Top Tech Dividend Payers: Yeah, It Matters

The Future

PREFACE

One of the most powerful investment vehicles is a dividend paying stock and while most of the world assumes that we have to step outside of the world of growth stocks to find dividends, that simply is not the case.

Research done several years ago by Dr. Harry DeAngelo, formerly of the University of Michigan and now at at the University of Southern California, showed that dividend cuts impact stock returns negatively.

This research was so prevalent that companies began to change their policies on dividend hikes, assuring that they would not have to reverse course if they did raise the payout. So in short, yes, paying attention to dividend changes is critical to stock performance, not to mention the added cash benefit of owning a dividend payer.

LARGE CAP TECHNOLOGY DIVIDENDS

Let's first look at the top dividend yielding mega cap stocks over the last year. We are examining all technology companies with market caps currently over $15 billion.

The top paying dividend stock in large cap technology is HP Inc. (NYSE:HPQ). Due to its volatile trading and massive stock decline a few months ago, HP Inc. has actually delivered more than 5% in dividends. But, HP Inc. isn't a growth company. If we look further down the list we find NVIDIA Corporation (NASDAQ:NVDA).

NVIDIA is the tech marvel powering artificial super intelligence and machine learning. It's the crown jewel of technology’s future. Its stock price is up 188% in the last year, and that could very well just be the beginning. While all of this is happening, NVIDIA Corporation has paid out a dividend of over 1% in the last year. That's growth and income.

If we look at this list, we can also see Apple (AAPL), Intel (INTC) and Microsoft (MSFT). All three pay a noteworthy cash dividend, have a ton of corporate cash and are likely going to keep increasing dividends for several years to come.

Now let's turn to the same technology peer group but look at the companies that show the largest gain in dividends per share year-over-year.

Now we can see NetEase, Inc. (NASDAQ:NTES) with a huge 75% rise. If we look down the line, we will find NVIDIA Corporation (NASDAQ:NVDA) again. This time the company shows a 25% increase in dividends per share over the last year. Slow and steady, there is Apple, Microsoft and Intel again.

WHY THIS MATTERS

Earnings projections and dividend trends alone can never capture the force that truly drives growth for a company. The kind of growth that creates companies like Apple, and Facebook, comes from fundamental changes in technology and the economy. At Capital Market Labs, we identify these transformations, and the companies that will benefit most from them to find the "next Apple" or the "next Google." Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution. Our purpose is to break the information monopoly held by the top .1%.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

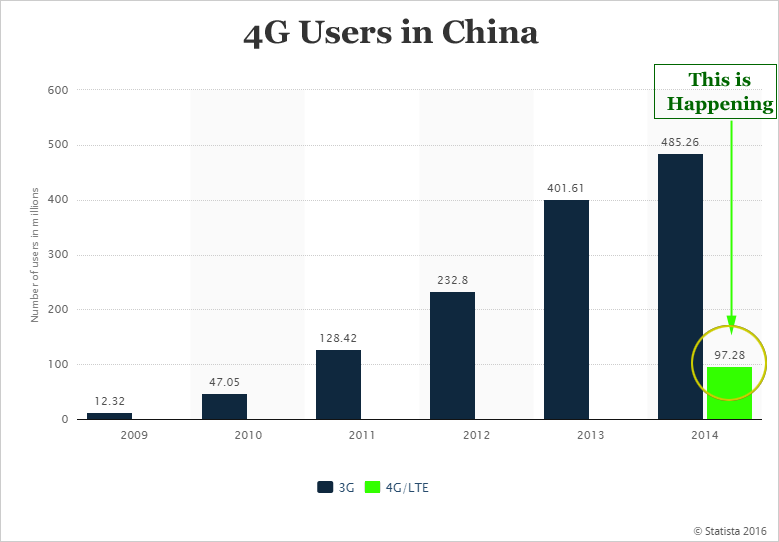

That light green colored bar (4G) is soon going to be larger than the dark colored bar (3G). 4G usage will grow from 330 million people today to nearly 2 billion in five years. CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends. The author is long Apple and NVIDIA shares.