Facebook: The Unbelievable New Data on Growth

The Real reason to Get Bullish on Facebook Inc. (NASDAQ:FB)

Preface

Facebook Inc. (NASDAQ:FB) is growing revenue faster than any mega cap with respect to revenue, but the real reason to get bullish has nothing to do with the financials and is borderline unbelievable.

FACEBOOK: FINANCIALS

Before we dig into the breaking research surrounding Facebook Inc. (NASDAQ:FB), let's quickly look to the impressive financials. We start with Facebook's revenue chart (TTM) through all-time.

Facebook Inc. (NASDAQ:FB) Revenue

As if that image wasn't impressive enough, the $20 billion in sales in the trailing twelve months is expected to hit just under $35 billion in 2017, or fully a 75% rise. In fact, here is how Facebook's revenue growth in the last year looks relative to every other mega cap in North America:

Facebook Inc. (NASDAQ:FB) Revenue Growth

At over 40% year-over-year revenue growth and yet more to come, these financial metrics show that Facebook is indeed a marvel. But, this isn't the bullish news.

That revenue growth is just beginning as both Facebook and Google (GOOGL) push further into online video -- easily them most disruptive form of advertising since the introduction of the television many decades ago. While we're at it, we can add Twitter (TWTR) to that list of companies ready to see revenue hit new highs because of this seismic shift. But, there's one thing that Twitter and Google don't have, and it's this:

FACEBOOK: BREAKING

Facebook the company includes the properties Facebook proper, Instagram, Facebook Messenger and WhatsApp. Those properties have 1.6 billion, 500 million, 1 billion and 1 billion (again) monthly average users, respectively. It has been Facebook's ability to separate these social media into silos that is in large part responsible for its tremendous growth in usage and ultimately profitability. But the scare for Facebook has always been relevance.

Perhaps unlike any other mega cap, Facebook is perceived as one that has a risk of a rapid deceleration in relevance. The detractors will rightly ask, "what happens if the next generations don't like Facebook?" There are certainly competitors, most notably Snapchat.

But here's new data that should make any Facebook stock holder feel pretty good about their long term prospects.

Contently just penned an article surrounding Generation Z and while the article focused on broader issues, it did strike a chord on social media. Here's what the firm found:

“

According to marketing agency Fluent, 67 percent of older Gen Zers regularly use Facebook, while 50 percent name the Facebook-owned Instagram—only one percentage point behind Snapchat.

Facebook was also named by 26 percent of respondents as the social network they use “constantly,” compared with 23 percent for Snapchat. Nearly half of respondents said they log onto Facebook multiple times a day.

According to marketing agency Fluent, 67 percent of older Gen Zers regularly use Facebook, while 50 percent name the Facebook-owned Instagram—only one percentage point behind Snapchat.

Facebook was also named by 26 percent of respondents as the social network they use “constantly,” compared with 23 percent for Snapchat. Nearly half of respondents said they log onto Facebook multiple times a day.

”

So, while the mainstream media will have us all thinking that Snapchat will eat Facebook's lunch as the new generations move into different media consumption habits, the truth turns out to be quite different and pretty bullish. FB, impossibly, is getting more popular.

That's a staggering result and is quite bullish for the firm in the face of criticism and competition that would imply the social media giant was facing the risk of irrelevance. Whether FB market cap is ahead of itself is a question to be debated, but the future yet again looks unbelievable and quite bullish, yet.

WHY THIS MATTERS

Facebook's monstrous revenue growth is going to come from video. The online video medium is turning into perhaps the largest disruption in the advertising world since the advent of the television and there is one firm that is aiming to be "the Google of online video." At Capital Market Laboratories we see these trends – the ones that will create the "next Google" or the "next Facebook." Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution. Our purpose is to break the information monopoly held by the top .1%.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, online video, biotech and more. In fact, here is just another of the trends that will radically affect the future that we are ahead of:

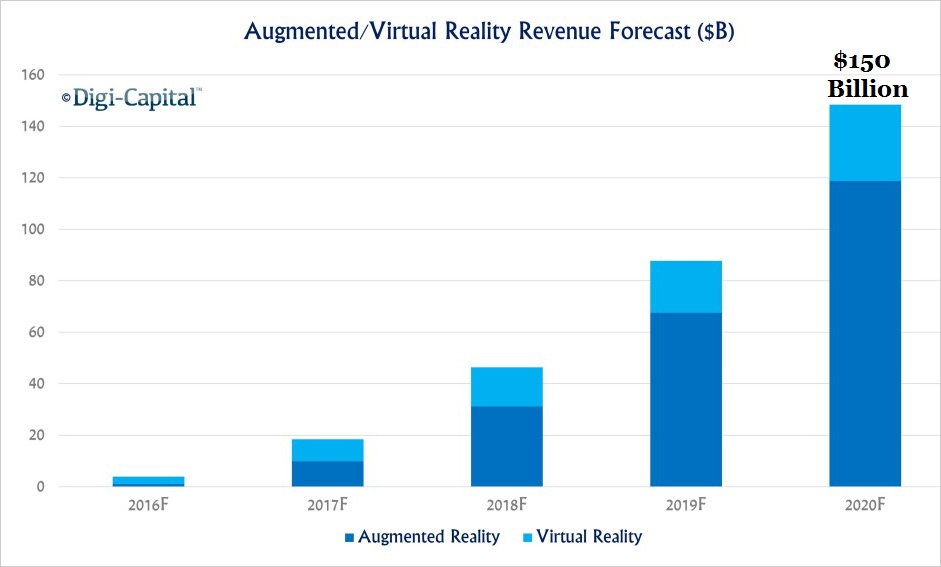

Virtual reality is one of the fundamental shifts coming in the very near future that will change how we live, work, and play. This is a technology whose consumer base looks increasingly like all of humanity. This is also the opportunity so many investors say they welcome – that say they search for. The opportunity to find the "Next Apple," or the "next Google." It lies in the depths of technology's core. It's not artificial intelligence, it's artificial super intelligence and there is one company that will rule all of it.

This just one of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.