Google Has a Secret Weapon

Fundamentals

PREFACE

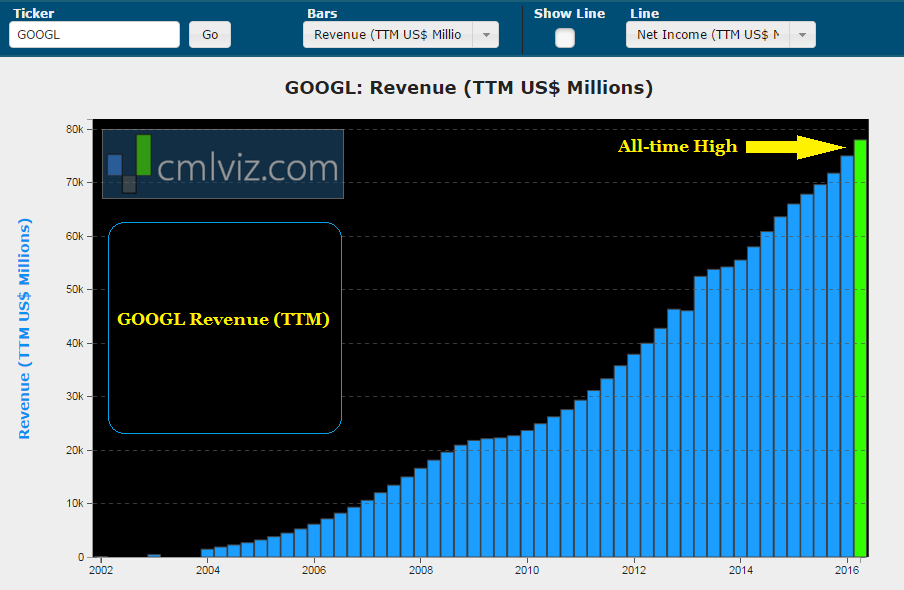

Alphabet's Google (NASDAQ:GOOG) continues to grow its massive revenue base at border line alarming rates. In fact, here's the all-time revenue chart for a quick glance:

But there's a secret going on over at Google, and for a company this size it's been remarkably well kept. But the secret is seeping through the cracks of the media and it's happening not so much because of investigative journalism but because the company keeps growing even at this scale and the tech experts are all starting to wonder how it's possible.

This is a story of how -- this is a story that isn't forward looking, it isn't about a technology that "someday" will transform our lives. It's a story about right now. It's a story about Google beating everyone at the most sophisticated and delicate parts of technology combined with human intellect. This is what artificial intelligence and machine learning look like, not in a robot or self-driving car, but real world business applications that are shaking the technological landscape.

START

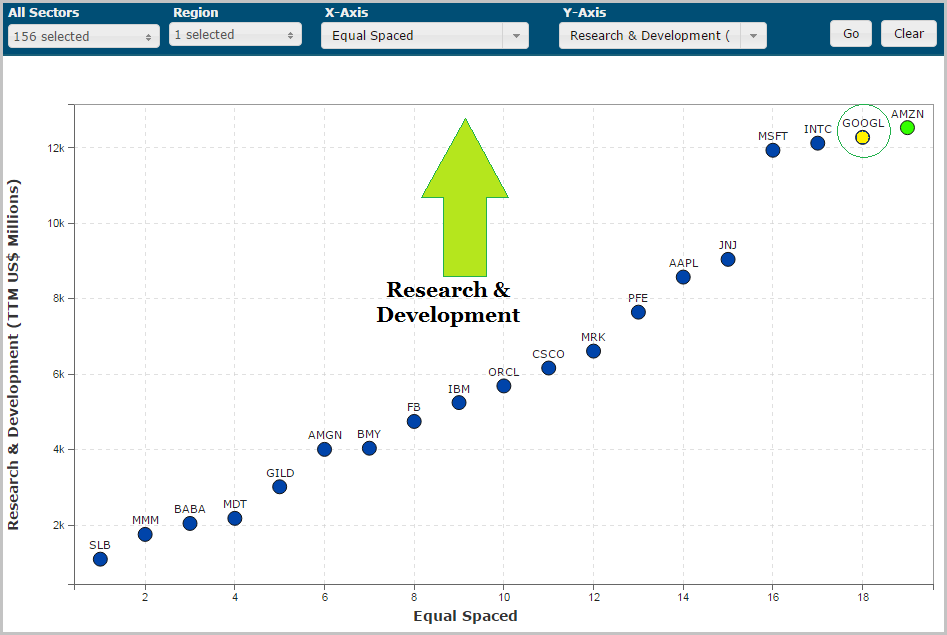

It begins very simply with research and development (R&D). In fact, if we take every company in every sector that trades on North American exchanges, Google spends the second most on R&D:

Now, here's the secret about that R&D and the tangible if not impossible results:

GROWTH: VIDEO

While Facebook (NASDAQ:FB) claims it receives 8 billion video views a day, Google announced this on its latest earnings call:

"YouTube on mobile alone now reaches more 18 to 34 and 18 to 49 year olds in the U.S. than any TV network, broadcast or cable."

YouTube Red, the pay streaming video on demand (SVOD) service is also swinging at Netflix's (NASDAQ:NFLX) core business, and although no one is talking about it, it's working. But that's just a cool fact -- it's not the secret.

GROWTH: ADVERTISING

Google's cost per click (CPC) on its advertisements have been decreasing as mobile becomes a greater share of its product mix, but we also got this news:

Paid clicks for Google were up 29 percent year-over-year for the first quarter, and the company’s revenue continues to increase.

Source: TechCrunch

Source: TechCrunch

GROWTH: E-COMMERCE

Not many people even thought of Google when it came to this thematic shift and I'm sure nobody knew it was making waves as large as it has. Buy news broke of a huge uptick in a business segment, and it opens up humongous opportunity for Google that no one saw coming.

We're talking about E-commerce and we're talking about a war with Amazon (NASDAQ:AMZN). On April 13th, PR Newswire revealed that retail sales from Google Shopping grew by 52% year-over-year in the first quarter. But that's just the tip of the iceberg:

Sales from mobile Product Listing Ads (PLAs) grew by 164%. In addition, clicks were up by 171%, orders were up by 171%, and ROAS was up by 23%.

Source: PR Newswire

Source: PR Newswire

Now here's where the secret Google is working on gets reveled simply due to success. While those e-commerce numbers are stunning, this is also a fact: Google Product Listing Ads were rolled out to all US advertisers in 2011. This isn't a new business, it's just newly successful, and this is why:

GOOGLE'S SECRET

On the most recent earnings conference call, Google's CEO Sundar Pichai reminded us of this:

"We've been investing in machine learning and AI for years, but I think we are at an exceptionally interesting tipping point where these technologies are really taking off."

Other than a few more sentences, Google's CEO didn't touch on the progress. But now it's the secret in plain sight. While Facebook's Mark Zuckerberg openly and loudly proclaimed that he was dedicating 2016 to artificial intelligence in his house, Google has been more subtle. That subtlety is now exploding.

THE RESULT

Google has seen quarter-over-quarter increase in CPCs from Google sites for the first time since the first quarter of 2014. It has seen huge growth in online video advertising as YouTube grows. And now, it has turned a once dead product that was rolled out five years ago into a booming e-commerce business. And it surrounds the efforts that the firm has dedicated itself to with artificial intelligence and machine learning.

While it's in vogue to talk about Apple's (NASDAQ:AAPL) rather absurd $233 billion cash pile, the world has forgotten about Google, which now has its own cash holdings of over $75 billion with just $2 billion in debt.

And, while the world sits breathless wondering what Apple will do next to turn the growth spigot back on, Google has kept it on and is accelerating it in areas once thought untouchable.

THEME 4: SELF-DRIVING CARS

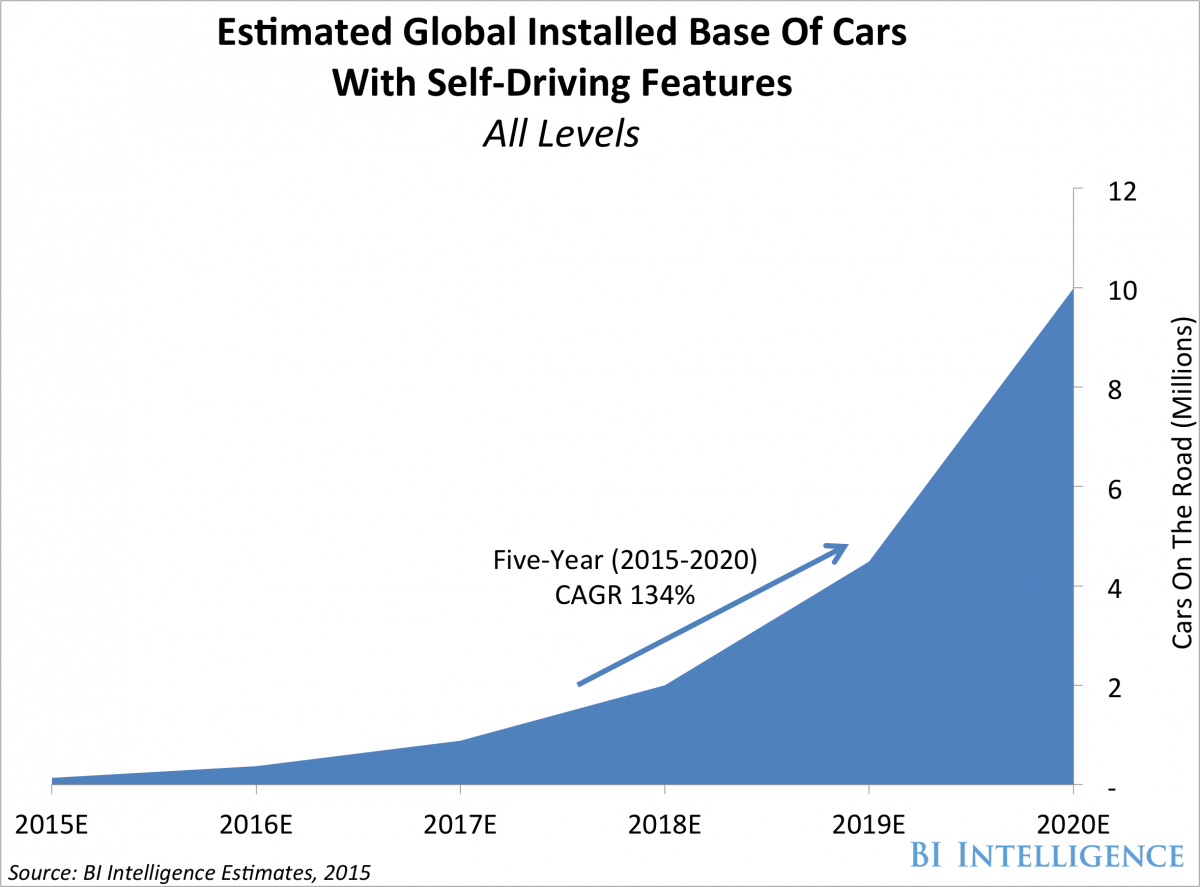

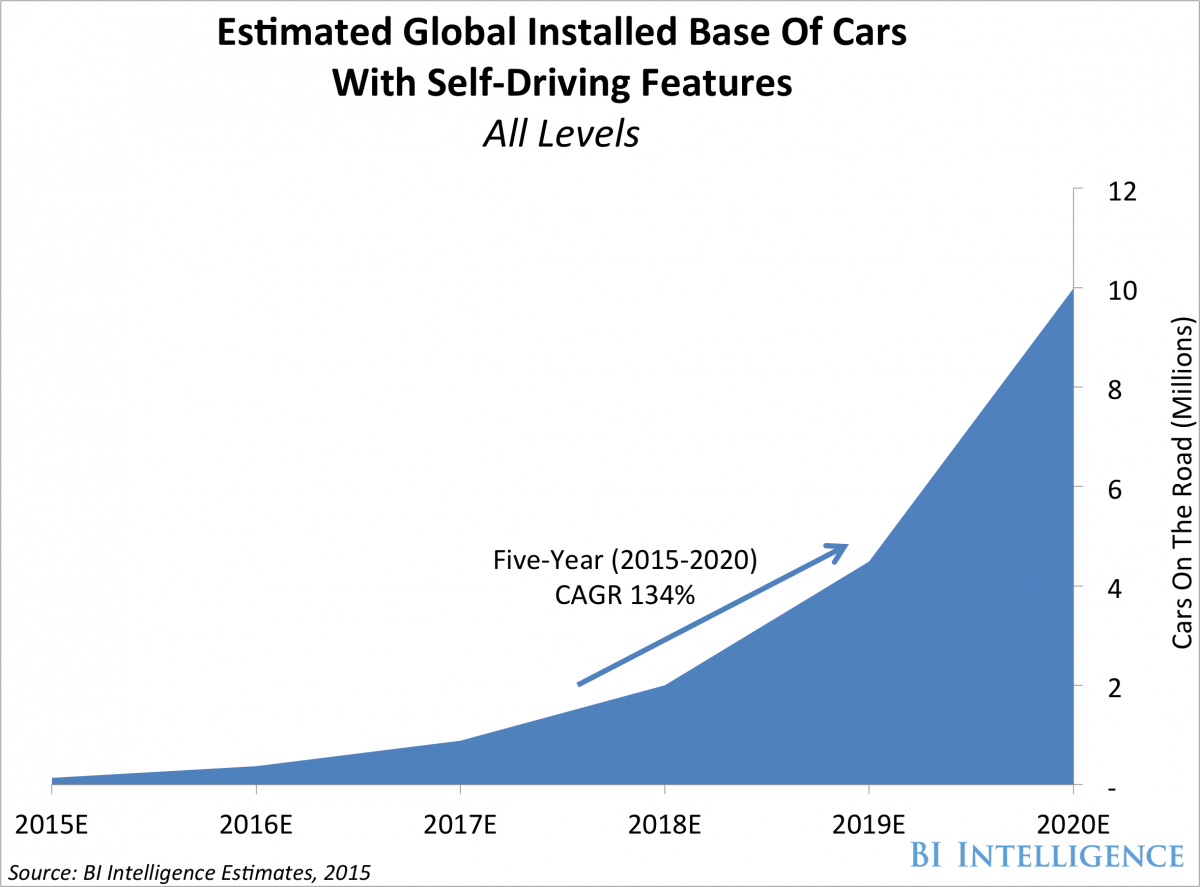

Google may be the most famous of all the tech gems for its self-driving aspirations. While Tesla (NASDAQ:TSLA) is a marvel and Apple will simply change the world with its car, Google is going about it slightly differently. Here is a growth in vehicles with self-driving features:

CARS WITH SELF-DRIVING FEATURES

We're looking at 134% compounded-annual-growth rate for the next five years ending at 10 million cars by 2020. But Google wants to create totally self-driving cars -- not a vehicle which features self-driving capability. The company is already lobbying politicians to not only get laws changed and approved, but more importantly, to begin the process of getting the idea of totally self-driving vehicles into the mental vernacular of society.

This is a long play, but one with an enormous upside and one totally dependent on Google's move forward with AI and deep learning.

SEEING THE FUTURE

There's so much going on with Google we can't cover it all in one report - it spans seven different thematic shifts in technology and it will battle Amazon, Facebook, Netflix and Apple for decades. But, to find the 'next Google' or 'next Amazon,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

The author is long Apple shares both in his personal account and family owned accounts.

Thanks for reading, friends.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn’t do it even if we were. We're sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.