Boeing Company (The), BA, earnings, option, swing, short-term

LEDE

While we have focused on tech, and will continue to do so, it's time for us to look where others are not, and then means finding the momentum gems that are not tech stocks. Today and next week we will look at two Dow components and we will shorten our window for bullish momentum down to three-days for both.

Preface

While we are going back-and-forth between bullish momentum and non directional back-tests (don't forget how important diversification is), today we turn back to momentum.

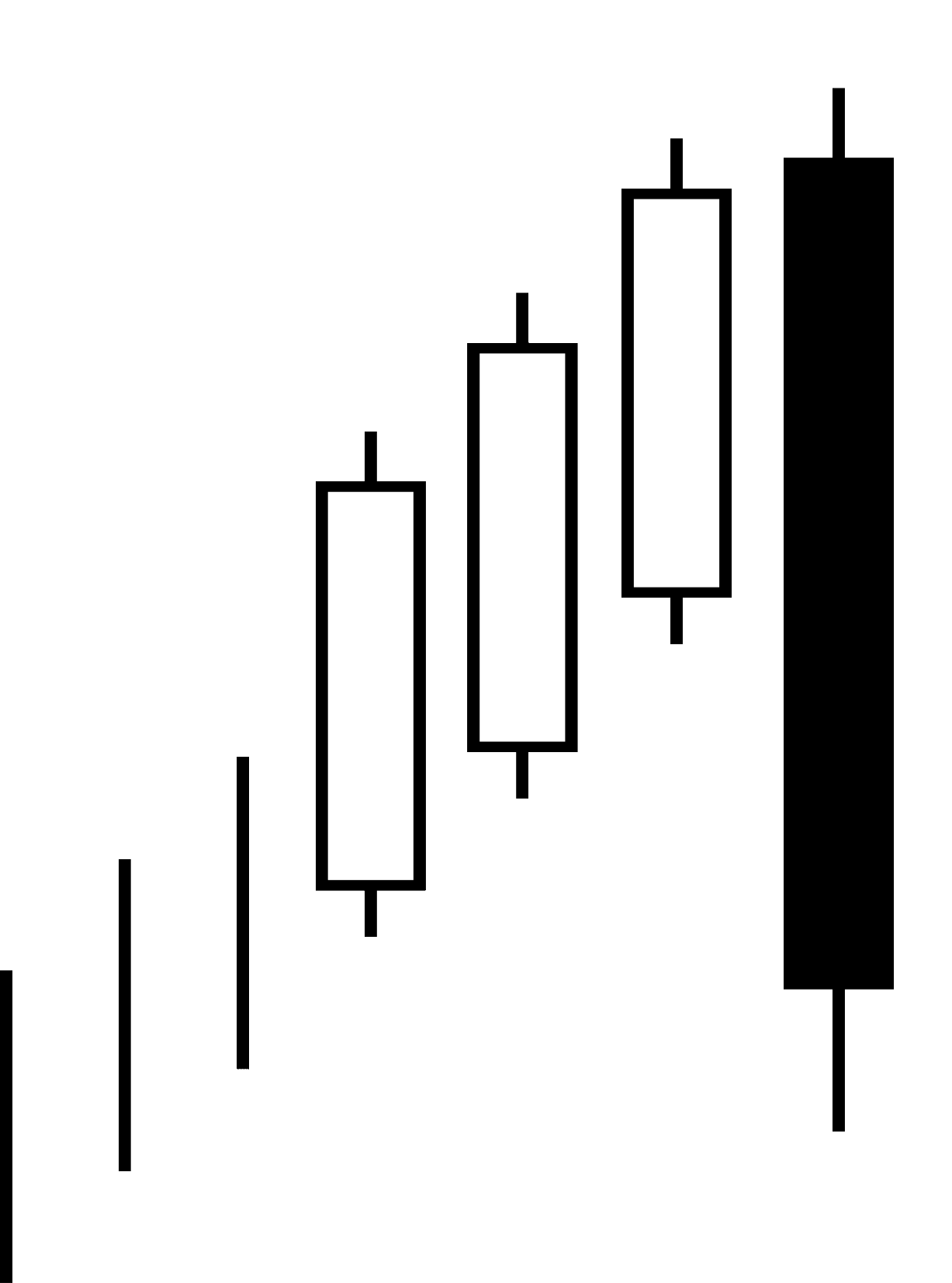

There is a pattern of bullish momentum in Boeing Company (The) (NYSE:BA) stock just days before earnings, and we can track that by looking at swing returns in the option market.

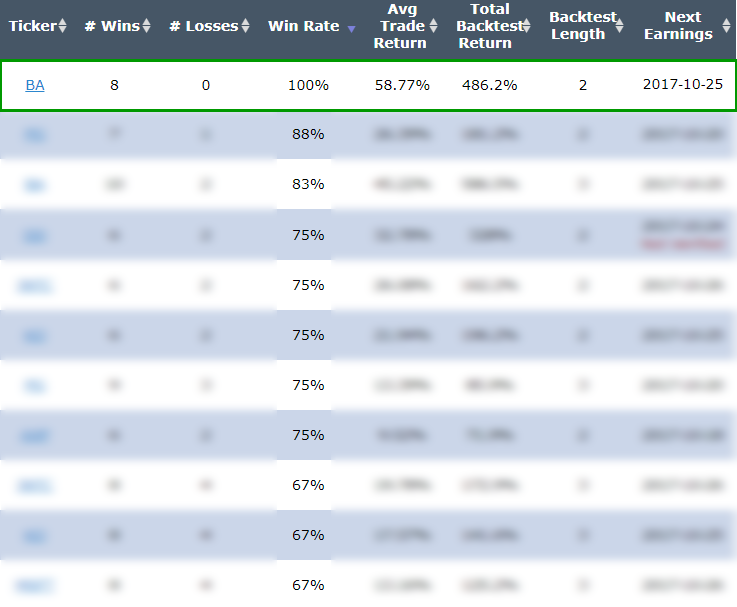

This is a short-term swing trade, it won't be a winner forever, and it can be easily derailed by a couple of down days in the market irrespective of Boeing Company (The) news, but for now it has shown a repeating success that has not only returned 486%, but has also shown a win-rate with 8 wins and 0 losses in the last two-years.

Note: Our earnings data provider, Wall Street Horizon, has a confirmed date of 10-25-2017, before the market opens for Boeing earnings. Since that is a Wednesday, 3-days before would take us back to Friday (at the close) as the opening trigger for the past back-tests.

IDEA

The idea is quite simple -- trying to take advantage of a pattern in very short-term bullishness just before earnings, and then getting out of the way so no actual earnings risk is taken. Now we can see it in Boeing Company (The).

The Short-term Option Swing Trade Ahead of Earnings in Boeing Company (The)

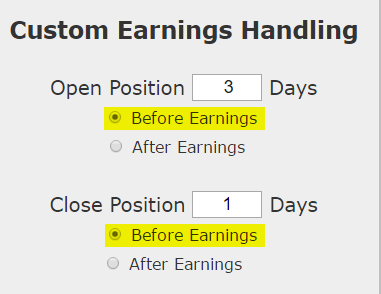

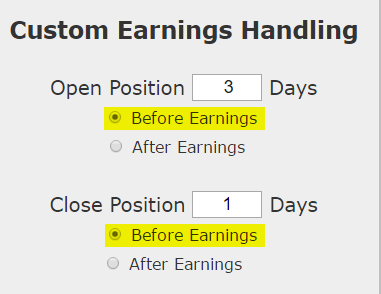

We will examine the outcome of going long a weekly call option in Boeing Company (The) just three trading days before earnings and selling the call one day before the actual news.

This is construct of the trade, noting that the short-term trade closes before earnings and therefore does not take a position on the earnings result.

RISK MANAGEMENT

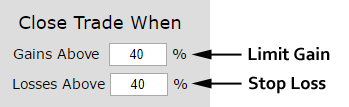

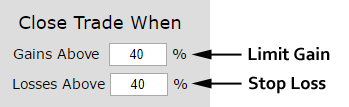

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

Back-test Discovery

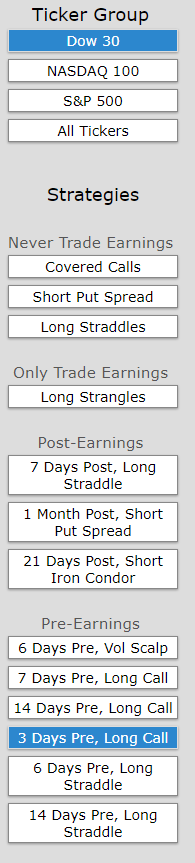

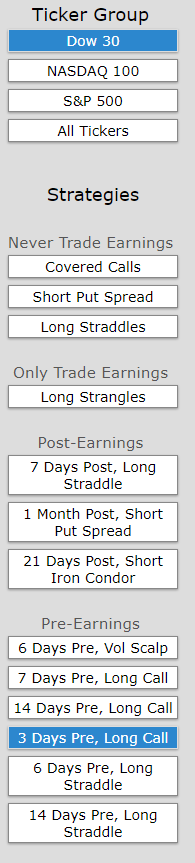

We found this trade using the Trade Machine™ Pro Scanner. We looked at the "Dow 30" as our ticker group and then the "3-days Pre-earnings Long Call" as the strategy.

In those results, one, and only one, company showed a 100% win rate over two-years.

RESULTS

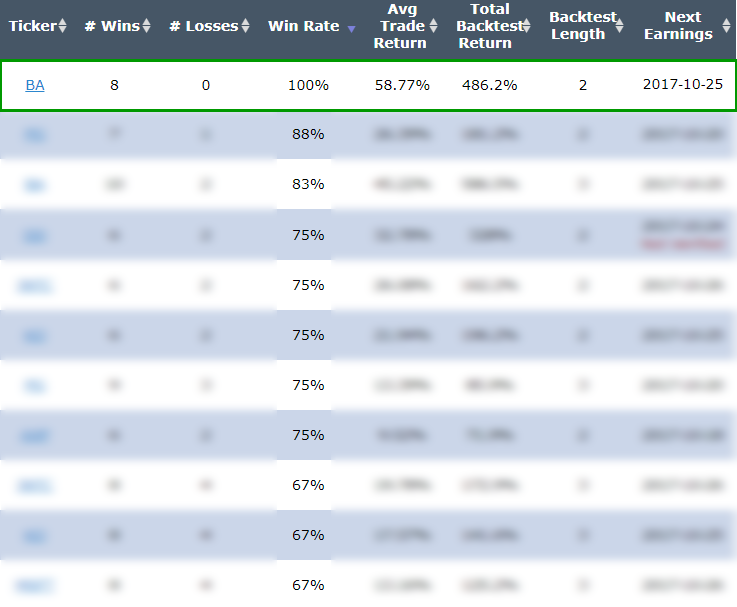

Below we present the back-test stats over the last two-years in Boeing Company (The):

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

We see a 486% return, testing this over the last 8 earnings dates in Boeing Company (The). That's a total of just 16 days (2-day holding period for each earnings date, over 8 earnings dates). That's the power of following the short-term pattern of bullishness ahead earnings -- and not taking on the actual risk from the earnings outcome.

Setting Expectations

While this strategy has an overall return of 486%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 58.8% in just three-days.

Looking at More Recent History

We did a multi-year back-test above, now we can look at just the last year:

Tap Here to See the Back-test

We're now looking at 210.1% returns, on 4 winning trades and 0 losing trades.

➡ The average percent return over the last year per trade was 49.78% in just three-days.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. To see how to test this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

Swing Trading Earnings Bullish Momentum With Options in Boeing Company (The)

Boeing Company (The) (NYSE:BA) : Swing Trading Earnings Bullish Momentum With Options

Date Published: 2017-10-12Author: Ophir Gottlieb

LEDE

While we have focused on tech, and will continue to do so, it's time for us to look where others are not, and then means finding the momentum gems that are not tech stocks. Today and next week we will look at two Dow components and we will shorten our window for bullish momentum down to three-days for both.

Preface

While we are going back-and-forth between bullish momentum and non directional back-tests (don't forget how important diversification is), today we turn back to momentum.

This is a short-term swing trade, it won't be a winner forever, and it can be easily derailed by a couple of down days in the market irrespective of Boeing Company (The) news, but for now it has shown a repeating success that has not only returned 486%, but has also shown a win-rate with 8 wins and 0 losses in the last two-years.

Note: Our earnings data provider, Wall Street Horizon, has a confirmed date of 10-25-2017, before the market opens for Boeing earnings. Since that is a Wednesday, 3-days before would take us back to Friday (at the close) as the opening trigger for the past back-tests.

IDEA

The idea is quite simple -- trying to take advantage of a pattern in very short-term bullishness just before earnings, and then getting out of the way so no actual earnings risk is taken. Now we can see it in Boeing Company (The).

The Short-term Option Swing Trade Ahead of Earnings in Boeing Company (The)

We will examine the outcome of going long a weekly call option in Boeing Company (The) just three trading days before earnings and selling the call one day before the actual news.

This is construct of the trade, noting that the short-term trade closes before earnings and therefore does not take a position on the earnings result.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

Back-test Discovery

We found this trade using the Trade Machine™ Pro Scanner. We looked at the "Dow 30" as our ticker group and then the "3-days Pre-earnings Long Call" as the strategy.

In those results, one, and only one, company showed a 100% win rate over two-years.

RESULTS

Below we present the back-test stats over the last two-years in Boeing Company (The):

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

We see a 486% return, testing this over the last 8 earnings dates in Boeing Company (The). That's a total of just 16 days (2-day holding period for each earnings date, over 8 earnings dates). That's the power of following the short-term pattern of bullishness ahead earnings -- and not taking on the actual risk from the earnings outcome.

Setting Expectations

While this strategy has an overall return of 486%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 58.8% in just three-days.

Looking at More Recent History

We did a multi-year back-test above, now we can look at just the last year:

| BA: Long 40 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 4 | Losses: 0 | ||

| % Return: | 210.1% | ||

Tap Here to See the Back-test

We're now looking at 210.1% returns, on 4 winning trades and 0 losing trades.

➡ The average percent return over the last year per trade was 49.78% in just three-days.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. To see how to test this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.