Momo Inc, MOMO, earnings, short-term, return

Preface

With nice wins in Alphabet Inc (NASDAQ:GOOGL), Lam Research Corporation (NASDAQ:LRCX) and Marriott International Inc (NASDAQ:MAR), we continue to look for winning patterns of bullish momentum ahead of earnings. Momo Inc is our next company to examine, with earnings due out 8-22-2017 before the market opens according to NASDAQ.

We have the same disclaimer as always which is that this is a short-term swing trade, it won't be a winner forever, and it can be easily derailed by a couple of down days in the market irrespective of Momo Inc news, but for now it has shown a repeating success that has not only returned 208% over the last two-years, it has also shown a win-rate of 75%.

For the record, Momo Inc. operates as a mobile-based social networking platform in the People's Republic of China, so volatility could be here.

IDEA

As always, we start by defining a simple idea -- trying to take advantage of a pattern in short-term bullishness just before earnings, and then getting out of the way so no actual earnings risk is taken.

The Short-term Option Swing Trade Ahead of Earnings in Momo Inc

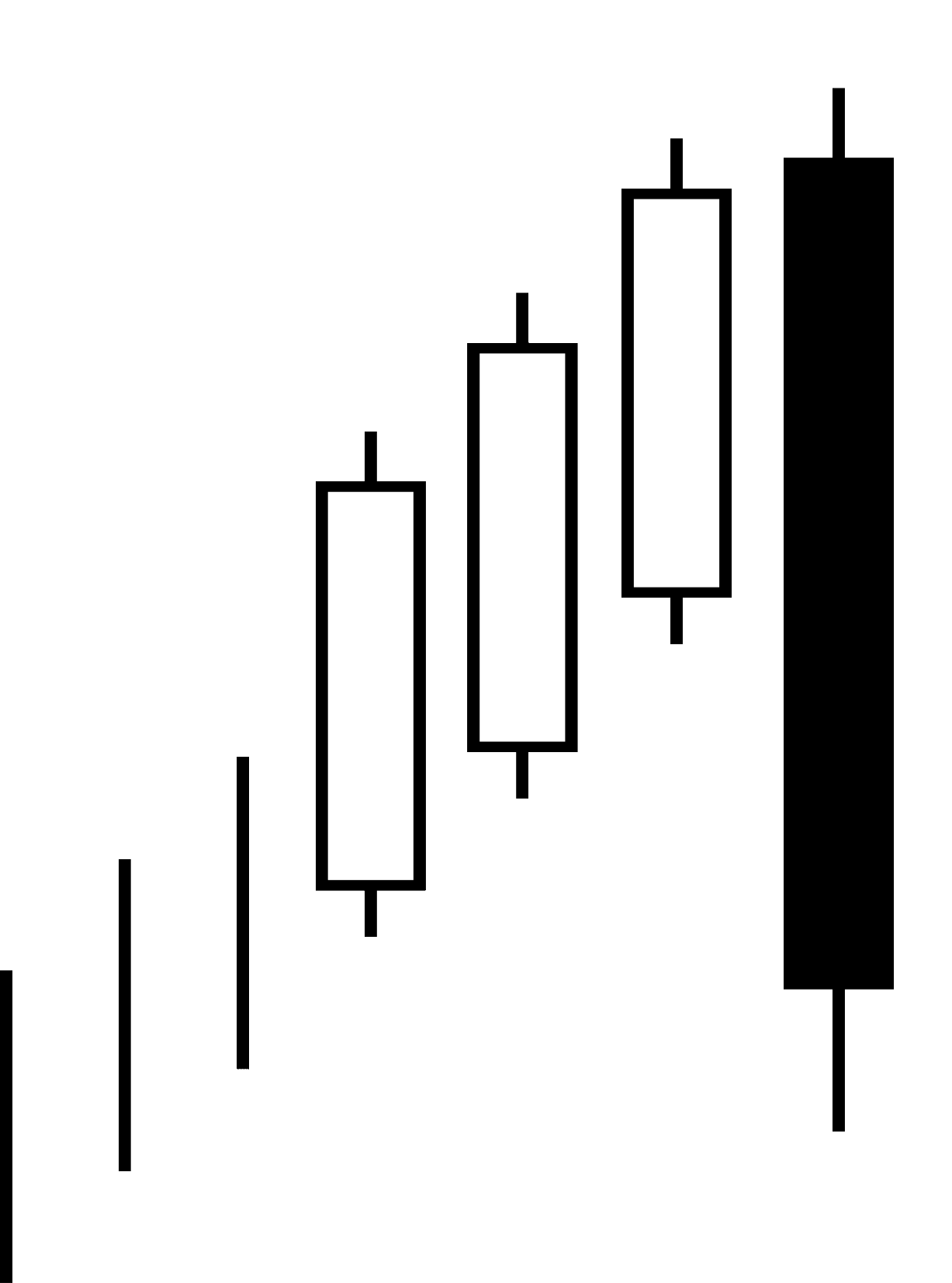

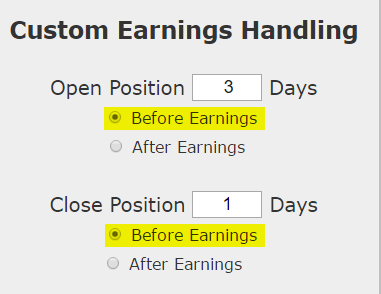

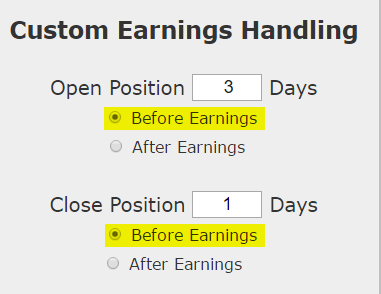

We will examine the outcome of going long a weekly call option in Momo Inc just three calendar days before earnings and selling the call one day before the actual news.

Below we present the back-test stats over the last two-years in Momo Inc:

Below we present the back-test stats over the last two-years in Momo Inc:

We see a 208% return, testing this over the last 8 earnings dates in Momo Inc. That's a total of just 16 days (2-day holding period for each earnings date, over 8 earnings dates). That's the power of following the short-term pattern of bullishness ahead earnings -- and not taking on the actual risk from the earnings outcome.

This short-term trade hasn't won every time, and it won't, but it has been a winner 6 times and lost 6 times, for a 75% win-rate.

Setting Expectations

While this strategy has an overall return of 208%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 26.6%.

➡ The average trade percent return per winning trade was 52.4%.

➡ The average percent return per losing trade was -50.7%.

Looking at More Recent History

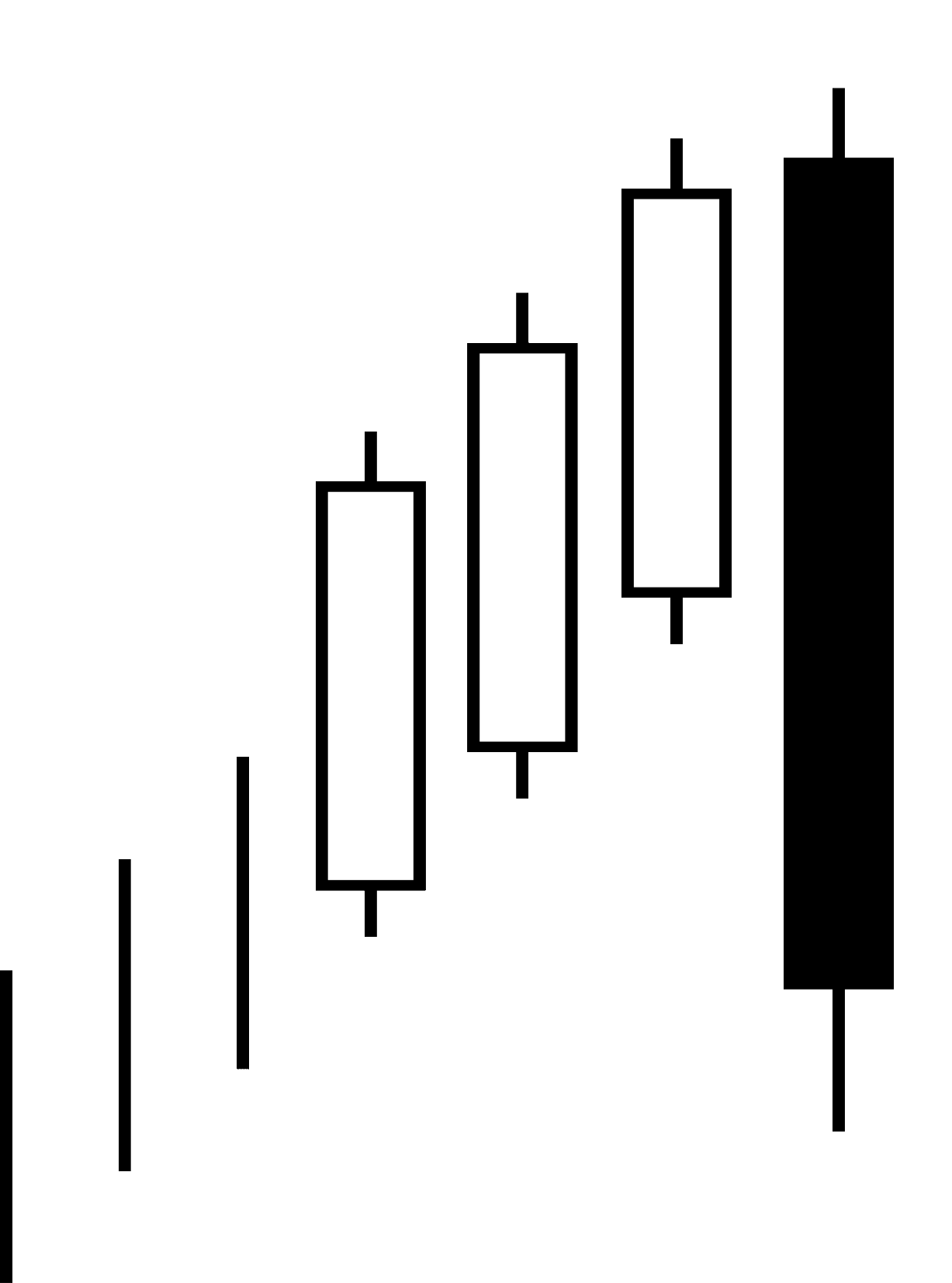

We did a multi-year back-test above, now we can look at just the last year:

We're now looking at 398% returns, on 3 winning trades and 1 losing trade.

➡ The average percent return per trade was 65.4%.

➡ The average trade percent return per winning trade was 96%.

➡ The average percent return per losing trade (which was one-trade) was -26.5%.

This is generally the idea: Take a trade that wins more often than it loses and where the gains for the winning trades are also larger than the losses from the losing trades. Creating portfolio of these types of results will create edge.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. This has been a tradable phenomenon in Momo Inc. To see how to test this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Swing Trading Earnings in Momo Inc

Momo Inc (NASDAQ:MOMO): Swing Trading Earnings Bullish Momentum With Options

Date Published: 2017-08-7Author: Ophir Gottlieb

Preface

With nice wins in Alphabet Inc (NASDAQ:GOOGL), Lam Research Corporation (NASDAQ:LRCX) and Marriott International Inc (NASDAQ:MAR), we continue to look for winning patterns of bullish momentum ahead of earnings. Momo Inc is our next company to examine, with earnings due out 8-22-2017 before the market opens according to NASDAQ.

We have the same disclaimer as always which is that this is a short-term swing trade, it won't be a winner forever, and it can be easily derailed by a couple of down days in the market irrespective of Momo Inc news, but for now it has shown a repeating success that has not only returned 208% over the last two-years, it has also shown a win-rate of 75%.

For the record, Momo Inc. operates as a mobile-based social networking platform in the People's Republic of China, so volatility could be here.

IDEA

As always, we start by defining a simple idea -- trying to take advantage of a pattern in short-term bullishness just before earnings, and then getting out of the way so no actual earnings risk is taken.

The Short-term Option Swing Trade Ahead of Earnings in Momo Inc

We will examine the outcome of going long a weekly call option in Momo Inc just three calendar days before earnings and selling the call one day before the actual news.

We see a 208% return, testing this over the last 8 earnings dates in Momo Inc. That's a total of just 16 days (2-day holding period for each earnings date, over 8 earnings dates). That's the power of following the short-term pattern of bullishness ahead earnings -- and not taking on the actual risk from the earnings outcome.

This short-term trade hasn't won every time, and it won't, but it has been a winner 6 times and lost 6 times, for a 75% win-rate.

Setting Expectations

While this strategy has an overall return of 208%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 26.6%.

➡ The average trade percent return per winning trade was 52.4%.

➡ The average percent return per losing trade was -50.7%.

Looking at More Recent History

We did a multi-year back-test above, now we can look at just the last year:

We're now looking at 398% returns, on 3 winning trades and 1 losing trade.

➡ The average percent return per trade was 65.4%.

➡ The average trade percent return per winning trade was 96%.

➡ The average percent return per losing trade (which was one-trade) was -26.5%.

This is generally the idea: Take a trade that wins more often than it loses and where the gains for the winning trades are also larger than the losses from the losing trades. Creating portfolio of these types of results will create edge.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. This has been a tradable phenomenon in Momo Inc. To see how to test this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.