How to Use Options to Profit from Bank of America Corp (NYSE:BAC)

Preface

It's been under reported, but an important opportunity has emerged in Bank of America Corp (NYSE:BAC) options and the rest of the market may be missing it.

WHAT IS EDGE?

One of the great beauties of option trading is that the market prices the 'greeks,' which serve as a measure of probability.

If a trade wins more often than the probability that is priced in, it has edge.

Here is that same thought process, but in English: A 30 delta (out of the money) put should end up in-the-money about 30% of the time (delta is roughly a measure of probability). In other words, if we sold a 30 delta put, we would expect that we could have a winner 70% of the time.

EDGE

Now, back to our idea of edge. If we can find an option strategy that has a 30 delta, but if selling it wins more than 70% of the time, then we have edge. Even further, even if it wins 'just' 70% of the time, if the net profit is positive, then that's another measure of edge.

When we have both, we have a great trading result, and that is exactly what we find with Bank of America Corp (NYSE:BAC).

Bank of America Corp (NYSE:BAC)

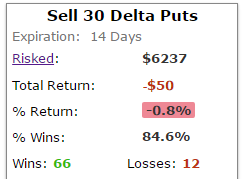

If we test selling a 30 delta put, every two-weeks in Bank of America Corp over the last 3-years, this is what we find:

This result is bad, but it gives us a window into how exactly to trade BAC options. We actually see a 84.6% win-rate, which is substantially superior to the 70% we expected. But, the returns are negative. Putting our detective hats on, what we are seeing here is that the few losing trades are having large negative returns.

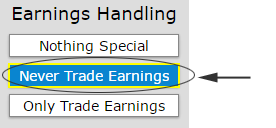

Now that we have diagnosed the problem, we can address it. Let's do this exact same strategy, but let's avoid the risk of earnings. That is, we simply skip trading during earnings events. Here is the easy set-up -- just a tap of the mouse:

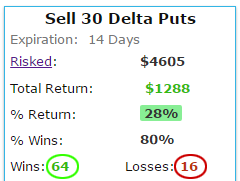

And here are the results, now that earnings are avoided:

By taking less risk, we have turned a losing strategy into a winner, while maintaining a very high percentage of winning trades. But the real opportunity here is not what has happened 3-years ago, it's the overwhelmingly bullish sentiment for banks that is happening right now.

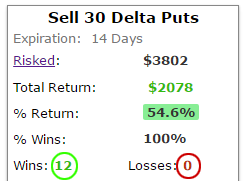

This is how that same short put strategy, while avoiding the risk of earnings, has done over the last 6-months:

Over the last 6-months, there have been 12 two-week trading windows if we avoid earnings. Every single two-week period has produced a win with this short put, and the returns are over 50%. That is enormous edge and it's growing as the market looks to a rate hike and possible deregulation.

Betting on a mega cap not going down has been very profitable, it can be adjusted to take less risk, and that risk reduced implementation has been even better.

This could have been any company -- like Apple, or Facebook, or any ETF. What we're really seeing is the radical difference in applying an option strategy with analysis ahead of time, whether that's a stop loss or avoiding earnings, or both. This is how people profit from the option market -- it's preparation, not luck.

To see how to do this for any stock, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading, friends.

The author has no position in Bank of America Corp (NYSE:BAC) at the time of this writing.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.