Lumentum Holdings Inc, LITE, earnings, option, optimism

Preface

With Lumentum Holdings Inc (NASDAQ:LITE) stock up 190% over the last two-years, there is a powerful pattern of optimism and momentum two-weeks before of earnings, and we can capture that pattern by looking at returns in the option market.

The strategy won't work forever, but for now it is a momentum play that has not only returned 5,700% annualized returns, but has also shown a high win-rate of 71%.

PREMISE

The premise is simple -- one of the least recognized but most important phenomena surrounding this bull market is the amount of optimism, or upward momentum, that sets in the two-weeks before an earnings announcement. Now we can see it in Lumentum Holdings Inc.

The Options Optimism Trade Before Earnings in Lumentum Holdings Inc

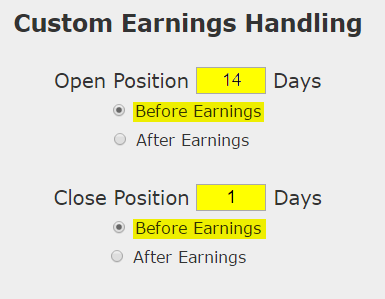

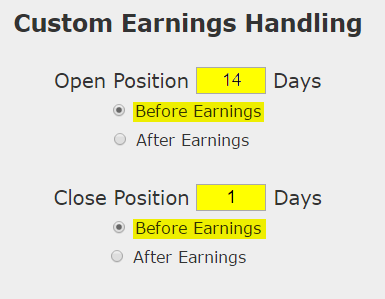

Let's look at the results of buying a monthly call option in Lumentum Holdings Inc two-weeks before earnings and selling the call before the earnings announcement.

Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

Now, unlike many of our other set-ups, this is in fact a straight down the middle bullish bet -- this absolutely takes on directional stock risk, so let's be conscious of that before we see the results, because they are quite good.

Here are the results over the last two-years in Lumentum Holdings Inc:

See the back-test in action

We see a 358% return, testing this over the last 7 earnings dates in Lumentum Holdings Inc. That's a total of just 98 days (14 days for each earnings date, over 7 earnings dates). That's a annualized rate of 1,335%. That's the power of following the trend of optimism into earnings -- and never even worrying about the actual earnings result.

We can also see that this strategy hasn't been a winner all the time, rather it has won 5 times and lost 2 times, for a 71% win-rate and again, that 1550% return in less than six-full months of trading.

RISK REDUCTION

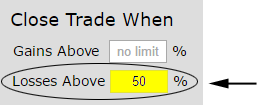

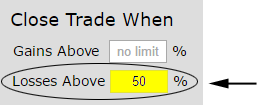

We didn't mention it yet, but all of these back-tests were actually risk reduced. We have put in a 50% stop loss in all of these trades, which means that if the long call ever loses half of its value, we close the position out, and move on. Here's how we did it:

Using risk protections is a valuable step in trading.

WHAT HAPPENED

This is it. This is just one of the ways people profit from the option market -- optimize returns and reduce risk. To see how to do this for any stock and for any strategy we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in Applied Optoelectronics Inc(NASDAQ:AAOI).

Back-test Link

Trading Earnings Optimism With Options in Lumentum Holdings Inc

Lumentum Holdings Inc (NASDAQ:LITE) : Trading Earnings Optimism With Options

Date Published: 2017-07-17Author: Ophir Gottlieb

Preface

With Lumentum Holdings Inc (NASDAQ:LITE) stock up 190% over the last two-years, there is a powerful pattern of optimism and momentum two-weeks before of earnings, and we can capture that pattern by looking at returns in the option market.

The strategy won't work forever, but for now it is a momentum play that has not only returned 5,700% annualized returns, but has also shown a high win-rate of 71%.

PREMISE

The premise is simple -- one of the least recognized but most important phenomena surrounding this bull market is the amount of optimism, or upward momentum, that sets in the two-weeks before an earnings announcement. Now we can see it in Lumentum Holdings Inc.

The Options Optimism Trade Before Earnings in Lumentum Holdings Inc

Let's look at the results of buying a monthly call option in Lumentum Holdings Inc two-weeks before earnings and selling the call before the earnings announcement.

Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

Now, unlike many of our other set-ups, this is in fact a straight down the middle bullish bet -- this absolutely takes on directional stock risk, so let's be conscious of that before we see the results, because they are quite good.

Here are the results over the last two-years in Lumentum Holdings Inc:

| LITE: Long Call | |||

| % Wins: | 71% | ||

| Wins: 5 | Losses: 2 | ||

| % Return: | 358% | ||

| % Annualized: | 1,335% | ||

We see a 358% return, testing this over the last 7 earnings dates in Lumentum Holdings Inc. That's a total of just 98 days (14 days for each earnings date, over 7 earnings dates). That's a annualized rate of 1,335%. That's the power of following the trend of optimism into earnings -- and never even worrying about the actual earnings result.

We can also see that this strategy hasn't been a winner all the time, rather it has won 5 times and lost 2 times, for a 71% win-rate and again, that 1550% return in less than six-full months of trading.

RISK REDUCTION

We didn't mention it yet, but all of these back-tests were actually risk reduced. We have put in a 50% stop loss in all of these trades, which means that if the long call ever loses half of its value, we close the position out, and move on. Here's how we did it:

Using risk protections is a valuable step in trading.

WHAT HAPPENED

This is it. This is just one of the ways people profit from the option market -- optimize returns and reduce risk. To see how to do this for any stock and for any strategy we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in Applied Optoelectronics Inc(NASDAQ:AAOI).

Back-test Link