Jumia (JMIA): One-on-One with the CEO

Lede

We sat down for a one-on-one comversation with the CEO of Jumia (NYSE:JMIA).

Preface

Jumia reported earnings on 8-10-2021, and you can read that earnings review dossier here:

Jumia’s Platform Aspirations Sputter.

Two items concerned us about the report.

The first was a change in trajectory of third-party sales (3P) versus first party sales (1P).

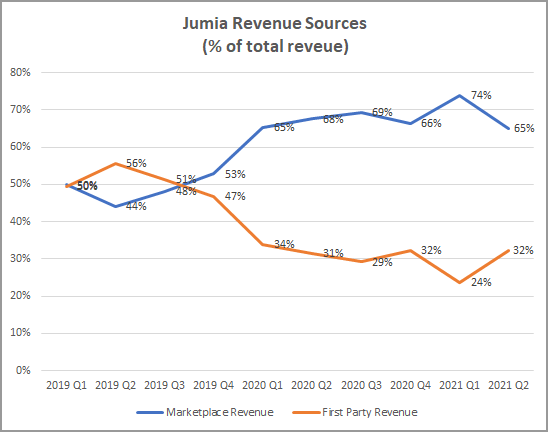

Here is a chart of the two revenue sources through time:

The mix went from 74% / 24% Marketplace / 1P to now 65% / 32%.

The risk we saw was the possibility that Jumia had turned back to a 1P business, which is wholly uninteresting to us.

We’re in it for the platform.

This risk, per the CEO, is not a risk.

In addressing our first question to him, he said:

So, we don’t steer for that [mix]. In our DNA, we’re a marketplace.

In an ideal world, we would be 100% 3P, but we are not shooting for that, and we are happy to keep flexibility.

He then expounded on the vacillation we saw and the vacillations we will see in the future:

The beauty is that we have the flexibility to do 1P, and we don’t want to prevent ourselves from doing it for artificial [reasons].

So, we keep this 1P and it’s tactical and it can go up and down.

And you might see this mix you know, doing some variation quarter after quarter with no bigger picture behind it, then the ability to fluidify the business.

We then spoke in rather detail about the actual difficulties of e-commerce in Nigeria, and not a surface level conversation about “e-commerce.”

We don’t have external factors from an infrastructure standpoint that prevent us [from growing in Nigeria].

[Nigeria] is, of course, a population that has alternatives that are very different. Our competition is not online.[In] Nigeria, we have fantastic footprint that allows us to deliver pretty much anything, anywhere at a cost that is unbeatable.

…we realized nine years ago, when we launched e-commerce, that people are rational decision makers, even though they are in a space that is driven by older dynamics.

The second bothersome piece of the latest earnings report was lack of growth, which has been persistent for more than a year and a half.

Jeremy had a lot to say about that lack of growth and the future plans for growth, so we won’t just dump the whole interview here in the preface section, but some good takeaways can be sound bites.

First, with respect to why growth has been so anemic for the last 18-motnhs.

We spent a couple of quarters not talking about growth, and I know people would have loved to redo the past, but we never said we would.

And we said we’d spend the time getting our economics in place.

A year and a half ago, every order we delivered, we’re losing money after logistics; the more we were growing the business, the more we were destroying it.

Now, we’re in a place where we generate $1 of profit for every order after all the logistics, despite what people think is a nightmare of infrastructure in Africa.

And that is a great foundation.

We have a stronger balance sheet.

Then we turned to future growth to which Jeremy noted:

I’m not saying the uncertainty of COVID is behind us.

I would say tomorrow looks the same as yesterday. So, it is predictable.

And we believe it’s the right time to accelerate.

And we only said we would do that last quarter, and we only started this quarter.

I think number one, marketing. We significantly reduced marketing for the last 18 months.

I’m not begging for people to be patient. People have many [investment] opportunities and they do whatever they want.

But I think we try to be as forthcoming as possible in walking our talk.

The opportunity is absolutely massive.

He then discussed Africa in general.

And at the end of the day, we’re talking about opportunities that are not only e-commerce, but bringing an entire informal world of economy online.

We work as fast as we can to bring exciting growth.

Buying growth is easy.

Building growth is hard.

Africa will never fall off the map and Jumia is right in the middle of it. So, that’s our job, to do it right.

In general, we’re in the warehouse, rolling up our sleeves and getting [stuff] done in a place where no one has any idea how complicated it is, but we love it more than anything in the world.

… We have all the fundamentals in place. We have built the operation, we have the price, we have the team. We need to continue what we have started.

We share a chart from Vala Afshar that illustrates the 20 fastest growing cities worldwide, and that 17 are in Africa.

We also note that three of the top nine are in Nigeria, including number one and number four.

Back to Jumia…

Jumia was first known for electronics sales and that made it an e-commerce destination that was for infrequent use — maybe twice a year.

But Jeremy did make a point to note that the overarching goal for Jumia, now, in its e-commerce business is to turn its current customers into weekly or even daily customers (our emphasis is added).

Our awareness is extremely high people are saying that they would buy on Jumia, and yet they don’t do it, or they don’t repurchase every week.

So, you know, they buy every 4, 5, 6 months, I want them to buy every week.

My mission, my job is to make people hooked on Jumia and buy every week, not every six months.

And here we are facing some mental barrier where Jumia is not yet the place where you go every day for everything

It is still a place that is fantastically convenient and has a value proposition that is unbeatable for some type of purchase, but not yet for everyday purchase.

If you look objectively at Jumia, you can live on Jumia.

So, we have still a lot of education to do in the consideration space, more than the awareness space to be frank.

The conversation also moved to Facebook to which Jeremy said:

It’s a very good [relationship].

We speak to them quite often, because they launch stuff in e-commerce, as in Brazil, and they have big ambitions, like with WhatsApp, et cetera.

They need infrastructure.

…even, if [WhatsApp] were to grow, we would be uniquely positioned to power the payment and the logistics of those transactions.

…That’s why I’m saying, we’re speaking very often to Facebook… at the end, they want to grow that market, we want to grow that market.

I then asked about Jumia’s digital advertising business to which Jeremy had many comments.

… it’s [] an opportunity for us to build a sales team up that goes directly after the advertisers and brings them with the right insights, the right numbers, et cetera.

Bottom line, there are millions and millions and millions of viewers in our audience. We have data quality that is amazing in a place where, you know, insights and data are quite scarce.

And, and that makes it very exciting.

It’s a journey we started now two years ago to build the tools. The team is now up and running.

… We are competitors of Facebook, Google, and YouTube. I mean, we have no other [online advertising] competitors except Facebook, Google, and YouTube.

Finally, we discussed value-add services. My goal was to understand how Jumia sees opportunities to produce high margin revenue with or without adding new customers. Advertising is one of those areas, but there are others.

Here’s what the CEO said:

We don’t want to wait 10 years. And that’s why we build those [value-add] monetary streams as we can.

Logistics, we want to get packages and inject them in our logistics supply chain, because we already have drivers and warehousing, etc.

And Jumia Pay in the future, we want also to be open to third-party merchants.

And finally, we spoke about Jumia Pay. Here is the CEO:

At the moment, it’s three things.

One is a payment platform, so you can plug any payment maker you want into it, and then this is plugged into Jumia. It’s like a multiplug.

We don’t care where the money comes from when it comes in.

You have a mobile money wallet. You have a bank account. You have a credit card.

I don’t care, as long as it goes into your Jumia Pay account, where you have a login and a password.

Please enjoy our lengthy conversation with the CEO included as a transcription below.

One-on-One with the CEO of Jumia

Ophir Gottlieb:

I’m going to start with some financial questions and go more into the realm of the business. Let’s just talk about Q2 first.

Marketplace to 1P revenue, the split, first of all, it’s risen very impressively.

In Q2, 2019 marketplace was 44% of revenue, in Q1 of 2021, it was 74% of revenue.

This transformation that you and Sacha [Poignonnec, Co-CEO] have been talking about was empirically true. Here we are in Q2 where 3P went down to 65%, 1P to 35%.

What happened in the quarter? Have we peaked in this transformation or was this more due to some external factor?

Jeremy Hodara (Co-CEO Jumia):

Yeah. So, we don’t steer for that. In our DNA, we’re a marketplace. And so, in an ideal world, we would be 100% 3P.

That’s what we believe that works in Africa and we are here to make successful sellers and they do their job better than we would do for them.

The beauty is that we have the flexibility to do 1P, and we don’t want to prevent ourselves from doing it for artificial [reasons].

So, we keep this 1P and it’s tactical and it can go up and down.

It’s never a strategic objective to bring 1P to zero, but it also will not be an objective to bring it to 50%.

We’re happy that it’s, I don’t know, 10% of our GMV, more or less, but we can see going it up or down.

For example, when we see some shortage of supply, as we see at the moment in the world, and especially in Africa, we don’t mind to do a bit of retail 1P in order to secure some stock.

When we do some specific categories where you want to 100% control the supply to make sure you get very sensitive products and you want to make sure you control the supply chain, we might do it as well.

In an ideal world, we would be 100% 3P, but we are not shooting for that, and we are happy to keep flexibility.

And you might see this mix you know, doing some variation quarter after quarter with no bigger picture behind it, then the ability to fluidify the business.

OG:

I think of 1P in the long-term for Jumia as the supplier of last resort.

I give a silly example. If someone comes on to Jumia’s platform, and they’re looking for a toothbrush, they normally get a toothbrush from 3P. Okay.

But if the 3P for example, doesn’t have a toothbrush, you don’t want people leaving Jumia without a toothbrush.

JH:

The reason why we went 1P is for tactical reasons.

One, to secure supply we wouldn’t have, or that our sellers wouldn’t be able to get sometimes we’re more powerful.

Number two, to get some sellers to go into some categories that they don’t see the potential for.

And we want to show them, you know, for example, we have a big distributor. He doesn’t believe in a brand or that category. We say, look, we are going to do it, we are going to show you. Then you take it over.

And lastly, if there is really a very specific economic gain, for some reason, you know, in some categories you would get, I don’t know, 10 points of margin, and that would make a big difference at the end, we would do it.

Those would be the three reasons, you know, shortages, discovery of a category or a brand, and the economics. It’s never meant to last forever.

OG:

So, in other words, I shouldn’t pay too much attention to the change in Q2. There’s a trajectory, there’s an intention.

JH:

That’s why, you know, you see some people who would love to look at a different KPI, but we have those two KPIs, GMV and gross profit that are meant to be in a retail world, you know, the equivalent, of the revenue and the gross margin.

But because we have this mix of the 1P and 3P it has to be normalized, and we always look back at people discussing the revenue, because we say, if we start discussing only revenue then we are going to do [1P] retail and we don’t want to end up there.

OG:

All right. Thank you. That was really good answer.

I want to focus on Nigeria and believe me, I know Jumia’s business, is not all Nigeria.

The roadblocks to growing e-commerce in Nigeria are substantial. And anyone that studies the country and goes beyond a sort of sophomoric Western view that, you know, “e-commerce is booming. So everything should work.”

In Nigeria, consumer preferences, remarkable data cost sensitivity for mobile where shopping via phone is very, very rare. There are inexpensive labor costs for the wealthiest households.

So, they can go ahead and send someone to the open-air markets rather than order it online. I mean, that’s real competition.

There are issues of trust, maybe issues of unreliable merchants, speed of delivery, lack of wealth.

There are so many roadblocks, okay.

But this is the market that Jumia is in, and it’s a difficult market.

So how does Jumia get through these roadblocks to get to substantial growth, even 20% growth, not to speak of hyper-growth what, what does, I mean, these are realities and you know them much better than I do.

What does Jumia do to get through this?

JH:

Yeah, a very good question.

I think the way we looked at it is that we have built the bridge to go over those difficulties when it comes to physical infrastructure. And what remains ahead of us are some education challenges and I’ll go into those.

Our operating model in Nigeria works fantastically. It has worked for years. You know, probably because of, as you say, the size and the complexity of the country, Nigeria is one of our most robust models of all our countries.

And, you know, it’s a combination of working with a large base of sellers including, you know, big brands and big distributors, long tail of sellers that are in China and, you know, sending their products across borders, that’s working very well.

In terms of physical infrastructures, for the delivery operations, the logistics, it’s our country, where we have some of the most efficient operations.

And we have built the machine that basically relies on hundreds of locals 3P you know, family SMEs that know a region or neighborhood very well.

And we know them now for nine years, we have equipped them with our tools and technology. And in Nigeria, we have fantastic footprint that allows us to deliver pretty much anything, anywhere at a cost that is unbeatable.

We have, you know, it’s not physical, but we have a brand, which is amazingly well known.

Once when the situation gets easier and you know, the day, you will have a chance to go to Nigeria.

You will go to the airport and don’t speak to the rich guy who’s flying from London. That’s too easy.

Speak to the guy who is at the immigration, controlling the line. This guy knows Jumia.

I promise you a hundred percent of the time.

So those are the assets that we have. And last but not least, I would say the team, which is never an easy thing to put together in our countries. The team is probably the most experienced team in those specific skills of e-commerce that you don’t find otherwise in the country.

This has been in place.

Now, what we’re facing is a situation where I would say the mindsets are not easy to change, and the mindset are not easy to be changed because we’re facing a population that knows Jumia very well and, and Safae [head of IR] can share with you some brand survey that we have published in the past, or you’ve seen them.

Our awareness is extremely high people are saying that they would buy on Jumia, and yet they don’t do it, or they don’t repurchase every week.

So, you know, they buy every 4, 5, 6 months, I want them to buy every week. My mission, my job is to make people hooked on Jumia and buy every week, not every six months.

And here we are facing some mental barrier where Jumia is not yet the place where you go every day for everything

It is still a place that is fantastically convenient and has a value proposition that is unbeatable for some type of purchase, but not yet for everyday purchase.

Hence the strategic move we have done now for a couple of quarters, but it takes time, the position now from a place where you can find your electronics to simplify [the conversation] — to a place where you can find your everyday needs. If you look objectively at Jumia, you can live on Jumia.

You can find, you know, the food and the stuff for your kids and for your home, et cetera. Yet, when we do our, you know, consumer surveys, people have strange answers as to why they didn’t buy everything.

They’re like, “I didn’t think about it. I didn’t know you had these, you had that, et cetera.”

So, we have still a lot of education to do in the consideration space, more than the awareness space to be frank.

We always need to get prices [lower] because as much as people say price is not important, price is the key number one entry to e-commerce.

And we run price checks every day. We are 98% better price.

But, again, it’s not about having the best price. It’s having a price that is so much better that people switch for everyday purchase to e-commerce, and we need to get them to repeat purchase.

I wouldn’t say, to some of your comment, that data is a challenge or smartphone penetration. It’s not that bad.

We don’t have external factors from an infrastructure standpoint that prevent us.

I would say we need to continue. We do a very detailed work of bringing Jumia into the consideration space of every day. That’s much harder than telling you, “You know what? This is about the price of the data.”

That would be an easy answer.

We have all the fundamentals in place. We have built the operation, we have the price, we have the team. We need to continue what we have started.

We think of it as the journey of e-commerce, in other places of the world but in an accelerated way, and we need to take [the path] for Amazon or other players to be something that you use every day.

[Amazon] was first to buy some books once in a while and then some DVDs, etc. We have to do that in a much faster way.

It is, of course, a population that has alternatives that are very different. Our competition is not online.

Our competition is not the modern retailer. There is no modern retailer pretty much none. It’s traditional retail, informal retail, open-air markets.

As you say, “because it’s my guy.” Your guy, who can get you access to something.

And we have to go after that, and we realized nine years ago, when we launched e-commerce, that people are rational decision makers, even though they are in a space that is driven by older dynamics.

Now that we have the engine to build everyday purchase, we have to drive the mental space there.

OG:

Okay. Interesting. So that’s the battle for Jumia. Is it just a matter of time? Are there education… I’m calling it education roughly… Education programs going on for Jumia?

How do you address this?

JH:

I think, of course it’s a matter of time, but time, you know, you can fast forward or you can slow it down.

It’s our job to fight against time. I would say the two things we communicated recently on is the reality of what we are working on that will make a difference.

I think number one, marketing. We significantly reduced marketing for the last 18 months.

Because there was too much uncertainty, and at some point, you need to get into the mental space of people, not again because they know the brand – think about you every time you need to make a purchase, and that takes some investment.

The second thing that I strongly believe is in the tech. We have about 250 developers.

It’s a number that… despite last year’s cost reduction, we never touched… but we never increased it either over the last two years.

And business gets more complex, more sophisticated, and so on and so forth, and we have good room to grow our investments, and I believe in the power of the product to make the experience more seamless, more addictive, more predictable, and we have a roadmap, very exciting and full of important topics that can make the experience of everyday usage of Jumia even more attractive than it is today.

So today if you use Jumia, it’s working. It’s operational. It’s functional.

But we are missing some social commerce features.

There are some invisible pixels in the app that, if we were tweak the right way, would make the experience invisibly more seamless. You can always do better in search and personalization.

I mean Amazon has thousands of people working on search, so we can, by definition, do always better.

And I think, between marketing, done the right way, and tech, this is what it takes to drive every usage.

OG:

That’s great color. I appreciate it.

A good deal of commerce in Nigeria is done offline, as you said, and there are a lot of businesses building tools for them to go online, effectively reducing some of Jumia’s competitive advantage, from supply chain to payment. That would be a reasonable bearish argument.

I’m talking about companies in this case like Paystack and Flutterwave for example, so first, are companies like that having an impact on bringing new small businesses to Jumia’s platform?

And second, how quickly is Jumia bringing new vendors online? Is the pace accelerating or slowing? What can you tell me about that?

JH:

So, I’ll discuss Jumia as a whole and then Jumia Pay in part.

For Jumia as a whole, we’re so at the beginning of an exciting journey to bring the entire economy online… that the more people that go toward that objective the better.

If you look at the origins of this world, you wouldn’t be worried [about competition], because three people are working in the online space.

OG:

I agree. I agree 100%, by the way, yes.

JH:

If there are more enablers to that, great. If you see a country in our footprint that is a little bit more competitive, it’s Egypt.

And it has never prevented us from growing and even growing faster because more consumers are getting educated and the entire ecosystem goes online on whole.

So, I think that’s great.

Also, the names you mentioned work with us, so it’s not like we are in competition. We work with them.

OG:

Oh, you’re partners? You partner with them?

JH:

Through Jumia Pay, we work with them.

Because the value chain in payments is always a bit more… I mean you know it better than me, but it’s a complex value chain. At least in e-commerce it’s a bit simpler. You do or you do not do e-commerce.

In payment, you can do every single bit and pieces of the value chain.

Secondly, we have spent the last nine years taking the sellers and bringing them online.

So, I’m not saying we have all of them, but the ones that make a difference, that matter, that have the breadth of assortment, the depths of stock, and the professional expertise to run a business. We have most of them, to be humble but to be clear.

And you can always have a guy who has a few things to sell, but at the end, what makes a difference for businesses is cost of acquisition of consumers.

If you want your shop on Shopify or Flutterwave or whatever, you still need to get consumers.

We have spent nine years acquiring consumers. That’s the number one cost when you build the business.

You need to be able to operate your business at scale, which is something you do when you proper support from someone like Jumia, but it can be others in other countries, and then also you need to be able to do the delivery.

It’s one thing to have a website, even have a payment method but you need to get your goods delivered.

I think the success we see here in the past, opening our logistics platform to third parties, shows that the need is not fulfilled, so I think the barriers to entry are strong.

In Jumia Pay itself, because they are closer to what we do in Jumia Pay. Jumia Pay, in our view, you know, it’s our payment tool. It’s very much like PayPal and eBay and all those examples.

At the moment, it’s three things.

One is a payment platform, so you can plug any payment maker you want into it, and then this is plugged into Jumia. It’s like a multiplug.

So, you do the plug once, and then you have it.

We don’t care where the money comes from when it comes in.

You have a mobile money wallet. You have a bank account. You have a credit card. I don’t care, as long as it goes into your Jumia Pay account, where you have a login and a password.

We do work with some of the payers you mentioned to make that inflow possible, so we are complementary, and also what’s very exciting is that what we do is that we own the customers, just like PayPal.

We don’t want to be the back end or a commodity. We own the customers. We have educated them to use payment and e-commerce. We are giving them financial services through our partners.

We are giving them access to new tools, new technology, and I think payment shouldn’t be commoditized.

Its value is not only in facilitating the payment for you and ultimately for others, but it is also about the consumers you have brought to that space. So that’s the way we look at it.

OG:

Thank you. How does Jumia sit relative to social selling?

So, in Nigeria, we’re talking about the Facebook ecosystem, Facebook proper, Instagram, but really WhatsApp. How does Jumia sit there?

And is Facebook a potential partner for Jumia? Or is that really just a competitor?

JH:

It’s a very good [relationship].

We speak to them quite often, because they launch stuff in e-commerce, as in Brazil, and they have big ambitions, like with WhatsApp, et cetera.

They need infrastructure. They need an infrastructure to operate, and without an infrastructure… an infrastructure, I mean, the payment, the logistics, et cetera… it’s no different from the BlackBerry group we had 10, 15 years ago.

I mean, if you look at Nigeria, people had BlackBerry groups. When we started the business nine years ago, there were BlackBerry groups, and they were like, you know, these things online.

It has existed and could always exist. The question that you mentioned in one of the barriers to is the trust.

And there is some business that can be done without trust, but the vast majority will be done with the… you have to have trust.

So first you need a middleman. I think that makes a difference.

And we’re not saying we will, but we’re not against using our assets, which is logistics and payments to at least control two thirds of the value of that.

And so anyway, today it’s not there.

So, I don’t think the [Facebook] question is there, but we, even, if [WhatsApp] were to grow, we would be uniquely positioned to power the payment and the logistics of those transactions.

So, we are very active on that front, but not, not there yet.

OG:

It’s just sort of my perspective, but if Facebook were to push harder on social commerce, it’s such an early stage in such a big market, that would just help Jumia, honestly.

At some point being a market maker, which is what Jumia is… that’s very, very burdensome. Someone else can make the market too. So, that’s my view.

JH:

That’s why I’m saying, we’re speaking very often to Facebook because as much as they’re in a very theoretical world competition, whatever, at the end, they want to grow that market, we want to grow that market.

There are immensely stronger than us and many, many dimensions and they’re some of the biggest company in the world and there is a way to do it right.

OG:

Please don’t comment on this. It seems like a very easy investment for Facebook to make in Jumia, given how the market values Jumia, which is I think an under appreciation. A $100 million investment and they own 5% of Jumia, for example.

Let’s talk about Jumia.

With 7 million active annual customers, Jumia has done the nearly impossible.

It has created a platform in a very difficult market including 50 million downloads.

These are things that even if you took a $2 trillion company and they said, we’re going after Jumia’s business, I don’t think they could. Or if they wanted to it would take years.

So, while e-commerce is a hard path forward, there are some other value-added services that can help Jumia leverage the customer base even without the customer base growing very quickly.

Food delivery clearly is one you’ve talked about.

Another one is digital advertising, which I want to talk about.

Is this part of the strategy going forward? So, has Jumia finally amassed a large enough audience to generate high margin value-add revenue, can you talk about that?

JH:

In our framework, we have both on and off platform.

On-platform we have the marketplace and, in the marketplace, we take, I mean, operationally wise to be different, but food delivery, for example, there’s a category.

You know, we have sellers, they have pizza, we have an app and we have customers and drivers.

So, we have multiple categories, marketplace.

We have logistics and we have the payments. That’s called on-platform.

We are started a couple of quarters ago — as you say — to open our on-platform to off-platform in order to monetize our position.

And we believe each of those three components, have their own of off-platform, opportunity.

Advertising for us is the opportunity to get advertisers that are not sellers of Jumia. Use the traffic that we have on our app that is very qualified and to push their content.

Being a car maker, banks, telco, whatever. We want to extract revenue from them because we already have this traffic in this app and those insights.

Logistics, we want to get packages and inject them in our logistics supply chain, because we already have drivers and warehousing, etc.

And Jumia Pay in the future, we want also to be open to third-party merchants.

We always say in an ideal world, and we’re not there yet to take a couple of years, you know, we love Alibaba.

You get free commission, you give free commission, you get free shipping. What better way create barrier to entry for anyone who do business in your turf and how much, how much better it is to get the best price and economics to your customers.

Commissions one day, should go to zero, it’s just going to make prices more competitive. A shipping fee should go to zero. It would just improve the conversion rate.

But for that to happen, you need a massive platform that you can monetize enough from third-parties in order to release the pressure inside the system.

We don’t want to wait 10 years. And that’s why we build those [value-add] monetary streams as we can.

OG:

I want to talk about digital advertising just for a second. I say that because the United States has invested so much in artificial intelligence for digital ads that it’s become essentially the most monetizable business in the world.

There are so many great technologies in the U.S. But honestly, there’s nothing more prolific than digital advertising.

Digital advertising has been a small, but growing business for Jumia. And I imagine high margin.

It grew from 6.1 million Euros a year, I’m doing a trailing twelve-month calculation, in Q4 2019 to 8.1 million euros in Q1 2021 outpacing all other Jumia growth.

But here in Q2 2021, the growth essentially slowed or stopped.

Can you talk to me about the opportunity in advertising and specifically what I mean is, can you talk about the demand, but also the supply?

Is there a lot of supply available to fill the demand or is supply actually a problem? How do you see it?

JH:

Yeah. So, we have two types of advertisers.

We have our own sellers or brands and we have a complete third-party participants ecosystem.

We have built tools for both of them to get visibility and to be able to target our traffic and audience.

For some, of course, because they’re sellers, it’s more about product.

For others, it’s more about building campaigns the target specific demographics.

We’ve had, of course, a kind of a spike last year, you know, when lots of budgets were available, lots of uncertainty was coming and, you know, everyone was in this kind of mood to put everything online.

So now we are more like, you know, going to business normally.

I think there is a massive opportunity. I think this opportunity that we’re going after has two small challenges that maybe don’t exist in the rest of the world.

First, offline remains extremely important in Nigeria, or at least a little more than in the rest of the world.

You know, being on TV, being on the billboard or try something that for our consumer base remains important.

You know, when you get the share of the marketing budget of big advertisers that go online and offline, a bit more goes offline here than in the rest of the world. But it’s our job to move it. So, we start from there, we can only move it to a better place.

The second thing is I don’t think the ecosystem of media agencies, et cetera, is yet at the level of professionalism that you describe the rest of the world.

And so, I’m not always blown away by the quality of the advice that advertisers get from their media agency.

So, it’s also an opportunity for us to build a sales team up that goes directly after the advertisers and brings them with the right insights, the right numbers, et cetera.

Bottom line, there are millions and millions and millions of viewers in our audience. We have data quality that is amazing in a place where, you know, insights and data are quite scarce.

And, and that makes it very exciting.

Marketing budgets in our regions are big maybe again, not as big as in the rest of the world, but, but we believe very strongly in it.

And that’s something that can only prove, you know, as you say, it’s a virtuous cycle. You know, the more that you get, the better insights you get.

It’s a journey we started now two years ago to build the tools. The team is now up and running.

We have a tech team dedicated to it, a sales team in every country. And that’s something we push very much. We enjoy because as you said, the returns are fantastic.

OG:

Yes, advertising is a good business.

Jumia has the one thing that no matter what anyone says, there’s just nothing like the opportunity that Jumia offers for e-commerce advertisers.

JH:

We are competitors of Facebook, Google, and YouTube. I mean, we have no other competitors except Facebook, Google, and YouTube.

OG:

And those two aren’t e-commerce platforms. And of course, that doesn’t matter. Advertising goes wherever it goes, but if you want to advertise on an e-commerce platform then that’s it. It’s Jumia.

Do you have time for one more question? I’m taking your time.

JH:

So, I have something that dropped, so I have 10 more minutes.

OG:

Oh, great. Last question. Okay, let’s talk about JumiaPay.

First, one point of clarity and then a real question.

One point of clarity before deeper question is can JumiaPay be used for both 1P and 3P transactions?

JH:

The answer is, not today but that’s the goal.

OG:

Okay. Right now, it is a 1P product. Is that right?

JH:

A hundred percent of the numbers that you see are made on Jumia.

OG:

Second question, what kind of margins does JumiaPay offer the company? What is the best-case scenario for Jumia?

Is it that most transactions are made with JumiaPay, or is there a level we say, “Well, we only want so many?” What is the best-case version for JumiaPay?

JH:

On platform, which is what we do today (and we do not have another website using JumiaPay).

On platform. I keep saying it will never go to 100% and no one should model for that.

The number one barrier to entry to e-commerce is trust, and someone who has never used e-commerce is not going to make two leaps of faith. Number one, I will buy online. Number two, I will pay online.

My best marketing tool is my cash on delivery. And by the way, it’s an amazing barrier to entry that no one can refute.

My new customers start for one, two, three purchase to use cash.

Once they feel comfortable, I have my onboarding to JumiaPay.

There will never be a world it’s 100%. I don’t know if the plateau is at 50% or at 60%, but there is no world where it’s going to be 100%.

Now, the sky is the limit because, once we open it, then we can have transactions coming from other apps, other websites, can be even from offline retailers.

And so, the number of transactions and the TPV is not limited by the JumiaPay platform ultimately.

But on Jumia, there is a natural plateau that will come up, that is reasonable to believe. But again, this is not the end game. Jumia is my education tool for JumiaPay.

Once people know how to use JumiaPay, and once I open it to third parties, then they can do transactions anywhere else.

OG:

Yeah, as a point of reference, even Shopify and Shopify Pay, I don’t think that is more than 50% of GMV… and that’s, I think in America, we would consider that a massive success.

Is there anything else you want to tell investors before I let you go?

I can tell you right now that there are large investors who are willing to believe in the idea of e-commerce, payments, and logistics in Africa, but they are not willing to really dive deep into the difficulties of it. And therefore, they don’t see the growth and they don’t understand why growth is so poor.

JH:

Completely. We are a young company in terms of being a public company. We were a young company anyway nine years.

We’ll always be very straightforward with what we do, because we know our only asset is our words and the trust people put in them.

When COVID hit, it was in Q1, Q2 last year, we said, “Look, there is a lot of uncertainty and we’re going to spend a couple of quarters getting the economics in a place where, whatever the future brings to us, we’re able to make the best out of it.”

We spent a couple of quarters not talking about growth, and I know people would have loved to redo the past, but we never said we would. And we said we’d spend the time getting our economics in place. A year and a half ago, every order we delivered, we’re losing money after logistics.

OG:

That’s right.

JH:

But the more we were growing the business, the more we’re destroying it.

Now, we’re in a place where we generate $1 of profit for every order after all the logistics, despite what people think is a nightmare of infrastructure in Africa.

And that is a great foundation.

We have a stronger balance sheet. I’m not saying the uncertainty of COVID is behind us.

I would say tomorrow looks the same as yesterday. So, it is predictable. And we believe it’s the right time to accelerate.

And we only said we would do that last quarter, and we only started this quarter.

I’m not begging for people to be patient. People have many opportunities and they do whatever they want.

But I think we try to be as forthcoming as possible in walking our talk.

The opportunity is absolutely massive.

This is the last point here, and there is nothing that looks like Africa, not for e-commerce, for modern retail as a whole. There are barriers to entry that are absolutely massive and I’m not afraid of waiting one quarter to get it right.

And at the end of the day, we’re talking about opportunities that are not only e-commerce, but bringing an entire informal world of economy online.

We work as fast as we can to bring exciting growth.

Buying growth is easy.

Building growth is hard.

Africa will never fall off the map and Jumia is right in the middle of it. So, that’s our job, to do it right. We learn every day.

In general, we’re in the warehouse, rolling up our sleeves and getting [stuff] done in a place where no one has any idea how complicated it is, but we love it more than anything in the world.

It’s the 13th of August, and if it’s not going to work on August 13th it’s going to be the 14th. So, we are here to make it work.

OG:

Jeremy, I really appreciate your time. I hope we can do it again next quarter. Please enjoy your time with your family and we will speak soon.

JH:

Any time. Thank you so much.

OG:

Thank you.

Conclusion

You can get more research and conversations with executive teams at CML Pro here.

Thanks for reading, friends.

The author is long Jumia (JMIA) at the time of this writing.

Please read the legal disclaimers below and as always, remember, CML Pro does not make recommendations or solicitations for the sale or purchase of any security ever. We are not licensed to do so, and wouldn’t do it even if we were. We share research and provide you the power to be knowledgeable to make your own decisions.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.