For Microsoft, Pre-Earnings Optimism Has Meant a Momentum Trade Win

For Microsoft, Pre-Earnings Optimism Has Meant a Momentum Trade Win

Date Published: 2018-09-20

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.Preface

Microsoft Corporation (NASDAQ:MSFT) has a pattern of optimism and momentum before of earnings, and in particular it has shown overwhelming strength over the last year and a half.The Options Optimism Trade Before Earnings in Microsoft Corporation

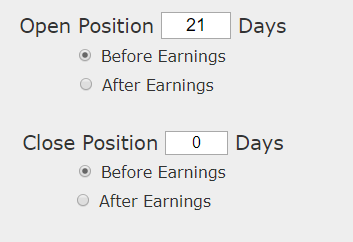

Let's look at the results of buying a slightly out of the money (40 delta) monthly call option in Microsoft three-weeks before earnings (using calendar days) and selling the call before the earnings announcement.Here's the set-up in great clarity; again, note that the trade closes before earnings since MSFT reports after the market closes, so this trade does not make a bet on the earnings result.

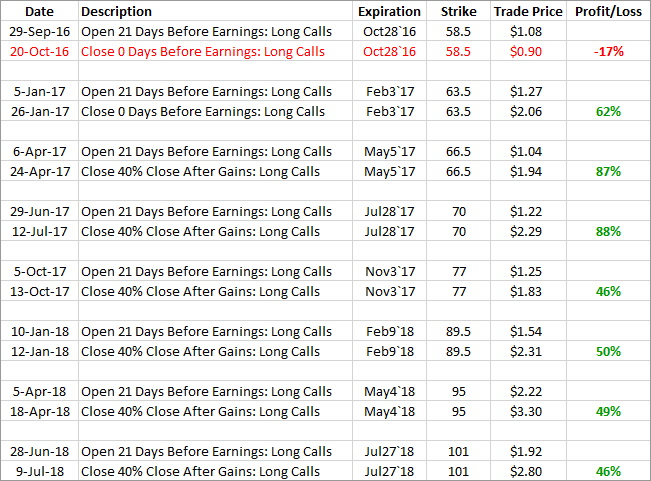

Here are the results over the last five-years in Microsoft:

The mechanics of the TradeMachine® Stock Option Backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

Track this trade idea. Get alerted for ticker `MSFT` 21 days before earnings

The trade will lose sometimes, but over the most recent trading history, this momentum and optimism options trade has won ahead of earnings.

Setting Expectations

While this strategy had an overall return of 848%, the trade details keep us in bounds with expectations:➡ The average percent return per trade was 42.2%.

➡ The average percent return per winning trade was 67%.

➡ The average percent return per losing trade was -32.3%.

Checking More Time Periods in Microsoft Corporation

Now we can look at just the last year and a half -- or the last six pre-earnings periods:➡ The average percent return over the last year per trade was 60.2%.

RISK NOTE

The October earnings release does have a special place for most companies because September and October tend to be volatile. In fact, September has been the worst performing month for the S&P 500, overall.It's particularly relevant to Microsoft because the last time this back-test showed a loss was... October. Here are the last 8 periods, with 7 winners:

What Happened

Find opportunities like these. Become the expert in the room. You can tap the link below to become that expert.Tap Here, See for Yourself

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Remember to consider every piece of investment information you receive, not as a de facto recommendation, but as an idea for further consideration. Even the strongest disclosure policy in the world does not excuse individuals from taking responsibility for their own decisions. Due diligence and critical thought are crucial to your financial success.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.