Finding Edge in JPMorgan Chase & Co.(NYSE:JPM) Options in the Era of Donald Trump

Date Published: 2017-04-04

Written by Ophir Gottlieb

LEDE

Trading options in JPMorgan Chase & Co.(NYSE:JPM) using a strategy that profits from the stock "not going down a lot," but while also while avoiding earnings, has vastly outperformed the stock -- and in an era where President Donald Trump is now targeting legislation that regulates banks, it's time to take a closer look.

Preface

The big four banks, JPMorgan Chase & Co (NYSE:JPM), Bank of America Corp (NYSE:BAC), Wells Fargo & Co (NYSE:WFC), and Citigroup Inc (NYSE:C) have suddenly become front and center news as the Federal Reserve juggles interest rates and the federal government begins discussions of changes to federal regulations -- specifically Donald Trump's phrase of a 'haircut' for Dodd–Frank bank regulations.

Reuters reported the following:

U.S. President Donald Trump said on Tuesday that his administration is working on changes to Dodd-Frank banking regulations that will make it easier for banks to loan money.

"[W]e're going to be doing things that are going to be very good for the banking industry [.] We're going to do a very major haircut on Dodd-Frank." Trump said.

"[W]e're going to be doing things that are going to be very good for the banking industry [.] We're going to do a very major haircut on Dodd-Frank." Trump said.

With those words from Donald Trump, it's time to look at the banks as an investment vehicle -- but with a twist.

JPMorgan Chase & Co (NYSE:JPM)

Let's focus on JPM as an investment vehicle.

Selling a put is in fact an investment strategy that benefits from the stock "not going down a lot." Perhaps in an aged bull market, that investment thesis is an alternative to one that profits from the stock rising.

While that sounds tame, if not boring, it has been far from that. Here is what selling an out of the money put has returned in JPMorgan Chase & Co.(NYSE:JPM) over the last 3-years:

That's a 76.9% return while the stock was up just 60%. But, that's not where the real strategy lies. Selling a naked put is a risky investment, and that risk elevates as earnings announcements approach.

But now there is a facility for us to explicitly see the impact of earnings on a strategy, by tapping a button:

And the impact has been remarkable:

That initial 76.9% return over three-years turned into 158% over the same time period by simply avoiding earnings. This phenomenon can fly by quickly on a computer screen -- here's what we found -- more than double the return with less risk.

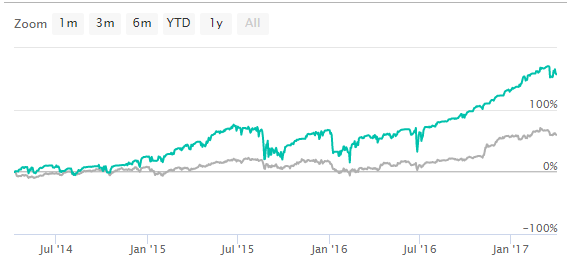

Here is a graphical display of the stock return in gray and the option strategy -- avoiding earnings -- in blue.

CONSISTENT

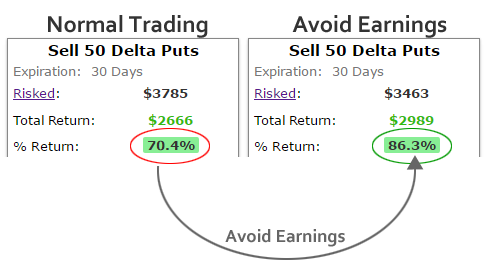

Skepticism is natural -- what we need to do now is look at this short put over various time periods. We see that it has worked over the last three-years, now let's look at the last two-years:

That's a n86.3% return while avoiding earnings versus 70.4% when making no adjustment for that risk. Further, the stock itself has been up just 51% compared to that 86.3% with options.

It's not a magic bullet -- it's just easy access to objective data. Investing in the idea that JPM stock will "not go down a lot" has actually far outperformed owning the stock -- which is an investment in the idea that "the stock will rise."

Finally, we look at this short put over the last six-months, these are the results:

Again we find better returns with less risk. And for context the stock is up 33% versus the 58.3% for the option strategy that avoids the risk of earnings. Perhaps in a period where Donald Trump will work with Congress to reduce regulations, this thesis is compelling enough to examine.

WHAT JUST HAPPENED

This is how people profit from the option market - it's preparation, not luck.

To see how to do this for any stock or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no stock position in JPMorgan Chase & Co (NYSE:JPM) but does own call options. The author has no position in Bank of America Corp (NYSE:BAC), Wells Fargo & Co (NYSE:WFC) or Citigroup Inc (NYSE:C).