Volatility in NVIDIA Corporation (NASDAQ:NVDA) May Mark an Opportunity

Date Published: 2017-04-12

Written by Ophir Gottlieb

LEDE

As NVIDIA Corporation (NASDAQ:NVDA) stock has met a new found volatility, often times surrounding differing views from Wall Street analysts, a deft hand and a clever option investor may have an opportunity to profit from the stock swings, irrespective of the direction.

Preface

The volatility in NVIDIA Corporation (NASDAQ:NVDA) shares over the last year and even pinpointing down to the last six-months has opened up an opportunity in the option market.

Owning Option Premium

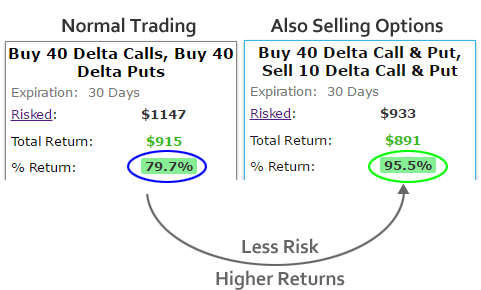

Here are the results of owning naked options in NVIDIA over the last year -- we're looking at out-of-the-money strangles, and always avoiding earnings.

Just owning out of the money options has returned nearly 80% over the last year -- but there's a huge risk in this approach.

IMPROVE

Instead of buying naked options in Nvidia to invest in a strategy that benefits from stock volatility, we will sell options that are further out of the money to offset the expense of the purchases. The strategy we are going to look at is called a condor (or an iron condor). Here are the results of both avoiding earnings and selling out of the money options against the long options:

It's remarkable, but these are the realities of option trading. The results went from a 79.7% gain, to a 95.5% gain by reducing risk -- that is, by selling options against the long options.

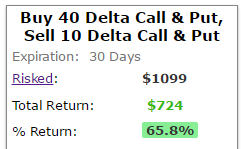

We can do this over the last six-months as well:

Now we see a 65.8% return as the stock has returned 48% -- and again, this strategy does not make a stock direction bet -- either way will do, volatility is the key.

WHAT JUST HAPPENED

This is how people profit from the option market - it's preparation, not luck.

To see how to do this for any stock, index or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author is long stock in NVIDIA Corporation (NASDAQ:NVDA) as of this writing.

Back-test link.