QUALCOMM Incorporated, WYNN, market, earnings, risk, results, options, bull, stock, trading

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

Preface

With volatility spiking and market direction becoming tenuous, we can explore option trading opportunities in QUALCOMM Incorporated, Limited (NASDAQ:QCOM) that do not rely on stock direction. Above and beyond this back-test, QCOM has been in a wild period of attempted acquisitions and attempts to be acquired.

The goal is to find trades that expose risk in short-bursts of time, with out-sized historical gains relative to historical losses and so far, over the last two-years, we have seen exactly that. While these types of back-tests don't get the headline news, this has been a clever approach to a heavily volatile market.

This back-test shows a 133% return with 6 wins and 2 losses over the last two-years in QCOM over each 5-day period before earnings. QCOM earnings are due out om 4-25-2018 after the market closes, you can set an alert for 5-days before in the body of this article, below, after the back-test results are shared.

Pay special attention to the size of historical losses compared to the size of historical wins.

The Trade Before Earnings in QUALCOMM Incorporated, Limited

Let's examine the results of getting long a weekly at the money straddle 5-calendar days days before earnings, and then sell out of that position one-day before the actual release earnings.

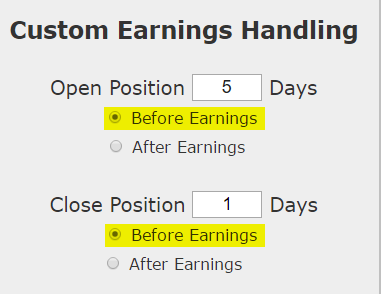

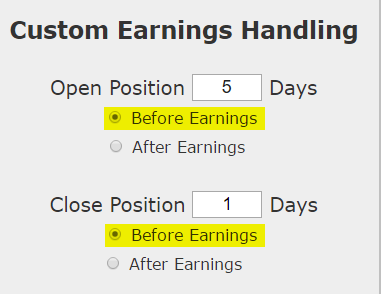

Here is the setup:

We are testing opening the position 5 calendar days pre-earnings event and then closing the straddle 1 day before earnings. This is not making any earnings bet. This is not making any stock direction bet.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

Returns

If we did this long at-the-money (also called '50-delta') straddle (using the options closest to one-week in expiration) in QUALCOMM Incorporated, Limited (NASDAQ:QCOM) over the last two-years but only held it before earnings we get these results:

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

Setting Expectations

While this strategy has an overall return of 133%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 22.7% over each five-day period.

➡ The average percent return per winning trade was 33.9% over each five-day period.

➡ The average percent return per losing trade was -10.7 over each five-day period.

Tested Across Bull and Bear Markets

While many times we can identify strategies that work during a bull or a bear market, this strategy, when we tested it empirically, worked during both. Here are the specifics:

Using the Nasdaq 100 and the Dow 30 as our study group, here are the average total returns by stock for the bull market from 2012-2018 (January) and 2007-2009, which includes the bear market, and the wild 2009 -- where the S&P 500 bottomed in March and then ripped higher -- in other words, a highly volatile time in the market.

As a quick reminder, here is the 2007-2009 period for the S&P 500:

Since we are looking at total returns, it turns out those time periods show nearly identical results (2012-2018 was six-years and 2007-2009 was three-years). Yet more impressive, the strategy showed a 57% win rate by stock during the wildly volatile 2007-2009 market.

These results are empirical, which is to say, they are objective. We are not inserting opinion.

WHAT HAPPENED

We don't always have to look at bullish back-tests in a bull market -- sometimes a straight down the middle volatility pattern pops up. This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

The Remarkable: Short Bursts of Risk Exposure Create Opportunity in QUALCOMM Incorporated

The Remarkable: Short Bursts of Risk Exposure Create Opportunity in QUALCOMM Incorporated

Date Published: 2018-03-29Author: Ophir Gottlieb

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

Preface

With volatility spiking and market direction becoming tenuous, we can explore option trading opportunities in QUALCOMM Incorporated, Limited (NASDAQ:QCOM) that do not rely on stock direction. Above and beyond this back-test, QCOM has been in a wild period of attempted acquisitions and attempts to be acquired.

The goal is to find trades that expose risk in short-bursts of time, with out-sized historical gains relative to historical losses and so far, over the last two-years, we have seen exactly that. While these types of back-tests don't get the headline news, this has been a clever approach to a heavily volatile market.

This back-test shows a 133% return with 6 wins and 2 losses over the last two-years in QCOM over each 5-day period before earnings. QCOM earnings are due out om 4-25-2018 after the market closes, you can set an alert for 5-days before in the body of this article, below, after the back-test results are shared.

Pay special attention to the size of historical losses compared to the size of historical wins.

The Trade Before Earnings in QUALCOMM Incorporated, Limited

Let's examine the results of getting long a weekly at the money straddle 5-calendar days days before earnings, and then sell out of that position one-day before the actual release earnings.

Here is the setup:

We are testing opening the position 5 calendar days pre-earnings event and then closing the straddle 1 day before earnings. This is not making any earnings bet. This is not making any stock direction bet.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

Returns

If we did this long at-the-money (also called '50-delta') straddle (using the options closest to one-week in expiration) in QUALCOMM Incorporated, Limited (NASDAQ:QCOM) over the last two-years but only held it before earnings we get these results:

| QCOM Long At-the-Money Straddle |

|||

| % Wins: | 75% | ||

| Wins: 6 | Losses: 2 | ||

| % Return: | 133% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

Track this trade idea. Get alerted for ticker `QCOM` 5 days before earnings

Setting Expectations

While this strategy has an overall return of 133%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 22.7% over each five-day period.

➡ The average percent return per winning trade was 33.9% over each five-day period.

➡ The average percent return per losing trade was -10.7 over each five-day period.

Tested Across Bull and Bear Markets

While many times we can identify strategies that work during a bull or a bear market, this strategy, when we tested it empirically, worked during both. Here are the specifics:

Using the Nasdaq 100 and the Dow 30 as our study group, here are the average total returns by stock for the bull market from 2012-2018 (January) and 2007-2009, which includes the bear market, and the wild 2009 -- where the S&P 500 bottomed in March and then ripped higher -- in other words, a highly volatile time in the market.

As a quick reminder, here is the 2007-2009 period for the S&P 500:

| Time Period | Return by Stock |

| 2012-2018 (January) | +40% |

| 2007-2009 | +21% |

Since we are looking at total returns, it turns out those time periods show nearly identical results (2012-2018 was six-years and 2007-2009 was three-years). Yet more impressive, the strategy showed a 57% win rate by stock during the wildly volatile 2007-2009 market.

These results are empirical, which is to say, they are objective. We are not inserting opinion.

WHAT HAPPENED

We don't always have to look at bullish back-tests in a bull market -- sometimes a straight down the middle volatility pattern pops up. This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.