Netflix Inc (NASDAQ:NFLX) Huge Earnings Miss

Netflix Inc (NASDAQ:NFLX) Huge Earnings Miss

Date Published: 7-18-2016Author: Ophir Gottlieb

BREAKING

Netflix Inc (NASDAQ:NFLX) just released earnings and the results were a huge miss relative to expectations. The stock price is tumbling after hours -- see the highlighted yellow prices.

Here are the details.

RESULTS

Netflix set its own expectations for subscriber growth to hit 2.5 million in the quarter and the company missed badly, reporting just 1.7 million new subscribers. The breakdown was as follows:

Netflix expected to add 500,000 new United States subscribers and it added just 170,000.

Netflix expected to add 2,000,000 new international subscribers and it added just 1.52 million.

The company did report $0.09 in earnings per share versus estimates of $0.02, but that has little to do with the future of the company. Revenue hit the Wall Street estimnates of $2.11 billion, up from $1.64 billioninthe same quarter last year.

The bullish thesis behind Netflix is simple: It can be both a content creator and content re-distributor and in that vein would rule the streaming video on demand world.

In a letter to shareholders, Netflix admitted to losing subscribers in U.S. due to fears of price increase which was a huge surpise as many had believed the $2 price hike to previosuly grandfathered users would be no issue for the firm.

On the original content side, the company delivered an impressive 54 Emmy nominations, beating out every other national broadcast channel. But, the popularity of its shows appears not to be enough to keep the growth engine moving at the pace the firm projected.

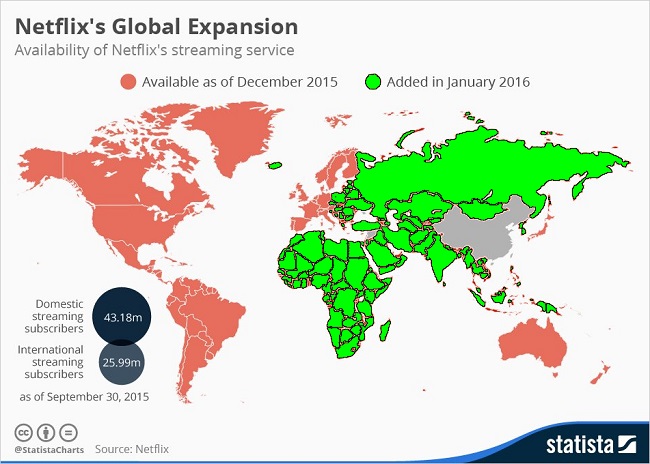

Here is the world map of coverage for Netflix as of January 2016, when the company reported a huge international expansion.

While CEO Reed Hastings has said the firm will pile $6 billion into original content, that number was justifiable, even if it meant negative free cash flow, as long as the Netflix Inc (NASDAQ:NFLX) added subscribers at the projected rate. It has not, and now a new valuation must be placed on the company to reflect the substantially slower growth and the huge miss.

But, calmer heads will prevail. While Netflix Inc (NASDAQ:NFLX) may be expensive for now as the stock tumbles in the after-hours trade, if it can grow, even at a slower pace, this could still be a company with a huge consumer base in the coming years. The bulls will argue that Netflix in five years would have 200 million users and at that rate, a sub $40 billion market cap is hardly expensive. The bears will argue that competition could mean not just slowed growth, but at some point, negative growth.

WHY THIS MATTERS

The seismic disruption that will come streaming video on demand also brings with it a total revolution for advertising. One not seen since the advent the television itself. It's identifying trends like this that allows us to find the 'next Apple' or the 'next Google.' This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

That chart plots the growth in 4G usages worldwide and how it will grow from 330 million people today to nearly 2 billion in five years. This is the lifeblood fueling every IoT and mobile device on the planet and CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.