Five9 (FIVN) CEO Trollope calls the business Mona Lisa because it’s so beautiful

Probably every successful business should have this: A “Mona Lisa chart,” a graphic of the financials that is so desirable, you’d even call it beautiful.

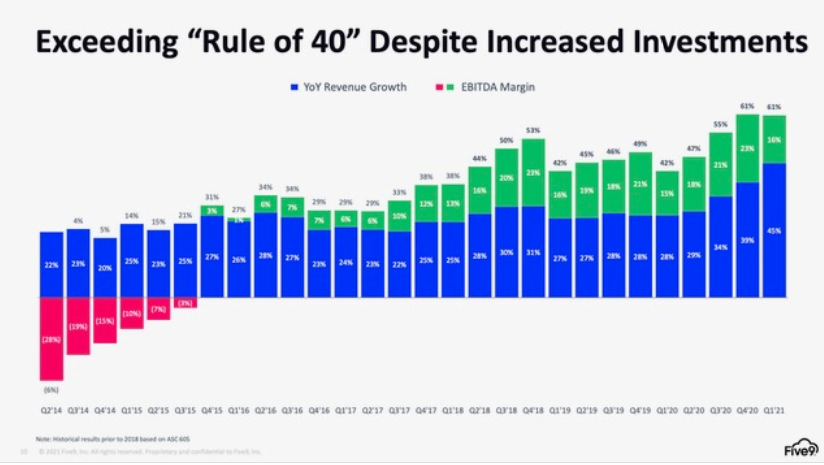

That is how Five9’s (NASDAQ:FIVN) CEO, Rowan Trollope, describes his company’s financial performance as represented in one chart, which shows revenue growth plus EBITDA margin. It’s better than the famed “Rule of 40”: In Five9’s case, it’s the Rule of 60, at the moment.

Trollope sat down to talk with Capital Market Labs, as he has many times, following yet another quarterly report April 29th of better-than-expected sales and profit and a higher outlook as well.

In addition to talking about the beautiful financial metrics, Trollope talked about how the company forecasts, and why growth keeps surprising — “we’re very prudent” with forecasts, he says — and about the acceleration quarter after quarter in enterprise deals — “There’s a huge demand, especially from larger enterprises, for automation technology,” he says.

Trollope also offered some fascinating insights about how his company uses software from younger firms in the go-to-market software industry, the SaaS “Wave Two,” as he calls it, such as Gong and Chorus, companies still private but with lots of potential.

Capital Market Labs: As we usually do, Rowan, let’s throw it out to you first, what should investors take away from the results and outlook?

Rowan Trollope: Not anything other than what we’ve said, it was a great quarter where growth continued to accelerate, now up to 45%, driven by our enterprise business, really.

And we sort-of saw this acceleration happening pre-pandemic.

And I feel like enterprises took a little bit of — some enterprises accelerated those decisions during the pandemic. But as we come out of it, that transition is back on its inexorable trend upwards.

CML: I’m going to throw out some numbers here. It looks total topline guide from you this year was twenty-six percent?

RT: Yes, and we raised that. Thematically, the story with Five9 is that we are very prudent with our guidance.

So that, the guide, if you — We spend a lot of time with our investors, and they know us quite well.

They understand how we guide, that we are very prudent with the numbers.

I think they appreciate that.

And they appreciate the consistency that we’ve been able to bring, in terms of the beat-and-raise, the expectations that we set.

CML: The Street is consistently way out in space. What is going on here? Is there something that you see within your conservative guide that they are missing?

RT: Nothing whatsoever. Nothing whatsoever. Our guidance is not a reflection of the strength or weakness of business in whatever shape or form.

It is a consistent methodology we have used over the years.

As you point out, the Street tends to get ahead of that, and they have their own estimates, and they tend to be fairly accurate with those estimates.

We beat their estimates handily, but they understand the business really well.

Our investors and the sell side analysts do a good job of modeling the business, and we provide them a good deal of guidance and insight to help them with those models.

CML: But they are consistently way off. So, there must be something — either you are executing a lot better than your anticipation going into a quarter or a year, or there is some big factor that they haven’t modeled.

RT: Yeah. Our execution has been excellent, consistently excellent, but I would say getting better.

In this quarter, there wasn’t any one thing you could point to that drove the accelerated revenue growth to 45%.

It was actually all parts of the business that did very well.

Our commercial business that three years ago was hovering at zero percent, kind of flat, now is over 20%.

Our enterprise business has grown from the low 20s over that period up into the 40s now.

Our LTM enterprise subscription grew at 45%.

So, it’s really just strength across every part of the business.

You know, we’ve invested pretty heavily in international, as another thing that’s driving growth.

That business grew 300%, year over year, in bookings. That was the European business.

The Latin America business grew 250%. So, the international investments we’ve made.

I think probably the biggest driver of what you are seeing is the investments we’ve made in product innovation.

Specifically, we’ve built out an automation portfolio through three acquisitions, and organic development.

So, we have both of those going on.

That automation portfolio is really resonating well with customers because it’s a very direct ROI story that they can understand.

It’s a very simple story that is very believable.

And so, there’s a huge demand, especially from larger enterprises, for automation technology.

We acquired the market leader in intelligent virtual agents, Inference, and we have integrated that into our product now.

And a great example of that is we announced a very large deal, the largest deal in the company’s history, $14 million in ARR.

That customer — that’s part of the overall company, so we have more room to grow there — that customer has estimated that over a period of time, I forget exactly what the number is, three to five years, they believe they can save $59 million for their company.

Again, it’s a simple story.

That story is, a lot of the time that agents spend with customers is dealing with high-volume, low-value calls. And text messages and emails. And computers can do, actually, better now.

They weren’t able to do it better in the past.

In fact, we have all been frustrated by the voice interface that just doesn’t seem to understand what we are saying, or just wastes our time.

What’s really changed is the voice technologies have gotten much, much better.

We actually sit on top of all the hyper scale vendors — Google, Amazon, we can work with Microsoft, we work with IBM.

And that technology has really advanced very quickly.

And all the parts of that technology stack, from automatic speech recognition, which is now 90% to 95% accurate; the natural language processing part of that, and the conversational AI part, it’s all gotten very good.

And what that's allowing for the first time is, it’s allowed a company like us to build a visual workflow that helps deliver these voice agents, digital virtual agents, that can have real conversations with customers and help solve problems.

And so, there are direct cost savings there, and that’s what that large customer was looking at.

And one of the reasons they made the decision was, we have the best technology out there.

CML: So, it’s not firing people, it’s getting more work out of the same headcount, presumably?

RT: It’s two things.

It’s making the agents more efficient, that’s one piece.

The other one is just reducing the overall load on the agent, based on the agents that they have.

And if they can reduce load, they can reduce headcount.

And on reducing headcount, this is one of the biggest problems in the contact center, is turnover.

The average agent life span is something like 18 months.

They’re constantly struggling to add new people.

What this allows our customers to do — and one of the reasons for that turnover is, it’s really boring to take the same call over and over and over again.

You try that for a year, and I bet you’ll be looking for something else to do.

CML: That describes all of my conversations except for ours!

RT: Thanks. I did this, by the way. And it was mind-numbing.

So, this is an opportunity to take that work away, and automate it, and let humans do what they are really good at, which is dealing with complex situations, and places where you need empathy, and that human connection and that human touch.

So, that’s what the story is. And that what, frankly, one of the biggest drivers, from a technology perspective, of why you’re seeing the acceleration.

It’s that we’ve got market-leading technology, and it’s behind a need that customers have.

CML: So, it sounds less like layoffs, ultimately, more like, if you’re going to have people rapidly turning over, you can be not frantically searching for new talent if you can augment what you do...

RT: Right. Yeah, that’s one away to look at it.

Another way is, for those customers who want to invest to drive a better customer experience, this freeing up the rote, routine work, frees up those people to do the work that is more — spending more time with a customer, focusing more on value-add.

CML: Quality time?

RT: Yeah, exactly.

CML: Another way to look at your story is, the enterprise business keeps trending up.

What’s the potential there? It’s been going up now for several quarters.

RT: The overall market, we are still in the first inning, call it, of the transition from premises to cloud.

You know, the whole enterprise B-to-B SaaS space kicked off fifteen years ago.

And there was a whole wave of stuff that went first, most notably CRM, Salesforce, followed by all the names we have heard about, Netsuites, Workday, etc.

I call that Wave One B-to-B SaaS.

What we are now in is Wave Two B-to-B SaaS, and contact center is one of them.

Some people have asked me, why is this happening later than you saw the rest of the parts of the portfolio transition.

And the reason is the that the real-time technologies are much more sensitive to bandwidth and infrastructure than the previous Wave One. Think about meetings, and UC [unified communications] and contact center as the three representative technologies in this category.

You really need reliable, robust bandwidth.

Ten years ago, I don’t think we would be able to have this high-quality Zoom conversation we are having now without jitter or lag.

One of our home office connections wouldn’t be good enough.

And now, in my house, I can have five of these conversations going on at once, and I do, with my kids and everybody else, and no problem.

That’s a big part of why Wave Two of B-to-B SaaS it’s happening now.

Because businesses have robust, reliable infrastructure.

And so, it becomes possible to move your on-premises voice solution to the cloud. And so, your question, how much is left, well it’s less than fifteen percent penetrated in terms of enterprises moving onto cloud contact centers.

CML: Less than 15% of companies are doing those things?

RT: That’s right. And so, you’ve got 85%-plus of the market still using on-premises systems. And those systems are old, and they need to be refreshed.

And the obvious answer is to move to the cloud.

And by the way, nothing made that more apparent to customers than the pandemic.

Because when you need to send all of your agents home, overnight, in some cases, when you had an on-premises system, it was not easy to do.

Because you had the physical hardware in your closet, and telephones on desks, blah, blah, blah.

Getting that to work from a remote agent perspective is very difficult.

But from our customers’ perspective, it was a non-event, essentially, because all they had to do was to have a computer at home and Web browsers and a headset, and that’s all you need to be successful.

CML: If it’s been going up, percentage growth in enterprise sales, quarterly, maybe there is further upside in terms of that rate of growth?

RT: Well, I’m comfortable with our guidance ... now we’re back to the boring part of our conversation! [laughs]

CML: The other thing is, we are not only seeing record revenue, but we are also seeing consistently higher sequential dollar-based next expansion rate. What’s up with that?

RT: We have done very well at up-selling our customers with new technology.

So, our churn, we have driven down.

And that’s a function of our customer success team, who have done a fantastic job through the pandemic.

A lot of our customers had a hard time with that transition, and we were there to help them.

So, our churn, we had a little blip in the beginning of the pandemic, but coming out of the pandemic we have hit record low churn rates, and have seen even more success up-selling selling to customers.

We have expanded our portfolio quite a lot.

So, we have more technologies, and compelling technologies, to sell to our customers, so that’s helping.

And the other factor, maybe the biggest factor, is that where we are seeing the fastest growth in our business is the very largest customer deals, like the $14 million.

CML: Who was that?

RT: We haven’t publicized the name, but it was a logistics company, or a shipping company. We were able to, for the largest customers where we are seeing the most growth, that segment actually has traditionally had the highest retention rates.

And once they buy, they buy more.

So, that segment has been growing the fastest.

As opposed to the commercial tends to churn the fastest.

Some have five seats, so, you know, a company goes out of business. Tends to be much higher churn.

So as the mix-shift goes toward enterprise, that dollar-based retention has an upwards…

CML: Makes sense, because you have more opportunities in a large entity...

RT: Yeah.

CML: Let’s talk about international. How large is that addressable market relative to North America?

RT: I would say it is somewhere around 50% of the total TAM. The Total TAM is $24 billion. Call it half of that, $12 billion, outside the U.S.

CML: The bookings there have been quite a step function every quarter.

RT: They’ve been growing well.

We doubled our headcount just recently in EMEA.

It’s really seeing great success there.

I just sent one of my executives to go live there for a while to build out our delivery capability and operations team.

We run 24/7 around the globe, but having folks living in Europe is important, actually having people living there is important.

CML: Where’s there?

RT: The U.K. We’re building a network operations center there, and service delivery, and everything else.

CML: Is that a step function in expense, as well? Do you need to plow money into that to do that?

RT: Yes, but with the company growing the way it’s growing, we’ve been investing in R&D and operations, it’s part of the profile we’ve shared with the Street.

CML: One can assume international is a meaningful contributor for the future to grow?

RT: Yes, and the other thing that enables that international expansion it that over the last 3 years, we have re-architected our platform to run in public cloud.

We traditionally have had all our software in our own data centers and co-los. We have shifted that to public cloud.

That’s allowed us to much more quickly build out or deploy our software running on top of hyper-scalers.

We use both Amazon and Google, we use them for different things, for technical reasons.

That’s allowed us to get out into many, many more locations, more quickly.

And that’s important because in Europe, even each country has specific residency requirements to comply with.

So that’s allowed us to scale much more quickly. And it’s also causing a shift of dollars from cap-ex to op-ex.

CML: Do you dump your own capacity at some point and go fully public-cloud-native?

RT: No. We have invested quite a lot in that infrastructure, but what I see happening is, all the growth happening on public cloud.

Our architecture actually leverages a bit of a hybrid.

We use public cloud for almost everything, but we are keeping the voice traffic at the edge.

So, if you go back to our conversation about Wave One versus Wave Two of B-to-B SaaS, how you build and architect a real time app globally is different in Wave Two real-time apps than how you would do that in standard enterprise software apps.

And by the way, Zoom do this, and RingCentral do stuff like this, we all do somewhat similarly — you try to keep the high-volume traffic out of the public cloud as much as you can, because there’s a huge expense with that.

So, you try and run that on your own network.

And you want to try and build out that global network to get the economies of scale. And then you use the public cloud for the things it’s good at.

CML: There are burst uses?

RT: Yeah, and that’s what we are doing. We burst in, and also for expansion regions where we don’t want to invest in the co-los and hardware, we just start with public cloud, and then to control costs later on, we can come back and re-plumb it if we want to.

CML: For the foreseeable future there will be a real economic advantage to having your own infrastructure?

RT: Yeah, I don’t know substantial it is, but it’s definitely there.

CML: One more boring question: What is your long-term EBITDA margin goal?

RT: Twenty seven [percent].

CML: Why is it twenty-seven?

RT: Feels like a good number.

CML: Really? There wasn’t something more specific?

RT: I think what we did is, we trended out the path — we have a chart, my CFO calls the Mona Lisa Chart, it’s just so beautiful.

It’s the revenue plus the EBITDA margin. You have this monotonically increasing EBITDA.

There’s only been two or three quarters it has declined.

And that was a result of me saying we’re pushing the gas in R&D or something else.

But outside of that, we’ve been just executing like a machine at improving that EBITDA margin.

I think we committed to that at our financial analyst day, pre-pandemic, and we trended it out, and said, what do we think we could achieve if we could get our sales and marketing spend, and our product R&D spend into these ranges, so that’s how that happened.

That’s a long-term model that we committed over a five-year period.

CML: So, it’s a goal for you?

RT: It’s a goal.

CML: Are you at 27% now?

RT: Each quarter bounces around. Sometimes we are in the twenties, sometimes in the teens, but we are always in that zone.

CML: Why is it called the Mona Lisa Chart?

RT: It’s a Mona Lisa cause it’s so beautiful! And when you add — look at the last two quarters, if you add our add EBITDA margin and revenue growth, we are north of 60, we are at 61. You know, that metric that investors…

CML: The rule of 40.

RT: Yes, we are at 61

CML: Which is better than the Rule of 40…

RT: Yes, 61 is better!

CML: Anything that’s not boring that we haven’t touched on that you’d like to mention?

RT: We just have our heads down and executing.

It’s not that fancy of a story, it’s fairly straightforward.

We just keep doing our jobs and business keeps going in the right direction. So, there’s nothing else to say.

CML: Let’s pick your brain on one more thing.

Because you have a lot of people trying to sell your software. In the area of front-office automation technology, such as go-to-market, do they mean anything in terms of productivity, for you? Things such as process automation? These are companies younger than you…

RT: Like Gong, and Chorus?

CML: Yes, Gong, Chorus, ZoomInfo... Systems of action, systems of engagement. They think they are kind-of a part of Wave Two of SaaS.

RT: Yeah, I think they are, just in terms to timing.

We leverage those technologies quite extensively in our sales and go-to-market machine.

We are early adopters of those types of technologies.

We are a very happy ZoomInfo customer. Their CEO, I think his name is Henry [Schuck], great guy, and just has done incredibly well at our company.

We have tried to leverage as many of those technologies as possible. Because we do have that machine in the commercial business that is just driving leads to the Web site, and following up.

So, we leverage a platform called Gainsight, which is awesome, for customer success management.

Their CEO, Nick Mehta, is fantastic.

We have done really well by leveraging these more modern technologies.

While Salesforce gives us the baseline for a bunch of that technology, there are so many innovative companies in the ecosystem that are popping up around that Salesforce core, it’s been fantastic for us to drive efficiencies.

So, our sales efficiencies is actually phenomenal, it’s highest I’ve ever seen in enterprise SaaS, just in terms of the fully productive reps and how much we drive per rep.

CML: Some of that is automation, and some of that is just being smarter sales people?

RT: It’s both. A lot of it is pre-sales, it’s the lead-gen, follow up, nurturing, all those kinds of campaigns that drive the leads into the sales force.

There’s a bunch of technology that we use there, in that toolchain, that is very effective.

And then, I’ll say that, that wave is also helping power our business.

Because we are both inbound for customer service, and outbound for sales.

These companies are actually plugging into our platform.

And we provide that engagement platform, system of engagement, while they are coming in with the intelligence, how do we tell the salesperson to say the right thing at the right time.

We have a new part of our platform that we have launched, called VoiceStream, and VoiceStream is real-time streaming voice capabilities.

So, these AI companies, if they want to plug right into a live conversation, we can stream them the conversation, either audio or text, so they can just get the text stream, and use natural language processing and machine learning, to say, Ah, something interesting is happening, let’s flag something to that salesperson, for example.

So, a Gong, for example, could subscribe to and leverage this API to build real-time interactions for salespeople during phone calls.

CML: Would Gong be using for internal consumption or for their customers?

RT: They would use that — I’m using Gong as an example, they’re not actually a partner — anyone who wants to do what Gong is doing, which is, build a product that can provide guidance and recommendations and suggestions to sales people or customer service people, outbound or inbound, we are the substrate that sits underneath that , that provides the transport, but then we’ve created this higher-level API that lets you plug in and receive the real-time voice.

CML: You are the supplier?

RT: Yes. We are the enabler, exactly.

We’ve had a lot of interest in that.

I mean, I can’t throw a rock here in San Francisco without hitting a conversational AI company, they’re all over the place.

And so, opening up our platform, we’ve got now over 200,000 agents on our platform that are talking every day, and more than 7 billion minutes flowing through our pipes.

And so, the fact that we can open that up for these innovative small companies that are trying to build new technologies I think is a real game-changer.

CML: Fascinating. That will be good for a longer conversation at some point. Thanks, Rowan.

RT: Good seeing you again, take it easy.

Conclusion

Each company in our 'Top Picks’ has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty.

The precious few thematic top picks, research dossiers, and alerts are available for a limited time at a 30% discount.

Thanks for reading, friends.

The author has no position in Five9 (FIVN) at the time of this writing.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn’t do it even if we were. We’re sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.