Intel Corporation, INTC, earnings, options, volatility, secret

Preface

There is a wonderful secret to trading options right before earnings announcements in Intel Corporation (NASDAQ:INTC) , and really many stocks, that benefits from the rising implied volatility but avoids the risk into the actual earnings release and also avoids any kind of stock direction risk.

THE WONDERFUL SECRET

What a trader wants to do is to see the results of buying an at the money straddle a few days before earnings, and then sell that straddle just before earnings.

The goal, is two-fold: (i) to benefit from that known implied volatility rise, and (ii) to own the straddle for a very short period of time when the stock might move 'a lot,' but never take the risk of actually owning options during the earnings release.

If either of those two phenomena occur, there's a very good chance this wins, if neither occur, the amount risked is normally quite small. Here is the setup:

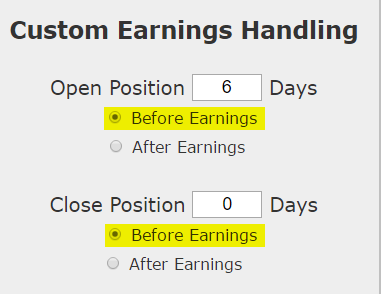

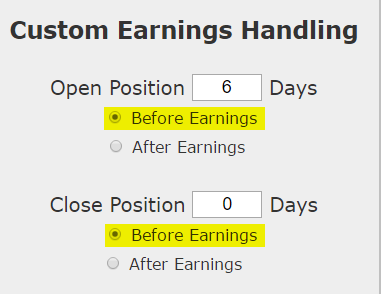

We are testing opening the position 6 days before earnings and then closing the position right before earnings. This is not making any earnings bet. This is not making any stock direction bet.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

RETURNS

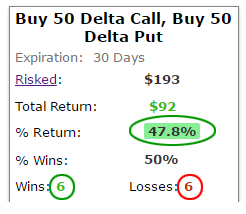

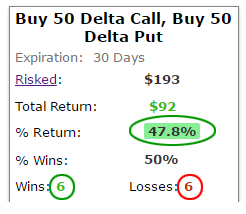

If we did this long at-the-money (also called '50-delta') straddle in Intel Corporation (NASDAQ:INTC) over the last three-years but only held it before earnings we get these results:

We see a 47.8% return, testing this over the last 12 earnings dates in Intel Corporation. That's a total of just 72 days (6 days for each earnings date, over 12 earnings dates). That's a annualized rate of 242%.

We can also see that the win/loss rate is split with 6-wins and 6-losses, yet the return is enormous. That means the winning trades are much larger than the losing trades, which is exactly what a successful trading strategy attempts to do. No magic bullets -- rather smart methodologies for wealth creation.

MORE TO IT THAN MEETS THE EYE

While this strategy is benefiting from the implied volatility rise into earnings, what it's really doing is far more intelligent.

The ideal stocks for this strategy have a couple of common characteristics:

(i) The companies rarely pre-announce earnings -- this is an investment that does not look to make an earnings bet, so an earnings pre-announcement is the opposite of what we're hoping for.

(ii) The underlying stock price of these companies tend to move a lot (or some) as earnings approach and various institutions and traders shuffle the stock price around in anticipation of the earnings result. The more one sided the outside world starts betting on direction -- up or down, the better it is to own the straddle.

WHAT HAPPENED

This is it -- this is how people profit from the option market -- it's preparation, not luck.

Test the results on Apple Inc and Alphabet Inc, and the results are staggering.

To see how to do this for any stock and for any strategy with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in Intel Corporation Inc (NASDAQ:INTC) as of this writing.

Back-test Link (does require custom earnings settings).

The Secret Behind Options Pre-Earnings Trading in Intel Corporation (NASDAQ:INTC)

Intel Corporation (NASDAQ:INTC): The Wonderful Secret Behind Options Pre-Earnings Trading

Date Published: 2017-05-4Author: Ophir Gottlieb

Preface

There is a wonderful secret to trading options right before earnings announcements in Intel Corporation (NASDAQ:INTC) , and really many stocks, that benefits from the rising implied volatility but avoids the risk into the actual earnings release and also avoids any kind of stock direction risk.

THE WONDERFUL SECRET

What a trader wants to do is to see the results of buying an at the money straddle a few days before earnings, and then sell that straddle just before earnings.

The goal, is two-fold: (i) to benefit from that known implied volatility rise, and (ii) to own the straddle for a very short period of time when the stock might move 'a lot,' but never take the risk of actually owning options during the earnings release.

If either of those two phenomena occur, there's a very good chance this wins, if neither occur, the amount risked is normally quite small. Here is the setup:

We are testing opening the position 6 days before earnings and then closing the position right before earnings. This is not making any earnings bet. This is not making any stock direction bet.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

RETURNS

If we did this long at-the-money (also called '50-delta') straddle in Intel Corporation (NASDAQ:INTC) over the last three-years but only held it before earnings we get these results:

We see a 47.8% return, testing this over the last 12 earnings dates in Intel Corporation. That's a total of just 72 days (6 days for each earnings date, over 12 earnings dates). That's a annualized rate of 242%.

We can also see that the win/loss rate is split with 6-wins and 6-losses, yet the return is enormous. That means the winning trades are much larger than the losing trades, which is exactly what a successful trading strategy attempts to do. No magic bullets -- rather smart methodologies for wealth creation.

MORE TO IT THAN MEETS THE EYE

While this strategy is benefiting from the implied volatility rise into earnings, what it's really doing is far more intelligent.

The ideal stocks for this strategy have a couple of common characteristics:

(i) The companies rarely pre-announce earnings -- this is an investment that does not look to make an earnings bet, so an earnings pre-announcement is the opposite of what we're hoping for.

(ii) The underlying stock price of these companies tend to move a lot (or some) as earnings approach and various institutions and traders shuffle the stock price around in anticipation of the earnings result. The more one sided the outside world starts betting on direction -- up or down, the better it is to own the straddle.

WHAT HAPPENED

This is it -- this is how people profit from the option market -- it's preparation, not luck.

Test the results on Apple Inc and Alphabet Inc, and the results are staggering.

To see how to do this for any stock and for any strategy with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in Intel Corporation Inc (NASDAQ:INTC) as of this writing.

Back-test Link (does require custom earnings settings).