Netflix Makes a Bold, Brilliant Move into India

The Future

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. Thanks for standing with us.PREFACE

Netflix Inc. (NASDAQ:NFLX) stock is down more than 20% from its highs but the future is still bright, regardless of the recent stock drop.

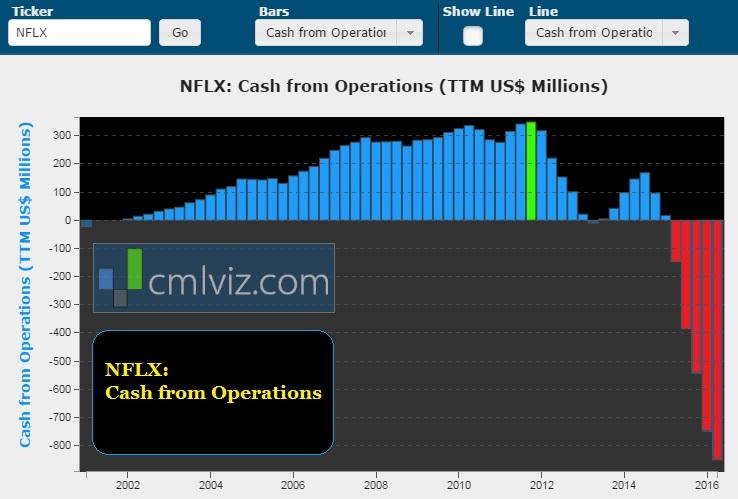

CASHFLOW

Before we get to the recently announced news, we can look at the risk inherent in Netflix stock by focusing on cash from operations.

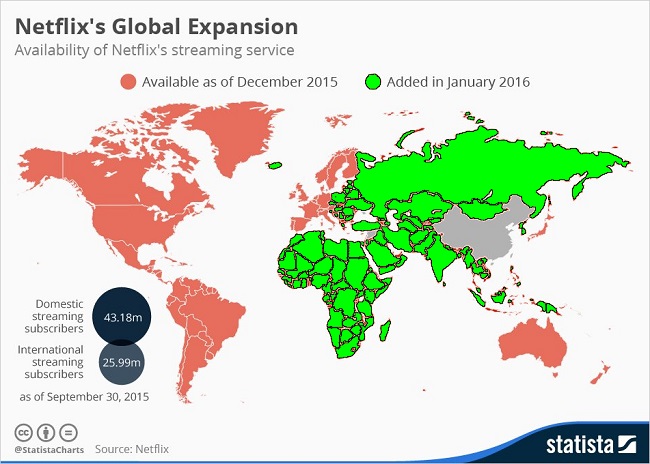

The cash burn must come into context with the company's enormous global expansion which just this year includes 130 countries, and India is one we want focus on.

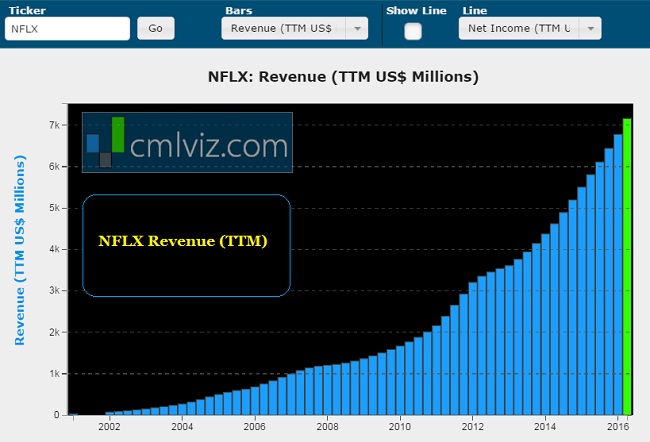

The green filled areas represent countries added in 2016. For the final chart before we get to the breaking news, we can see Netflix Inc. (NASDAQ:NFLX) revenue chart below.

Discover of the Undiscovered

Get Our News Alerts.

STEP I.

First we need context into the company's success so far, and then we can turn to a huge move in India. Netflix has seen domestic growth slow and has turned its eye toward that rapid international expansion. In a recent report we noted the results of a Piper Jaffray report written by Michael Olson, where he reported positive survey results based on 1,000 Internet users in Brazil and 1,000 in Mexico. Netflix brand awareness and the intent to subscribe was quite high (BARRON'S).

“

By 2020, we see potential for Netflix to reach ~141M worldwide subscribers, including 63.2M domestic and 77.3M international subs.

Source: BARRON'S

By 2020, we see potential for Netflix to reach ~141M worldwide subscribers, including 63.2M domestic and 77.3M international subs.

”

Source: BARRON'S

Barron's also reported that UBS's Doug Michelson reviewed findings of his European colleague, Richard Eary, covering online media on the continent.

“

Netflix is doing quite well across Europe despite intense focus from local competitors in each market, not to mention competition with Amazon (AMZN), who was earlier to enter the U.K. and Germany.

Source: BARRON'S

Netflix is doing quite well across Europe despite intense focus from local competitors in each market, not to mention competition with Amazon (AMZN), who was earlier to enter the U.K. and Germany.

”

Source: BARRON'S

Mitchelson went on to say that "management continues to suggest that only about 20% of international viewing is from local content and that U.S. content continues to travel well everywhere, including in the rest of world markets launched this year."

This is critical because it means that Netflix can focus its spend on US based original content rather than a wild spend on various countries with no substantial estimate as to how each region would do.

STEP II: INDIA

We could go on and on about surveys from Europe as well that show how quickly Netflix adoption is taking place, but let's turn to the second largest country in the world by population, and the largest country for Netflix since China is a "no-go" for right now.

In an article from Fortune we just got this news:

“

Netflix announced a new series based on the novel Sacred Games, by Indian author Vikram Chandra.

Filmed locally in India, the Hindi-English series—which focuses on organized crime, corruption and espionage—will eventually stream on Netflix.

Netflix announced a new series based on the novel Sacred Games, by Indian author Vikram Chandra.

Filmed locally in India, the Hindi-English series—which focuses on organized crime, corruption and espionage—will eventually stream on Netflix.

”

Source: Fortune

While Netflix has been pouring money into original content in the United States, the move in India is a first. There are more than a quarter billion Internet users in the country and Netflix wants to reach them. India is famously known for Bollywood -- a wonderful community of film makers and story tellers that have entered the film making vernacular in the United States for quite some time.

This move is genius in that Netflix has limited resources pegged for non-English original content but it has chosen beautifully with India, the content itself and the launch.

COMPETITON IS FIERCE

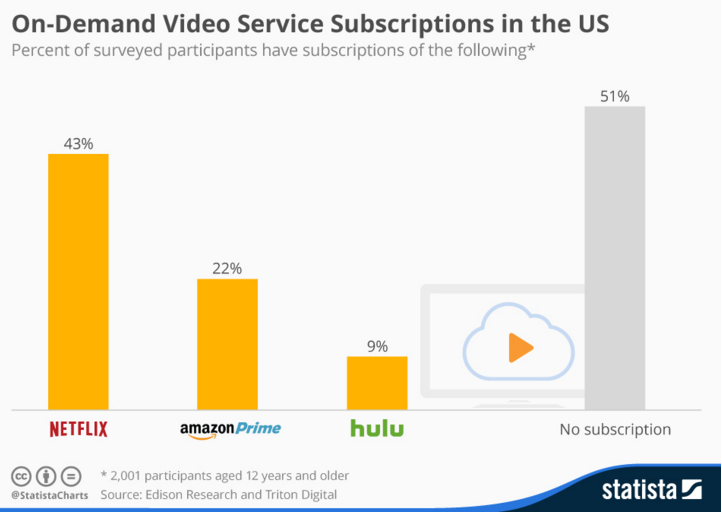

Amazon.com (NASDAQ:AMZN) announced a few weeks ago that it has spun its SVOD service out of Amazon Prime as a stand-alone product and Alphabet (NASDAQ:GOOGL) has its YouTube Red service as a premium SVOD service with original content coming soon.

Even Facebook (NASDAQ:FB) announced a standalone SVOD product to compete with YouTube and Netflix and Apple (NASDAQ:AAPL) to has invested in original content for its Apple TV ecosystem.

But even given this competition, Netflix maintains a strangle hold on the United States market:

With new evidence from several sources that the Netflix expansion overseas is working, we have to look now at that cash investment and believe that it's worth it and could very well lead Netflix up from its $7 billion base to somewhere near $20 billion in the next five years.

WHY THIS MATTERS

To identify trends like SVOD in the early stages, and then to go beyond, to find the next Apple, Google or Netflix, we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Netflix is one of just a precious few 'Top Picks' for CML Pro. Each company identified as the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

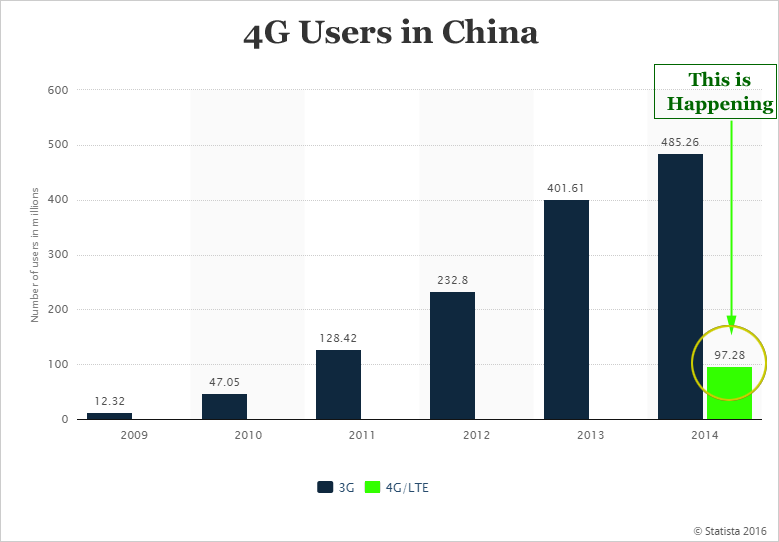

That light green colored bar (4G) is soon going to be larger than the dark colored bar (3G). 4G usage will grow from 330 million people today to nearly 2 billion in five years. CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.