How to Trade Covered Calls in Facebook Inc

How to Trade Covered Calls in Facebook Inc

Date Published: 2017-06-02Preface

A covered call is one of the most common option strategies for owners of a stock, and with relative ease, we can go much further -- to identify the risks we want to take, and those that we don't, in order to optimize our results. Facebook Inc (NASDAQ:FB) is one of those cases.

A risk averse approach to covered calls in Facebook Inc has not only been a winner for an entire year, but it has returned upward of 70% annualized returns.

STORY

Everyone knows that the day of an earnings announcement is a risky event for a stock. Before we get into a real action strategy, we can look at how selling a covered call in Facebook Inc has done over the last year if we always avoided earnings.

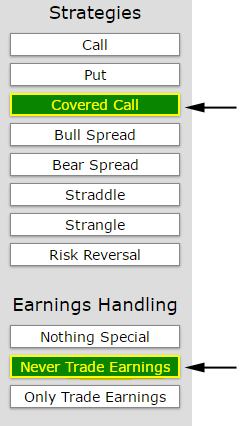

What we want to impress upon you is how easy this is with the right tools. Just tap the appropriate settings.

And here are the results:

At first blush this looks like a reasonable approach. The long stock position combined with the covered call returned 27.9% in a year, trading every month and avoiding earnings. But there's a question that we must ask if we want to be exceptional option traders:

Are there better months to sell a covered call than other months?

It turns out that the answer for Facebook Inc is, yes.

BETTER

Facebook is one of the five largest companies in the world forever tied to its other large cap rivals Apple, Alphabet, Amazon and Microsoft. As the earnings date approaches for Facebook Inc, we can test the idea that it will neither "go up a lot" nor will "go down a lot" in that month right before earnings.

That is to say, with so much attention on these mega caps, the month before earnings can be relatively tame as all the anticipation builds for the single day of earnings.

If this is true, then selling a covered call should work very well. Here is how we set it up:

Rules

* Sell a covered call 29 days before earnings

* Close the position one day before earnings

We note that we are not taking earnings risk, but are closing the covered call before earnings. It's easy to see in the settings:

And now, here the results over the last year:

We see a 17.7% return but note that this was a one-month trade each time earnings came around, so that 17.7% took just four-months of trading which is more than 70% returns annualized. We can also see that in the last year, this strategy worked all four times.

In the last two-years this has worked six of the last eight times.

WHAT HAPPENED

We just took perhaps the most common option strategy, did a little analysis and found a process that created out-sized returns while only trading one-month a quarter. For those that are long Facebook Inc stock, a 17.7% return from just the month before earnings in the last year is a serious find.

This is how people profit from the option market -- it's preparation, not luck. There are a lot of companies that fit this strategy, and there's more -- don't forget that month after earnings.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Back-test Link