How to Use Options to Profit from Nvidia, Facebook and Intel

Date Published: 2017-02-28

Preface

It's a fair question to ask, if there is a way to use options to profit from mega cap technology companies' stocks simply not falling apart, like Nvidia Corporation (NASDAQ:NVDA), Intel Corporation (NASDAQ:INTC)or Facebook Inc (NASDAQ:FB).

The answer is yes, but it takes an intelligent risk reduction strategy, and here's how.

NVDA

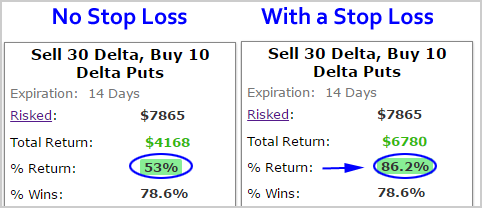

Selling an out-of-the-money put spread is a bet that a price won't drop a lot. It's semi-bullish, but mostly just "anti-bearish." It can be a huge boost in returns, but it must be applied thoughtfully. Here's how selling a put spread every two weeks in NVDA over the last two-years has done.

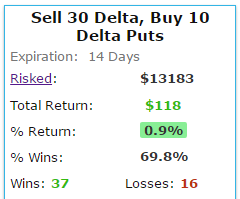

There are a lot of things that look bad here -- first is the 0.9% return in a stock that has lit the S&P 500 on fire. But there's more to address, as well. Selling a put spread only has a 100% upside, but the downside can actually pretty large. So, here's what we do.

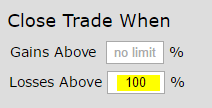

We will implement this same strategy, but put in a stop loss at 100%. That simply means if during any two-week period a short put spread shows a 100% loss, we exit the position, and don't let it turn into one of those regrettable losers. Here's the simple implementation:

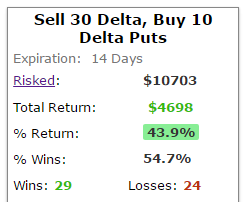

And here are the breathtaking results:

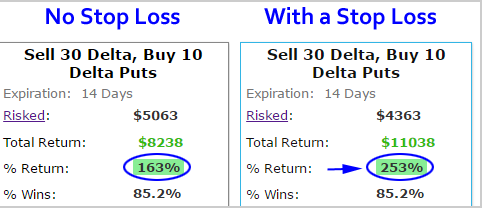

We took a strategy that returned next to nothing and turned it into a 43.9% winner. Even further, we vastly reduced the risk by using a stop loss. But the real intelligence here goes further. Here is how this strategy did over the last year, with the stop loss version on the right hand side and the normal version on the left hand side:

Now we're starting to see "Nvidia type returns," all the while we are limiting risk and profiting from the stock simply not going down a lot. Here are the results for the last 6-months:

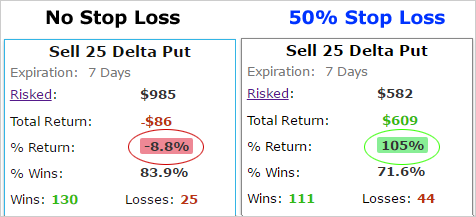

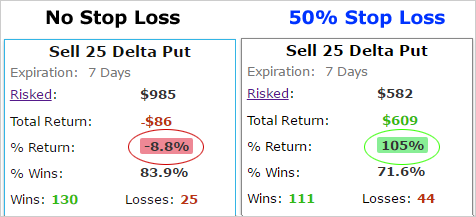

What we've found here is powerful, but it doesn't work for every stock. If you're looking at technology it works with stocks like Intel Corporation (NASDAQ:INTC). Here are the results for Intel short puts with a stop loss:

Intel Short Put

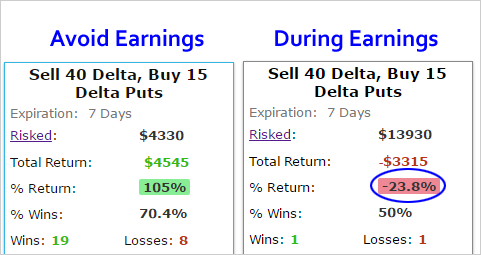

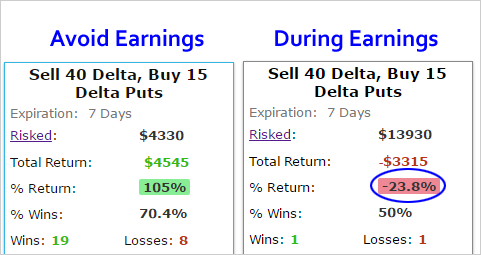

But we can go further. Here's how this strategy looks for Facebook Inc (NASDAQ:FB) when we also avoid the risk of earnings:

Facebook Short Put Spreads

Betting on a mega cap not going down has been very profitable, it can be adjusted to take less risk, and that risk reduced implementation has been even better.

This could have been any company -- like Apple, or Facebook, or any ETF. What we're really seeing is the radical difference in applying an option strategy with analysis ahead of time, whether that's a stop loss or avoiding earnings, or both. This is how people profit from the option market -- it's preparation, not luck.

To see how to do this for any stock, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading, friends.

The author is long NVIDIA Corporation (NASDAQ:NVDA) and has no position in Intel Corporation (NASDAQ:INTC) or Facebook Inc (NASDAQ:FB) at the time of this writing.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.