Coherent Has a Trading Pattern That's Working Incredibly Well Right Now, Exactly, in This Market

Coherent Has a Trading Pattern That's Working Right Now, Exactly, in This Market

Date Published: 2018-12-08

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.Lede

Skew and volatility make a perfect match right now in this market -- and that match gets stronger when we look specifically at one technology stock.Preface

We have published several insights over the last two months surrounding market volatility and how it has become a unique opportunity for option traders. We then demonstrated the importance of option skew -- an odd sounding term which is in fact very easy to understand and critically important to successful option trading.Today we take both ideas, and combine them into a back-test that has shown, by far, the highest win rate with large returns over this bear market turn -- while taking no stock direction risk. These are the under the radar gems that we want to identify.

The Short-term Option Volatility Trade in Coherent

It's time to take advantage of volatility. Fear, uncertainty, doubt, unclear news headlines -- these are all trade-able events, at any time, without concern for earnings. Today we look at exactly what has worked in Coherent (COHR).

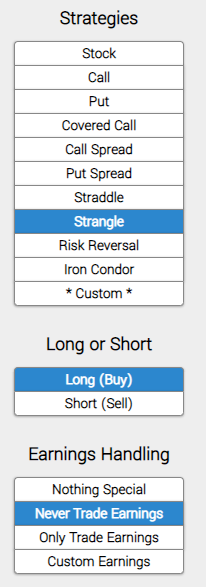

We will examine the outcome of going long a short-term out-of-the-money (40 delta) strangle, in options that are the closest to 7-days from expiration. But we have a rule -- it's a stop and a limit of 20%, and, we back-test re-opening the position immediately, as opposed to waiting for 7-days later.

Let's not worry about stock direction or earnings, let's try to find a back-test that benefits from volatility. Here it is, first, we enter the long strangle.

Second, we set a very specific type of stop and limit:

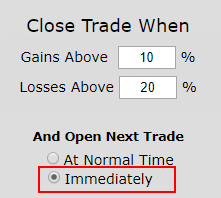

At the end of each day, the back-tester checks to see if the long strangle is up 10% or down 20%. If it is, it closes the position, and re-opens at the same time, another long strangle, but this one now re-adjusted for what is the newest out-of-the-money strike price.

The plain English explanation of setting a looser stop loss (20%) to the limit gain (10%) is as follows: "If it didn't work today, we'll see if it will work tomorrow." That has been a steady dose of winning back-tests in this market. If one-day is calm, there's a good chance, soon enough, a volatile day will follow.

We have a full blown tutorial write up on this type of stop/limit behavior in the Discover Tab: Stops & Limits Roll Timing What does "open again at normal time" vs "immediately" mean?

The Results

We back-tested this only over the last nine-weeks. We are hyper focusing not on a long drawn out pattern, but rather this time, right now, this period of volatility.

| COHR: Long 40 delta strangle | |||

| % Wins: | 82.6% | ||

| Wins: 19 | Losses: 4 | ||

| % Return: | 425% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® Stock Option Backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

Notice that this has triggered a trade 23 times in the last nine-weeks. This is a fast moving, re-adjusting strangle. The idea is simple:

Take well bounded risk, small, and direction-less, and let a tweet, a news headline, an Apple headline, a day of pessimism or a day of optimism, whatever -- move the market, as it has so often in this new volatility regime.

Setting Expectations

Since we use end of day open and closes, while this strategy has an overall return of 425%, the trade details keep us in bounds with expectations:➡ The average percent return per trade was 33.3% over each few day period.

➡ The average percent return per winning trade was 45.1% over each few day period.

➡ The percent return per losing trade was -22.8% over each few day period.

Not only are we seeing a high winning percentage, but also that the average win is twice as large as the average loss. Further, this trade takes no stock direction risk at all.

We are seeing gains so far beyond the limit (10%), because Trade Machine uses end of day prices for triggers -- this creates a solidified rules based system, and that system sees the average loss right near the stop setting (20%), but the average gain substantially larger.

The Last Month

The nine-week back-test ranged from 10-01-2018 to 12-08-2018. Now we hyper focus even more, to look at the results from 11-08-2018 through 12-08-2018, so exactly one-month.

| COHR: Long 40 delta strangle | |||

| % Wins: | 90% | ||

| Wins: 9 | Losses: 1 | ||

| % Return: | 187% | ||

Tap Here to See the Back-test

WHAT HAPPENED

This is how people profit from the option market, its empirical testing, not luck. Trade Machine gives you the capacity to trade beyond luck.Tap here to see it for yourself

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.