Trading Options in the PowerShares QQQ Trust, Series 1 (ETF)(NASDAQ:QQQ)

Being Better

Date Published: 2017-02-13Written by Ophir Gottlieb

Preface

It's a fair question -- does selling put spreads in the Nasdaq 100 (QQQ) work, and if so, how do we optimize the results?

ANSWER

We start with a simple test -- selling out of the money put spreads in PowerShares QQQ Trust, Series 1 (ETF)(NASDAQ:QQQ) over the last two-years using weekly options. Here are the results:

That approach returned 56.5% in two-years with a 74% win rate. But the next questions follow a deeper more intelligent narrative -- can we do better?

DOING BETTER

Next we will examine that same strategy, but we'll use monthly options rather than weekly. This will reduce our commissions and trading frequency.

We see a huge jump in the return from 56% to 83%. Even more, we see our win rate rise from 74% to 84.6%. But, we're not done. Trading is about precision, and our next gut check is to put in a stop loss.

DOING EVEN BETTER

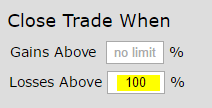

We run the same test, using monthly options, but this time we put in a stop loss at 100% for the trade in PowerShares QQQ Trust, Series 1 (ETF)(NASDAQ:QQQ). Remember, selling a put spread can lose much more than 100% while it can only gain a maximum of 100%, so what we're doing here is evening our our profit and loss distribution curve.

Here's the setting we put in:

And here are the results:

The return jumps to 120% and we have actually reduced the risk of the trade by putting in a stop loss. This is trading, friends. Now it's your turn.

Now we can see that while 99% of traders likely did the poorer version of this trade or simply skipped it, they were wrong and you can be right. This is why:

We've just seen an explicit demonstration of the fact that there's a lot less 'luck' and a lot more planning in successful option trading than many people realize. Here is a quick 3-minute demonstration video that will change your option trading life forever: Tap here to see the demo movie

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.