The Key to Trading Options in Microsoft Corporation (NASDAQ:MSFT)

Date Published: 2017-02-20

Microsoft Corporation (NASDAQ:MSFT)

There is a powerful phenomenon that has impacted Microsoft Corporation option trading.

There are a lot of ways to play a bull market with options. The aggressive bullish approach is simply to buy calls, but you better be right on direction, and then some.

There's also a different approach -- to sell naked puts -- which is a simple bet that the stock doesn't go down a lot. It's less bullish, but has a much higher probability of success.

It also has a much larger maximum loss.

It also has a much larger maximum loss.

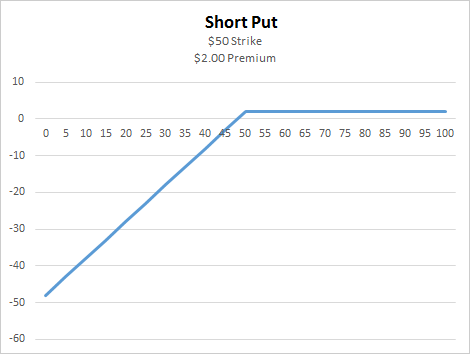

Here is the payoff of a short put:

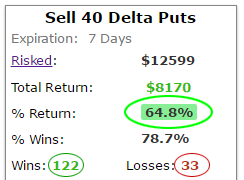

Before we blow off this strategy as too risky with little upside -- try this. Here is what has happened over the last three-years if we sold a 40 delta (out of the money) put in MSFT every week.

That's a 64.8% return and a win rate of 78.7% (there were 122 winning trades and just 33 losing trades). But... we still have that nagging huge loss potential. Let's get clever.

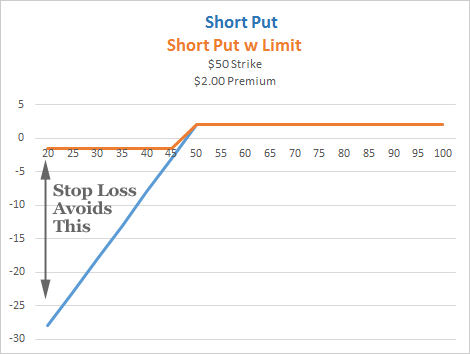

Let's do this same strategy in Microsoft Corporation, but implement a stop loss at 75%. That means if any short put in any week hits a 75% loss, we buy it back and end the trade until the next week. This makes our maximum gain on any one trade 100% from the short sale of a put, and just 75% if we cut off the losses early. Here are the results:

All of a sudden the return in MSFT leaps to 113%. But we did something more than just double our returns. Here is what the payoff of a short put with a stop loss looks like in orange, versus the standard short put in blue.

All of a sudden, that disproportionate profit versus loss diagram has been turned into a favorable one.

Now, we must note that this idea works great in theory, but if a stock is very volatile, the stop loss can do us little good if the stock gaps down. But, that's why we're trying it on Microsoft Corporation (NASDAQ:MSFT) -- a steady, calm, mega cap. This also works absolute wonders on Intel.

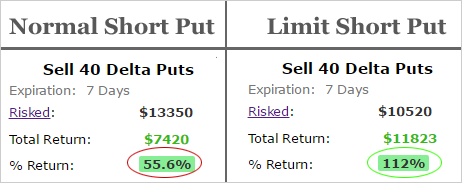

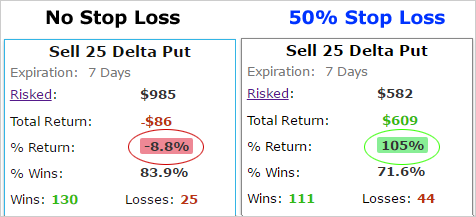

Now, here are the results for that same strategy over two-years instead of three-years -- the left hand side is the normal short put, the right hand side is the one with a 75% stop loss.

The risk averse implementation works very nicely over two-years as well. For the record, here's how we turned the table on Intel short puts:

Again, the implementation with less risk dominated the one with more risk.

With Intel, Microsoft Corporation, Tesla, Apple and others it actually goes further. If we were to do this same trade but always avoid earnings, we get yet different results. So what's going on?...

THE KEY

The key here is to find edge, optimize it -- in this case by putting in a stop loss -- and then to see if it's been sustained through time. For MSFT it has, and that makes for a powerful result.

We've just seen an explicit demonstration of the fact that there's a lot less 'luck' and a lot more planning in successful option trading than many people realize. Here is a quick 4-minute demonstration video that will change your option trading life forever: Tap here to see the Trade Machine in action

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.