Using a Risk Reversal to Get Long Alibaba Group Holding Ltd (NYSE:BABA)

Date Published: 2017-04-17

Written by Ophir Gottlieb

LEDE

Using a risk reversal to get long Alibaba Group Holding Ltd (NYSE:BABA) but adding a stop loss and always avoiding earnings as risk limiters, has so outperformed the stock it's almost unbelievable. But these are the facts.

Preface

In a toppy market and risky geopolitical landscape, it may seem odd to look at an aggressively bullish option strategy. But, given that Alibaba Group Holding Ltd (NYSE:BABA) is one of the two mega cap technology leaders in China, perhaps it's time to take a look outside of the United States.

Getting long Alibaba Group Holding Ltd (NYSE:BABA) with options can take many forms. Buying calls or call spreads, or selling puts or put spreads, each one makes sense for a specific type of investment. But one approach gets long with more risk in the hunt for greater returns.

RISK REVERSAL

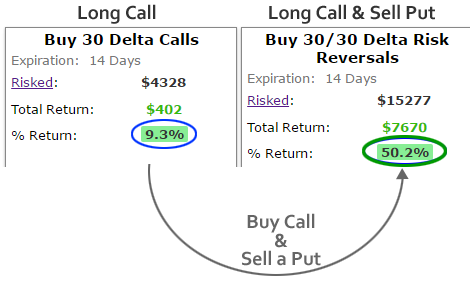

Buy a call means paying out of pocket for option premium -- although it does create a bullish position. But, selling a put to fund the purchase of that call actually creates a credit, leaves the upside of the call, and even benefits if the stock doesn't "go down very much." Of course, there is now more downside risk.

Before we address that extra risk, let's look at the results of "selling a risk reversal," which in English means, buying an out of the money call and selling an out of the money put. This is over two-years and we note, we taking the extra risk precaution of always avoiding earnings and trading every two-weeks.

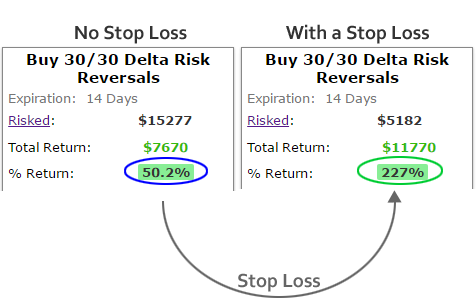

Just owning a long call returned only 9.3%. But, when we sell a put to cover the premium, we see a 50.2% return. The stock was up 40% during this time. While the trade avoided the risk of earnings, it does have a heap of risk to the downside when compared to the long call by itself.

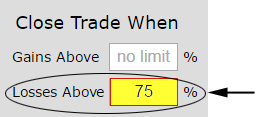

Let's address that risk by implementing a stop loss:

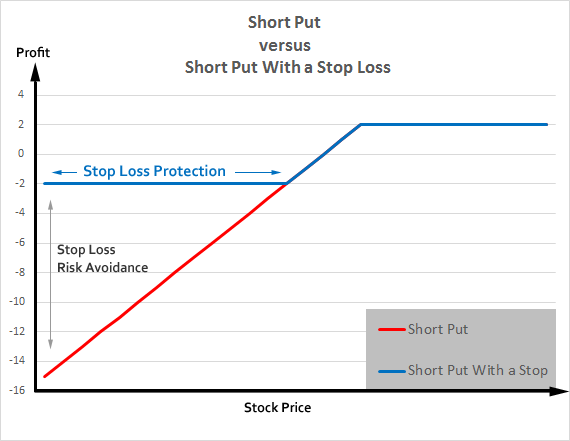

Selling a naked put can lose several hundred percent, but with a stop loss, we have tried to cap that loss, in this case, no more than 75% in a two-week period. The short put part of this strategy has been changed to look like this:

And with less risk, it turns out this risk reversal strategy has turned into a massive winner:

A long call returned just 9.3%. A long call funded by selling a put returned 50.2%. But, when we add another layer of risk protection with a stop loss, we see that trade turn into a 227% return -- again, the stock was up 40% in this time period.

SUCCESS THROUGH TIME

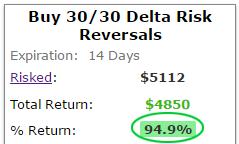

Next we examine this strategy over the last year.

That's a 94.9% return while the stock rose 39.5%. We can test this over the last six-months as well:

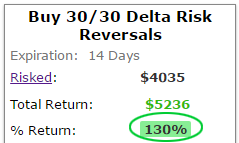

That's a 130% return while the stock was up just 7.2% Yes, we're looking at about 18-fold the stock return.

While this is certainly a risky strategy, we did temper that risk by:

* Always avoiding earnings

* Using a stop loss

WHAT JUST HAPPENED

This is how people profit from the option market - it's preparation, not luck.

To see how to do this for any stock, index or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in Alibaba Group Holding Ltd (NYSE:BABA) as of this writing.

Back-test link.