A Catastrophic View of Facebook and Google

Pubished: 8-15-2016

Preface We have written a number of glowing reports about Facebook (NASDAQ:FB) and Alphabet (NASDAQ:GOOGL). This is a report that looks through the other side, and taken to its conclusion, it is catastrophic.

STORY

Facebook generates about 95% of its revenue from selling advertising. This is a fact. Here is the remarkable revenue growth.

That redible growth is expected to continue, with Thomson First call estimates coming for over $36 billion in revenue by 2018, up from $22 billion in the last year. Yes, that's more than 50% growth forecast in the stock price. But there's a potential problem, and taken to its end, is catastrophic.

THE RISK

Most of us don't like advertisements. The advent of the DVR, Netflix, Hulu, TiVo, whatever, have made skipping TV ads much easier, especially when it's not live TV.

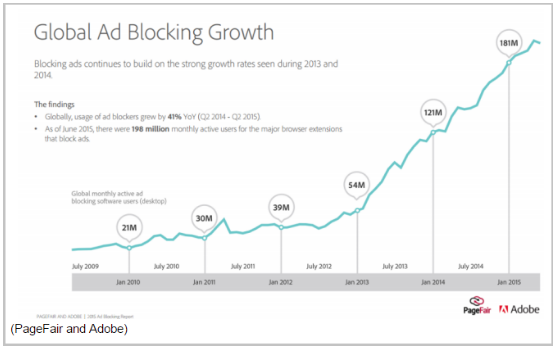

That same reality is coming to the web -- desktop, mobile and in application. "Ad blockers," are applications that can be installed on our phones, laptops and desktops that, for all intents and purposes, block web ads. Here's a frightening chart that shows the proliferation of ad blocking software:

According to a report published by PageFair and Adobe, ad blocking software worldwide has increased 41% year-on-year to 198 million monthly active users and is expected to cost publishers more than $21.8 billion in 2015 in lost revenue (BusinessInsider).

But the real movement is just beginning:

The battle is heating up. According to Columbia Journalism Review, we get this: "The problem is that surveys show many internet users, particularly younger ones, have already decided they hate online ads."

Facebook CEO and Founder mark Zuckerberg is now openly discussing ad blockers, as is Google (which receives about 80% of its revenue from advertising). A cat and mouse game has begun, but as we reprise it, there is one phenomenon behind it that Facebook (NASDAQ:FB) and likely Alphabet (NASDAQ:GOOGL) simply cannot win.

THE GAME IS NOT FUN

Adblock Plus is a big deal in the adverting blocking world with more 60 million active users.

"

Adblock Plus has released a browser for mobile Android devices that blocks ads, and it's planning to release a similar product for Apple devices. But Adblock Plus might not be the biggest threat for publishers on mobile.

Adblock Plus has released a browser for mobile Android devices that blocks ads, and it's planning to release a similar product for Apple devices. But Adblock Plus might not be the biggest threat for publishers on mobile.

"

They have taken it upon themselves to become the leader -- to end unwanted (which means all) advertisements. The company launched its blocker, Facebook countered, then the company countered, on and on, until this headline, which is real, from The Register came out on August 12, 2016:

Adblock Plus blocks Facebook block of Adblock Plus block of Facebook block of AdBlock Plus block of Facebook ads

You know why it's funny to Facebook and Alphabet ? This is real. The populace no longer wants advertisements. Just like the populace no longer wanted to pay $19.99 for a music CD and the music industry went away over night with mp3 downloads (mostly illegal).

You see, when something moves us like this, it becomes a part of our social vernacular and it turns into something like "a right." We have "the right" to see no advertisements. Or, we have "the right" to not pay $19.99 for a CD with one song we love and the rest we don't care about.

And, even when that right is false, even when it means illegal actions by hundreds of millions of people as in the case of the early days of mp3 downloads, it takes hold, and the populace always wins. The back and forth between Facebook and Alphabet on one side, and the ad blockers on the other, will not stop. And the populace, will not lose.

The argument could spin out of control, away from "right and wrong," to very simply, "we the people want this and it will happen." Remember, ad filled pages load much slower. In fact, there is a wonderful right up on apmblog.com which notes the unintended consequences of ads:

1. Ads slow your page speeds to a crawl

2. Ads are intrusive/distracting from the content

3. Fear of tracking/loss of personal privacy information

Source: APMBlog

While the focus now is on desktop ads, a small portion of Facebook 's revenue source, mobile and mobile apps are coming. And while the argument will read that the apps built by Facebook, or YouTube, or Google Search, will not allow external apps to flourish (or even start), they will. There will be work arounds. There will be ad blockers that will pour their guts into blocking ads just so they can do it.

It might seem mean spirited, or, in the case of music, it might even seem illegal, but it really doesn't matter. If this ad blocking rally turns into one of a general populace movement that it is our "right" to block ads, then Facebook and Alphabet will lose, and they will lose huge.

CALMER HEADS

Now, that was the catastrophic view of a small trend that is picking up steam for Facebook (NASDAQ: FB) and Alphabet (NASDAQ:GOOGL). Let's not go ahead and assume these two huge winners are idea. But, let us not also forget the possibility that these two companies do face an existential risk the size that no one has ever seen.

THE WAY OUT

It turns out that Facebook and Alphabet do have a way out, even if this movement turns into a total disintegration of web and app adverting as we know it. The answer is video, and very much to both of these firms' fortune, online video and online video ads are the new black.

There is a revolution coming from video adverting that will shake the adverting world as much as the radio did in the 1920s and the television did in the 1950s. And that is where our focus should be.

The author had no position in Facebook (NASDAQ:FB) or Alphabet (NASDAQ:GOOGL) stock at the time of this writing. The author is long shares of TubeMogul (TUBE).

WHY THIS MATTERS

Facebook and Google just crushed earnings and nearly all of their business comes from advertising. But that world is changing dramatically toward video. It turns out that there is one technology company that will power this revolution, regardless of whether it's Facebook, Google, Twitter, or whomever that will end up with the largest audience.

It's identifying trends and companies like this this that allows us to find the 'next Apple' or the 'next Google.' This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

That chart plots the growth in 4G usages worldwide and how it will grow from 330 million people today to nearly 2 billion in five years. This is the lifeblood fueling every IoT and mobile device on the planet and CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.