Children's Place Inc (The), PLCE, earnings, option, before, stock

Written by: Ophir Gottlieb

Preface

We have identified a number of bullish patterns ahead of earnings but today we take a more rounded approach. With the market's direction becoming tenuous, we can explore option trading opportunities in Children's Place Inc (The) (NASDAQ:PLCE) that do not rely on stock direction.

It turns out, over the long-run, there is a clever way to trade both market anxiety or market optimism before earnings announcements with options and not take a stock direction bet.

This approach has returned 56.3% with a total holding period of just 40 days, and has been a winner 7 of the last 8 earnings cycles.

While NASDAQ has PLCE earnings due out 8-16-2017, we see the company clearly has the date set for 8-9-2017, so we will go with the date straight form the source.

The Trade Before Earnings that Takes no Stock Direction Position

What a trader wants to do is to see the results of buying an at the money straddle a few days before earnings, and then sell that straddle just before earnings. The goal is to benefit from a unique and very short time frame when the stock might move 'a lot', either due to earnings anxiety (stock drops before earnings) or earnings optimism (stock rises before earnings), but taking no actual earnings risk.

This trade is not a panacea, which is to say, we have to test it, stock by stock, to see when and why it worked. We start with Children's Place Inc (The).

Here is the setup:

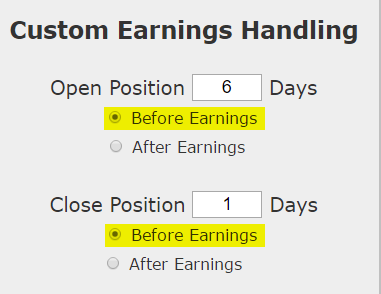

We are testing opening the position 6 calendar days before earnings and then closing the position 1-day before earnings. This is not making any earnings bet. This is not making any stock direction bet.

If earnings are in fact due on 8-9-2017, then to replicate the back-test this time around, the position would open 8-3-2017 near the close.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

Returns

If we did this long at-the-money (also called '50-delta') straddle in Children's Place Inc (The) (NASDAQ:PLCE) over the last two-years but only held it before earnings we get these results:

Tap Here to See the back-test

We see a 56.3% return, testing this over the last 8 earnings dates in Children's Place Inc (The). That's a total of just 40 days (5 days for each earnings date, over 8 earnings dates).

We can also see that this strategy hasn't been a winner all the time, rather it has won 7 times and lost 7 time, for a 87.5% win-rate and again, that 56% return in less than two-full months of trading.

Setting Expectations

While this strategy has an overall return of 56.3%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 9.3% over five-days.

Option Trading in the Last Year

We can also look at the last year of earnings releases and examine the results:

Tap Here to See the back-test

In the latest year this pre-earnings option trade has 4 wins and lost 0 times and returned 39.1% which annualizes to over 700% .

➡ Over just the last year, the average percent return per trade was 12.1% over five-days.

MORE TO IT THAN MEETS THE EYE

While this strategy is benefiting from the implied volatility rise into earnings, what it's really doing is far more intelligent.

The option prices for the at-the-money straddle will show very little time decay over this 5-day period, so what this strategy really does is buy "five days" of potential stock movement with what is actually fairly small downside risk.

That means the ideal stocks for this strategy have a couple of common characteristics:

(i) The companies rarely pre-announce earnings -- this is an investment that does not look to make an earnings bet, so an earnings pre-announcement is the opposite of what we're hoping for.

(ii) The underlying stock price of these companies tend to move a lot (or some) as earnings approach and various institutions and traders shuffle the stock price around in anticipation of the earnings result. The more one sided the outside world starts betting on direction -- up or down, the better it is to own the straddle.

WHAT HAPPENED

This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Avoid Bear Market Risk: The Secret to Option Trading Before Earnings in Children's Place Inc (The)

Children's Place Inc (The) (NASDAQ:PLCE) : Avoid Bear Market Risk: The Secret to Option Trading Before Earnings

Date Published: 2017-08-3Author: Ophir Gottlieb

Written by: Ophir Gottlieb

Preface

We have identified a number of bullish patterns ahead of earnings but today we take a more rounded approach. With the market's direction becoming tenuous, we can explore option trading opportunities in Children's Place Inc (The) (NASDAQ:PLCE) that do not rely on stock direction.

It turns out, over the long-run, there is a clever way to trade both market anxiety or market optimism before earnings announcements with options and not take a stock direction bet.

This approach has returned 56.3% with a total holding period of just 40 days, and has been a winner 7 of the last 8 earnings cycles.

While NASDAQ has PLCE earnings due out 8-16-2017, we see the company clearly has the date set for 8-9-2017, so we will go with the date straight form the source.

The Trade Before Earnings that Takes no Stock Direction Position

What a trader wants to do is to see the results of buying an at the money straddle a few days before earnings, and then sell that straddle just before earnings. The goal is to benefit from a unique and very short time frame when the stock might move 'a lot', either due to earnings anxiety (stock drops before earnings) or earnings optimism (stock rises before earnings), but taking no actual earnings risk.

This trade is not a panacea, which is to say, we have to test it, stock by stock, to see when and why it worked. We start with Children's Place Inc (The).

Here is the setup:

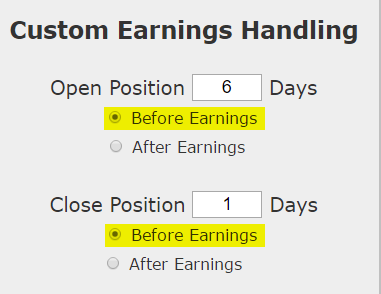

We are testing opening the position 6 calendar days before earnings and then closing the position 1-day before earnings. This is not making any earnings bet. This is not making any stock direction bet.

If earnings are in fact due on 8-9-2017, then to replicate the back-test this time around, the position would open 8-3-2017 near the close.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

Returns

If we did this long at-the-money (also called '50-delta') straddle in Children's Place Inc (The) (NASDAQ:PLCE) over the last two-years but only held it before earnings we get these results:

| PLCE Long At-the-Money Straddle |

|||

| % Wins: | 87.5% | ||

| Wins: 7 | Losses: 1 | ||

| % Return: | 56.3% | ||

Tap Here to See the back-test

We see a 56.3% return, testing this over the last 8 earnings dates in Children's Place Inc (The). That's a total of just 40 days (5 days for each earnings date, over 8 earnings dates).

We can also see that this strategy hasn't been a winner all the time, rather it has won 7 times and lost 7 time, for a 87.5% win-rate and again, that 56% return in less than two-full months of trading.

Setting Expectations

While this strategy has an overall return of 56.3%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 9.3% over five-days.

Option Trading in the Last Year

We can also look at the last year of earnings releases and examine the results:

| PLCE Long At-the-Money Straddle |

|||

| % Wins: | 100.00% | ||

| Wins: 4 | Losses: 0 | ||

| % Return: | 39.1% | ||

Tap Here to See the back-test

In the latest year this pre-earnings option trade has 4 wins and lost 0 times and returned 39.1% which annualizes to over 700% .

➡ Over just the last year, the average percent return per trade was 12.1% over five-days.

MORE TO IT THAN MEETS THE EYE

While this strategy is benefiting from the implied volatility rise into earnings, what it's really doing is far more intelligent.

The option prices for the at-the-money straddle will show very little time decay over this 5-day period, so what this strategy really does is buy "five days" of potential stock movement with what is actually fairly small downside risk.

That means the ideal stocks for this strategy have a couple of common characteristics:

(i) The companies rarely pre-announce earnings -- this is an investment that does not look to make an earnings bet, so an earnings pre-announcement is the opposite of what we're hoping for.

(ii) The underlying stock price of these companies tend to move a lot (or some) as earnings approach and various institutions and traders shuffle the stock price around in anticipation of the earnings result. The more one sided the outside world starts betting on direction -- up or down, the better it is to own the straddle.

WHAT HAPPENED

This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.