Winning Option Trading in Nike Inc

Winning Option Trading in Nike Inc

Date Published: 2016-12-20Author: Ophir Gottlieb

Written by Ophir Gottlieb

Preface

There are two risk controlled winning option trading strategies that have worked very well in Nike Inc (NYSE:NKE) over the last two-years.

But, before we get to them, let's recognize that back-testing is not about guessing if a stock will rise or fall. Once we realize that, we then recognize that there is a lot less luck and a lot more planning than many people know when it comes to successful option trading. Here we go.

STORY

Nike Inc (NYSE:NKE) stock has been a quiet under-performer over the last two-years, up 8% as the S&P 500 has been up about 10%. But, if we employ any of two risk controlled option strategies, we find much better results.

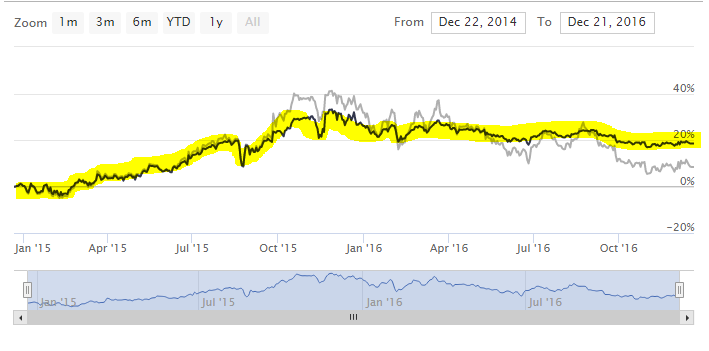

Let's look at covered calls to start, then an even lower risk approach. If we back-test selling a covered call on Nike Inc over the last two-years, trading every 30-days, we get this result:

That's a 18.4% return over two-years versus a stock that has stagnated a bit. Here's the stock chart compared to the option strategy:

Not too bad, there. But, we can take this analysis further.

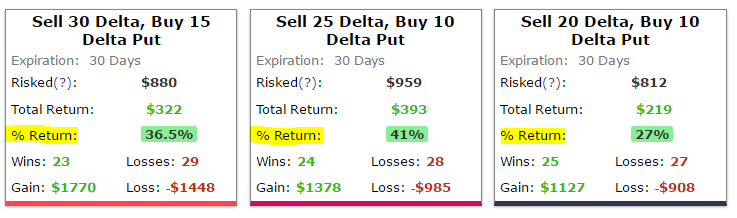

While selling puts or selling covered calls are essentially the same trade, we can risk manage that trading approach by testing selling a put spread. And this is where we start to get powerful results:

We can see much better results, using an option strategy that is even less risky than selling a covered call. But, this back-test is even more clever. The results above actually tested selling a put spread in Nike Inc (NYSE:NKE), but also avoiding earnings. That is, every time earnings approached, we closed the trading strategy (held no position), then started the trading strategy again after the volatility of earnings had ended.

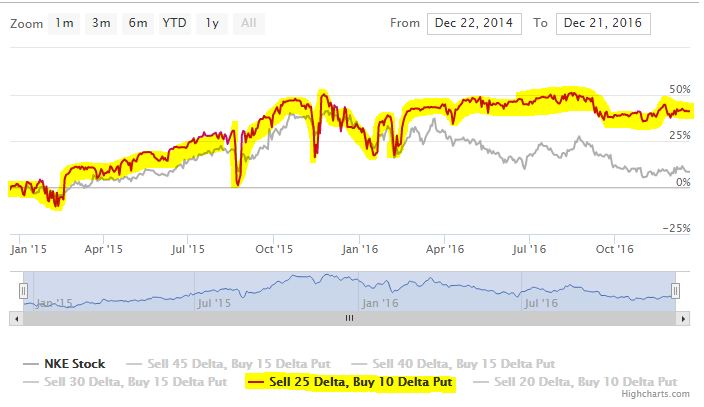

Here is how that lower risk, lower volatility option trade did relative to the stock:

We're looking at anywhere from 27% to 41% over two-years versus Nike Inc stock that is up just 8%. Now, remember what we first discussed at the top about not guessing stock price movement. Check this out in the next section "Why This Matters."

WHY THIS MATTERS

When we wrote that there's actually a lot less 'luck' and a lot more planning in successful option trading than many people know, this is what we meant.

It's not about trying to guess which stocks will go up or down.

What the back-tester allows us to do is find calm, low stress stocks or ETFs (like SPY, QQQ, etc), and in this case, Nike, and find the option strategies that have created a high percentage of winning trades, gaining profitability slowly, while avoiding unnecessary risks - specifically, avoiding earnings.

In a five minute video below, your entire view of the options world and what people mean when they say 'expert trader' will be turned upside down - to your advantage.

Tap here to see the CML Pro option back-tester.

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.