Lam Research Corporation, LRCX, earnings, call, 50 delta

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

Preface

Lam Research Corporation (NASDAQ:LRCX) has been on a tear. It's a tech marvel that CML Pro Research members are well aware of. It was added to the "Companies to Watch" list on 7-1-2017 when it was trading at $141 and as of this writing it is trading above $188. Here's a quick two-year stock chart:

We do note the very recent sell-off in January, which was due to the Intel/AMD/ARMH CPU debacle surrounding a massive security flaw that spooked this entire segment.

LRCX develops innovative solutions that help its customers build smaller, faster, more powerful, and more power-efficient electronic devices-the kind that are driving the proliferation of technology into our everyday lives.

This space, the guts of technology, where Nvidia and Applied Materials sit, has been on a tear and that means optimism ahead of earnings is a legitimate phenomenon we can explicitly observe in the recent past. LRCX has earnings due out on 01-24-2018 and three-trading days before then is 1-19-2018.

IDEA

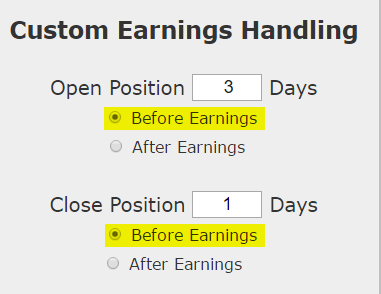

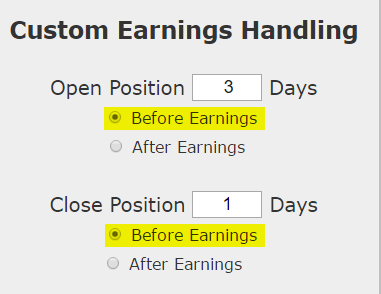

We will examine the outcome of going long a weekly 50-delta (at the money) call option in Lam Research Corporation just three trading days before earnings and selling the call one day before the actual news.

This is construct of the trade, noting that the short-term trade closes before earnings and therefore does not take a position on the earnings result.

Often times we look at option set-ups that are longer-term, and take no directional bet -- this is not one of those times. This is a no holds barred short-term bullish swing trade with options and that's it. It's a bullish bet, so must be conscious of the delta risk.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

RESULTS

Below we present the back-test stats over the last two-years in Lam Research Corporation:

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

We see a 212% return, testing this over the last 8 earnings dates in Lam Research Corporation. That's a total of just 24 days (3-day holding period for each earnings date, over 8 earnings dates).

The trade will lose sometimes, and since it is such a short-term position, it can lose from news that moves the whole market that has nothing to do with Lam Research Corporation, but over the recent history, this bullish option trade has won ahead of earnings.

Setting Expectations

While this strategy has an overall return of 212%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 26.7%.

Looking at More Recent History

We did a multi-year back-test above, now we can look at just the last year:

Tap Here to See the Back-test

We're now looking at 143% returns, on 4 winning trades and 0 losing trades over the last year.

➡ The average percent return over the last year per trade was 35.5%.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. To see how to find the best performing historical momentum, technical analysis or non-directional trades for any stock using empirical results rather than guesses, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

Swing Trading Earnings Bullish Momentum in Tech Gem Lam Research Corporation

Lam Research Corporation (NASDAQ:LRCX) : Swing Trading Earnings Bullish Momentum With Options

Date Published: 2018-01-12Author: Ophir Gottlieb

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

Preface

Lam Research Corporation (NASDAQ:LRCX) has been on a tear. It's a tech marvel that CML Pro Research members are well aware of. It was added to the "Companies to Watch" list on 7-1-2017 when it was trading at $141 and as of this writing it is trading above $188. Here's a quick two-year stock chart:

We do note the very recent sell-off in January, which was due to the Intel/AMD/ARMH CPU debacle surrounding a massive security flaw that spooked this entire segment.

LRCX develops innovative solutions that help its customers build smaller, faster, more powerful, and more power-efficient electronic devices-the kind that are driving the proliferation of technology into our everyday lives.

This space, the guts of technology, where Nvidia and Applied Materials sit, has been on a tear and that means optimism ahead of earnings is a legitimate phenomenon we can explicitly observe in the recent past. LRCX has earnings due out on 01-24-2018 and three-trading days before then is 1-19-2018.

IDEA

We will examine the outcome of going long a weekly 50-delta (at the money) call option in Lam Research Corporation just three trading days before earnings and selling the call one day before the actual news.

This is construct of the trade, noting that the short-term trade closes before earnings and therefore does not take a position on the earnings result.

Often times we look at option set-ups that are longer-term, and take no directional bet -- this is not one of those times. This is a no holds barred short-term bullish swing trade with options and that's it. It's a bullish bet, so must be conscious of the delta risk.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

RESULTS

Below we present the back-test stats over the last two-years in Lam Research Corporation:

| LRCX: Long 50 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 8 | Losses: 0 | ||

| % Return: | 212% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

We see a 212% return, testing this over the last 8 earnings dates in Lam Research Corporation. That's a total of just 24 days (3-day holding period for each earnings date, over 8 earnings dates).

The trade will lose sometimes, and since it is such a short-term position, it can lose from news that moves the whole market that has nothing to do with Lam Research Corporation, but over the recent history, this bullish option trade has won ahead of earnings.

Setting Expectations

While this strategy has an overall return of 212%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 26.7%.

Looking at More Recent History

We did a multi-year back-test above, now we can look at just the last year:

| LRCX: Long 50 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 4 | Losses: 0 | ||

| % Return: | 143% | ||

Tap Here to See the Back-test

We're now looking at 143% returns, on 4 winning trades and 0 losing trades over the last year.

➡ The average percent return over the last year per trade was 35.5%.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. To see how to find the best performing historical momentum, technical analysis or non-directional trades for any stock using empirical results rather than guesses, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.