in ASML Holding N.V.

ASML Holding N.V. (NASDAQ:ASML) : Short-term Option Swing Trading Ahead of Earnings

Date Published: 2018-01-2Author: Ophir Gottlieb

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

Preface

While 2017 was the year of technology, it was really the year of the chip and chip equipment maker. From Nvidia and Micron, to Lam Research and Applied Materials, the space was on fire due to the promise of renewed and continuous demand that has broken the industry out of a long-time cyclical nature and into a period of sustained growth. Or so say the bulls.

One of the seldom covered companies in this space is ASML Holding, a manufacturer of chip-making equipment sporting a giant $76 billion market cap. Here is the two-year stock return chart:

The stock is up over 100% over the last two-years and nearly 60% last year alone. With that stock rise has come the familiar pattern we are so keenly aware of -- pre-earnings optimism.

According to our earnings date data provider, ASML has earnings due out 1-17-2018, before the market opens. Since that is a Wednesday, 3 trading days ahead of that would be Friday 1-12-2018.

IDEA

We will examine the outcome of going long a monthly out of the money (40 delta) call option in ASML Holding N.V. just three trading days before earnings and selling the call one day before the actual news.

This is construct of the trade, noting that the short-term trade closes before earnings and therefore does not take a position on the earnings result.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

DISCOVERY

As always, we use empirical results to drive out analysis and we found this pattern in ASML by using the Trade Machine Pro scanner, looking across the S&P 500 and examining the 3-day pre-earnings momentum call. We sorted by the nearest earnings date, and ASML was the fifth result:

RESULTS

Below we present the back-test stats over the last three-years in ASML Holding N.V.:

| ASML: Long 40 Delta Call | |||

| % Wins: | 83% | ||

| Wins: 10 | Losses: 2 | ||

| % Return: | 294.5% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

-- Not a member of our community: Stop guessing, discover empirical results and the power of scientific option trading: Watch the video.

We see a 294.5% return, testing this over the last 12 earnings dates in ASML Holding N.V.. That's a total of just 36 days (3-day holding period for each earnings date, over 12 earnings dates).

This short-term trade has not won every time, and it won't, but it has been a winner 10 times and lost 2 times, for a 83% win-rate and again, that 294.5% return in less than one-full month of actual holding period.

Setting Expectations

While this strategy has an overall return of 294.5%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 48.5%.

➡ The average percent return per winning trade was 65.4%.

➡ The average percent return per losing trade was -36.1%.

Looking at More Recent History

We did a multi-year back-test above, now we can look at just the last year:

| ASML: Long 40 Delta Call | |||

| % Wins: | 75% | ||

| Wins: 3 | Losses: 1 | ||

| % Return: | 580.1% | ||

Tap Here to See the Back-test

We're now looking at 580.1% returns, on 3 winning trades and 1 losing trade.

➡ The average percent return over the last year per trade was 96.44%.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. To see how to find the best performing historical momentum, technical analysis or non-directional trades for any stock using empirical results rather than guesses, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.