Technical Short Put Spread Fade the Dip Trade and Trigger in Ping Identity Holding Corp

Ping Identity Holding Corp (NYSE:PING) : Technical Short Put Spread Fade the Dip Trade and Trigger

Date Published: 2022-03-24

Disclaimer

The results here are provided for general informational purposes from the CMLviz Trade Machine Stock Option Backtester as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.Preface

While some traders like to "Buy the Dip" (BTFD), and we have a model for that event, sometimes it can be prudent to take a less aggressive tack.In this case we ok for tbut seek a higher win rate strategy than buying a call. Looking to "fade the dip" is a fancy way of saying, we examined a straegy that looks to profit if a stock "doesn't go down very much," after bouncing out of technical failure, as opposed to getting aggressively long by buying the dip.

This strategy looks to win if the stock goes up or even if it just doesn't go down very much. It's profit zone is signifantly larger than just buying a call, but its upside is limited relative to a long call. The result is a higher average win rates for a trade off of smaller average win amounts.

Whether it's buying the dip or fading the dip, this only works if a stock in a down trend actually reverses to a rally or at the very least, doesn't drop back down into techncial failure.

We focused our testing specifically on the trigger that identifies a stock in a down channel and when the selling pressure has eased and the stock may be ready for a bounce or a steady state. In other words, we focused less on a simplistic mantra of "buy the dip," and more on the empirical view of "when the dip might is over."

After rigorous testing over multiple time periods and over 100,000 back-tests, today we demonstrate the technical conditions that have provided a strong short-term 'not bearish' trigger for Ping Identity Holding Corp (NYSE:PING) , as well as, broadly speaking, the Nasdaq 100 index constituents over the ten year period from 2009-2019.

Find today's option triggers today. Tap here to finally find the trading outcomes you've been looking for.

Logic

It doesn't matter if PING is in a downtrend right now. What matters is what has happened historically when that time comes, because it will come again.Fade the Dip Trigger: The Option Trade with Technical Analysis and Moving Averages in Ping Identity Holding Corp (NYSE:PING) .

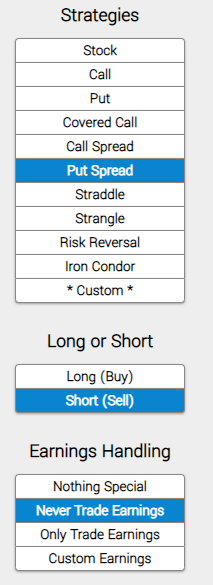

We will examine the outcome of going short an out-of-the-money putg spead by selling the 40 delta strike and buying the 30 delta delta strike in options that are the closest to 30-days from expiration (using calendar days). But we follow three rules:* Never Trade Earnings

Let's not worry about earnings. Here it is, first, we enter the long call.

Use a technical trigger to start the trade, if and only if these specific items are met.

Trigger is here: [Trade Machine members only]

You can set an alert in Trade Machine®, which will track all of these moving parts for you. Let Trade Machine do the work for you -- there's no need to stare at the screen.

* Finally, we set a very specific type of limit:

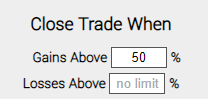

* Use a 50% limit and no stop.

At the end of each day, the back-tester checks to see if the 30-day short put spread has seen a 50% gain (it has gone down in value by 50% or more). If it has, it closes the position. As an example, of a put spread was sold at $1.00 and in a week it had dropped to $0.50, it would purchased to close with that 50% win on the initial credit.

Fade the Dip: 5-year Stock Option Backtester Results in Ping Identity Holding Corp

Here are the results of opening a 30-day short put spread, using the 40 delta / 30 delta as the strike prices, over the last five-years once this "fade the dip" trigger has fired:

| PING: Short 40/30 Delta Put Spread | |||

| % Wins: | 83.00% | ||

| Wins: 5 | Losses: 1 | ||

| % Return: | 74.6% | ||

Tap Here to See the Back-test

We're now looking at 74.6% returns, on 5 winning trades and 1 losing trades.

➡ The average percent return over the last year per trade was 17.18%.

RESULTS

Here are the results for the 30-day short put spread over the last three-years in Ping Identity Holding Corp:| PING: Short 40/30 Delta Put Spread | |||

| % Wins: | 83% | ||

| Wins: 5 | Losses: 1 | ||

| % Return: | 74.6% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

Setting Expectations

While this strategy had an overall return of 74.6%, the trade details keep us in bounds with expectations:➡ The average percent return per trade was 17.18% for each 30-day period.

Checking the Moving Average

You can check to see the values of all the moving averages discussed above with real-time daily prices, including live after hours prices, for PING by viewing the Pivot Points tab on www.CMLviz.com.Now we can look at just the last year as well:

| PING: Short 40/30 Delta Put Spread | |||

| % Wins: | 75.00% | ||

| Wins: 3 | Losses: 1 | ||

| % Return: | 32.5% | ||

Tap Here to See the Back-test

We're now looking at 32.5% returns, on 3 winning trades and 1 losing trades.

➡ The average percent return over the last year per trade was 14.15%.

Next Steps

Find tomorrow's option trades triggers today. For that matter, find today's option triggers today. Tap here to finally find the trading outcomes you've been looking for.Risk Disclosure

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

You should read the Characteristics and Risks of Standardized Options.