Identifying When a Stock is (Precisely) Oversold - The Stock Trigger in Manchester United PLC

Manchester United PLC (NYSE:MANU) and Technical Analysis: Identifying When a Stock is (Precisely) Oversold - The Buy the Oversold Stock Trigger

Date Published: 2022-03-21

Disclaimer

The results here are provided for general informational purposes from the CMLviz Trade Machine Stock Option Backtester as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.Preface: Using Charts and Computations Simultaneously to Buy the Dip

An "oversold" condition takes on many forms in the world of technical analysis, but following market mantras is insufficient for a trader looking to be data driven and precise.Rather than pluck a market mantra out of the air, like "RSI below 30 is oversold," we tested a specific set-up, across a decade and half of data and tens of thousands of backtests.

In this case we identified a different result. This doesn't mean it's a trigger now, it means when it has happened, that has led to historically good returns, and in particular, good risk adjusted returns.

These is one two technical requirement for the open and then one for the close of the backtest:

Open

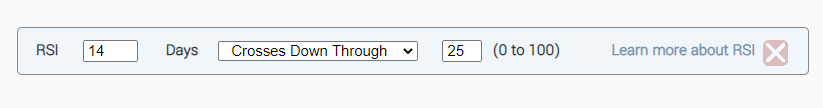

Here is the set-up in Stock TradeMachine®.

Close

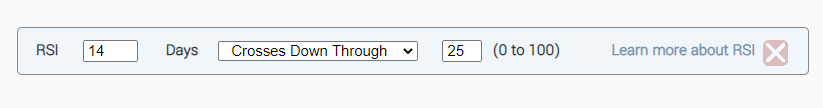

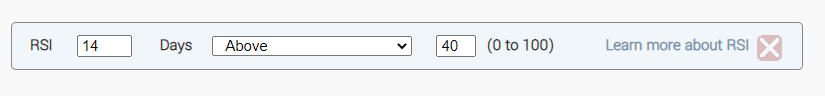

And here is the close rule:

Translated from an image into words:

Open Trigger

1. Wait until the day that the 14-day RSI drops below 25 (this is very rare).

Close Trigger

2. Wait until the 14-day RSI gets above 40 (from below 25) or 22 trading days have passed, whichever of those two closing rules happens first.

If you 're not making use of computing power to examine patterns, then the algorithms are using you to profit. That's it.

Why not become an algorithm yourself, and take back the edge that is rightly yours from the Wall Street bots -- Tap here to finally find the trading outcomes from charts you've been looking for. It's free for a limited time.

CML Efficiency Score™

At Capital Market Laboratories (CMLviz), we created a standardized reward to risk measurement for backtests called the CML Efficiency Score™ (ES).The ES takes the average trade return from each triggered backtest (the 'reward') and divides it by the maximum drawdown (the risk).

The max drawdown is measured as the largest open-to-trough decline in the value of a backtest for each new opening trade.

Our view is that an CML Efficiency Score above 0.80 is very good and above 1.0 is excellent. A number above 1.0 indicates that the average return is in fact larger than the maximum realized loss.

Do technical analysis on purpose with Stock TradeMachine® (for free).

5-Year Backtest Results: Oversold RSI in Manchester United PLC

Here are the results of a long stock position held either for 22 trading days (about one calendar month) or until the RSI climbs back above 40, tested over the last 3-years in Manchester United PLC:| MANU: Long Stock for One-Month | |||

| % Wins: | 100% | ||

| Wins: 4 | Losses: 0 | ||

| CML Efficiency Score™: | 1.13 | ||

| Return: | 23.9% | ||

Tap Here to See the Back-test

The mechanics of the Stock TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

We see 4 wins and 0 losses with a total backtest return of 23.9%.

We note an CML Efficiency Score™ above 1.00, which is excellent.

One-Year Backtest Results: Oversold RSI in Manchester United PLC

Here are the results of that same trigger, but focused on just the last year:| MANU: Long Stock for One-Month | |||

| % Wins: | 100% | ||

| Wins: 2 | Losses: 0 | ||

| CML Efficiency Score™: | 4.51 | ||

Tap Here to See the Back-test

We note an CML Efficiency Score™ above 1.00, which is excellent.

This technical event (RSI dips below 25) happens infrequently and if the event is of interest, setting an alert in Stock TradeMachine® is a great way to have a computer do the market scanning for you.

Next Steps

If you use Technical Analysis, be precise. This is free, so: Tap here to try Stock TradeMachine®.Risk Disclosure

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.