The Secret is Out: This is the Marvel Powering Biotech

Fundamentals

Follow @OphirGottlieb

Six years ago Medivation (MDVN) was on the fringes of established medicine but now it is the foundation powering mega biotech drug discovery. Wall Street is trying its best to stay quiet about the firm, but with 96% of the stock owned by institutions, the secret is out.

Medivation is a truly unique opportunity with a simple strategy: generate revenue and speed up the process of getting new drugs to market while mitigating the enormous risk associated with drug discovery.

The company searches the rare and serious disease spaces, with a focus on cancer, for drugs that are ready for development for human testing in 12-18 months (Source: InvestorPlace). In English:

"In essence, MDVN is a biotech head-hunting firm, but instead of looking for biotech research talent, Medivation is looking for the most talented drugs it can find to get into human trials."

Source: InvestorPlace

Source: InvestorPlace

Do you enjoy discovering new companies and opportunities and really understanding them? Get Our (Free) News Alerts Once a Day.

What's Going On

While the stock is down 30% in the last six-months, it's up nearly 1,300% over the last five years (yes, 13-fold). But, the market cap is still 'just' $6.8 billion, and this company may very well have legs to grow substantially larger. Earnings are due out Thursday 11-5-2015 after the market closes.

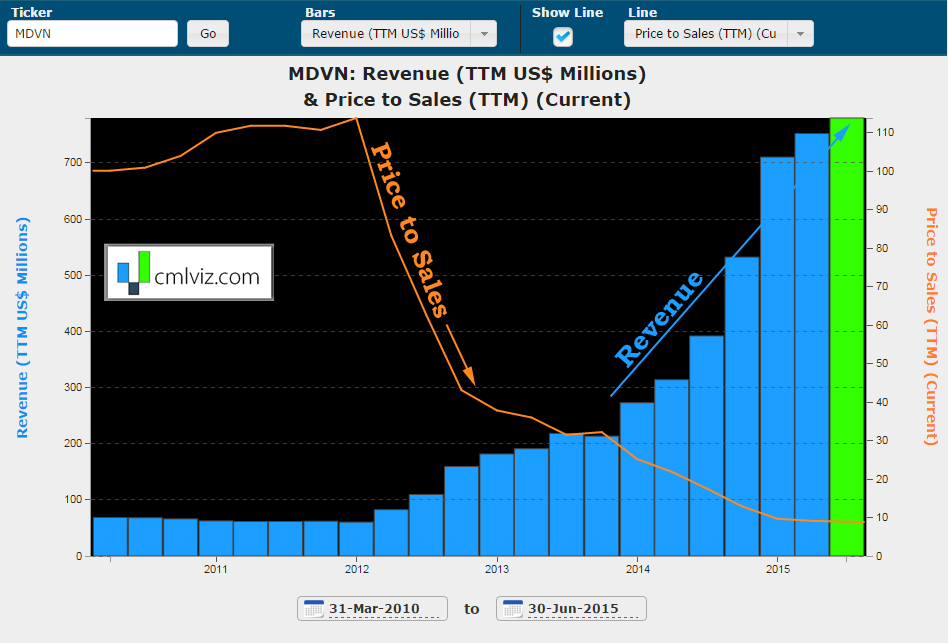

Let's take a look at a fascinating chart of trailing-twelve-month revenue in the bars and price to sales in the orange line for MDVN, below:

Do you enjoy using visualizations like the one above to understand what's really going on in a company? We do too. Get Our (Free) News Alerts Once a Day.

That's what revenue looks like for a stock up 1,300% in five-years, and that's what the valuation measure looks like when a stock has come down so quickly off of its highs.

The critical product for MDVN is cancer drug Xtandi. After approval by the FDA in 2012 as a treatment for previously treated patients with metastatic castration-resistant prostate cancer, Xtandi achieved a potentially more lucrative label expansion last year when it was given the green light by the FDA as a first-line indication prior to chemotherapy (Source: The Motley Fool).

David Hung, M.D., president and CEO said:

"XTANDI's performance, in both the U.S. and outside the U.S., demonstrates continued traction toward becoming a foundation of therapy for the treatment of metastatic castration-resistant prostate cancer."

Source: StreetInsider

Source: StreetInsider

The drug is already a smash success and the extended usage could mean more than a double in sales, making it legitimately a billion dollar drug (actually, more like $1.5 billion). The growth prospects for MDVN due to this extended labelling are remarkable and should ease some fears of a company relying on a single product to drive everything. Louis Navellier writes it better than I can, so I'll just quote him and cite that same InvestorPlace link, above.

The main stream media doesn't have the vocabulary to understand breaking technology and biotechnology. Get free news alerts (once a day) from us and you will be the expert in the room. Get Our (Free) News Alerts.

Here is MDVN's straightforward three-part strategy:

1. Build a portfolio of four to six product candidates that have the potential to be in clinical development within 12 to 18 months after acquisition.

2. Develop those product candidates as rapidly and efficiently as possible; and

3. Consider partnering or selling successful programs to large pharmaceutical, biotechnology or medical device companies for late-stage clinical studies and commercialization.

Source: InvestorPlace.

The main stream media doesn't have the vocabulary to understand breaking biotechnology. But you can. Get free news alerts (once a day) from us and you will be the expert in the room. Get Our (Free) News Alerts.

Diversification of Revenue

On August 25th of 2015, MDVN purchased PARP inhibitor (a group of pharmacological inhibitors developed for multiple indications; the most important is the treatment of cancer) 'Talazoparib' from BioMarin (BMRN) for $410 million with additional milestone payments of up to $160 million.

Talazoparib selectively targets tumor cells with certain gene mutations. It is being explored across a variety of solid tumors, and is furthest along in development as a treatment for patients with breast cancer.

Quoting Medivation's CEO, David Hung, again:

"Acquiring all worldwide rights to Talazoparib provides Medivation with a transformational opportunity to diversify and expand our proprietary portfolio and global oncology franchise.

PARP inhibitors are an exciting class of oncology therapeutics that have been associated with promising activity across multiple tumor types, including breast and prostate cancer."

Source: OncLive.

Source: OncLive.

The drug is in the midst of several FDA trials, all of which are piggy backing on positive initial results. And just to be totally clear, this drug is aimed at treating breast, prostate and lung cancer.

The main stream media doesn't have the vocabulary to understand breaking technology. Get free news alerts (once a day) from us and you will be the expert in the room. Get Our (Free) News Alerts.

Conclusion

Medivation can (and has) brought products to market and is also trying to become the single most trusted place for mega cap biotech companies to go to for potential drug candidates, especially in the oncology (cancer) realm. MDVN sells the drugs, or partners with the larger firms. It reduces its risk of the costly FDA approval process and continues to grow a pipeline at speed that is virtually unmatched (and unmatchable). If it succeeds in this venture, the firm's growth potential is staggering.

We write one story a day to uncover new opportunities. Get Our (Free) News Alerts Once a Day.

One Final Risk Note

MDVN has extraordinary stock price movement potential over the next 30-days (movement up or down). Although several proprietary factors affect the risk rating, in particular for MDVN some of the items driving the rating are:

- High 30-day implied volatility relative to the last year and a large stock return (either up or down) over the last 3-months (-20.1%).

Try CML Pro for free and become the expert in the room. You will be powerful because you will have knowledge that to this point Wall Street has held for itself. That advantage is no longer acceptable to us. Try CML Pro. No credit Card. No Payment Info. Just the Power.