Alibaba: Wall St. Has Intentionally Created Radical Fear

Fundamentals

On September 24th I wrote: "Alibaba is a Fraud or an Enormous Stock Opportunity." The stock was trading at $58, an all-time low shedding $140 billion from its high watermark in market cap. The weakness surrounded China's economic slowdown on one hand, and a very disturbing accusation of outright fraud on the other.

But, incredibly, Alibaba has reported that revenue and earnings in the last year are both at all-time highs. That's right, all time highs in revenue and earnings in a stock down 50%. Here's a chart of revenue (TTM) in the blue bars and net income (TTM) in the orange line.

Do you enjoy using visualizations to understand what's really going on in a company? We do too. Try CML Pro and Get the Most Advanced Visual Tools and Sought After Stock Research.

Wall Street couldn't have been more wrong about BABA stock at its lows. Atlantic Equities LLP’s James Cordwell, the top-ranked analyst covering the stock according to Bloomberg said:

The shouldn't expect a reprieve any time soon. "[T]he slowing Chinese economy will undercut e-commerce transaction growth until at least 2016... All the operating metrics seem to be pointing in the wrong direction" (Source: Bloomberg).

Further Barron's made a splash by predicting the stock could drop another 50%. Alibaba rebutted by saying that "the report was based on incorrect calculations, contained factual inaccuracies and selectively used information."

I don't know what metrics Mr. Cordwell or Barron's were looking at, but as we saw above, revenue and earnings are booming to all-time highs. There are also worries about some investments Chairman Jack Ma has been making with the firm's cash. In fairness to Mr. Corwell, he did say he saw a light at the end of the tunnel, with the company ultimately emerging stronger. But that's not the issue, and we know it. Here's the issue -- and it's pretty ugly.

Did You Know We Also Publish Research Just Like this But Only Share it With Pro Users? Join Us: Try the Most Sought After Stock Research.

What's Really Going On

There is a phobia in the western world of all things China when it comes to the stock market. 'Sinophobia' has grabbed Western investors by the throat and created a panic based on a fraud epidemic fear. For the moment that fear has eased a bit, if for no other reason than the stock price was just so damn compelling at $58.

The sinophobia, like all fears, has roots dug into the truth, as we have seen so many Chinese fraud's gone bankrupt in the stock market it's become absurd. But, also like all fears, a grain of truth can get stretched to encompass a sort of end-all-be-all truth which simply isn't true. It's our natural tendency to amplify fear to its worst possible outcome.

The sinophobia for Alibaba surrounds a "too good to be true" belief, and here's where the fear stems from. Alibaba's "hold no inventory" business model has proven to lead to absolutely enormous earnings margins. In fact, if take all technology companies with market caps above $40 billion and equal space them on the x-axis (rank) then plot the net income margin % on the y-axis, we see there's BABA, and then there's everybody else...

We publish research using visualizations that break news. There's a limited promotion right now: Try CML Pro and Get the Most Advanced Visual Tools and Sought After Stock Research.

It's interesting that no one questions Apple's (AAPL) unbelievable 99% year-over-year growth in China, isn't it? So Apple's growth is believable, but BABA's growth isn't?

Alibaba's last earnings release on October 27th revealed $3.49 billion in revenue versus estimates of $3.39 billion and earnings per share (EPS) of $0.57 versus estimates of $0.54 (Source: TheStreet.com. The revenue number the quarter ending Sep. 30th was an all-time for that time period by a ton, showing an astounding 40% growth year-over-year.

But Alibaba is so much more than just e-commerce. The company has a cloud computing arm, much like American competitor Amazon.com, and the firm said the business line was on an "accelerating path." Further, on November 6th, Alibaba finally came to terms in its $4.4 billion acquisition of Youku Tudou, which is basically China's Youtube (Source WSJ).

It takes more than click bait and a 140 characters to be an expert and journalists aren't trained to understand breaking technology. Try CML Pro. You will be powerful.

Single's Day

Although its headline grabbing it really hasn't had any effect on the stock. China just had its "Single's Day," which started out as a sort of mock celebration day from people not in relationships but has actually turned into a total bonanza. Here's a quote from a Reuters article:

Cyber Monday, could see this year's sales rise to as much as $13.8 billion [surpassing] last year's total of $9.3 billion. (Source: Reuters).

Here's the Fear Problem

There have been calls that Alibaba is an outright fraud. Here's a snippet from Fortune:

"Last week Fortune reported that certain respected investors had begun to doubt the accuracy of various figures reported by Alibaba, the leading Chinese e-commerce company. Hedge fund manager John Hempton of Bronte Capital even suggested that Alibaba might be committing fraud by 'faking their numbers.'" (Source: Fortune).

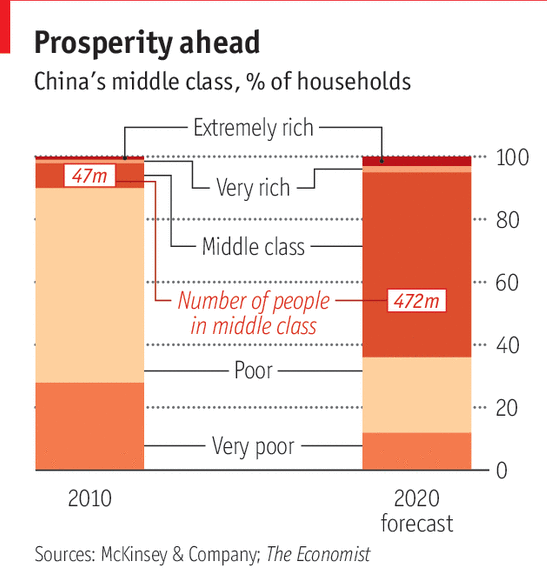

In response to those accusations, Alibaba's founder and executive Chairman Jack Ma retorted that China's community of online shoppers is massive and prolific in their purchasing power, and Alibaba’s marketplace is their favorite place to shop. He simply said that the numbers look "to good to be true" because of China's market. Check out this image that shows the unimaginable growth in the size of China's middle class (evidence to support Jack Ma).

We're talking about estimates of nearly half a billion more people in China's middle class by 2020. That doesn't mean Alibaba isn't a fraud, but let's be honest here, the United States does have a palpable Sinophobia. The stock market has at least some reason for it, as there have been a large number of outright frauds in China that were trading on US markets.

Government Trouble

Beyond the fraud allegations, there is a huge counterfeit issue with Chinese retailers.

Did You Know We Also Publish Research Just Like this But Only Share it With Pro Users? Join Us: Try the Most Sought After Stock Research.

Conclusion

If the fraud claims are simply wrong, then Alibaba is a remarkable investment opportunity with a stock price hammered by systematic risk (the Chinese market) and what could be totally unsubstantiated fraud accusations. It does deserve the lofty market cap it saw in its early days as growth appears to be accelerating, regardless of the Sinophobia and fears of a China economic slowdown.

But, if Alibaba is a fraud at any meaningful level, the stock still holds a $190+ billion market cap, so the fall from here could be abruptly lower.

We're left with two questions:

1. Is Alibaba a fraud?

2. Are we asking that question because of bias in our thinking?

Whatever your answers, they will direct your investment thesis on the stock.

It takes more than click bait and a 140 characters to be an expert and journalists aren't trained to understand breaking technology. Try CML Pro. You will be powerful.