Option Backtester The Exact Trigger that Indicates Volatility in ASML Holding N.V.

Stock Option Backtester ASML Holding N.V. (NASDAQ:ASML) : The Exact Trigger that Indicates Volatility

Date Published: 2019-02-06

Disclaimer

The results here are provided for general informational purposes from the CMLviz Trade Machine Stock Option Backtester as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.Preface

There is a trigger in ASML Holding N.V. (NASDAQ:ASML) that has preceded a large stock move and that move has created a powerful option trading opportunity in the past. It hasn't triggered yet, but the recent stock rise makes it closer.Use Trade Machine to set alerts for all the triggers you find -- let it do the work rather than you having to stare at the screen all day. Emails (or texts) when triggers fire -- Trade Machine watches the market for you.

ASML is a chipmaker, and it has had its bull run and then a sputter, and then a recovery, like the other semi-conductor makers. The trigger we're after is the one that indicates when a period of volatility is about to start, so a non-directional option trade may be in play.

The strategy won't work forever, but for now it is a volatility back-test that has not only returned 866.3%, but has also shown a win-rate of 72% while taking no stock direction risk.

Idea

Simply owning puts and calls together, like a straddle or a strangle, can be a huge winner, as it was at the end of 2018. But, equally, it has been a huge losing strategy outside of that time frame. So, the need has arisen -- an empirical and structured trigger that indicates when a large stock move is coming so owning a strangle has a higher probability of succeeding.There is such a technical condition, and we will review it, right now.

Here is a quick 3-minute video that demonstrates the back-test:

We have previously discussed this same trigger with Amazon (AMZN), Apple (AAPL), and PayPal (PYPL).

This Trigger is Turning Apple's Volatility into A Huge Winner (AAPL)

This Trigger is Turning Amazon's Volatility into A Huge Winner (AMZN)

This Trigger is Turning PayPal's Volatility into A Huge Winner (PYPL)

A portfolio of the same strategy in several stocks isn't really diversified, it's just the same risk taken over and over again. These non-directional trades, together with bullish and bearish trades, create a portfolio of option trades.

The Short-term Option Volatility Trade in ASML Holding N.V.

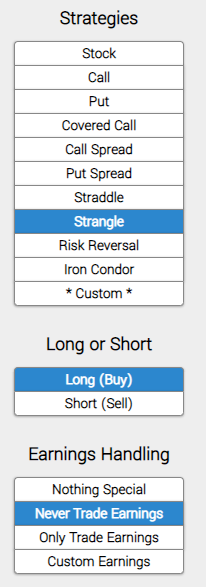

We will examine the outcome of going long a short-term out-of-the-money (using 40 delta as the strike price) strangle (buying an out of the money call and buying an out of the money put), in options that are the closest to 14-days from expiration. But we follow three rules:* Never Trade Earnings

Let's not worry about stock direction or earnings, let's try to find a back-test that benefits from volatility. Here it is, first, we enter the long strangle.

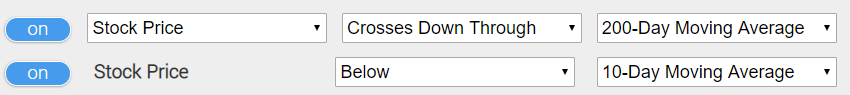

* Use a technical trigger to start the trade, specifically:

Wait until the day that the stock price crosses below the 200-day moving average and the stock price is below the 10-day moving average. Here is a nice simple image of the technical requirement:

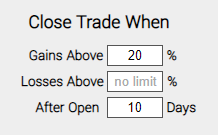

* Finally, we set a very specific type of limit:

* Use a 20% limit

* Close the trade after 10 days, if the limit has not been hit.

At the end of each day, the back-tester checks to see if the long strangle is up 20%. If it is, it closes the position. If after 10-days the limit has not been hit, the strangle is closed so not to suffer total time decay.

RESULTS FROM THE OPTION BACKTESTER

Here are the results over the last five-years in ASML Holding N.V.:| ASML: Long 40 Delta Strangle | |||

| % Wins: | 72% | ||

| Wins: 13 | Losses: 5 | ||

| % Return: | 869 | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® Stock Option Backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

Setting Expectations

While this strategy had an overall return of 869%, the trade details keep us in bounds with expectations:➡ The average percent return per trade was 35.28%.

Checking the Moving Average

You can check to see the moment a stock dips below the 200-day MA for ASML on the Pivot Points tab on www.CMLviz.com.Back-testing More Time Periods in ASML Holding N.V.

Now we can look at just the last year as well:| ASML: Long 40 Delta Strangle | |||

| % Wins: | 100% | ||

| Wins: 1 | Losses: 0 | ||

| % Return: | 85% | ||

Tap Here to See the Back-test

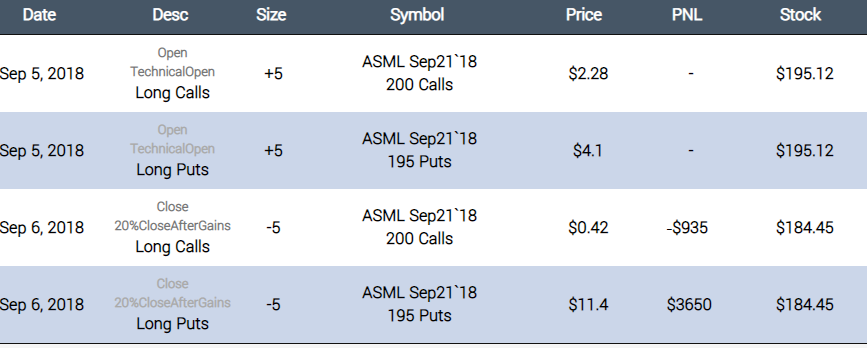

We're now looking at 85% returns, on 1 winning trade and 0 losing trades. As for the timing of that trade, we simply tap on the back-test tile in Trade Machine, and viola:

ASML cracked that technical trigger on Sep 5th, and the next day the stock dropped $11, with the strangle gaining 85% in a single day. Here it is on the stock chart, where the sweeping black line is the 200 DMA and the volatile one is the 10 DMA.

WHAT HAPPENED: Option Backtester

Trade beyond luck.Tap here to see it for yourself

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.