Invitae, NVTA, company, revenue, million, network, information, technology

Invitae Wants to be the Amazon of Genomics, and It's Working

Date Published: 2018-08-15

Written by: Ophir Gottlieb

This is a snippet from the original CML Pro dossier published on 08-09-2018.

PROFILE

Invitae Corporation (NYSE:NVTA), is a genetic information company that focuses on bringing comprehensive genetic information into mainstream medical practice to enhance the quality of healthcare. (Source: Invitae)

Invitae is trying to set itself up as the Amazon of genome sequencing by making the process of ordering medical-grade tests so easy and cheap that testing for genetically inherited diseases becomes as simple as ordering books online. (Source: Economist)

LEDE

We added Invitae to Top Picks on 1-Sep-16 for $7.42. As of this writing it is trading at $9.95, up 34.1%.

The company reported an earnings beat on revenue, EPS and gross profit, raised guidance and the stock has taken flight.

But, as always, I have my quarterly call with Sean George, CEO of Invitae, and he clarified some statements that were public but I felt needed to be more explicit for me to focus on.

The takeaway is that while Invitae still uses the phrase "cash burn," as it should, and that indicates serious risk, it is my belief that there may be less than five other companies in the world that literally have an addressable market the size of Facebook, Alphabet, and Apple. Invitae is one of those companies.

In fact, while Invitae notes that its current addressable market is about 1 billion people, we could make an argument that Invitae's addressable market is every born and and unborn person in the world, from now and into the future.

Further, we believe that this is a genomics-technology company, built on a network with recurring revenue coming in as its new customer base grows.

We urge the company to re-focus investors and analysts on its dual role -- and remind the world that it is a technology company, and a great one at that.

Let's talk about Invitae -- soup to nuts -- and my quick chat with Sean, with our other chats as additional substantiation of our bullish thesis.

THEMATICS

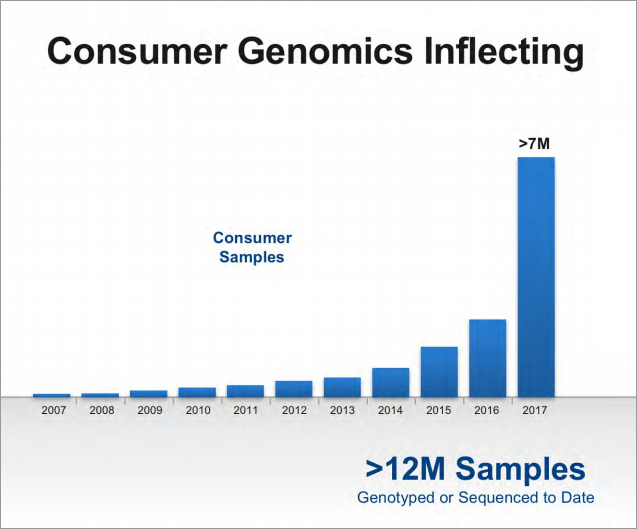

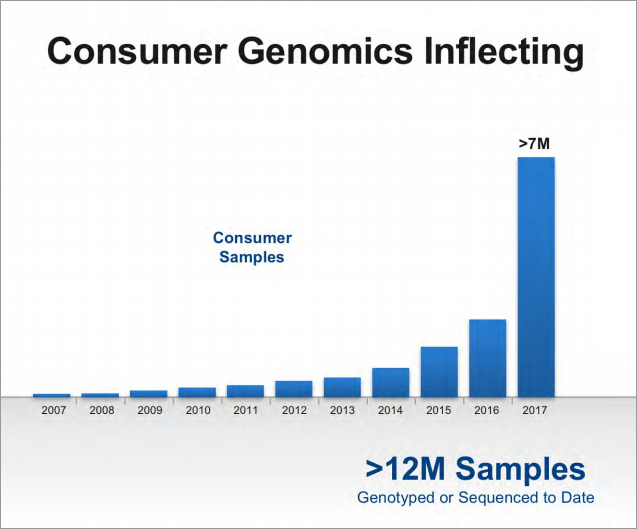

To motivate the discussion, we can first glance at the thematic that is genomics. This chart comes from Illumina, the hardware maker, and another Spotlight Top Pick.

Even with that chart, this is so early, that last bar of "> 7M" is likely to look like one of those other bars before it as the new data comes out. This is rounding error, even today, with respect to what's coming.

Or, I'll say it yet clearer, I think that bar will reach near 2 billion within 10 years.

Now, onto a snapshot at the past for Invitae -- that is, earnings results from this quarter and prior quarters' trends:

SNAPSHOT

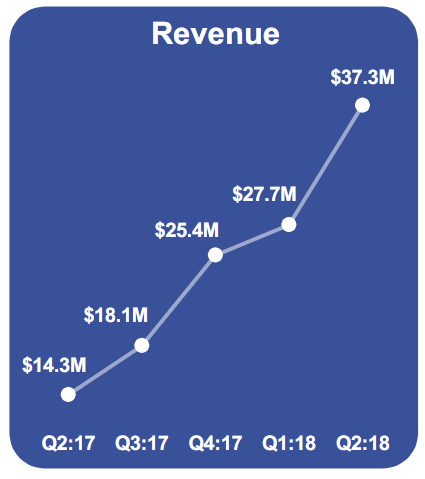

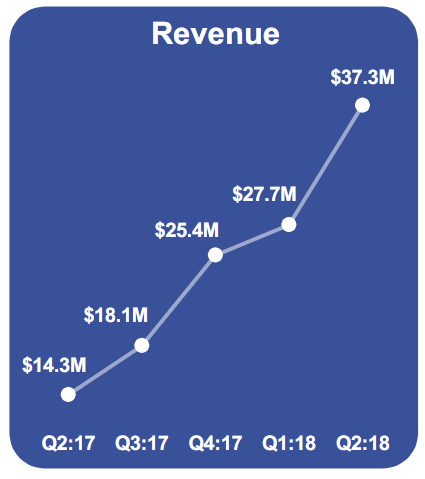

* Quarterly revenue of $37.3 million in the second quarter of 2018, a 35% sequential increase over the first quarter of 2018 and a 161% increase over the second quarter of 2017 revenue of $14.3 million.

Here's the chart:

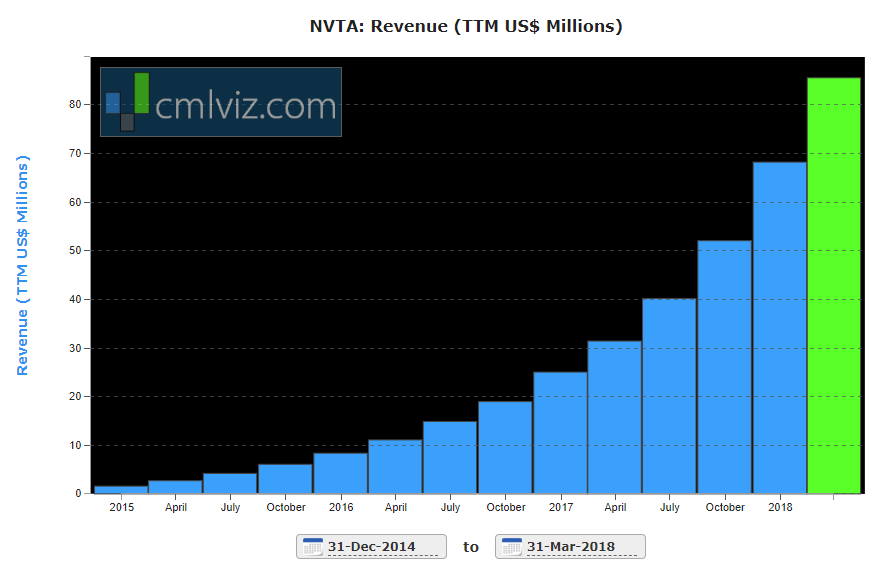

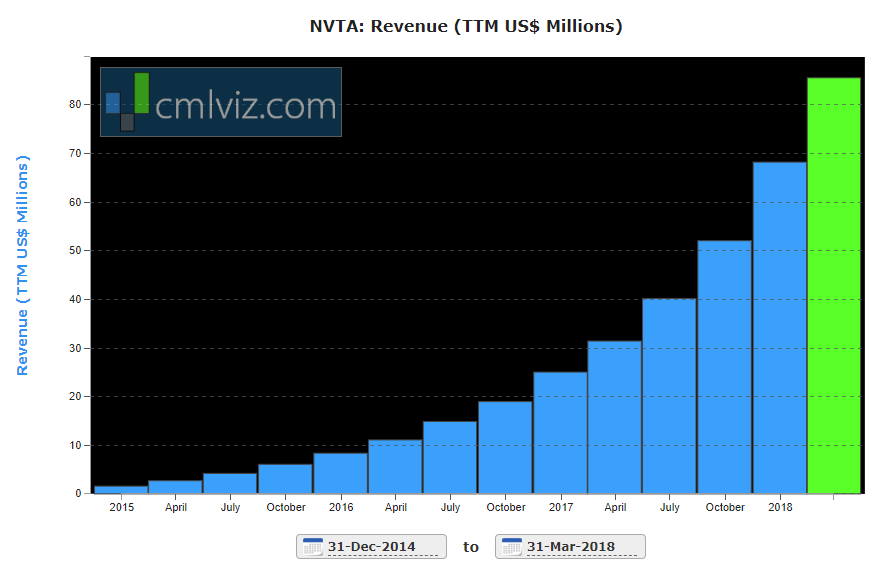

That was the graphic provided by the company, but I prefer ours a little more -- it has more history and we roll it up into trailing twelve month periods (read: annual revenue).

Our chart, however, does not yet have the latest quarter, so there is another bar to the right, substantially higher than the current.

* Revenue Guidance Invitae started the year out with a guide of "at least" $120 million in revenue for 2018. This is the the third consecutive raise:

Raising annual revenue guidance amid strong quarter performance from more than $130 million to between $135 and $140 million in 2018.

So, look back at the chart above, that ends at ~$85 million, and imagine a bar there at ~$137.5 million by year end.

Even further, Invitae has re-iterated it's longer term guidance that the company sees revenue doubling every year for the foreseeable future.

This is a $750 million market cap company, as of this writing, forecasting $500 million in sales in two and a half years (full 2020).

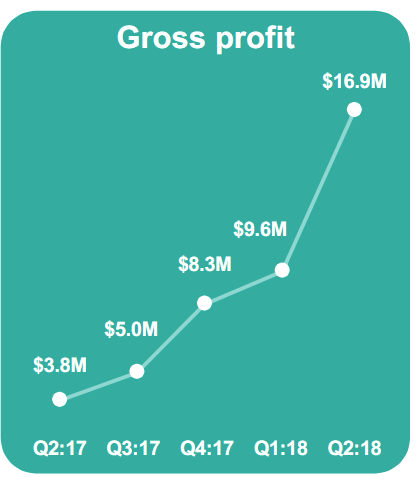

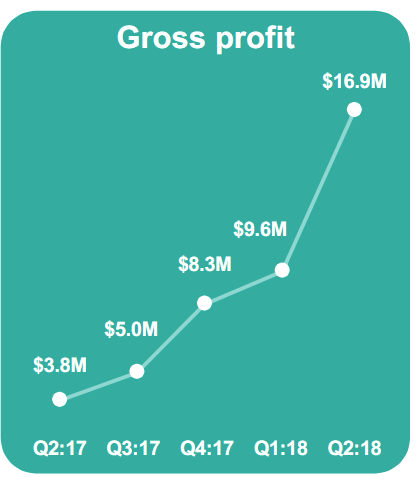

* Invitae achieved positive gross profit of $16.9 million in the second quarter of 2018 compared to a gross profit of $9.6 million in the first quarter of 2018, and $3.8 million gross profit in the second quarter of 2017.

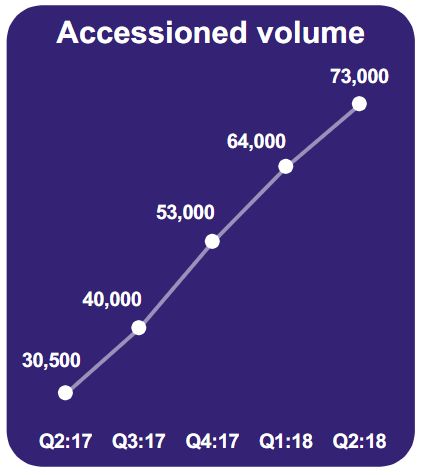

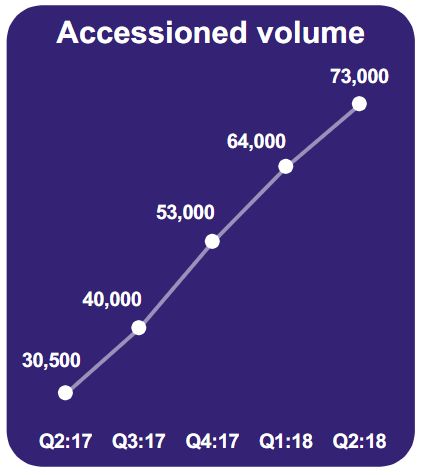

*Accessioned more than 73,000 samples in the second quarter of 2018, a 14% sequential increase over the first quarter of 2018 and a 139% increase over the 30,500 samples in the second quarter of 2017 (read: number of customers):

In total we are looking at 160% revenue growth, and 140% customer growth, year-over-year.

*Cash burn: The company is in on track to cut cash burn from Q1:18 by 40-50% by year-end, while revenue will be up over 100%.

*Need for capital: Sean said this openly on the earnings call, first the actual quote:

This is one point I asked for clarification, and I feel comfortable writing this (not a quote):

While exogenous unforeseen risk always exists, company has no intention of doing equity financing.

That was just a snapshot, now it's time to go beyond the snapshot, beyond what the headlines read, beyond what some of the bumbling analysts understand, and dive into the company -- and its future.

INVITAE

The company set a mantra several years back to become "The Amazon of Genomics." If they execute properly, Amazon's customer base will be a fraction of what Invitae has in front of it.

* In our prior talk, CEO Sean George said he believes the industry is going through "unqualifiedly the most unprecedented change in the history of our space."

And by that, he means that the old version of the test by test approach, or the "lab test," version of a business model, paid to answer specific questions at a specific time is over.

* He also said that the genetic diagnostic industry, as we know it is dead.

The future is a network, in which there will be essentially one winner, where information is used by the entire network and patients are treated throughout their lifetimes, likely, for some, from birth to death. Not to address just an one-time fear or event, but an entire life cycle.

In that vein, Sean firmly believes that:

To help illustrate this view of the world even further, Sean had some great things to say when we spoke a couple of quarters ago:

NEW INFORMATION

On the earnings call, a single line, maybe it's a phrase, had me sit up straight, and this was it:

I don't love the phrase "same store sales," simply because it leaves the observation up to analysts' imaginations. I prefer the term that every technology company in the world tries so hard to squeak into their earnings call: Recurring revenue.

I confirmed this with Sean -- that he was in fact alluding to a recurring revenue piece of the business based on that network they have built and are building.

Companies like Twilio (another Spotlight Top Pick) call it the "Dollar-Based Net Expansion Rate."

Invitae has grown its customer base by 140% while revenue has grown 160%. That is simply a reflection of a company that is building a moat through better technology (we'll look at that in a moment), immense insurance coverage (we'll look at that in a moment), a booming network (discussed above), and recurring revenue on top of organic growth.

The next step in the evolution of this bullish thesis is obvious: "How big is the addressable market? Here's a quote from Sean:

And now let's look at proof of the moat in three ways.

I. MOAT - TECHNOLOGY

I feel that the company should categorize itself as a genomics-technology company -- if it does not, Wall Street does not have the imagination to do it on its own.

We've spoken about recurring revenue and a network model -- which sounds a lot like a technology company, but we can also just be on the nose.

Here is what got from the earnings call (our emphasis added)

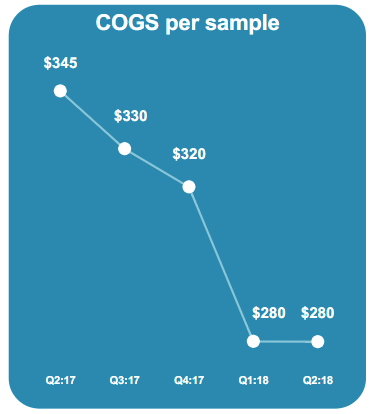

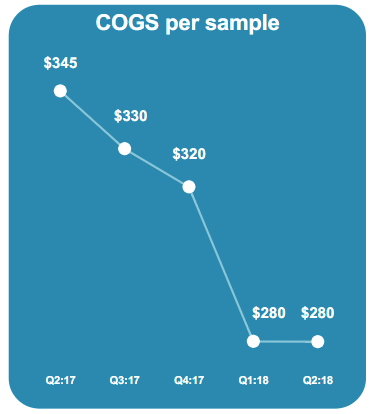

And the graphic that goes with that is the cost of goods sold (cost per test):

Better technology and economies of scale have pushed the average genetic test to $280, which is a 19% reduction year-over-year. If we take that $37.3 million in revenue and that $16.9 million in gross profit, that leaves us with 45% gross margin percent.

From the earnings call we learned that "if one strips out the one-time Medicare, gross margin would have been 42%." OK, good to know -- there was some one time collection of past due revenue (remember that, it's a part of the second moat), but in any case, margins are nearing a very special number.

* Special: The company's stated long-term goal, when I spoke with then CFO and now COO Lee Bendekgey, was 50% gross margin percent. With all the noise and moving parts, the company is on the verge of reaching it's long-term gross margin goals, already, while growing revenue at triple digit percent, customers at triple digit percent and gross profit at tripe digit percent.

II. MOAT - COVERAGE

When Sean said "this is going to be a winner take most industry," a part of that stems from the reality the getting payors (read insurance companies and medicare) to just pay for the tests that have been delivered is actually a real sticking point.

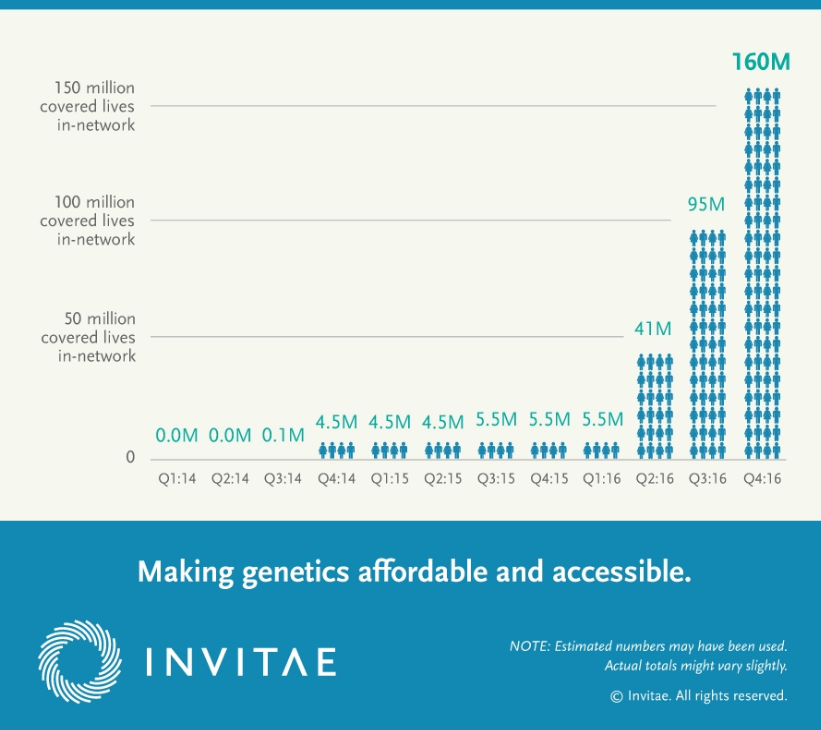

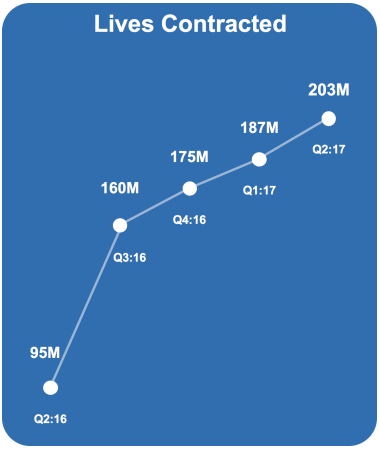

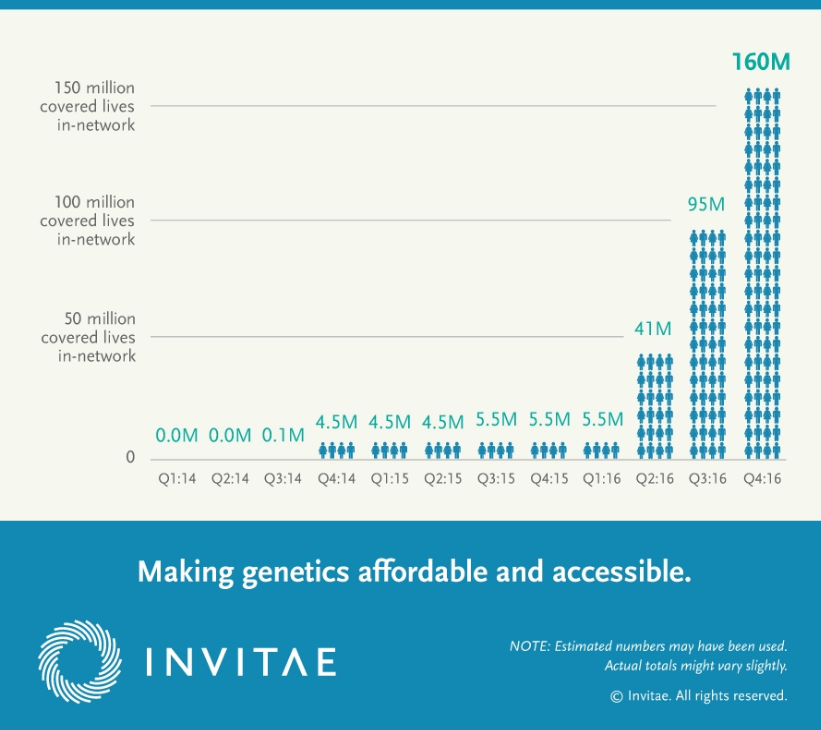

But Invitae has a special moat -- and here it is, in one old chart and one newer chart.

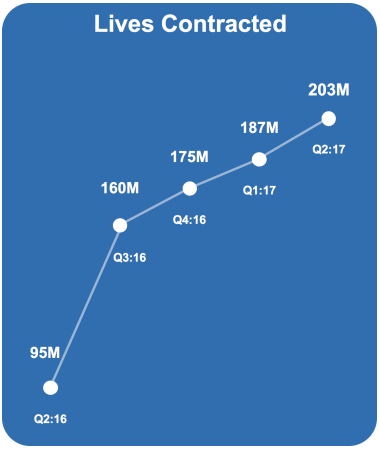

First, we start with lives contracted, which is a fancy way of measuring the number of people whose insurance covers the genetics test that Invitae provides, but this is from 2016.

And the most recent chart I could find looks like this:

Putting both charts together we can see that this wasn't an overnight success, this was painful years of work, but Invitae has gone from less than 5 million lives covered to 203 million, in two-years.

but from their financial disclosures, we get this: As of June 30, 2018, we have entered in to contracts for laboratory services with payers covering approximately 250 million lives, comprised of Medicare, most national health plans, and Medicaid in 30 states, including California (Medi-Cal), our home state.

When insurance covers a certain firm, the collections start to move more quickly, and I believe that is a part of what we saw with the accelerated past due revenue that Invitae received last quarter.

Invitae's tests are basically covered for "all" people.

In any case, this makes for moat number 2.

III. MOAT - NETWORK

There is no other genomics company that we're aware of that has even conceived of the idea of a network, not to mention building one. Inviate is singularly focused on this, and for good reason -- it's the basis for a multi billion dollar business.

Here is what the company presented and Sean re-iterated nearly a year ago.

* The best way to build the future, is a network of information managed on a patient in order to improve health care at a lower cost. The more patients we can get with more novel information with more industry partners to improve their outcomes.

* Like all new network business, the value of the network increases with each new patient, entry, data point.

This network has boomed. For the full year of 2104 it was 3,600 people. For the full year of 2017 it was 134,000 people, and over 220,000 with family history.

Now recall, according to Inviate, the addressable market for this network is all the people in modernized health care systems – that's 1-2 billion people.

This is the third moat.

WRAPPING IT UP

When I spoke with Sean in January of 2018, he said the following, and I can't think of a better way to conclude the analysis than simply, "what he said."

RISK

We must discuss risk -- it is incumbent upon all of us to understand the risk in any investment.

1. Invitae has enough cash to get to profitability if all things go according to plan, or even slightly slower, but if there are hiccups, the company will need to turn to the capital markets for more money and that could mean a stock sale.

2. Execution is a risk: While the company has lofty goals, there is competition from small, little heard of firms. Invitae has a powerful technology that is growing very quickly, but $140 million in revenue is hardly a flag stuck in the dirt for assured growth.

3. The stock price could whip around at a schizophrenic rate. This is a risky investment, with a very long-term view forward, which at the same time requires some babysitting in the near-term (that's our job) to make sure the company is hitting its goals.

InVitae Corp (NYSE:NVTA) is a risky investment. It's one of those few companies that might actually go away - that is, it has an existential risk to it, unlike most other companies which simply have a risk of under performance. But signs are pointing to the potential of a giant win.

The precious few thematic top picks for 2018, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author is long shares of Invitae at the time of this writing.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Invitae Wants to be the Amazon of Genomics, and It's Working

Invitae Wants to be the Amazon of Genomics, and It's Working

Date Published: 2018-08-15

Author: Ophir Gottlieb

Written by: Ophir Gottlieb

This is a snippet from the original CML Pro dossier published on 08-09-2018.

PROFILE

Invitae Corporation (NYSE:NVTA), is a genetic information company that focuses on bringing comprehensive genetic information into mainstream medical practice to enhance the quality of healthcare. (Source: Invitae)

Invitae is trying to set itself up as the Amazon of genome sequencing by making the process of ordering medical-grade tests so easy and cheap that testing for genetically inherited diseases becomes as simple as ordering books online. (Source: Economist)

LEDE

When technologies disrupt, it happens way faster than anyone thinks, and the stable denizens are the last to know.

- Sean George, CEO of Invitae

- Sean George, CEO of Invitae

We added Invitae to Top Picks on 1-Sep-16 for $7.42. As of this writing it is trading at $9.95, up 34.1%.

The company reported an earnings beat on revenue, EPS and gross profit, raised guidance and the stock has taken flight.

But, as always, I have my quarterly call with Sean George, CEO of Invitae, and he clarified some statements that were public but I felt needed to be more explicit for me to focus on.

The takeaway is that while Invitae still uses the phrase "cash burn," as it should, and that indicates serious risk, it is my belief that there may be less than five other companies in the world that literally have an addressable market the size of Facebook, Alphabet, and Apple. Invitae is one of those companies.

In fact, while Invitae notes that its current addressable market is about 1 billion people, we could make an argument that Invitae's addressable market is every born and and unborn person in the world, from now and into the future.

Further, we believe that this is a genomics-technology company, built on a network with recurring revenue coming in as its new customer base grows.

We urge the company to re-focus investors and analysts on its dual role -- and remind the world that it is a technology company, and a great one at that.

Let's talk about Invitae -- soup to nuts -- and my quick chat with Sean, with our other chats as additional substantiation of our bullish thesis.

THEMATICS

To motivate the discussion, we can first glance at the thematic that is genomics. This chart comes from Illumina, the hardware maker, and another Spotlight Top Pick.

Even with that chart, this is so early, that last bar of "> 7M" is likely to look like one of those other bars before it as the new data comes out. This is rounding error, even today, with respect to what's coming.

Or, I'll say it yet clearer, I think that bar will reach near 2 billion within 10 years.

Now, onto a snapshot at the past for Invitae -- that is, earnings results from this quarter and prior quarters' trends:

SNAPSHOT

* Quarterly revenue of $37.3 million in the second quarter of 2018, a 35% sequential increase over the first quarter of 2018 and a 161% increase over the second quarter of 2017 revenue of $14.3 million.

Here's the chart:

That was the graphic provided by the company, but I prefer ours a little more -- it has more history and we roll it up into trailing twelve month periods (read: annual revenue).

Our chart, however, does not yet have the latest quarter, so there is another bar to the right, substantially higher than the current.

* Revenue Guidance Invitae started the year out with a guide of "at least" $120 million in revenue for 2018. This is the the third consecutive raise:

Raising annual revenue guidance amid strong quarter performance from more than $130 million to between $135 and $140 million in 2018.

So, look back at the chart above, that ends at ~$85 million, and imagine a bar there at ~$137.5 million by year end.

Even further, Invitae has re-iterated it's longer term guidance that the company sees revenue doubling every year for the foreseeable future.

This is a $750 million market cap company, as of this writing, forecasting $500 million in sales in two and a half years (full 2020).

* Invitae achieved positive gross profit of $16.9 million in the second quarter of 2018 compared to a gross profit of $9.6 million in the first quarter of 2018, and $3.8 million gross profit in the second quarter of 2017.

*Accessioned more than 73,000 samples in the second quarter of 2018, a 14% sequential increase over the first quarter of 2018 and a 139% increase over the 30,500 samples in the second quarter of 2017 (read: number of customers):

In total we are looking at 160% revenue growth, and 140% customer growth, year-over-year.

*Cash burn: The company is in on track to cut cash burn from Q1:18 by 40-50% by year-end, while revenue will be up over 100%.

*Need for capital: Sean said this openly on the earnings call, first the actual quote:

With a more than $110M in capital available to us, we have all we need to further drive the fundamentals of our business.

This is one point I asked for clarification, and I feel comfortable writing this (not a quote):

While exogenous unforeseen risk always exists, company has no intention of doing equity financing.

That was just a snapshot, now it's time to go beyond the snapshot, beyond what the headlines read, beyond what some of the bumbling analysts understand, and dive into the company -- and its future.

INVITAE

The company set a mantra several years back to become "The Amazon of Genomics." If they execute properly, Amazon's customer base will be a fraction of what Invitae has in front of it.

* In our prior talk, CEO Sean George said he believes the industry is going through "unqualifiedly the most unprecedented change in the history of our space."

And by that, he means that the old version of the test by test approach, or the "lab test," version of a business model, paid to answer specific questions at a specific time is over.

* He also said that the genetic diagnostic industry, as we know it is dead.

The future is a network, in which there will be essentially one winner, where information is used by the entire network and patients are treated throughout their lifetimes, likely, for some, from birth to death. Not to address just an one-time fear or event, but an entire life cycle.

In that vein, Sean firmly believes that:

"[The] best way to build the future, is a network of information managed on a patient in order to improve health care at a lower cost. The more patients we can get with more novel information with more industry partners to improve their outcomes."

To help illustrate this view of the world even further, Sean had some great things to say when we spoke a couple of quarters ago:

That will basically move the entire world from an one-test, one-sample, one-person, type of business which is known today as genetic testing, to a feature which is where everybody in modernized care, roughly a billion plus people, at some point and time in their life get into our sphere of influence and we get information on them and we manage information on them on behalf of and in context of their care ... and that is an incredibly valuable business that we think we can build.

And in building that new business, building that new industry, the nice thing about going through the pain of all of this is once we build it and once we hit a certain scale, there is a network effect that will be put in place, where there will be no catching us.

In fact, right now we suspect we are already there on our infrastructure because of our cost advantage of providing genetic testing and managing it, we don't see anybody gearing up to do so, and we're absolutely confident that at some scale, and the ability to demonstrate the value of that network beyond just the initial genetic testing.

It will be apparent and obvious to everybody that we have created this new industry, are a clear runaway leader in it, and by the way, there will be no close second.

This is going to be a winner take most industry. That is what the true value potential of this business is. The faster we get there, the faster that we believe we will see that value inflection point happens.

And in building that new business, building that new industry, the nice thing about going through the pain of all of this is once we build it and once we hit a certain scale, there is a network effect that will be put in place, where there will be no catching us.

In fact, right now we suspect we are already there on our infrastructure because of our cost advantage of providing genetic testing and managing it, we don't see anybody gearing up to do so, and we're absolutely confident that at some scale, and the ability to demonstrate the value of that network beyond just the initial genetic testing.

It will be apparent and obvious to everybody that we have created this new industry, are a clear runaway leader in it, and by the way, there will be no close second.

This is going to be a winner take most industry. That is what the true value potential of this business is. The faster we get there, the faster that we believe we will see that value inflection point happens.

NEW INFORMATION

On the earnings call, a single line, maybe it's a phrase, had me sit up straight, and this was it:

We know we can effectively drive same-store sales once we bring on a new account. So this is a key indicator of market growth potential.

I don't love the phrase "same store sales," simply because it leaves the observation up to analysts' imaginations. I prefer the term that every technology company in the world tries so hard to squeak into their earnings call: Recurring revenue.

I confirmed this with Sean -- that he was in fact alluding to a recurring revenue piece of the business based on that network they have built and are building.

Companies like Twilio (another Spotlight Top Pick) call it the "Dollar-Based Net Expansion Rate."

Invitae has grown its customer base by 140% while revenue has grown 160%. That is simply a reflection of a company that is building a moat through better technology (we'll look at that in a moment), immense insurance coverage (we'll look at that in a moment), a booming network (discussed above), and recurring revenue on top of organic growth.

The next step in the evolution of this bullish thesis is obvious: "How big is the addressable market? Here's a quote from Sean:

With an addressable market of more than one billion people in the modern medical systems worldwide, we continue to face a huge opportunity to lead the effort in delivering genetic information to and from health care across all stages of life.

And now let's look at proof of the moat in three ways.

I. MOAT - TECHNOLOGY

I feel that the company should categorize itself as a genomics-technology company -- if it does not, Wall Street does not have the imagination to do it on its own.

We've spoken about recurring revenue and a network model -- which sounds a lot like a technology company, but we can also just be on the nose.

Here is what got from the earnings call (our emphasis added)

At the end of June, we were able to leverage our technology infrastructure to introduce an industry-leading expanded carrier screen that we developed in less than three quarters.

And the graphic that goes with that is the cost of goods sold (cost per test):

Better technology and economies of scale have pushed the average genetic test to $280, which is a 19% reduction year-over-year. If we take that $37.3 million in revenue and that $16.9 million in gross profit, that leaves us with 45% gross margin percent.

From the earnings call we learned that "if one strips out the one-time Medicare, gross margin would have been 42%." OK, good to know -- there was some one time collection of past due revenue (remember that, it's a part of the second moat), but in any case, margins are nearing a very special number.

* Special: The company's stated long-term goal, when I spoke with then CFO and now COO Lee Bendekgey, was 50% gross margin percent. With all the noise and moving parts, the company is on the verge of reaching it's long-term gross margin goals, already, while growing revenue at triple digit percent, customers at triple digit percent and gross profit at tripe digit percent.

II. MOAT - COVERAGE

When Sean said "this is going to be a winner take most industry," a part of that stems from the reality the getting payors (read insurance companies and medicare) to just pay for the tests that have been delivered is actually a real sticking point.

But Invitae has a special moat -- and here it is, in one old chart and one newer chart.

First, we start with lives contracted, which is a fancy way of measuring the number of people whose insurance covers the genetics test that Invitae provides, but this is from 2016.

And the most recent chart I could find looks like this:

Putting both charts together we can see that this wasn't an overnight success, this was painful years of work, but Invitae has gone from less than 5 million lives covered to 203 million, in two-years.

but from their financial disclosures, we get this: As of June 30, 2018, we have entered in to contracts for laboratory services with payers covering approximately 250 million lives, comprised of Medicare, most national health plans, and Medicaid in 30 states, including California (Medi-Cal), our home state.

When insurance covers a certain firm, the collections start to move more quickly, and I believe that is a part of what we saw with the accelerated past due revenue that Invitae received last quarter.

Invitae's tests are basically covered for "all" people.

In any case, this makes for moat number 2.

III. MOAT - NETWORK

There is no other genomics company that we're aware of that has even conceived of the idea of a network, not to mention building one. Inviate is singularly focused on this, and for good reason -- it's the basis for a multi billion dollar business.

Here is what the company presented and Sean re-iterated nearly a year ago.

* The best way to build the future, is a network of information managed on a patient in order to improve health care at a lower cost. The more patients we can get with more novel information with more industry partners to improve their outcomes.

* Like all new network business, the value of the network increases with each new patient, entry, data point.

This network has boomed. For the full year of 2104 it was 3,600 people. For the full year of 2017 it was 134,000 people, and over 220,000 with family history.

Now recall, according to Inviate, the addressable market for this network is all the people in modernized health care systems – that's 1-2 billion people.

This is the third moat.

WRAPPING IT UP

When I spoke with Sean in January of 2018, he said the following, and I can't think of a better way to conclude the analysis than simply, "what he said."

[We are] building that new business, building that new industry, the nice thing about going through the pain of all of this is once we build it and once we hit a certain scale, there is a network effect that will be put in place, where there will be no catching us.

In fact right now we suspect we are already there.

It will be apparent and obvious to everybody that we have created this new industry, are a clear runaway leader in it, and by the way, there will be no close second.

That is what the true value potential of this business is. The faster we get there, the faster that we believe we will see that value inflection point happens.

From an investor perspective, we see that as the value of the company and that's we are building it and the sooner it will show up for investors the sooner people realize that is the case.

In fact right now we suspect we are already there.

It will be apparent and obvious to everybody that we have created this new industry, are a clear runaway leader in it, and by the way, there will be no close second.

That is what the true value potential of this business is. The faster we get there, the faster that we believe we will see that value inflection point happens.

From an investor perspective, we see that as the value of the company and that's we are building it and the sooner it will show up for investors the sooner people realize that is the case.

RISK

We must discuss risk -- it is incumbent upon all of us to understand the risk in any investment.

1. Invitae has enough cash to get to profitability if all things go according to plan, or even slightly slower, but if there are hiccups, the company will need to turn to the capital markets for more money and that could mean a stock sale.

2. Execution is a risk: While the company has lofty goals, there is competition from small, little heard of firms. Invitae has a powerful technology that is growing very quickly, but $140 million in revenue is hardly a flag stuck in the dirt for assured growth.

3. The stock price could whip around at a schizophrenic rate. This is a risky investment, with a very long-term view forward, which at the same time requires some babysitting in the near-term (that's our job) to make sure the company is hitting its goals.

InVitae Corp (NYSE:NVTA) is a risky investment. It's one of those few companies that might actually go away - that is, it has an existential risk to it, unlike most other companies which simply have a risk of under performance. But signs are pointing to the potential of a giant win.

THIS MATTERS

It's understanding technology that gets us an edge to find the "next Apple," or the "next Amazon." This is what CML Pro does. We are members of Thomson First Call -- our research sits side by side with Goldman Sachs, Morgan Stanley and the rest, but we are the anti-institution and break the information asymmetry.The precious few thematic top picks for 2018, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author is long shares of Invitae at the time of this writing.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.