Alphabet Inc -- Self-driving Waymo Has Upside

Self-driving Waymo Has Upside

Date Published: 2017-05-17Written by Ophir Gottlieb

This article is a snippet from the original published to CML Pro members on 5-14-2017.

LEDE

While Top Pick Alphabet Inc (NASDAQ:GOOGL) has seen new all-time highs, there is a growing body of evidence that points to yet more upside in the long-run with self-driving cars and its Waymo division, and the evidence is getting yet clearer.

ALPHABET

Alphabet Inc (NASDAQ:GOOGL) is a Spotlight Top Pick for CML Pro, added for $787.68 on April 16th, 2016 and is now up 21.3% at $955.14.

| Ticker | Date Added | Price Added | Return |

| GOOGL | 4-16-2016 | $787.68 | 21.26% |

The bullish thesis for Alphabet Inc is long and detailed, but also very clear. The company is hitting every major technology trend in the world, and either has a growing profitable business in each segment, or is on the verge of doing so.

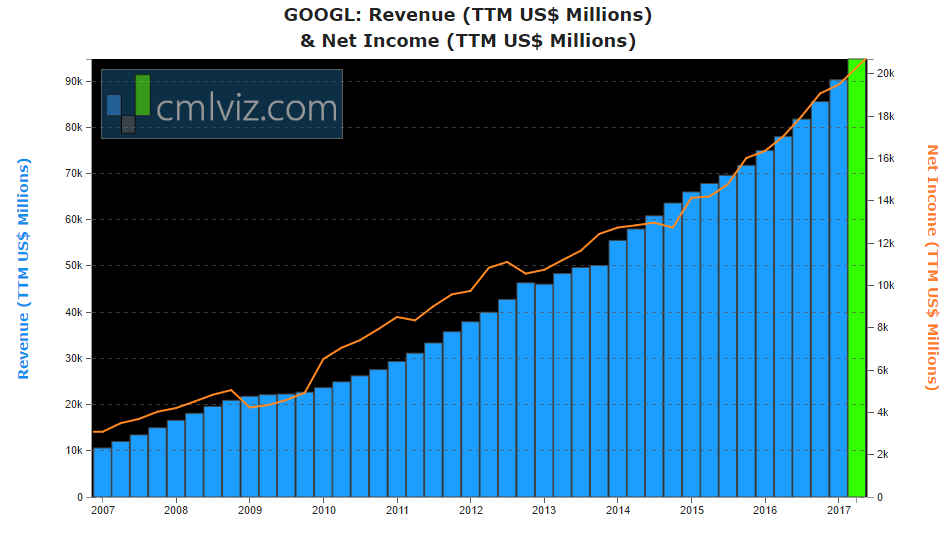

Here is the chart of Alphabet's revenue (in the blue bars) and net income (in the orange line):

We won't outline the entire thesis here, but we do encourage a full read of the Top Pick dossier Google Has Turned on the Growth Engine, or for a more updated view, the dossier published this March Google's Upside Is Absolutely Enormous and Unaccounted For.

In that most recent dossier we highlight Waymo, Google's self-driving car business and we want to re-emphasize some progress in that realm as of today.

Self-driving Cars and Alphabet Inc

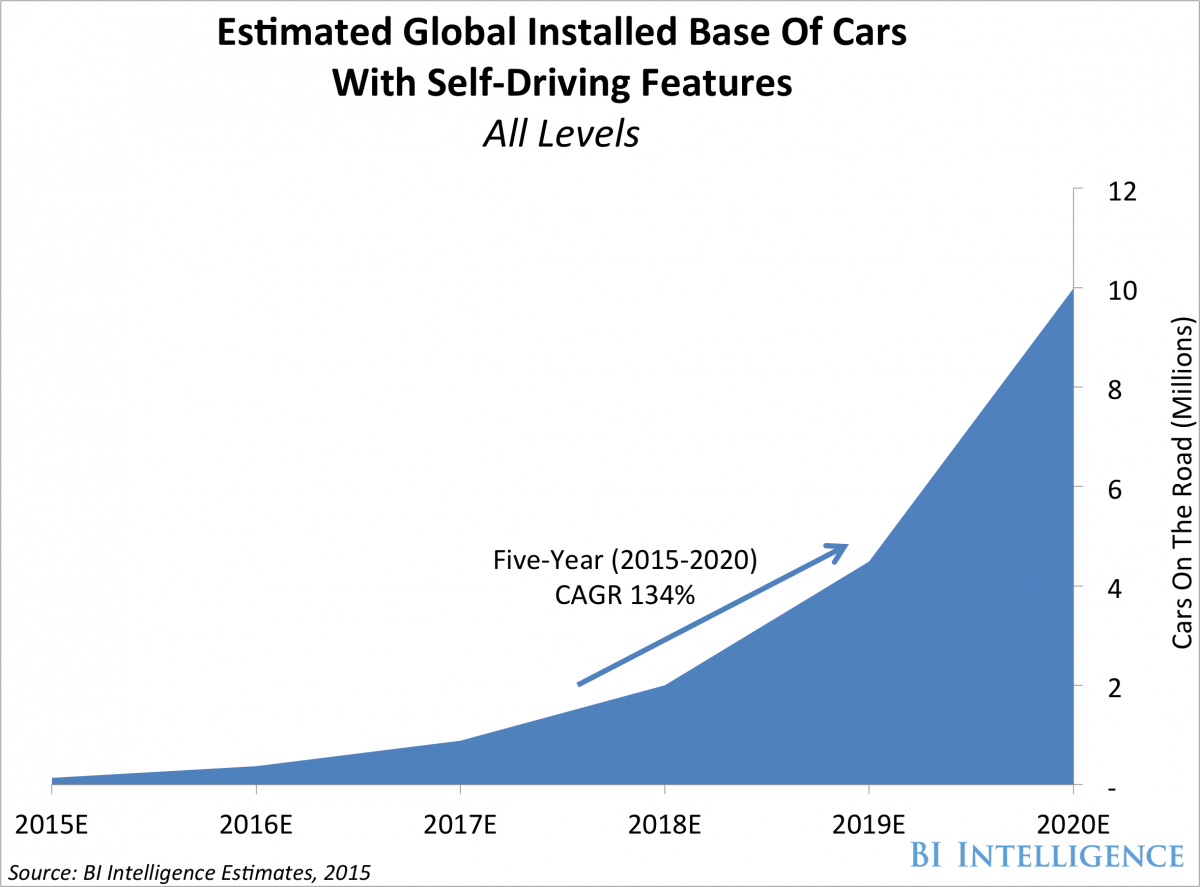

Before we dig into the details, a quick step back. This is the expected growth in the market for self-driving featured cars:

We're looking at 134% compounded-annual-growth rate for the next five years ending at 10 million cars by 2020. But Google wants to create totally self-driving cars - not a vehicle which features self-driving capability.

Waymo has already partnered with Fiat Chrysler, Toyota, Honda, GM and Ford. Now, imagine for a moment that the self-driving revolution, which is coming much sooner than Wall Street understands, is driven by Alphabet's technology. Yeah, Tesla will have their cars, and likely Apple as well, but Chrysler, Honda and possibly other manufacturers partnering with Alphabet Inc could mean a leader has already been established.

Let Tesla sell its 500,000 cars by 2018 if they can. Alphabet is looking to sell tens of millions within five years, with no cost of production, no assembly line, no radical new business - just the best technology in the world licensed to the largest auto makers in the world.

Supporting this thesis, we got yet more news from Alphabet Inc about Waymo -- and it's very good.

Progress

In a tweet sent on May 9th, Waymo revealed some stunning progress on the number of miles the company has driven to help train its neural networks. Here is the tweet (click on the image to see the chart):

We've reached 3 million miles of self-driving on public roads! That's 1 million miles in just 7 months pic.twitter.com/VsC1ZSscbY

— Waymo (@Waymo) May 9, 2017

Here is some commentary from The Verge:

What's important about Waymo's milestone is the speed with which it logged the last million miles. It took seven years (2009–2016) to reach 2 million miles when the project was still a part of Google. Spinning the self-driving effort off into its own company in December - and adding 100 autonomous minivans to the fleet - seems to have accelerated things, because the project logged 1 million miles in the last seven months alone.

The point here is that it will take millions of miles to get this technology right and turn it into a real business and the company is doing it. And there's even better news -- or that is to say, news that proves this process is actually working.

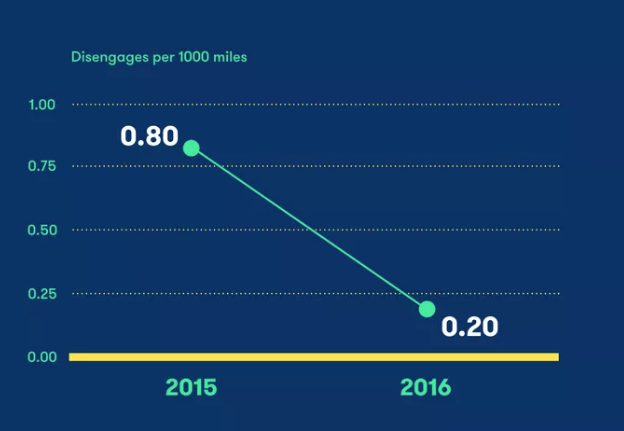

California's DMV released its annual autonomous vehicle disengagement report on February 1st of this year and it shows that Alphabet Inc's Waymo cars are failing at a much lower rate, even as they are driving a whole lot more miles.

Here is a chart:

Dmitri Dolgov, the head of self-driving technology for Waymo said this:

This four-fold improvement reflects the significant work we've been doing to make our software and hardware more capable and mature.

And because we're creating a self-driving car that can take you from door to door, almost all our time has been spent on complex urban or suburban streets.

This has given us valuable experience sharing the road safely with pedestrians and cyclists, and practicing advanced maneuvers such as making unprotected left turns and traversing multi-lane intersections.

And because we're creating a self-driving car that can take you from door to door, almost all our time has been spent on complex urban or suburban streets.

This has given us valuable experience sharing the road safely with pedestrians and cyclists, and practicing advanced maneuvers such as making unprotected left turns and traversing multi-lane intersections.

But the point here is simple and actually lost in that quote. This is the point, the CML view:

More miles has led to better driving which is the very premise of self-driving cars and deep learning. And by the way, in that DMV report, there were no reports of crashes or accidents.

This is it, friends. It's working, and while it has been lost in the shuffle, Alphabet Inc's advantage is growing. We maintain our Spotlight Top Pick status on Alphabet Inc (NASDAQ:GOOGL) which goes well beyond self-driving cars. But, this news is very welcomed.

The author has no position in Alphabet Inc (NASDAQ:GOOGL) at the time of this story.

WHY THIS MATTERS

It's finding the technology gems that will turn into the 'next Google,' or 'next Apple,' where we have to get ahead of the curve. This is what CML Pro does.

Each company in our 'Top Picks' has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.