Roku, GOOGL, AAPL, hours, year, platform, streaming, revenue, content, video

Date Published: 2018-06-08

Written by: Ophir Gottlieb

This is a snippet from the original CML Pro dossier published on 5-11-2018.

LEDE

ROKU beat earnings estimates, but the earnings results were the smaller story. Roku (NASDAQ:ROKU) is on the verge of becoming the operating system to streaming video - and that is a massive opportunity.

STORY

ROKU is a Spotlight Top Pick and we cover the broad, far-reaching bullish thesis in the Top Pick dossier The Tech Gem Looking to Dominate Streaming Video.

ROKU is building a business based on users and if we measured them as a cable provider, as of right now, they would be the third largest cable provider in the country behind just Comcast and AT&T -- that's how many people and how much content they serve, already.

Further, the number of accounts for ROKU rose 47% while Comcast and AT&T are essentially flat. All of this is driven by the large secular shift by consumers to streaming video and away from linear TV.

Check out this video consumption pattern forecast:

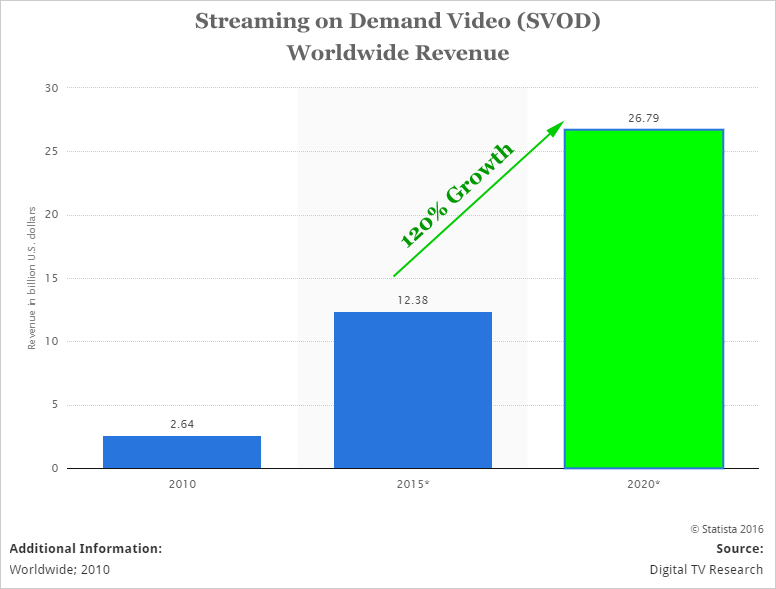

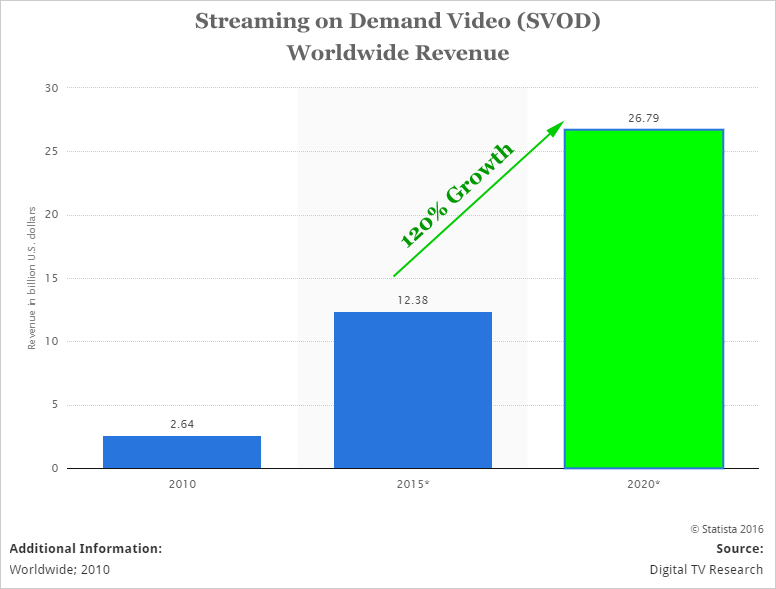

And then straight to SVOD revenue forecasts.

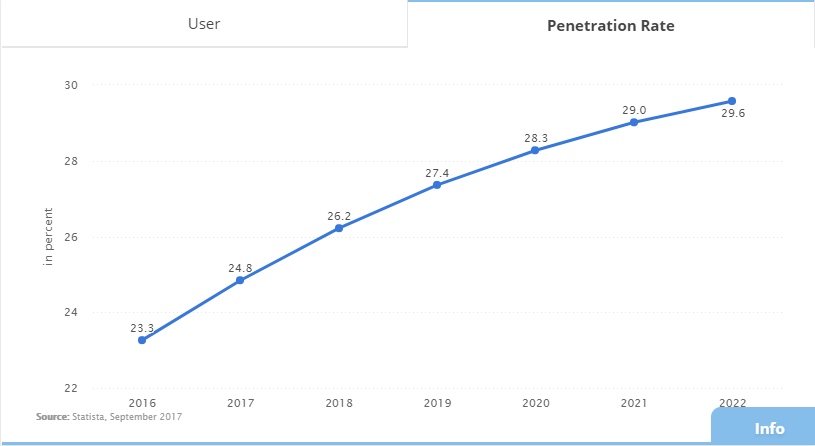

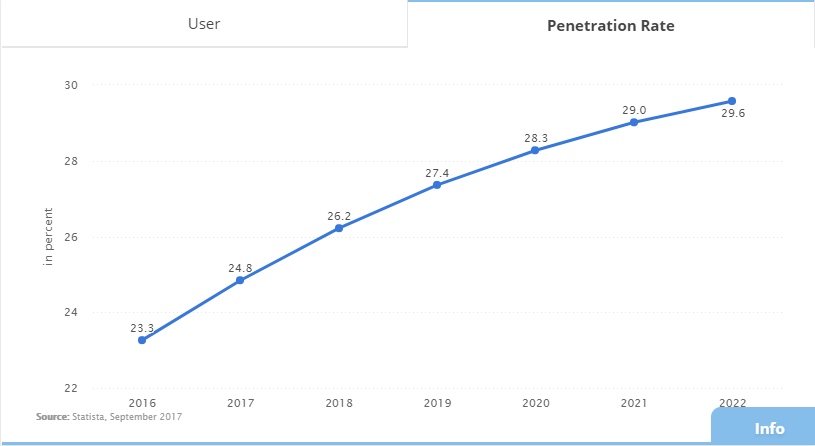

The penetration rate of streaming video is growing in the United States, but is still below 25%:

The various SVOD content providers are in a war - to buy content, to buy users, to keep users, to differentiate. Netflix, Amazon Prime Video and Hulu are at war with each other, as they are with other over the top (OTT) video services like those coming from Apple, Google (YouTube), Disney, and many others.

That battle doesn't interest us - what we are after is the operating system, the guts, that will house all of it. And this is where Roku exists. Each of these over the top (OTT) content providers are available with Roku hardware or software.

The idea behind the business is to grow scale -- to grow active accounts, and to become the operating system of streaming TV. Yes, their goal, their future, is to be what Microsoft was to PCs and what Apple is to smartphones -- the platform, the operating system, for the booming industry that is Streaming Video on Demand (SVOD).

Now, let's turn to the earnings results, and the information we gathered form the call that goes well beyond the numbers.

EARNINGS AND MORE

* Revenue: $136.6 million (up 36% in the year-ago period) vs. estimates of $127.5 million.

* EPS: -$0.07 vs estimates of -$0.16.

The real story, though, goes well beyond these headline numbers. Remember, the company is purposefully lowering prices on its hardware to grow its user base and platform reach.

In fact, in the last quarter, player (hardware) revenue declined 3% as the company focused on positive unit growth. As for that "unit growth," try these facts:

* Roku TV is the #1 licensed TV operating system in the U.S.

* One in four smart TVs sold in the U.S. were Roku TVs up from one in five in 2017.

Even further, the company is getting entrenched in the future of TV:

So, the business model then is based on platform revenue from accounts, of which about two-thirds is ad revenue. The only way for that to work is if (1) the user base balloons and (2) the user base is more engaged. Both are happening at staggering rates.

ROKU noted:

This is the story and below we share the pieces of data that really moved us -- that is, the data that is our circumstantial evidence that ROKU can in fact accomplish its lofty goals:

* Active accounts rose 47% year over year to 20.8 million at quarter end.

* The company saw 2.8 hours of streaming hours per active account during the quarter.

* Streaming Hours: Roku streamed 5.1 billion hours of content in the quarter, up 56% from the prior year.

* Average Revenue Per User (ARPU) rose 50% year over year to $15.07.

All of this led to platform revenue busting out:

* Platform revenue rose 106% year over year to $75.1 million.

Since platform and advertising revenue are much higher margin businesses than selling hardware, we then saw this:

* Gross profit rose 62% year over year to $63.1 million.

* Platform gross profit increased 90% year over year.

But there is even more going on -- and it's gigantic.

A BIGGER STORY

The company said that nearly half of its roughly 21 million active users have cut the cord or have never had a traditional pay TV subscription.

Stop for a moment and think about that. That means any kind of marketing that is supposed to come through TV ads simply cannot be reached through linear TV -- it must go through ROKU.

The CEO went further to say that "according to Nielsen, 10% of 18 to 34-year-olds in the U.S. are only reachable on the Roku platform in the living room."

And there's more. A television advertisement, as we all have seen, is broad and can be wildly unfocused. For example, perhaps we watch TV and see an ad for a new Ford truck -- what percentage of the viewing population has an interest in a truck?

The answer is, we don't know. The ad companies use Nielson ratings and demographic data and then the stations try to sell their ads to the right "type" of advertiser.

Now try this one sentence, which is true, that is, it is a fact, but it's also mind blowing:

Every advertisement on ROKU to its users is custom for that individual user.

That's right. Not only are tens of millions of people totally unreachable by traditional TV, even the ones that are, if they are on ROKU, they get personalized ads. That reminds me of two other companies that did this to create two of the six largest companies in the world: Google and Facebook.

And the evidence that this is working, again from the CEO (our emphasis added):

But the narrative gets even stronger. Based on data from 2017 we get this:

* Facebook users spend 35 minutes on average on the platform, although the United States is higher, perhaps closer to 50 minutes.

* YouTube users spend upwards of 40 minutes a day on the platform.

And here is a simple copy and paste from above, that ROKU management shared:

* ROKU saw 2.8 hours of streaming hours per active account during the quarter.

Yes -- Facebook and YouTube combined have about half the total daily viewership per user as ROKU.

And just to make sure that math really holds up, we did some back of the envelope calculations.

- ROKU streamed 5,100,000,000 hours of content.

- ROKU ended the quarter with 21,000,000 active users.

That comes out to 243 hours per active user per quarter.

- Now take that and divide it into 90 days per quarter and we get... 2.7 hours per day per user. The company reported 2.8 hours, but we have come close enough to verifying that the numbers play out.

Of course, the hours spent on ROKU aren't exactly the same as hours spent on Facebook, or YouTube, but my goodness, this company is saying out loud, with actual data, it is becoming a behemoth.

Even further, ROKU has its own channel -- where it controls everything (as opposed to streaming hours on Netflix on ROKU). And how is that plan for native content going? Here's an update from management:

OTHER THINGS TO CONSIDER

Owning a stock for the sole purpose of a takeover possibility is, in our opinion, a terrible idea.

Ownership in an asset that is "supposed" to appreciate must be based on a bullish narrative that stands on its own.

But, we are also starting to see a narrative where this firm may become a takeover candidate. For example -- Netflix has no ecosystem at all -- in one fell swoop it could have one, with a advertising business.

Facebook, which has no hedge against its own platform, could suddenly challenge YouTube with a powerful content and ad business and jump into living rooms, after being relegated to just the smartphone.

There are other examples -- but if ROKU keeps growing at this pace, and the other metrics continue to support this idea of ROKU fulfilling its promise to become the leading operating system for streaming TVs (like Apple has become for smartphones, like Microsoft became for PCs), then it's quite possible it becomes a takeover target.

SEEING THE FUTURE

It's understanding technology that gets us an edge to find the "next Apple," or the "next Amazon." This is what CML Pro does. We are members of Thomson First Call -- our research sits side by side with Goldman Sachs, Morgan Stanley and the rest, but we are the anti-institution and break the information asymmetry.

The precious few thematic top picks for 2018, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author is long shares of ROKU at the time of writing and publication.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

ROKU Beats, But the Story is Bigger

ROKU Beats, But the Story is Bigger

Date Published: 2018-06-08

Author: Ophir Gottlieb

Written by: Ophir Gottlieb

This is a snippet from the original CML Pro dossier published on 5-11-2018.

LEDE

ROKU beat earnings estimates, but the earnings results were the smaller story. Roku (NASDAQ:ROKU) is on the verge of becoming the operating system to streaming video - and that is a massive opportunity.

STORY

ROKU is a Spotlight Top Pick and we cover the broad, far-reaching bullish thesis in the Top Pick dossier The Tech Gem Looking to Dominate Streaming Video.

ROKU is building a business based on users and if we measured them as a cable provider, as of right now, they would be the third largest cable provider in the country behind just Comcast and AT&T -- that's how many people and how much content they serve, already.

Further, the number of accounts for ROKU rose 47% while Comcast and AT&T are essentially flat. All of this is driven by the large secular shift by consumers to streaming video and away from linear TV.

Check out this video consumption pattern forecast:

And then straight to SVOD revenue forecasts.

The penetration rate of streaming video is growing in the United States, but is still below 25%:

The various SVOD content providers are in a war - to buy content, to buy users, to keep users, to differentiate. Netflix, Amazon Prime Video and Hulu are at war with each other, as they are with other over the top (OTT) video services like those coming from Apple, Google (YouTube), Disney, and many others.

That battle doesn't interest us - what we are after is the operating system, the guts, that will house all of it. And this is where Roku exists. Each of these over the top (OTT) content providers are available with Roku hardware or software.

The idea behind the business is to grow scale -- to grow active accounts, and to become the operating system of streaming TV. Yes, their goal, their future, is to be what Microsoft was to PCs and what Apple is to smartphones -- the platform, the operating system, for the booming industry that is Streaming Video on Demand (SVOD).

Now, let's turn to the earnings results, and the information we gathered form the call that goes well beyond the numbers.

EARNINGS AND MORE

* Revenue: $136.6 million (up 36% in the year-ago period) vs. estimates of $127.5 million.

* EPS: -$0.07 vs estimates of -$0.16.

The real story, though, goes well beyond these headline numbers. Remember, the company is purposefully lowering prices on its hardware to grow its user base and platform reach.

In fact, in the last quarter, player (hardware) revenue declined 3% as the company focused on positive unit growth. As for that "unit growth," try these facts:

* Roku TV is the #1 licensed TV operating system in the U.S.

* One in four smart TVs sold in the U.S. were Roku TVs up from one in five in 2017.

Even further, the company is getting entrenched in the future of TV:

Today, Roku offers one of the broadest selections of direct-to-consumer services, including Sling TV, DirecTV Now, PlayStation Vue, Hulu Live, YouTube TV, fuboTV and Philo.

So, the business model then is based on platform revenue from accounts, of which about two-thirds is ad revenue. The only way for that to work is if (1) the user base balloons and (2) the user base is more engaged. Both are happening at staggering rates.

ROKU noted:

We believe virtually every TV OEM will eventually need to license a TV OS, as consumers shift to smart TVs with 4K displays,

and as OEMs focus on both cutting costs and boosting customer satisfaction.

This is the story and below we share the pieces of data that really moved us -- that is, the data that is our circumstantial evidence that ROKU can in fact accomplish its lofty goals:

* Active accounts rose 47% year over year to 20.8 million at quarter end.

* The company saw 2.8 hours of streaming hours per active account during the quarter.

* Streaming Hours: Roku streamed 5.1 billion hours of content in the quarter, up 56% from the prior year.

* Average Revenue Per User (ARPU) rose 50% year over year to $15.07.

All of this led to platform revenue busting out:

* Platform revenue rose 106% year over year to $75.1 million.

Since platform and advertising revenue are much higher margin businesses than selling hardware, we then saw this:

* Gross profit rose 62% year over year to $63.1 million.

* Platform gross profit increased 90% year over year.

But there is even more going on -- and it's gigantic.

A BIGGER STORY

The company said that nearly half of its roughly 21 million active users have cut the cord or have never had a traditional pay TV subscription.

Stop for a moment and think about that. That means any kind of marketing that is supposed to come through TV ads simply cannot be reached through linear TV -- it must go through ROKU.

The CEO went further to say that "according to Nielsen, 10% of 18 to 34-year-olds in the U.S. are only reachable on the Roku platform in the living room."

And there's more. A television advertisement, as we all have seen, is broad and can be wildly unfocused. For example, perhaps we watch TV and see an ad for a new Ford truck -- what percentage of the viewing population has an interest in a truck?

The answer is, we don't know. The ad companies use Nielson ratings and demographic data and then the stations try to sell their ads to the right "type" of advertiser.

Now try this one sentence, which is true, that is, it is a fact, but it's also mind blowing:

Every advertisement on ROKU to its users is custom for that individual user.

That's right. Not only are tens of millions of people totally unreachable by traditional TV, even the ones that are, if they are on ROKU, they get personalized ads. That reminds me of two other companies that did this to create two of the six largest companies in the world: Google and Facebook.

And the evidence that this is working, again from the CEO (our emphasis added):

"A recent study by IPG and MAGNA concluded that ads on the Roku platform are 67% more effective per exposure at driving purchase intent compared to traditional linear TV ads."

But the narrative gets even stronger. Based on data from 2017 we get this:

* Facebook users spend 35 minutes on average on the platform, although the United States is higher, perhaps closer to 50 minutes.

* YouTube users spend upwards of 40 minutes a day on the platform.

And here is a simple copy and paste from above, that ROKU management shared:

* ROKU saw 2.8 hours of streaming hours per active account during the quarter.

Yes -- Facebook and YouTube combined have about half the total daily viewership per user as ROKU.

And just to make sure that math really holds up, we did some back of the envelope calculations.

- ROKU streamed 5,100,000,000 hours of content.

- ROKU ended the quarter with 21,000,000 active users.

That comes out to 243 hours per active user per quarter.

- Now take that and divide it into 90 days per quarter and we get... 2.7 hours per day per user. The company reported 2.8 hours, but we have come close enough to verifying that the numbers play out.

Of course, the hours spent on ROKU aren't exactly the same as hours spent on Facebook, or YouTube, but my goodness, this company is saying out loud, with actual data, it is becoming a behemoth.

Even further, ROKU has its own channel -- where it controls everything (as opposed to streaming hours on Netflix on ROKU). And how is that plan for native content going? Here's an update from management:

The Roku Channel is now a top 15 channel on Roku devices based on hours streamed - and the #3 free ad-supported channel on the Roku platform.

In Q1, we expanded the content syndicated from channel partners and added more movies and TV shows from Lionsgate, MGM, Sony Pictures Entertainment, Warner Bros. and other studios. Recently, we announced the addition of live news from ABC News, Cheddar, People TV and others.

In Q1, we expanded the content syndicated from channel partners and added more movies and TV shows from Lionsgate, MGM, Sony Pictures Entertainment, Warner Bros. and other studios. Recently, we announced the addition of live news from ABC News, Cheddar, People TV and others.

OTHER THINGS TO CONSIDER

Owning a stock for the sole purpose of a takeover possibility is, in our opinion, a terrible idea.

Ownership in an asset that is "supposed" to appreciate must be based on a bullish narrative that stands on its own.

But, we are also starting to see a narrative where this firm may become a takeover candidate. For example -- Netflix has no ecosystem at all -- in one fell swoop it could have one, with a advertising business.

Facebook, which has no hedge against its own platform, could suddenly challenge YouTube with a powerful content and ad business and jump into living rooms, after being relegated to just the smartphone.

There are other examples -- but if ROKU keeps growing at this pace, and the other metrics continue to support this idea of ROKU fulfilling its promise to become the leading operating system for streaming TVs (like Apple has become for smartphones, like Microsoft became for PCs), then it's quite possible it becomes a takeover target.

SEEING THE FUTURE

It's understanding technology that gets us an edge to find the "next Apple," or the "next Amazon." This is what CML Pro does. We are members of Thomson First Call -- our research sits side by side with Goldman Sachs, Morgan Stanley and the rest, but we are the anti-institution and break the information asymmetry.

The precious few thematic top picks for 2018, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author is long shares of ROKU at the time of writing and publication.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.