Lam Research Corporation, LRCX, earnings, option, optimism

Preface

Following the bullish optimism patterns ahead of earnings we have looked at in Apple, Facebook, Alphabet and Nvidia, we can also do the same with Lam Research Corporation (NASDAQ:LRCX). But this is a back-test of a two-day trade, rather than our usual week or two-week trades for pre-earnings moves.

The strategy won't work forever (it really won't), but in the last 2-years it has won 6 times and only lost 2 times. Over the last year it has won 3 times and lost only once.

We see a projected date of 7-26-2017 for Lam Research Corporation, after the market closes.

PREMISE

The premise is simple -- one of the least recognized but most important phenomena surrounding this bull market is the amount of optimism, or upward momentum, that sets in the week before an earnings announcement. Now we can see it in Lam Research Corporation (NASDAQ:LRCX).

The Options Optimism Trade Before Earnings

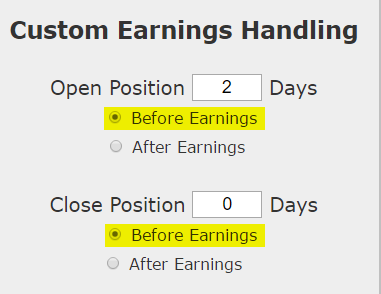

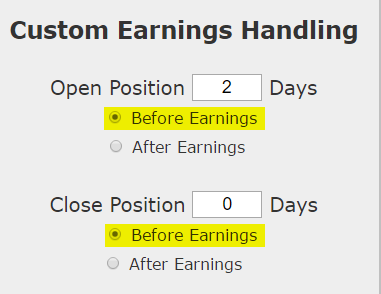

Let's look at the results of buying a slightly out of the money monthly call option in Lam Research 2-days before earnings and selling the call on the day of the earnings announcement (but before the actual announcement).

Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

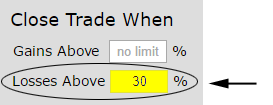

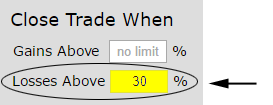

Further, we will test a tight stop loss on this call at 30%:

Now, unlike many of our other set-ups, this is in fact a straight down the middle bullish bet -- this absolutely takes on directional stock risk, so let's be conscious of that before we see the results, because they are mind bending.

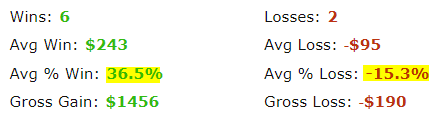

Here are the results over the last two-years in Lam Research Corporation, buying the monthly 40 delta call with a 30% stop loss:

Tap here to see the back-test in action

We see a 273% return, testing this over the last 8 earnings dates. We can also see that this strategy hasn't been a winner all the time, rather it has won 6 times and lost 2 times, for a 75% win-rate.

Checking More Time Periods

Now we can look at just the last year as well:

Tap here to see the back-test in action

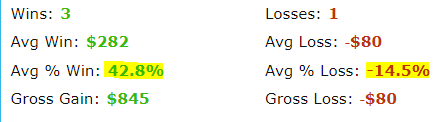

We're now looking at 162% returns, on 3 winning trades and 1 losing trade. It's worth noting again that we are only talking about two-days of trading for each earnings release, so this is 162% in just 8-days of total trading.

THE RISK

This trade would open this time around on Monday, 7-24-2017 and close right at the close (or near the close) on 7-26-2017, unless a stop loss is triggered before. All of that sounds nice and neat, but it really does have more risk than that. Since we are just looking at a monthly option two-days before earnings, a gap down move in between trading days could reveal a loss worse than 30%.

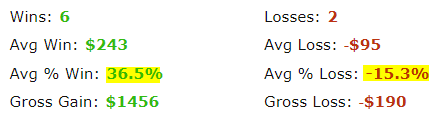

For the record, here are the average wins and losses over two-tears and then one-year (this is a new feature in CML Trade Machine):

It's good to understand the expected "good case scenario" return on these calls -- this is not a large move trade, this is one where it would be marked as a significant success if a $5.00 call rises to $6.50 or higher. That would be 30% in two-days.

WHAT HAPPENED

The personality of this bull market is one that shows optimism before earnings -- irrespective of the actual earnings result. That has been a tradable phenomenon in Lam Research Corporation.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading. The author is has no position in Lam Research at the time of this writing.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Trading Earnings Optimism and Momentum With Options in Lam Research Corporation (NASDAQ:LRCX)

Lam Research Corporation (NASDAQ:LRCX): Trading Earnings Optimism With Options

Date Published: 2017-07-21Author: Ophir Gottlieb

Preface

Following the bullish optimism patterns ahead of earnings we have looked at in Apple, Facebook, Alphabet and Nvidia, we can also do the same with Lam Research Corporation (NASDAQ:LRCX). But this is a back-test of a two-day trade, rather than our usual week or two-week trades for pre-earnings moves.

The strategy won't work forever (it really won't), but in the last 2-years it has won 6 times and only lost 2 times. Over the last year it has won 3 times and lost only once.

We see a projected date of 7-26-2017 for Lam Research Corporation, after the market closes.

PREMISE

The premise is simple -- one of the least recognized but most important phenomena surrounding this bull market is the amount of optimism, or upward momentum, that sets in the week before an earnings announcement. Now we can see it in Lam Research Corporation (NASDAQ:LRCX).

The Options Optimism Trade Before Earnings

Let's look at the results of buying a slightly out of the money monthly call option in Lam Research 2-days before earnings and selling the call on the day of the earnings announcement (but before the actual announcement).

Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

Further, we will test a tight stop loss on this call at 30%:

Now, unlike many of our other set-ups, this is in fact a straight down the middle bullish bet -- this absolutely takes on directional stock risk, so let's be conscious of that before we see the results, because they are mind bending.

Here are the results over the last two-years in Lam Research Corporation, buying the monthly 40 delta call with a 30% stop loss:

| LRCX: Long 40 Delta Monthly Call | |||

| % Wins: | 75% | ||

| Wins: 6 | Losses: 2 | ||

| % Return: | 273% | ||

Tap here to see the back-test in action

We see a 273% return, testing this over the last 8 earnings dates. We can also see that this strategy hasn't been a winner all the time, rather it has won 6 times and lost 2 times, for a 75% win-rate.

Checking More Time Periods

Now we can look at just the last year as well:

| LRCX: Long 40 Delta Monthly Call | |||

| % Wins: | 75% | ||

| Wins: 3 | Losses: 1 | ||

| % Return: | 162% | ||

Tap here to see the back-test in action

We're now looking at 162% returns, on 3 winning trades and 1 losing trade. It's worth noting again that we are only talking about two-days of trading for each earnings release, so this is 162% in just 8-days of total trading.

THE RISK

This trade would open this time around on Monday, 7-24-2017 and close right at the close (or near the close) on 7-26-2017, unless a stop loss is triggered before. All of that sounds nice and neat, but it really does have more risk than that. Since we are just looking at a monthly option two-days before earnings, a gap down move in between trading days could reveal a loss worse than 30%.

For the record, here are the average wins and losses over two-tears and then one-year (this is a new feature in CML Trade Machine):

Two-Years

It's good to understand the expected "good case scenario" return on these calls -- this is not a large move trade, this is one where it would be marked as a significant success if a $5.00 call rises to $6.50 or higher. That would be 30% in two-days.

WHAT HAPPENED

The personality of this bull market is one that shows optimism before earnings -- irrespective of the actual earnings result. That has been a tradable phenomenon in Lam Research Corporation.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading. The author is has no position in Lam Research at the time of this writing.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.