Profiting From Volatility Before Earnings in Regeneron Pharmaceuticals Inc

Regeneron Pharmaceuticals Inc (NASDAQ:REGN) : Side-Stepping Stock Direction Risk in Option Trading Before Earnings

Date Published: 2018-04-11Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

Preface

We respect the volatile nature of the market -- and then look to find strategies that have benefited from it in the past.

For the investor that feel as though the market's direction is becoming tenuous, we can explore an option trading opportunity in Regeneron Pharmaceuticals Inc (NASDAQ:REGN) that does not rely on stock direction at all.

The bumpier the market gets the better for this approach. According to our earnings date provider, Wall Street Horizon, REGN has earnings due out on 5-3-2018, before the market opens. 14-days before then would be 4-19-2018.

Before we get to the details, here is an one-year stock chart of REGN. We have highlighted the 14-days before earnings in a blue box and the actual earnings dates with a "E" icon.

This helps us see rather clearly how much volatility the stock has tended to have the two-weeks before earnings and why the option strategy we discuss below has been so successful.

The Trade Before Earnings: When it Works

What a trader wants to do is to see the results of buying a near the money (just a little out of the money) strangle two-weeks before earnings, and then sell that strangle just before earnings.

The goal of this type of trade is to benefit from a unique and short time frame when the stock might move 'a lot', either due to earnings anxiety (stock drops before earnings) or earnings optimism (stock rises before earnings), but taking no actual earnings risk.

Here is the setup:

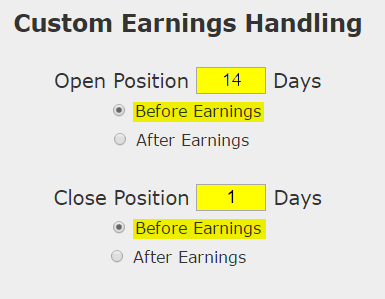

We are testing opening the position 14 calendar days before earnings and then closing the position 1 day before earnings. This is not making any earnings bet. This is not making any stock direction bet.

Once we apply that simple rule to our back-test, we run it on a near-the-money strangle (long a 40 delta call and long a 40 delta put):

Returns

If we did this long near-the-money strangle in Regeneron Pharmaceuticals Inc (NASDAQ:REGN) over the last two-years but only held it before earnings we get these results:

| REGN Long 40 Delta Strangle |

|||

| % Wins: | 87.5% | ||

| Wins: 7 | Losses: 1 | ||

| % Return: | 514% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

Track this trade idea. Get alerted for ticker `REGN` 14 days before earnings

We see a 514.1% return, testing this over the last 8 earnings dates in Regeneron Pharmaceuticals Inc.

Setting Expectations

While this strategy has an overall return of 514%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 72% over 13-days.

➡ The average percent return per winning trade was 85.9% over 13-days.

➡ The average percent return for the losing trade was -25% over 13-days.

Option Trading in the Last Year

We can also look at the last year of earnings releases and examine the results:

| REGN Long 40 Delta Strangle |

|||

| % Wins: | 100.00% | ||

| Wins: 4 | Losses: 0 | ||

| % Return: | 346% | ||

In the latest year this pre-earnings option trade has 4 wins and lost 0 times and returned 346%.

➡ Over just the last year, the average percent return per trade was 78.5% for each 13-day trade.

WHAT HAPPENED

We don't always have to look at bullish back-tests in a bull market -- sometimes a straight down the middle volatility pattern pops up. This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.