The Three Mega Caps With Stunning Revenue Growth

Facebook Inc. and Alibaba Group Holding Ltd

Preface

In a toppy market with risk building, perhaps the single greatest antidote to a stock sell-off is growth. While it will surprise few that Facebook Inc. (NASDAQ:FB) revenue growth is a top performer, it may be a bit stunning to realize that Alibaba Group Holding Ltd (NYSE:BABA) is the other company that has the largest revenue growth of any two companies with market caps over $150 billion in any industry in the world.

FACEBOOK INC. (NASDAQ:FB)

Facebook's market cap now makes it one of the largest seven companies in the world, but it is unlike the rest. It's revenue base is substantially smaller than the rest. Let's start with a chart of Facebook Inc. and the company's revenue rolled into trailing twelve month periods over time.

Facebook Inc. (NASDAQ:FB) revenue now stands at $19.767 billion, up from $13.5 billion last year, which is a staggering 46.3% rise. Two-years ago the company reported just $8.9 billion in revenue, so the company has more than doubled its revenue base in less than two years.

Alibaba Group Holding Ltd (NYSE:BABA)

We'll look at the same chart, but this time for Alibaba Group Holding Ltd.

Alibaba's revenue over the trailing-twelve-months stands at $16.67 billion, up from $12.29 billion one-year ago and $8.45 billion two-years ago.

While these two charts show beautiful trends, the numbers require context, and it is in that context that the uncanny similarity between FB and BABA is revealed.

CONTEXT

If we plot revenue one-year growth (TTM) for all companies in all sectors over $150 billion in market cap and then rank them on the y-axis, we end up with this startling image.

Facebook and Alibaba are growing revenue faster than every company in every industry with market caps above $150 billion. We can see Amazon.com, AT&T and Alphabet round out the top five. We can also see at the lower left of the chart the disastrous run for oil giants Chevron and ExxonMobil as oil prices have dropped.

When it comes down to it, Facebook and Alibaba are growing revenue spend at stunning levels and it's these growth numbers that have earned the two companies rather lofty valuations relative to their overall revenue base.

WHY THIS MATTERS

We know that the mega caps will innovate, and we know the mega caps that are growing revenue the fastest. But to find the companies that we all seek, the smaller companies that have the capacity to become the next mega caps we have to identify the revolutionary thematic transformations that are coming to find the "next Amazon" or the "next Facebook." This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution. Our purpose is to break the information monopoly held by the top .1%.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here is just one of the trends that will radically affect the future that we are ahead of:

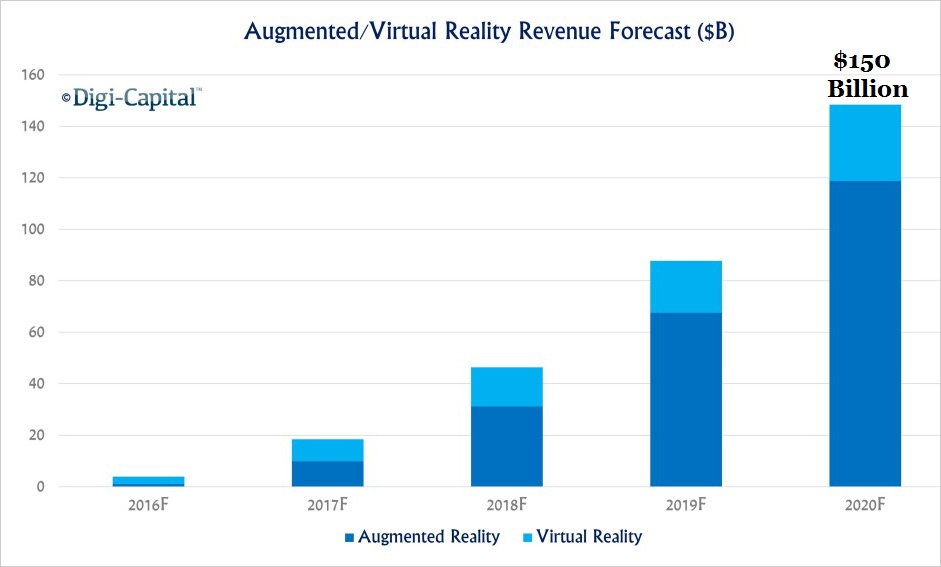

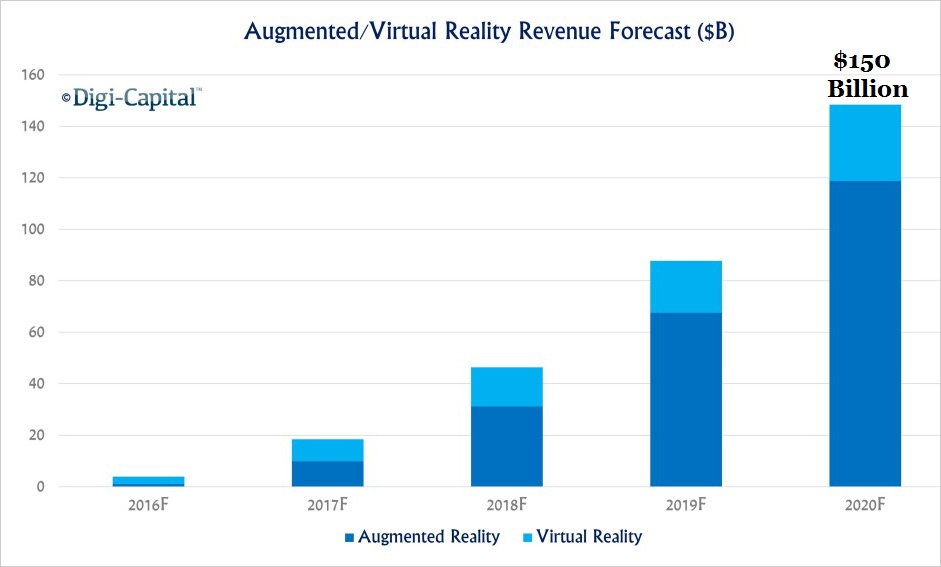

Virtual reality is one of the fundamental shifts coming in the very near future that will change how we live, work, and play. This is a technology whose consumer base looks increasingly like all of humanity. This is the opportunity so many investors say they welcome - that say they search for. The opportunity to find the "Next Apple," or the "next Google." Friends, it's coming right now, and it lies in the depths of technology's core. It's not artificial intelligence, it's artificial super intelligence and there is one company that will rule all of it.

This just one of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Facebook Inc. and Alibaba Group Holding Ltd

Preface

In a toppy market with risk building, perhaps the single greatest antidote to a stock sell-off is growth. While it will surprise few that Facebook Inc. (NASDAQ:FB) revenue growth is a top performer, it may be a bit stunning to realize that Alibaba Group Holding Ltd (NYSE:BABA) is the other company that has the largest revenue growth of any two companies with market caps over $150 billion in any industry in the world.

FACEBOOK INC. (NASDAQ:FB)

Facebook's market cap now makes it one of the largest seven companies in the world, but it is unlike the rest. It's revenue base is substantially smaller than the rest. Let's start with a chart of Facebook Inc. and the company's revenue rolled into trailing twelve month periods over time.

Facebook Inc. (NASDAQ:FB) revenue now stands at $19.767 billion, up from $13.5 billion last year, which is a staggering 46.3% rise. Two-years ago the company reported just $8.9 billion in revenue, so the company has more than doubled its revenue base in less than two years.

Alibaba Group Holding Ltd (NYSE:BABA)

We'll look at the same chart, but this time for Alibaba Group Holding Ltd.

Alibaba's revenue over the trailing-twelve-months stands at $16.67 billion, up from $12.29 billion one-year ago and $8.45 billion two-years ago.

While these two charts show beautiful trends, the numbers require context, and it is in that context that the uncanny similarity between FB and BABA is revealed.

CONTEXT

If we plot revenue one-year growth (TTM) for all companies in all sectors over $150 billion in market cap and then rank them on the y-axis, we end up with this startling image.

Facebook and Alibaba are growing revenue faster than every company in every industry with market caps above $150 billion. We can see Amazon.com, AT&T and Alphabet round out the top five. We can also see at the lower left of the chart the disastrous run for oil giants Chevron and ExxonMobil as oil prices have dropped.

When it comes down to it, Facebook and Alibaba are growing revenue spend at stunning levels and it's these growth numbers that have earned the two companies rather lofty valuations relative to their overall revenue base.

WHY THIS MATTERS

We know that the mega caps will innovate, and we know the mega caps that are growing revenue the fastest. But to find the companies that we all seek, the smaller companies that have the capacity to become the next mega caps we have to identify the revolutionary thematic transformations that are coming to find the "next Amazon" or the "next Facebook." This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution. Our purpose is to break the information monopoly held by the top .1%.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here is just one of the trends that will radically affect the future that we are ahead of:

Virtual reality is one of the fundamental shifts coming in the very near future that will change how we live, work, and play. This is a technology whose consumer base looks increasingly like all of humanity. This is the opportunity so many investors say they welcome - that say they search for. The opportunity to find the "Next Apple," or the "next Google." Friends, it's coming right now, and it lies in the depths of technology's core. It's not artificial intelligence, it's artificial super intelligence and there is one company that will rule all of it.

This just one of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.